🎄 Christmas Week Market Notes

Happy holidays everyone! While many markets slow down during the Christmas period, price still shows structure and reaction at key levels. Over the past few sessions, I’ve observed how liquidity zones behave when traders are away — useful for understanding how range and breakout behave in light volume conditions.

I’d love to hear how others interpret holiday price action and what lessons you’ve learned about structural levels during quieter sessions.

Shared for educational discussion, not trading advice.

It depends on the market and instrument traded. Many instruments whipsaw sideways from the week of U.S. Thanksgiving through the end of January. This is caused by wealthy institutional traders going on a lengthy holiday. If you're swing trading, just stay flat until volume picks up again. If you're scalping, feel free to exploit low volume price spikes during the holidays if you can survive the accompanying spread and/or slippage.

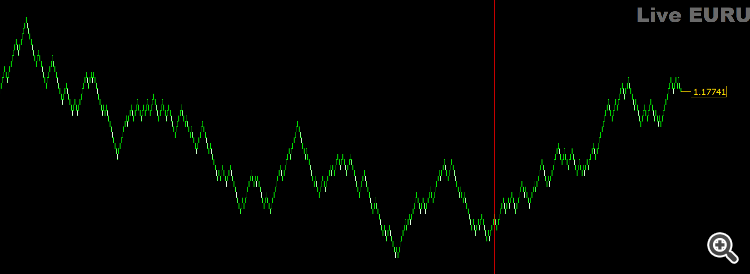

For example, here's a smoothed (Renko) custom chart of EURUSD. The red vertical line demarcates the start of U.S. Thanksgiving week. Notice the fairly cyclical swings preceding Thanksgiving week versus the ugly chop during the holidays:

If you're EA trading, the Tester Report shows you the winning versus losing hours, days, and months--provided that you know how to backtest accurately.If you're EA trading, the Tester Report shows you the winning versus losing hours, days, and months--provided that you know how to backtest accurately.

Thanks for the detailed explanation, that’s a great point. Holiday periods do seem to change market behavior significantly, especially due to reduced institutional participation and lower volume.

I agree that conditions can vary a lot depending on the instrument and trading style, and that sideways or choppy price action is common during this period. The Renko example is a good visual reminder of how structure quality can degrade around the holidays.

Appreciate you sharing your experience — it adds a lot of value to the discussion.

Thanks for the detailed explanation, that’s a great point. Holiday periods do seem to change market behavior significantly, especially due to reduced institutional participation and lower volume.

I agree that conditions can vary a lot depending on the instrument and trading style, and that sideways or choppy price action is common during this period. The Renko example is a good visual reminder of how structure quality can degrade around the holidays.

Appreciate you sharing your experience — it adds a lot of value to the discussion.

Of course. This thread will save some traders a lot of grief--provided that we all think about the effects of holiday trading before its actually upon us.

I tend to think about chart data as a 3 dimensions of price, time, and volume. We can loosely analogize this to Einstein's space, time, and gravity. I say, loosely, because price only has 1 subdimension--the vertical y axis--unlike space. Time is simply time in both cases and is a single dimension as well. Therefore, the time filter proposed in Post #1 merely addresses 1 dimension.

For a more nuanced approach, we can use an average volume filter. This can allow us to selectively hunt for good volume at all times, including holidays if so desired. Again, we'll need good volume to get in and to get out so this indicator is probably more useful for scalping than for swing trading.

Of course. This thread will save some traders a lot of grief--provided that we all think about the effects of holiday trading before its actually upon us.

I tend to think about chart data as a 3 dimensions of price, time, and volume. We can loosely analogize this to Einstein's space, time, and gravity. I say, loosely, because price only has 1 subdimension--the vertical y axis--unlike space. Time is simply time in both cases and is a single dimension as well. Therefore, the time filter proposed in Post #1 merely addresses 1 dimension.

For a more nuanced approach, we can use an average volume filter. This can allow us to selectively hunt for good volume at all times, including holidays if so desired. Again, we'll need good volume to get in and to get out so this indicator is probably more useful for scalping than for swing trading.

Well said — I really like the way you framed this using price, time, and volume as interacting dimensions. That analogy makes the limitation of using only a time-based filter much clearer.

I agree that incorporating volume adds an important layer of context, especially during holiday conditions when price alone can be misleading. Using an average volume filter to selectively participate makes a lot of sense, particularly for short-term approaches where entry and exit quality matter most.

This discussion is very helpful from a learning standpoint. Thanks for taking the time to explain it so clearly.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

🎄 Christmas Week Market Notes

Happy holidays everyone! While many markets slow down during the Christmas period, price still shows structure and reaction at key levels. Over the past few sessions, I’ve observed how liquidity zones behave when traders are away — useful for understanding how range and breakout behave in light volume conditions.

I’d love to hear how others interpret holiday price action and what lessons you’ve learned about structural levels during quieter sessions.

Shared for educational discussion, not trading advice.