Risk depends on your initial stop loss, lot size, and the value of the symbol. It does not depend on margin or leverage. No SL means you have infinite risk (on leveraged symbols). Never risk more than a small percentage of your trading funds, certainly less than 2% per trade, 6% account total.

-

You place the stop where it needs to be — where the reason for the trade is no longer valid. E.g. trading a support bounce, the stop goes below the support. Then you compute your lot size.

-

AccountBalance * percent/100 = RISK = OrderLots * (|OrderOpenPrice - OrderStopLoss| * DeltaPerLot + CommissionPerLot) (Note OOP-OSL includes the spread, and DeltaPerLot is usually around $10/PIP, but it takes account of the exchange rates of the pair vs. your account currency.)

-

Do NOT use TickValue by itself - DeltaPerLot and verify that MODE_TICKVALUE is returning a value in your deposit currency, as promised by the documentation, or whether it is returning a value in the instrument's base currency.

MODE_TICKVALUE is not reliable on non-fx instruments with many brokers - MQL4 programming forum (2017)

Is there an universal solution for Tick value? - Currency Pairs - General - MQL5 programming forum (2018)

Lot value calculation off by a factor of 100 - MQL5 programming forum (2019) -

You must normalize lots properly and check against min and max.

-

You must also check Free Margin to avoid stop out

-

For MT5, see 'Money Fixed Risk' - MQL5 Code Base (2017)

Most pairs are worth about $10 per PIP. A $5 risk with a (very small) 5 PIP SL is $5/$10/5 or 0.1 Lots maximum.

I am not looking for Risk calculation or Stoploss. I want to use 100% of my account balance/Free margin.

Is this formula is correct?

I am trying something like this

double CalculateMaxLotSize(string symbol, double freeMargin, double leverage) { double tickValue = MarketInfo(symbol, MODE_TICKVALUE); double marginRequired = MarketInfo(symbol, MODE_MARGINREQUIRED); if (leverage > 0) { marginRequired /= leverage; } double maxLotSize = freeMargin / marginRequired; return maxLotSize; }

Basic example to be refined/improved according to your needs:

if(!OrderCalcMargin(orderType, symbol, 1.00, price, margin)) { Print("Error: ", GetLastError()); return; } double maxLot = AccountInfoDouble(ACCOUNT_BALANCE) / margin;

I am trying like this. Is this correct?

double MaxLot_UsingTickSize = NormalizeDouble(((AccountFreeMargin() * AccountLeverage()) / Bid) / (1 / MarketInfo(Symbol(), MODE_TICKSIZE)), 2); double MaxLot_UsingLotSize = NormalizeDouble(((AccountFreeMargin() * AccountLeverage()) / Bid) / (MarketInfo(Symbol(), MODE_LOTSIZE)), 2);

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

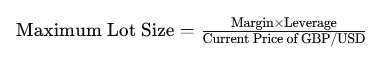

Let say,

Account Balance / Free Margin : $200

Leverage : 1000

Currency Pair : GBPUSD

Account Currency : USD

Currently i am using : https://www.hfm.com/int/en/calculators/position-size-calculator and this show accurate Lot size but i am looking for formula so i can code into my EA.

How can i calculate the Maximum Lot size it can take. What are the formula or code to calculate?