Thanks for great article Dmitriy,

Is there any way or room to fit Pardo's Perfect Profit criteria http://www.breakoutfutures.com/Newsletters/Newsletter0605.htm on top of your criterias?

Very useful article. Everything is easy to use.....

But it only describes the criteria for calling the OnTester() function, i.e. when the optimisation is over with this parameter.

Is it possible to abort the optimisation early? For example, if the drawdown is more than 50% or the balance is less than n-value, so as not to waste CPU time!

Very useful article. Everything is easy to use.....

But it only describes the criteria for calling the OnTester() function, i.e. when the optimisation is over with this parameter.

Is it possible to abort optimisation early? For example, when drawdown is more than 50% or balance is less than n-value, so as not to waste CPU time!

Could you please tell me, is there a possibility to filter out unnecessary results after the end of optimisation (OnTester call), for example with a minus result, in order not to clutter the tab"optimisation results"? ?

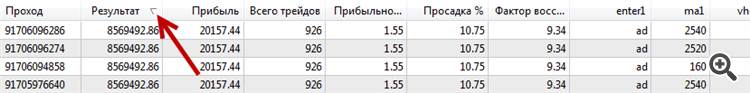

Sorting can be done by clicking on the...

on any columns.

You can also zero it in OnTester().

For me, personally, genetics sometimes went the wrong way.

So it's sorting, I want the unwanted results not to be displayed at all....

with sorting, it's simple, for example:

double OnTester() double balance = TesterStatistics(STAT_PROFIT); double trades_number = TesterStatistics(STAT_TRADES); if(balance < 5000 || trades_number < 20) return(-777); ....бла бла return(свой критерий оптимизации);

and then we sort it...

but it's a bit "clumsy", I want the undesirable results not to be displayed at all.

Karlson:

PS.It is not always possible to "tear down" ExpertRemove() in the process of genetic optimisation.

Here you are right that I do not manage to "tear off" the results during optimisation (any not only genetic) using ExpertRemove()....

maybe I don't know how to prepare it:) ...I put it in the OnTick() handler with a condition...

Are you saying that a code like :

if (balance < 3000) ExpertRemove();

doesn't work?

But that's not what I said. That such a breakdown (worked in the past at least) led to genetic escape in the end.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

New article Creating Custom Criteria of Optimization of Expert Advisors is published:

Author: Dmitriy Skub