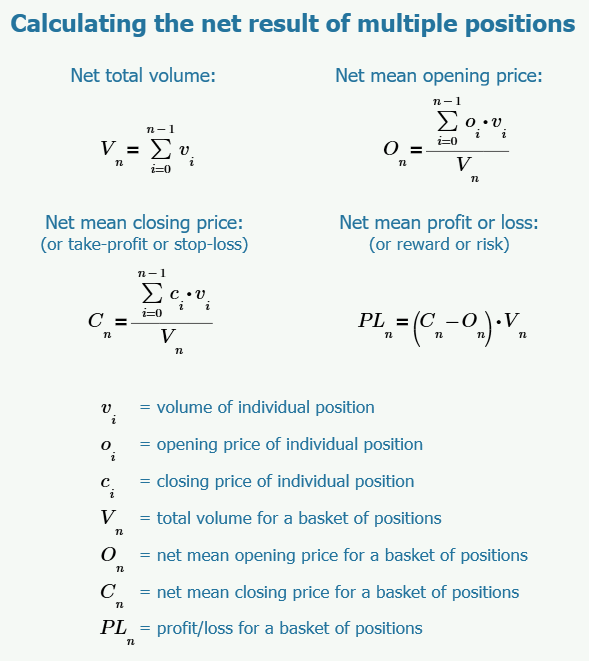

Calculating the net result of multiple positions ...

Hello Fernando,

I totally agree with your formulas but what do you think about my way of calculating the risk ?

Btw, I had a look on your profile, I would like to propose a collaboration, specially addressing Portugal and Brazil traders.

Sorry, but your question is unclear. What exactly are you asking?

Such things should be done in private and not on the forum.

Why Portugal and Brazil when you are from France?

Would it not be better for you to work with traders/programmers fluent in French?

Your image only shows distance to the Take Profit, nothing to do with risk.

Your risk for any trade is:

Risk depends on your initial stop loss, lot size, and the value of the symbol. It does not depend on margin and leverage. No SL means you have infinite risk (on leveraged symbols). Never risk more than a small percentage of your trading funds, certainly less than 2% per trade, 6% total.

-

You place the stop where it needs to be — where the reason for the trade is no longer valid. E.g. trading a support bounce, the stop goes below the support.

-

AccountBalance * percent/100 = RISK = OrderLots * (|OrderOpenPrice - OrderStopLoss| * DeltaPerLot + CommissionPerLot) (Note OOP-OSL includes the spread, and DeltaPerLot is usually around $10/PIP, but it takes account of the exchange rates of the pair vs. your account currency.)

-

Do NOT use TickValue by itself - DeltaPerLot and verify that MODE_TICKVALUE is returning a value in your deposit currency, as promised by the documentation, or whether it is returning a value in the instrument's base currency.

MODE_TICKVALUE is not reliable on non-fx instruments with many brokers - MQL4 programming forum (2017)

Is there an universal solution for Tick value? - Currency Pairs - General - MQL5 programming forum (2018)

Lot value calculation off by a factor of 100 - MQL5 programming forum (2019) -

You must normalize lots properly and check against min and max.

-

You must also check Free Margin to avoid stop out

-

For MT5, see 'Money Fixed Risk' - MQL5 Code Base (2017)

Most pairs are worth about $10 per PIP. A $5 risk with a (very small) 5 PIP SL is $5/$10/5 or 0.1 Lots maximum.

Your average risk as (given above) (Lots weighted Market - Lots weighted SL)/DeltaPerLot.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The underline question is how to measure the risk on opened positions.

Let see on an example:

Initial Balance : 1000 USD

P/L (USD)

StopLoss (in USD)

Risk on initial investment

Instant risk on equity

20

-20

40

-20

100

-20

-120

-10

-10

Total

170

-40

-40

-200

If I just total all the risks per position (based on the StopLoss), total is -40 USD which is only 4% of my initial investment. In fact, if I take into account my risk on equity (1170 = 1000 (balance)+170 (P/L), the risk is 14.5%.

The day I start calculating the risk, this way, changed my life...