You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

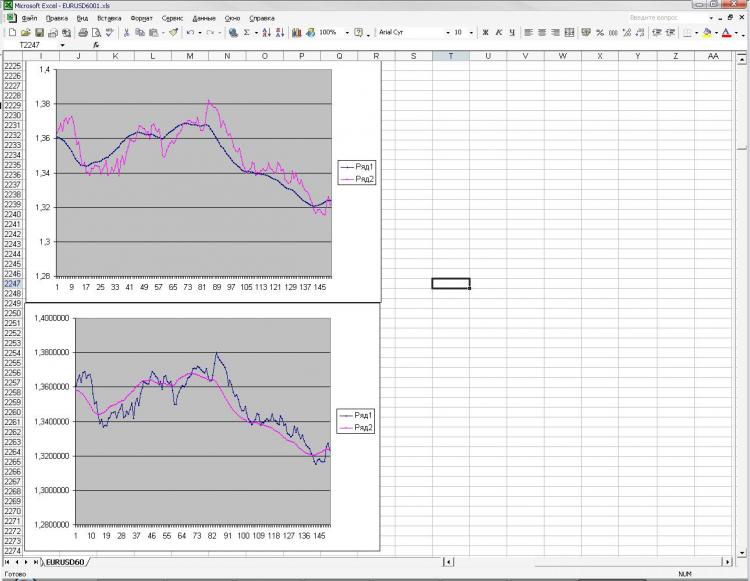

Continuing to experiment with neural networks and coming to e.... I don't understand, either they are "dumb" or I am) I really hope I am. Let me remind you that I do everything in statstica. I got discouraged because of this. I have given the grid two series, the correlation between them (in direction, not in amplitude) = 100%, visually they are the same and the price range is also about equal. After that I built EMA in one row, but not from the first bar to the last one, but from the last one to the first one, i.e. EMA goes first and then the price. I cut the right tail (end of the chart where the EMA forms its values) and gave the task to the grid based on row 1, row 2 and EMA from row 1 to tell me where the EMA will be (with the same period) for row 2. Got an accuracy of 2-005e. It seems to be good (even very cool), but only the same accuracy can be obtained by the simplest formula, which does not even need to be counted in a column))))) Moreover, the predicted EMA was all crooked and wobbled from bar to bar. Dyams.... Gentlemen pros, what am I doing wrong? In fact, this task has a lot of tips for the grid and it's not even about the prediction. Banal and simple formulas repeat grid results and even better, but they are so stupid that it becomes unclear what nets can do in principle? I really want to believe I don't fully understand how the nets should be set up and I'm doing something wrong. I attach a picture.

The network had a task to get EMA from the second picture knowing EMA from the first one and also all the first and second row clauses. EMA goes in the opposite direction (that was the task)

I agree, but we are fighting for maximum profit. And here, a minimum error does not give us the maximum profit. Well, at least I couldn't find any evidence of that in mine......

Maybe I'm wrong.... I think you should look for other inputs for the network. Repeatability of inputs is not good.

How many layers and number of neurons?

1) Did I understand correctly that a neural network is not able to reconstruct a function if it is inherently dynamic as in the case of ACC, even having all the necessary data to calculate it, since if the formula is rigidly static as in the case of LVSS or EMA, there is no problem.

2) If I am wrong, which networks should be used? And used MLP in statistics.

3) I have heard the opinion that auto nets and nets of own e.... design, if I may say so, there is not fundamentally much difference. Is this really the case?

4) What networks and what programs will you advise for application on financial markets, in particular for the task I have described, i.e. to restore values from all known data.

Respectfully, mrstock.

1. Entries must be 10 times the period of the slowest MA from the ACC. The value of the EMA usually depends on the number of bars, ten times its Period parameter. A single neuron with a linear transfer function is best suited to repeat the EMA. For ACC you would probably need another layer, one layer and all the more one neuron is not enough.

2. this is considered the hardest part - choosing the type of network and its configuration. If with EMA a single linear neuron is enough (just adder with different weights of inputs) for ACC maybe a combination of linear and sigmoid neurons and using multipliers instead of adders would be better.

If the nature of the desired regularity is not known at all, then only experiment - try all types of networks. You just need to train correctly, the more samples to be trained and the less neurons in the network, the better. After training, check on the check data which network gives the best result with the least possible number of neurons in this network.

1) The grid is able to recover the function if the input data contains it. If in the last experiment the period value depends on volatility, then the grid should have given some estimate of that volatility, i.e. you may not have provided all the necessary data for recovery.

2)You can squeeze everything you need out of MLP. Use other networks when you can mathematically prove that using other architecture is better than MLP.

3)NS2 - fast, quality result, easy to transfer anywhere...

You don't have to feed volatility value, in idea network itself should detect this volatility, maybe you should add neurons and to train, increase number of samples for training.

... In addition, the predicted EMA was all crooked and wobbled from bar to bar...

Probably too many neurons in the network. Probably something else with the input values normalization.

to mrstock

If you submitted for training exactly what is shown in the pictures, then I agree with Integer, the problem, among other things, is in the normalization.

to LeoV and StatBars

If NS allows, try using root mean error instead of RMS error. Be sure to report back on your impressions.

PS to mrstock

Try using increments as a training sample. In Statistica there is no automatic normalisation by the way.

joo писал(а) >>

Try using increments as a training sample.

Probably better the logarithm of the increment...

Наверное, лучше логарифм приращения...

Try playing with the parameter while doing so:

- parameter for the slope of the sigmoidal activation function.

If we say that we want to earn money with the help of networks, but not to make prediction experiments or build another bicycle, then price prediction or EMA from the price was abandoned in the last century because of futility of this action (in terms of earnings).