| USD/CAD Intraday: further upside. |

| Pivot: 1.077 Our preference: Long positions above 1.077 with targets @ 1.0825 & 1.084 in extension. Alternative scenario: Below 1.077 look for further downside with 1.075 & 1.073 as targets. Comment: The next resistances are at 1.0825 and then at 1.084. Prices are shaping a bullish continuation pattern (Bullish Flag). |

Forum on trading, automated trading systems and testing trading strategies

mazennafee, 2014.07.30 09:55

USD/CAD Daily Outlook

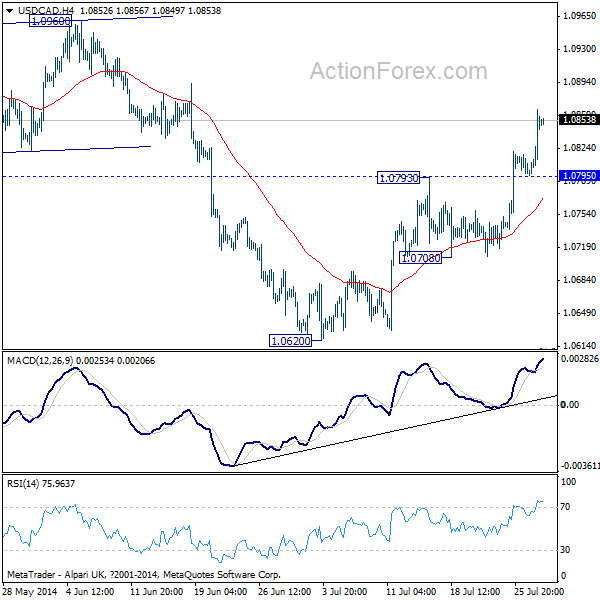

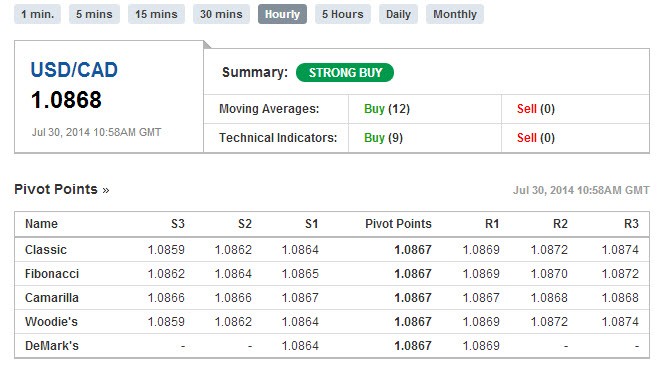

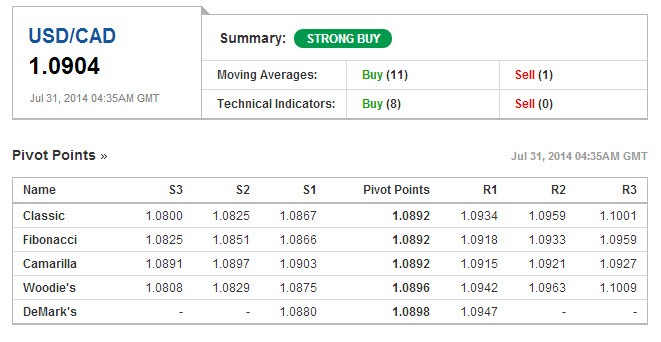

Daily Pivots: (S1) 1.0809; (P) 1.0837; (R1) 1.0878; More...

USD/CAD's rally extends to as high as 1.0865 so far and intraday bias remains on the upside. As noted before, that correction from 1.1278 has completed at 1.0620 already, just ahead of 1.0608 key cluster support and long term trend line. Rise from 1.0620 should extend to 1.0960 resistance next. Sustained break there will pave the way for retest of 1.1278 high. on the downside, below 1.0795 minor support will turn bias neutral and bring consolidations. But downside should be contained above 1.0708 support and bring another rise.

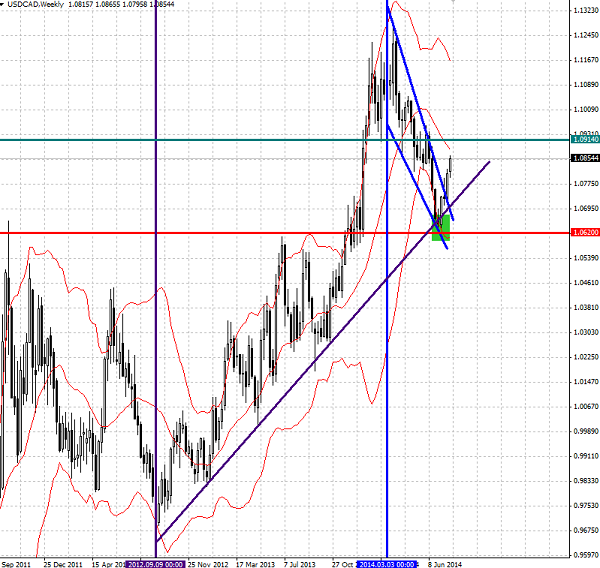

In the bigger picture, there is no clear sign that the whole up trend from 0.9633 and 0.9406 is reversing. We'll stay medium term bullish as long as 1.0608 support holds (61.8% retracement of 1.0181 to 1.1278 at 1.0600). Rise from 0.9406 is viewed as the third leg of the pattern from 0.9056 (2007 low) and is still expected to extend to 61.8% retracement of 1.3063 to 0.9406 at 1.1666 in medium term after completing the correction from 1.1278. However, sustained break of 1.0608 will argue that the medium term trend has reversed and will turn outlook bearish.

Forum on trading, automated trading systems and testing trading strategies

mazennafee, 2014.07.30 10:15

USD/CAD continues to rise after the recent breakout of the 4-hour key resistance level 1.0834 that was earlier identified by Autochartist –as you can see below. The pair is expected to rise to the target level 1.0914 in the coming trading sessions. This key resistance breakout follows the earlier breakout of the weekly Falling Wedge from March. This Falling Wedge was broken by the upward impulse from the support zone lying at the intersection of the weekly support trendline from September of 2009 and lower weekly Bollinger Band (as you can see from the weekly USD/CAD chart below).

USD/CAD Chart" title="USD/CAD Chart" height="242" width="474" />

The weekly USD/CAD chart below shows the longer-term picture of this pair’s movement:

Forum on trading, automated trading systems and testing trading strategies

mazennafee, 2014.07.30 10:22

Loonie Loses Ground This Morning

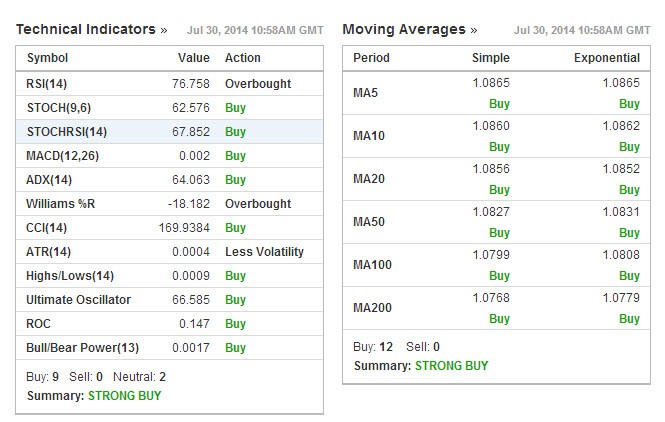

For the 24 hours to 23:00 GMT, the USD rose 0.47% against the CAD to close at 1.0851, after consumer confidence in the US surged to its highest level since 2007 in July.

Yesterday, a survey by the Conference Board of Canada revealed that the people in Canada were becoming more pessimistic about jobs in the nation, thereby raising concerns over the performance of the economy.

In the Asian session, at GMT0300, the pair is trading at 1.0855, with the USD trading marginally higher from yesterday’s close.

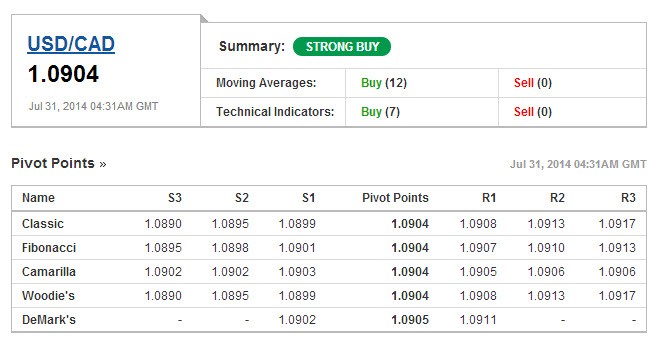

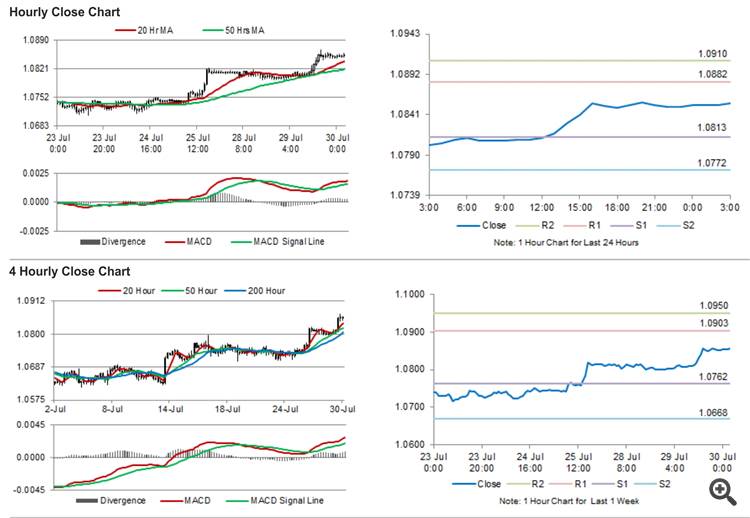

The pair is expected to find support at 1.0813, and a fall through could take it to the next support level of 1.0772. The pair is expected to find its first resistance at 1.0882, and a rise through could take it to the next resistance level of 1.0910.

Traders would await Canada’s industrial product prices and raw materials prices data, slated to be out later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.

Forum on trading, automated trading systems and testing trading strategies

mazennafee, 2014.07.31 06:35

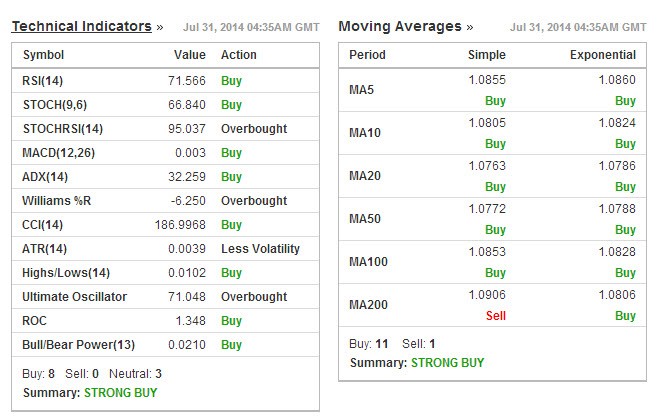

USD CAD Technical Analysis

5hours

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Our preference: Long positions above 1.077 with targets @ 1.0825 & 1.084 in extension.

Alternative scenario: Below 1.077 look for further downside with 1.075 & 1.073 as targets.

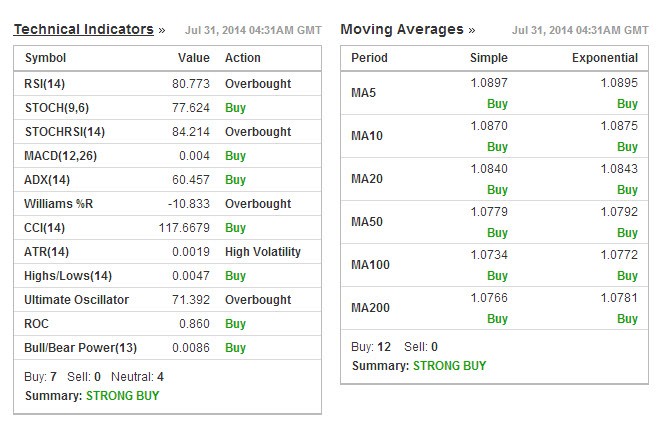

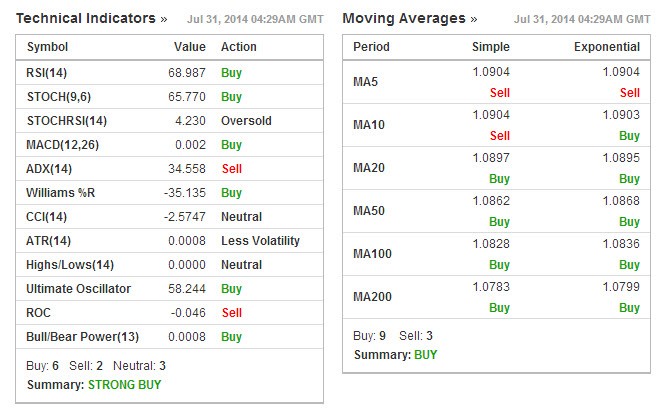

Comment: The RSI is bullish and calls for further upside.