You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.19 09:45

EUR/USD – Price Bottom vs. Rising Wedge (based on forexminute article)

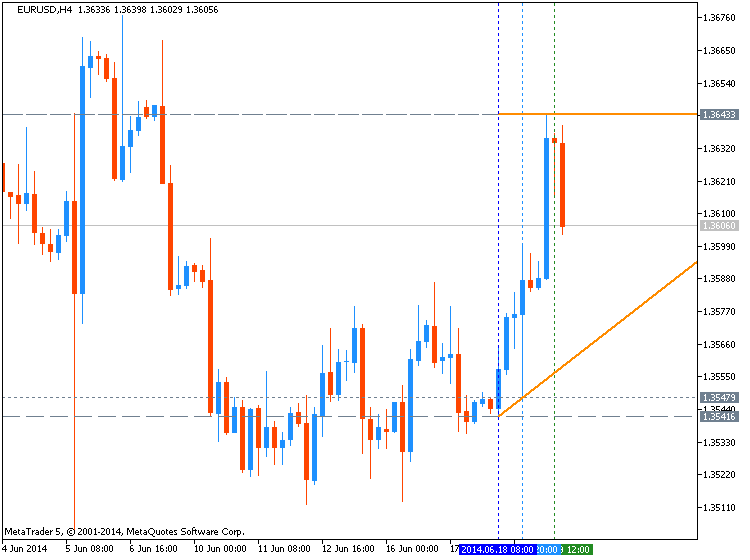

This week, traders are putting in a price bottom for EUR/USD and trying to build momentum from it.

The 1H chart shows that last week, the market found support at 1.3512. This week, the market held above this low, and have been putting in higher highs and higher lows. Traders faded USD after the FOMC event risk and EUR/USD pushed to 1.36, before stalling. Price action has cleared above the moving averages, signaling a bullish reversal. The 1H RSI has been holding above 40, but the inability to push above 70 shows that the new bullish momentum is still weak.

Rising wedge scenario: If price fails to push above 1.36 and falls below 1.3560, and below the rising trendline seen in the 1H chart, there would be a break down of a rising wedge. This would signal a bearish continuation towards at least the 1.35 handle and 1.3476 low on the year.

Note that a bullish divergence with the RSI has formed in the daily chart. With momentum building in the 1H chart, we can anticipate a bullish correction towards at least the 1.3676 pivot. A break above 1.37 at this point could revive the bullish outlook and open up the 2014 highs at 1.3966 and 1.3993.

However, if the rising wedge pattern scenario develops in the 1H chart, then we should look for 1.3476. Below 1.3476, look for Nov. 2013

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.19 14:30

US Dollar Bulls Gored by Dovish Yellen, EUR/USD Surges

There was sufficient evidence to believe that, even though US economic data has been slumping of recent, if the Federal Reserve came out with optimistic enough June economic projections, the US Dollar could rally. Instead of the running of the bulls starting a month early, Fed Chair Janet Yellen came out and gored US Dollar bulls.

While volatility came back to life momentarily - EURUSD traded in a 51-pip range in the 10-minutes following the release of the June projections and the policy statement - the tone for US Dollar weakness wasn't really set until Chair Yellen hammered home the idea that there was no technical mechanism in place to determine when interest rates would rise.

This is a significant dovish shift, irrespective of the slightly more optimistic Fed economic projections. Several months earlier, Chair Yellen suggested that the first rate hikes would come six months after QE3 ended; saying that there is no set timetable and that there is significant uncertainty around the path of economy walks back any clear horizon for a tighter Fed monetary policy.

The US Dollar has taken a significant beating in the hours since Chair Yellen's remarks, and has broken down through significant levels versus the British Pound and the Euro. Perhaps most interesting is USDJPY right now as it flirts with the 'BoJ trendline' from April 2013. See the video above for the technical outlooks, and click the link below for rationale on buying the British Pound.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.19 19:49

EUR/USD consolidates near a fresh high of 1.3643

EUR/USD consolidates near a fresh high of 1.3643, having stalled at the strong resistance level but maintaining the positive mood amid the general dollar weakness.

Key quotes

"Short term pullbacks found buyers in the 1.3610 level, now immediate short term support."

"The hourly chart shows indicators bouncing higher above their midlines, after correcting overbought readings, while 20 SMA extended its bullish slope and 100 one aims to cross 200 to the upside, all of which supports further gains."

"In the 4 hours chart technical readings present a mild bullish tone, with indicators advancing above their midlines albeit losing some of the upward strength."

"A price acceleration above mentioned high may lead to a test of 1.3680, Fibonacci resistance, while above it stops may get triggered and therefore result in a stronger upward move."

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.20 12:07

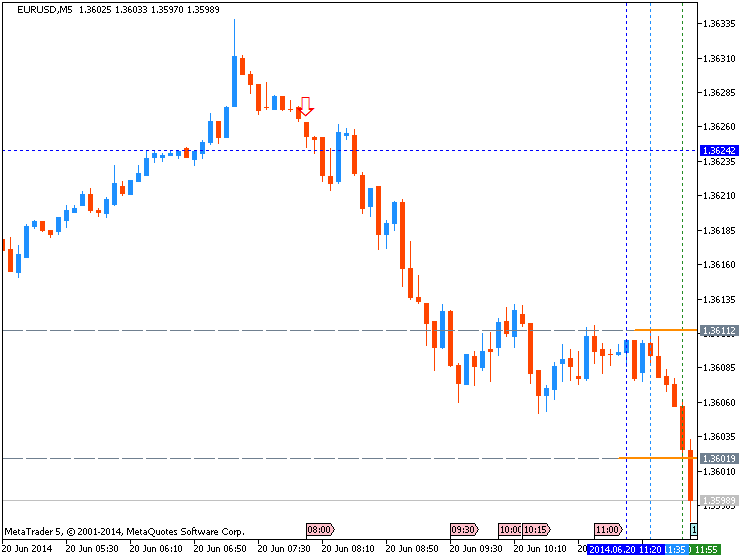

EUR/USD - Euro Shrugs Off Weak German PPI

EUR/USD is firm on Friday, as the pair is back above the 1.36 line, after some gains earlier in the week. On the release front, German PPI posted its third consecutive decline, as Eurozone inflation indicators continue to falter. There was better news from Eurozone Current Account, which improved in May. Although US markets are open on Friday, there are no releases on the schedule, so traders should be prepared for a quiet day from the pair.

Eurozone inflation rates continued to look dismal in May, as German PPI posted another decline, coming in at -0.2%. The manufacturing inflation index has failed to post a gain in 2014, pointing to weakness in the German manufacturing sector. The ECB lowering rates earlier in the month, declaring that the moves were intended to bolster weak growth and inflation levels in the region. However, we'll have to wait for the June inflation data to see if the ECB's moves push inflation to higher levels. If not, the euro could lose ground against the dollar. Earlier in the week, German ZEW Economic Sentiment lost ground, although somewhat surprisingly, the same Eurozone indicator showed improvement. We'll get a look at Eurozone Consumer Confidence later on Friday. The markets are expecting another weak reading in May.

On Wednesday, the Federal Reserve continued to taper to its QE program, reducing the scheme by $10 billion, to $35 billion/month. If all goes as planned, the Fed could wind up QE in the fall. The Fed also hinted that interest rates will continue to stay low for the foreseeable future, which likely means that we won't see any rate hikes before the first quarter of 2015. With regard to economic activity, the Fed noted that the recovery is continuing, but it reduced its forecast of economic growth to 2.1-2.3%, down from an earlier forecast of around 2.9 percent. The bottom line? There were no dramatic items in the Fed statement, with one analyst describing current Fed policy as "steady as she goes". The US dollar has responded with losses against its major rivals, and the euro has added about 70 points this week and pushed across the 1.36 line.

EUR/USD TechnicalForum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.20 18:23

EUR/USD at Trendline; USD/CAD Breaks Support (based on forexminute article)

A main theme in the forex market this week was the USD softening after the FOMC. Let’s see how that manifested in the EUR/USD. Today, Strong retail sales and hot inflation data from Canada is boosting the Loonie. Let’s take a look at the USD/CAD.

EUR/USD rallied this week after putting in a price bottom last week. There was broad USD-weakness after the FOMC event risk, and the EUR/USD popped up from the price bottom, only to stalled at 1.3643. As we get into the 6/20 session, we see that traders faded the pair down to a rising trendline. A break below 1.3550 should clear the trendline and the moving averages in the 4H chart. If the RSI also dips below 40, then we could be looking at a bearish continuation signal, refocusing traders on the 1.35 handle and the 1.3476 low on the year. Above 1.3560, the pair remains bullish in the very short-term, with upside toward 1.3676 June high.

USD/CAD is blasting through consolidation support today after very hot inflation and*retail sales data from Canada. The CPI in May came in at 0.5% on the month, and 2.3% on the year. This was a pick up from April’s reading and also beat most economists’*forecasts. Retail sales also grew 1.1% in April, faster than the 0.1% in March. Economists had forecast a 0.4% growth.

As both inflation and demand data moved higher and beat estimates, USD/CAD fell below its recent consolidation support at 1.0815. The dip is also breaking below the 200-day SMA. The 1.0737 pivot might provide some short-term support. But as long as price is below 1.09, there is downside risk toward the low on the year near 1.06, and the Dec. 2013 low at 1.0560.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.21 08:03

EUR/USD hold key Gann level (based on dailyfx article)

- EUR/USD remains in a sideways to higher range above the 4th square root relationship of the year’s low near 1.3520

- Our broader bias is negative on the Euro while below 1.3755

- A daily close under 1.3520 is needed to confirm a resumption of the broader decline

- The end of the month is the next cycle turn window of importance for the exchange rate

- A move through 1.3755 is needed to shift the broader trend bias to positive

Weekly EUR/USD Strategy: Like the short side while under 1.3755.