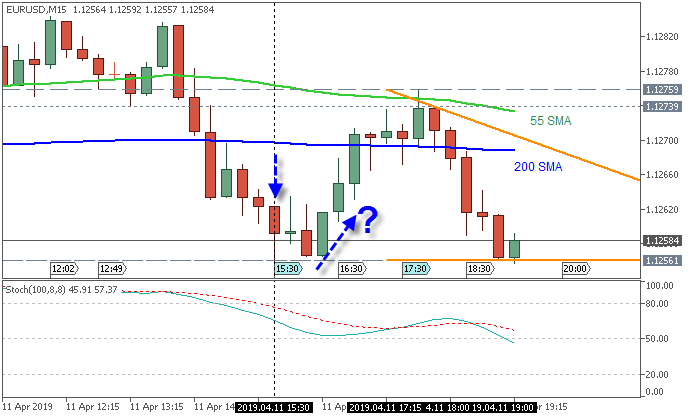

...Again, this indicated that the price should go down. ..

Yes, PPI news event was good for USD, and Jobless Claims was good for USD too.

And the price went to be initially down ... but ...

... We can make an educated decision on which way the market is going to go but in the end it is essentially gambling. The average trader is at the mercy of the “big boys”. ...

It is "the people are making money" ... or "someone told something" ...

:)

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forgive me for creating a new topic but I couldn't find one open related to this:

Hello traders. If you have been trading EUR/USD perhaps you share my frustration with a market that defies “normal” interpretations of both fundamental and technical analysis. Case in point, today (4-11-2019) prior to US data that was released at 8:30 EST and two fed speeches shortly thereafter, the pair was trading approximately at 1.2614. The data came in better than expected and the speeches had only a minor impact. The newly released data supported a strong US dollar which means that EUR/USD should have lowered in price. From a technical standpoint looking at the 4 hour chart at 8:30, Stochastic and MACD indicators showed overbought and that the pair was bearish trading well below the 200 day average. Again, this indicated that the price should go down. The pair did go down initially but very quickly rebounded and is, at the time of this writing, up at 1.2716? With data supporting a strong US dollar and lackluster performance in the European markets, how can the pair turn slightly bullish?

This leads me to confirm the realization that the “little guy” stands a low chance of being successful trading the FOREX market. Not that the little guy can't make a profit, its just very difficult. The movers and shakers like banks and investment companies control the market. Predicting what their knee jerk reaction to events and indicators will be is almost impossible for the average trader. We can make an educated decision on which way the market is going to go but in the end it is essentially gambling. The average trader is at the mercy of the “big boys”.

I realize that there are many other variables that affect the markets and that the EUR/USD trades in a wide range but ultimately, it is my opinion, that a relative few control the market and it is just a game of chance for the average trader.

I am interested in others experiences and opinions on this.

Happy Trading!