You can look at this manual for more explanation:

- www.metatrader5.com

and you can read this article for example -

----------------

MetaTrader 5 features hedging position accounting system

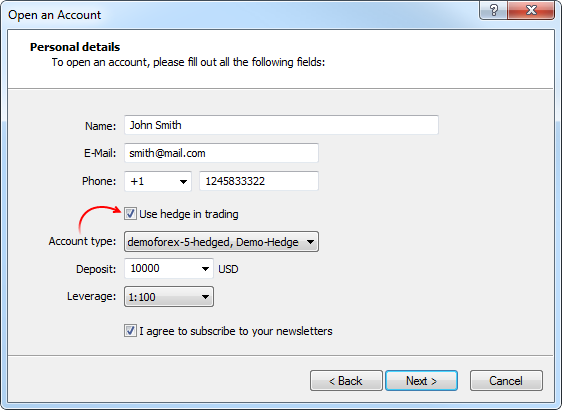

The MetaTrader 5 platform was originally designed for trading within the netting position accounting system. The netting system allows having only one position per financial instrument meaning that all further operations at that instrument lead only to closing, reversal or changing the volume of the already existing position. In order to expand possibilities of retail Forex traders, we have added the second accounting system — hedging. Now, it is possible to have multiple positions per symbol, including oppositely directed ones. This paves the way to implementing trading strategies based on the so-called "locking" — if the price moves against a trader, they can open a position in the opposite direction.

Since the new system is similar to the one used in MetaTrader 4, it will be familiar to traders. At the same time, traders will be able to enjoy all the advantages of the fifth platform version — filling orders using multiple deals (including partial fills), multicurrency and multithreaded tester with support for MQL5 Cloud Network, and much more.

Now, you can use one account to trade the markets that adhere to the netting system and allow having only one position per instrument, and use another account in the same platform to trade Forex and apply hedging.

This article describes the netting and hedging systems in details, as well as sheds light on the changes related to the implementation of the second accounting system.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi everyone.

I'm switching brokers and have an opportunity to migrate to Metatrader 5. After much Googling, I discovered a heap of information talking about the fact that Metatrader 5 only allows a single position per account/financial instrument. This included the article 'ORDERS, POSITIONS AND DEALS IN METATRADER 5'.

Metatrader 5 on the demo account I opened absolutely does not behave this way. As an example, I have included a screenshot showing two pending orders for the same market with identical entry prices and stop losses, but different take profit targets. Also, there are two open positions for the same market which are not being 'summarised' as described.

Have I misunderstood the concept of a single position or have changes been implemented to allow multiple positions similar to MT4?

Many thanks.

PS: Sorry, I forgot to mention, it's Version 5.00 Build 1881.