If it's like a wave, so if you develop 2 indicators to detect:

a- the return point

b- the equilibrium is above or bellow the price

then you can basically predict the marker. If it behaves like waves so it's predictable, because after the return point the price will move directly to equilibrium, so it will move straight in distance points.

it may be predictable to you, on certain timeframe, yet to be agree on multi-timeframe equilibrium.

There is no absolute timeframe. Time is personal to us.

...and what predictable to you, on your timeframe, is you edge.

except..equilibrium is dynamic, and it's varies between observer's timeframe.

it may be predictable to you, on certain timeframe, yet to be agree on multi-timeframe equilibrium.

There is no absolute timeframe. Time is personal to us.

...and what predictable to you, on your timeframe, is you edge.

If you study physics you can see that waves from light for example, you have the same ligh source, but several waves, that don't mix together, so each timeframe you have a different wave, there is no problem in that. But there is a valid point here, because another timeframe is another wave, so multi-timeframe equilibrium really should not exist because each wave is independent.

"there is no absolute timeframe"- that's the same principle of light, yet, there are waves, and depend on the observer point of view

If it's like a wave, so if you develop 2 indicators to detect:

a- the return point

b- the equilibrium is above or bellow the price

then you can basically predict the marker. If it behaves like waves so it's predictable, because after the return point the price will move directly to equilibrium, so it will move straight in distance points.

It's your dream, but Try cross pairs

Yes.

Soon you will be rich.

You are assuming seasonality is following a fixed pattern. Maybe it can be so for commodities, but for currency pairs, it is not possible due to unpredictable events. Just my sensibility test to your proposal.

I have a different opinion, you can see the flag in the wind, a chart works the same way, but in 2d. You can't predict the wind, but the waves in the flag are possible, at least half the wave, after the return point. So as long as the wind is blowing it will behave like a wave

If there were regular waves, you would easily extract their frequencies by (Fourier) analysis. But in reality you won't reveal any significant frequency by this approach.

There are economic cycles, which may resemble waves, but they won't help you with short-time trading.

If it's like a wave, so if you develop 2 indicators to detect:

a- the return point

b- the equilibrium is above or bellow the price

then you can basically predict the marker. If it behaves like waves so it's predictable, because after the return point the price will move directly to equilibrium, so it will move straight in distance points.

If it's like a wave, so if you develop 2 indicators to detect:

a- the return point

b- the equilibrium is above or bellow the price

then you can basically predict the marker. If it behaves like waves so it's predictable, because after the return point the price will move directly to equilibrium, so it will move straight in distance points.

btw. just as a addition, there are already indicators which does what you mentioned. Look for Hurst cycles.

Market does have waves. The main issue is new waves keep forming and old ones keep vanishing. And usually there is no fast and concrete way to detect these. For example you will need to wait at least wavelength/2 amount of time to detect the formation of a new wave. And by this amount of time there will be onset of new waves and so on. That way it's better to think market waves as waves in a ocean and not waves from a light source.

Thanks for the indicator Hurst Cycles, i'll look into it

You are only getting incomplete answer.

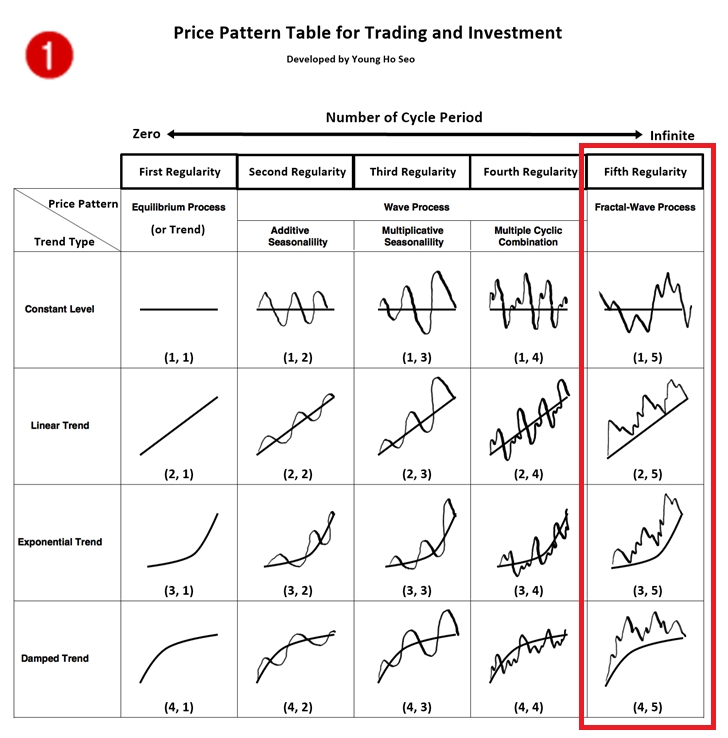

Here are the five regularties the market can costitues of (=more complete answer).

Regardless of what other people say, these regularities are in the market and 95% of trading strategies are based on one of these regularities (consider 6th regularity = correlation).

You were referring to regularity 2, 3 and 4 in your question but not 5.

As you can tell, fifth regularty (or regularity 5) is wave too but it does not need to base its cycle on time but on the magnitude of itself only.

This is the typical behavious when too many variables are influencing the end results of the thing.

The same analogy goes that human have birth - growth -mature - dead or you can find many other things in your life.

Fifth regularity is the superclass of all the other four regularities even including trend.

The scientific name for the fifth regularity is equilibrium fractal wave for your information.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

If it's like a wave, so if you develop 2 indicators to detect:

a- the return point

b- the equilibrium is above or bellow the price

then you can basically predict the marker. If it behaves like waves so it's predictable, because after the return point the price will move directly to equilibrium, so it will move straight in distance points.