101.63

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_8242.png

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_29534.png

101.63

USDJPY price going up because of high impacted news event : CAD - Employment Change

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.09 15:03

2014-05-09 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Employment Change]

- past data is 42.9K

- forecast data is 12.0K

- actual data is -28.9K according to the latest press release

if actual > forecast = good for currency (for CAD in our case)

==========

Canadian employment change -28.9K vs. 12.0K forecast

Canadian employment change fell unexpectedly last month, official data showed on Friday.

In a report, Statistics Canada said that Canadian employment change fell

to a seasonally adjusted -28.9K, from 42.9K in the preceding month.

Analysts had expected Canadian employment change to rise 12.0K last month.

And this is the situation for now :

Close all open position immediate before high impacted news event if doing scalping. Just a suggestion.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.10 13:49

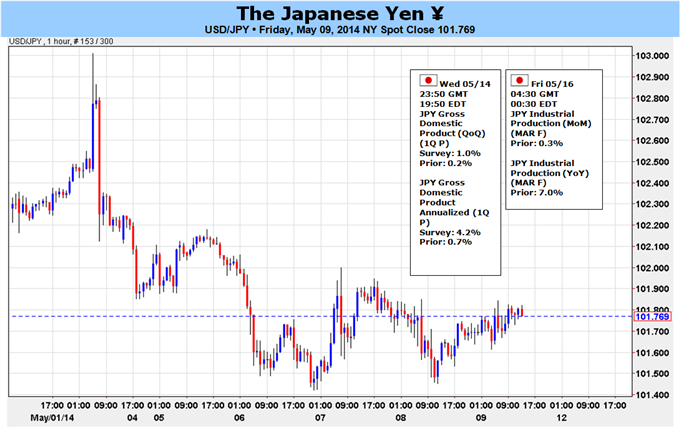

USDJPY Fundamentals (based on dailyfx article)

Fundamental Forecast for Japanese Yen: Bearish- Why is forex volatility so low, and why does it affect the Yen?

- Technical forecasts for the USDJPY point to sideways moves

The Japanese Yen trades at critical resistance versus the US Dollar

(USDJPY trades at support). Given extremely low volatility expectations

it seems unlikely we see a major USDJPY breakdown, but any major

surprises out of upcoming Japanese data could force sharp currency

swings.

FX traders sent 1-month volatility prices on USDJPY derivatives to their

lowest levels on record, and it’s obvious that very few expect to see

big things through the foreseeable future. Our forex technical forecasts

as well as sentiment-based outlook subsequently favor a USDJPY bounce

off of the lows. Yet expectations often beget disappointment; what could

force a major Japanese Yen breakout?

Top economic event risk comes from Japan’s Q1 GDP Growth numbers

due Wednesday night/Thursday morning, and any surprises could shake the

currency from its tight trading range. Consensus forecasts call for a

substantial 4.2 percent annualized rate of economic growth in the first

quarter. Such lofty expectations arguably leave risks to the downside

for the data itself and the Japanese currency. But why is the JPY stuck

in such miniscule trading ranges across the board?

Put simply, forex volatility is near record-lows as risky asset classes

continue to outperform. Yen volatility may trade to further lows if the

US S&P 500 and Japanese Nikkei 225 continue to trade onto fresh

peaks.

In that sense it will be important to watch how Japanese equities

respond to key economic data; any Nikkei 225 losses might actually

result in Yen strength (USDJPY weakness) regardless of the economic

implications of the news results.

The absence of any major surprises in upcoming event risk would likely

leave the status quo intact. It’s important to note that the Yen has

historically fallen in times of low volatility, and indeed we would

argue that a further compression in vols should keep the USDJPY above

key support. The risk is that material disappointments in data could

force equity market tumbles and, by extension, a USDJPY breakdown.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.10 15:19

USD/JPY forecast for the week of May 12, 2014, Technical AnalysisThe USD/JPY pair fell during the bulk of the week, but as you can see the trend line has held up as support. Because of this, we feel that this market continues to go higher, but recognize that it would be difficult to get to the 103 level initially. However, if we break above the 103 level, we are buyers as well, as it would send this market looking for the 105 level which is our longer-term target. As far selling is concerned, if we get below the 101 level, we feel that the 100 level will be targeted first, and then ultimately the 97 level.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.13 12:13

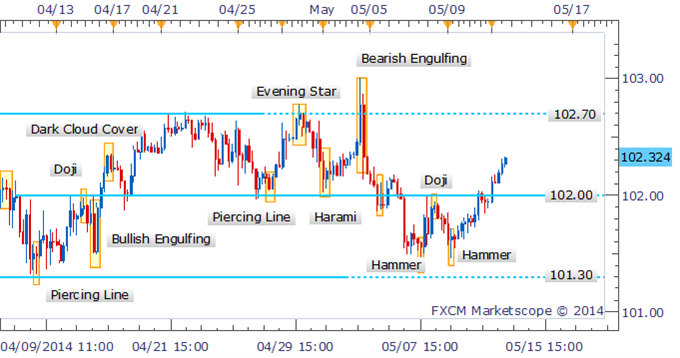

USD/JPY Clears 102.00 As Harami Suggests Further Gains

- USD/JPY Technical Strategy: Longs Preferred

- Push back above 120.00 opens 102.70

- Harami pattern supports further gains

USD/JPY: Prices Push Past 102.00 Following Harami Pattern

An examination of intraday price action on the chart below highlights

the hesitation from the bulls near 102.00. However following a push past

the psychologically-significant level of resistance USD/JPY is eying

the 102.70 mark.

USD/JPY: Hammer Foreshadowed Recovery

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.13 12:25

USD/JPY Showing Forex Trading Upside Momentum – May 13, 2014

On its 4-hour time frame, USD/JPY is showing enough forex trading upside

momentum after bouncing off the bottom of the rising channel. The pair

has formed short-term double bottoms and is moving on to making a larger

set on the same forex trading time frame.

With that, USD/JPY's next rally resistance appears to be located at the

103.00 major psychological level, which might also serve as the neckline

for the double bottom on the 4-hour chart. A break above this area of

interest could mean a move up to the 104.00 major psychological

resistance, which is at the top of the ascending channel.

USD/JPY Forex Trading Outlook

The US economy is set to print its retail sales data in today's New York

trading session. Market watchers are expecting to see a 0.6% gain in

headline consumer spending and a 0.5% increase in core retail sales,

both slightly slower gains compared to the previous month's figures.

Take note though that the US economy has shown stronger than expected

jobs gains in April, which could increase the odds of seeing higher than

expected increases in retail sales. As for Japan, there have been a few

weak spots in the economy and the recently implemented sales tax hike

could weigh on growth later on.

The Fed is on track with its taper plan, eventually looking to hike

interest rates once clearer signs of growth are seen. The BOJ, on the

other hand, is more inclined to ease given their ongoing battle with

deflation and potentially weak spending. With that, the path of least

resistance for this forex trading pair is to the upside, in line with

the trend channel that is holding.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

@101.56 next support for scalping

MetaTrader Trading Platform Screenshots

USDJPYm, M15, 2014.05.09

Exness Ltd., MetaTrader 4, Real