MAYZUS Daily Technical Levels

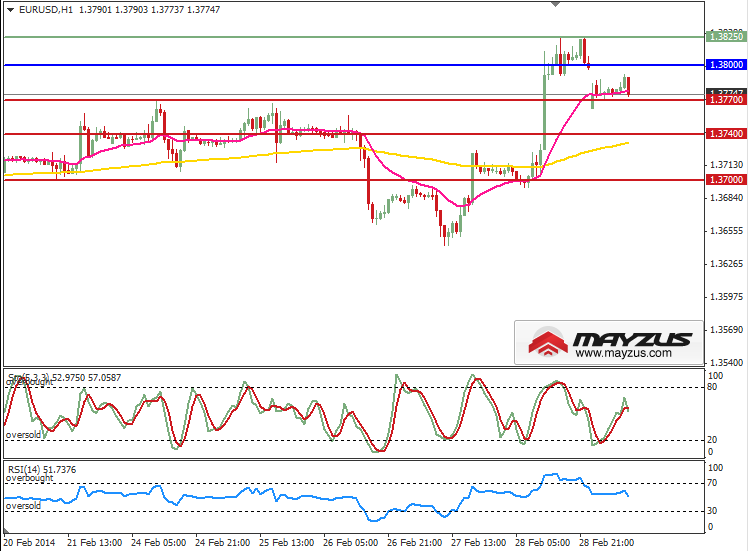

EUR/USD - during the day there is a risk of a technical correction

Our turning point is the level of 1.3800

Our preference: Sell the EUR/USD pair below the level of 1.37700 with the key targets being: 1.37400 and 1.37000

Alternative scenario: If the resistance level of 1.3800 is breached up with success, then the pair could rise to 1.38250.

Analysis: The technical indicators point towards the weakening of the upward trend.

Please note that this information is an analytical review of Capital and FX markets. The material presented, and the information contained, is investment research and should in no way be considered as the provision of investment advice for the purposes of Investment Firms Law 144(I)/2007 of the Republic of Cyprus, or any other form of personal advice, which relates to certain types of transactions, with certain types of financial instruments.

MAYZUS Daily Technical Levels

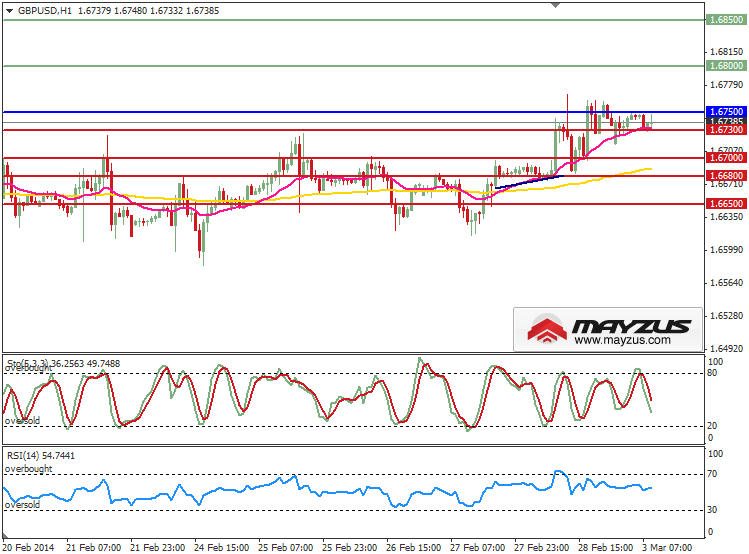

GBP/USD – during the day there is a risk of a technical correction

Our turning point is the level of 1.67500

Our preference: Sell the GBP/USD pair below the level of 1.67300, with the nearest targets being 1.67000, 1.66800 and 1.66500.

Alternative scenario: If the level of 1.67500 is breached up with success, then the pair could rise to 1.6800 and 1.68500

Analysis: The stochastic indicator gave a signal to sell the pair.

Please note that this information is an analytical review of Capital and FX markets. The material presented, and the information contained, is investment research and should in no way be considered as the provision of investment advice for the purposes of Investment Firms Law 144(I)/2007 of the Republic of Cyprus, or any other form of personal advice, which relates to certain types of transactions, with certain types of financial instruments.

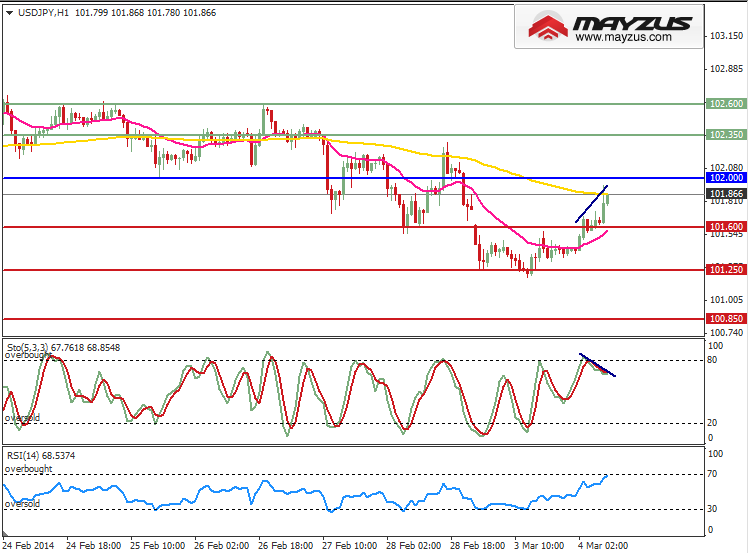

MAYZUS Daily Technical Levels

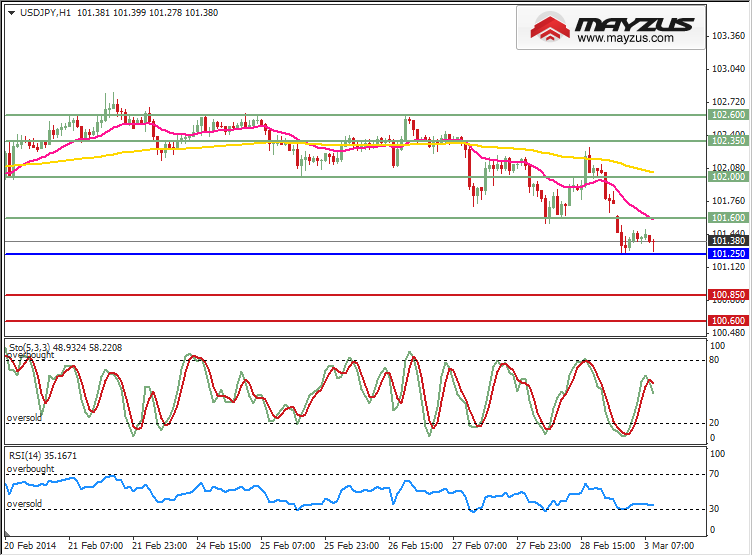

USD/JPY – rebound is possible

Our turning point is the level of 101.600

Our preference: Buy the USD/JPY pair above the level of 101.600, with the nearest targets being 102.00, 102.350, and 102.600.

Alternative scenario: If the support level of 101.250 is breached down with success, then the pair could drop to 100.850 and 100.600.

Analysis: The RSI indicator point that the USDJPY pair is oversold.

Please note that this information is an analytical review of Capital and FX markets. The material presented, and the information contained, is investment research and should in no way be considered as the provision of investment advice for the purposes of Investment Firms Law 144(I)/2007 of the Republic of Cyprus, or any other form of personal advice, which relates to certain types of transactions, with certain types of financial instruments.

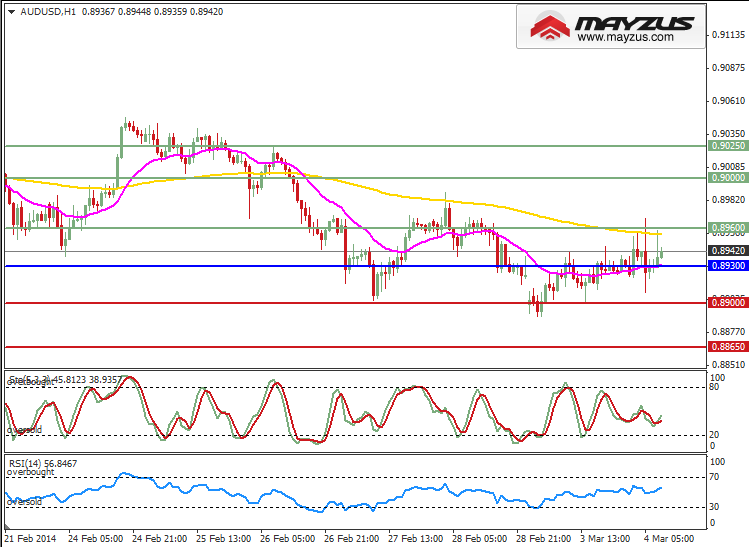

MAYZUS Daily Technical Levels

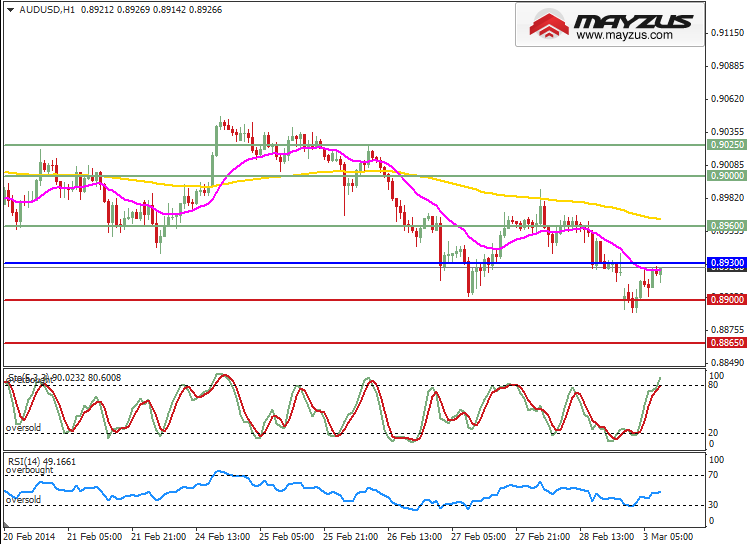

AUD/USD – during the day there is a risk of a technical correction

Our turning point is the level of 0.89300

Our preference: Sell the pair below the level of 0.89300, with the nearest targets being 0.89000 and 0.88650.

Alternative scenario: If the resistance level of 0.89300 is breached up, then the pair could rise to the following levels: 0.89600 and 0.90000.

Analysis: The stochastic indicator is near to the overbought area and will give a signal to sell soon.

Please note that this information is an analytical review of Capital and FX markets. The material presented, and the information contained, is investment research and should in no way be considered as the provision of investment advice for the purposes of Investment Firms Law 144(I)/2007 of the Republic of Cyprus, or any other form of personal advice, which relates to certain types of transactions, with certain types of financial instruments.

MAYZUS Daily Technical Levels

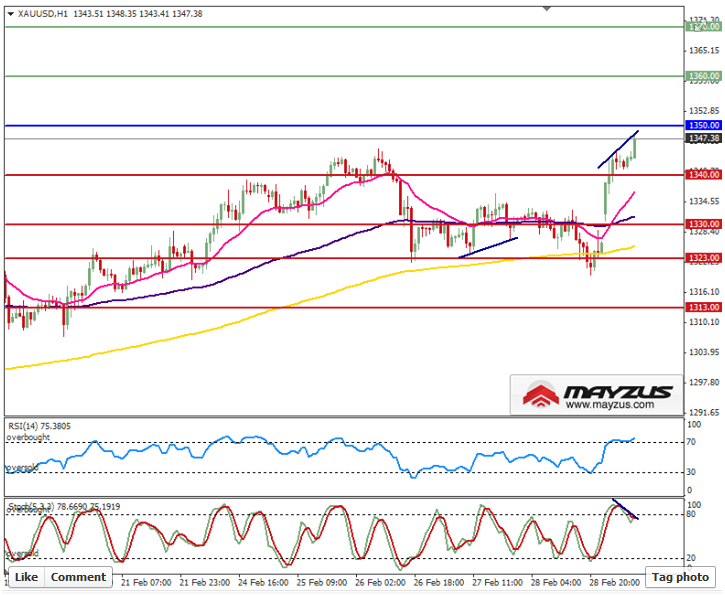

XAU/USD – during the day there is a risk of a technical correction

Our turning point is the level of $1350

Our preference: Sell #Gold below the level of $1350, with the nearest targets being $1340, $1330, $1323, $1313.

Alternative scenario: If the resistance level of $1350 is breached up, then Gold could rise to $1360 and $1370.

Analysis: The technical indicators point towards the weakening of the upward trend, the stochastic indicator gave a signal to sell #Gold.

undefined

This information is an analytical review of Capital and FX markets. The material presented, and the information contained, is investment research and should in no way be considered as the provision of investment advice for the purposes of Investment Firms Law 144(I)/2007 of the Republic of Cyprus, or any other form of personal advice, which relates to certain types of transactions, with certain types of financial instruments.

MAYZUS Daily Technical Levels

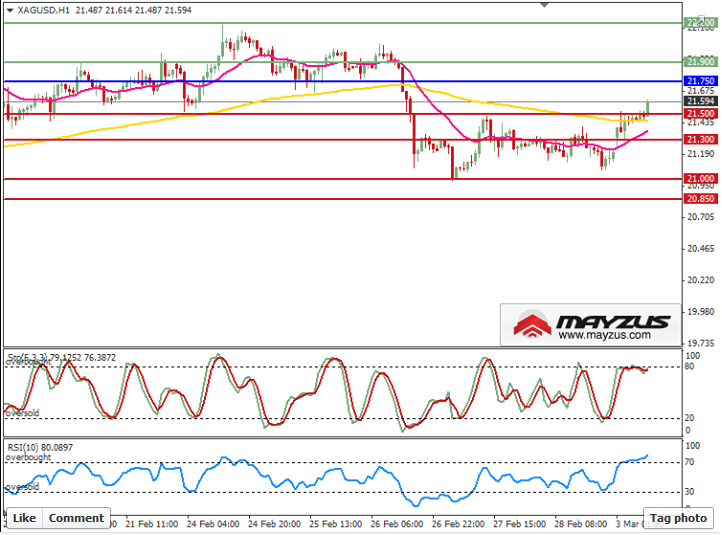

XAG/USD – during the day there is a risk of a technical correction

Our turning point is the level of $21.75

Our preference: Sell #Silver below the level of $21.50, with the nearest levels being $21.30, $21.00, $20.85.

Alternative scenario: If the resistance level of $21.75 is breached up, then Silver could rise to $21.90 and $22.20.

Analysis: The technical indicators point towards the weakening of the upward trend, the stochastic indicator gave a signal to sell #Silver.

undefined

This information is an analytical review of Capital and FX markets. The material presented, and the information contained, is investment research and should in no way be considered as the provision of investment advice for the purposes of Investment Firms Law 144(I)/2007 of the Republic of Cyprus, or any other form of personal advice, which relates to certain types of transactions, with certain types of financial instruments.

MAYZUS Daily Technical Levels

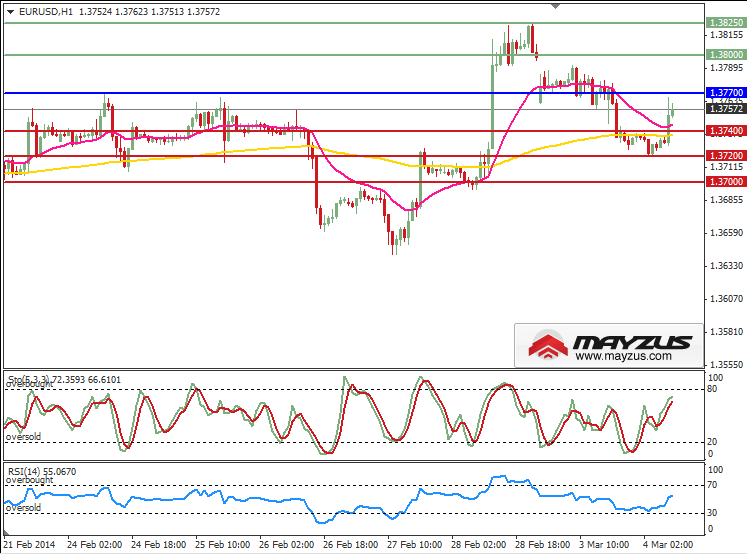

EUR/USD - during the day there is a risk of a technical correction

Our turning point is the level of 1.37700

Our preference: Sell the EUR/USD pair below the level of 1.37700 with the key targets being: 1.37400,1.37200 and 1.37000.

Alternative scenario: If the resistance level of 1.37700 is breached up with success, then the pair could rise to 1.38000 and 1.38250.

Analysis: The stochastic indicator is near to the overbought area and will give a signal to sell soon.

This information is an analytical review of Capital and FX markets. The material presented, and the information contained, is investment research and should in no way be considered as the provision of investment advice for the purposes of Investment Firms Law 144(I)/2007 of the Republic of Cyprus, or any other form of personal advice, which relates to certain types of transactions, with certain types of financial instruments.

MAYZUS Daily Technical Levels

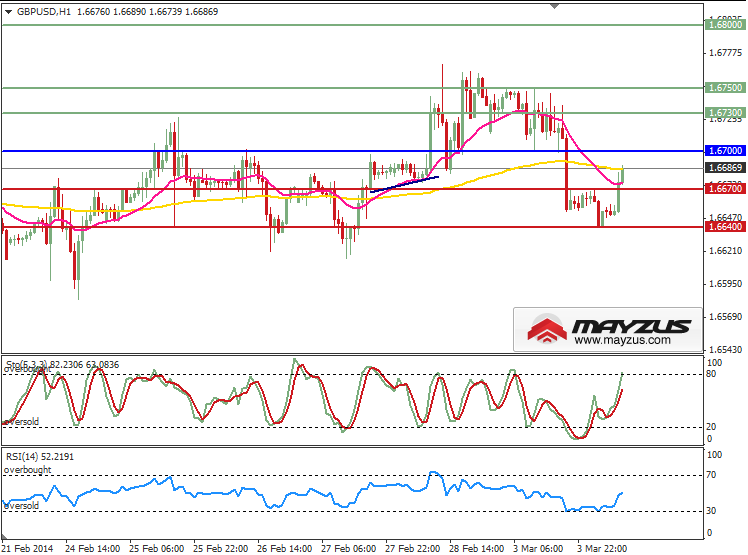

GBP/USD – during the day there is a risk of a technical correction

Our turning point is the level of 1.67000

Our preference: Sell the GBP/USD pair below the level of 1.67000, with the nearest targets being 1.66700 and 1.66400.

Alternative scenario: If the level of 1.67000 is breached up with success, then the pair could rise to 1.67300 and 1.67500.

Analysis: The stochastic indicator is near to the overbought area and will give signal to sell soon.

This information is an analytical review of Capital and FX markets. The material presented, and the information contained, is investment research and should in no way be considered as the provision of investment advice for the purposes of Investment Firms Law 144(I)/2007 of the Republic of Cyprus, or any other form of personal advice, which relates to certain types of transactions, with certain types of financial instruments.

MAYZUS Daily Technical Levels

USD/JPY – during the day there is a risk of a technical correction

Our turning point is the level of 102.000

Our preference: Sell the USD/JPY pair below the level of 102.000, with the nearest targets being 101.600, 101.250 and 100.850.

Alternative scenario: If the resistance level of 102.000 is breached down with success, then the pair could rise to 102.350, 102.600.

Analysis: The technical indicators point towards a weakening of the upward trend.

This information is an analytical review of Capital and FX markets. The material presented, and the information contained, is investment research and should in no way be considered as the provision of investment advice for the purposes of Investment Firms Law 144(I)/2007 of the Republic of Cyprus, or any other form of personal advice, which relates to certain types of transactions, with certain types of financial instruments.

MAYZUS Daily Technical Levels

AUD/USD – growth is possible

Our turning point is the level of 0.89300

Our preference: Buy the pair above the level of 0.89300, with the nearest targets 0.89600, 0.90000 and 0.90250.

Alternative scenario: If the support level of 0.89300 is breached up, then the pair could drop to the following levels: 0.89000 and 0.88650.

Analysis: The stochastic indicator gives a signal to buy.

This information is an analytical review of Capital and FX markets. The material presented, and the information contained, is investment research and should in no way be considered as the provision of investment advice for the purposes of Investment Firms Law 144(I)/2007 of the Republic of Cyprus, or any other form of personal advice, which relates to certain types of transactions, with certain types of financial instruments.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

MAYZUS Daily Technical Analysis

Dear forum members,

MAYZUS Investment Company is constantly working on providing the best possible services to its traders. One of the important areas of our focus is a provision of the high quality analytics that can give an overview of important world and economic events. We hope you will find our daily technical analysis prepared by the Company’s investment experts useful.

Best regards

Please note that this information is an analytical review of Capital and FX markets. The material presented, and the information contained, is investment research and should in no way be considered as the provision of investment advice for the purposes of Investment Firms Law 144(I)/2007 of the Republic of Cyprus, or any other form of personal advice, which relates to certain types of transactions, with certain types of financial instruments.