British Pound to Euro Exchange Rate Forecast to Rebound in 2017

Foreign exchange strategists at Barclays are forecasting a recovery in the GBP/EUR exchange rate through 2017 as political sensitivities turn to the Euro and an oversold Pound finds that the only route available is higher.

- 1 GBP = 1.1655 EUR today (18-11-16)

- 1 EUR = 0.8580 GBP today

2016 has been a testing year for those looking to buy Euros using Sterling.

The GBP/EUR exchange rate has fallen from a high of 1.3675 back in January to a flash-crash low 0f ~1.06.

However, a stabilisation seen since that flash-crash, and a subsequent rebound, has us believing the Pound is forming a bottom to its declines.

At present the pair sits near two-month highs with spot looking to test 1.17 and those making international payments looking at rates in the range of 1.1277-1.1581 depending on who you chose to send money.Goldman Sachs Forecasts: British Pound To Dollar Exchange Rate To Fall To 1.20, Sterling To Euro Targets 1.11

Though the pound sterling has outperformed its peers after the US Presidential elections, Goldman Sachs maintains its bearish view on the sterling

In the bank’s opinion, the current foreign exchange rate rally in the British pound is a good entry point for initiating fresh short positions.

They maintain a “year-end target of GBP/USD of 1.20 and EUR/GBP of 0.90”.

High level of uncertainty during Brexit negotiations

The process of leaving the EU will be a long and arduous one.

After Article 50 is triggered, for the first few months the uncertainty will increase with no clarity on the final deal.

This will hurt sentiment, investment and is likely to hurt employment.

“Sterling could fall around 20-40 percent relative to pre-Brexit for the UK current account to close to a 1.5 percent of GDP target and that Cable could fall a cumulative 25 percent in response to the large uncertainty shock that has hit the UK economy,” said analysts at Goldman Sachs.

Legal case to increase volatility

Goldman analysts are of the opinion that the legal case regarding the government needing the Parliament’s approval to trigger Article 50 will “increase volatility and not reduce downward pressure on the currency over the next 12 months.”

If case of delays in triggering Article 50, it can lead to an early election in 2017, which is likely to elect a stronger “pro-hard Brexit” Parliament.

Nevertheless, the bank’s UK economists’ expect the government to go ahead with its plan to trigger Article 50 by March 2017. The government is unlikely to soften its stance on the key issues of immigration and “excluding the UK from the jurisdiction of the European Court of Justice. “Hard Brexit” is the likely scenario, though with increased uncertainty.

Bank Of England likely to ease than hike rates

While the markets are pricing in a 60% probability of a rate cut in 2018, Goldman says that “the central bank is more likely to reintroduce its easing bias than turn more hawkish.” The BOE has a history of overlooking temporary periods of high inflation.

The inflation forecasts and the growth forecasts also point to a less hawkish BOE.

“Given the cost of tighter monetary policy in terms of job losses, we do not view any threat to tighten policy as credible at the current spot and expected inflation levels” said the Goldman report.

Is the Dollar’s Current Rally Based on Promises that Can Be Kept?

The Dollar

Index has reached 13-year highs and looks likely to continue rising. The

main reasons for the rise are Donald Trump’s new economic policies, but

how likely are they to become a reality?

Few investors saw the Dollar rising to its current dizzying heights on the back of a Trump presidential win. In fact, the opposite was true, most analysts expected Dollar

weakness following a Trump victory due to a probable delay in the

Federal Reserve raising interest rates. The main factor driving the currency higher appears to be a belief

that Trump will stimulate the economy and put money into infrastructure

spending, leading to higher inflation. The Fed will then be forced to raise interest rates pushing the Dollar higher in the process. This is based on promises made in Trump’s manifesto that he would

spend 550 billion on building an infrastructure in the US which was

“second to none”. It has only been two weeks since his election and none of his

policies have been enacted yet, and there is an argument that they will

not be because of resistance from the Republican-controlled Congress and

Senate, who contain members averse to government-backed stimulus. Unicredit’s Chief Global Economist Erik Nielsen is skeptical about

the ability of Trump to get much in the way of a stimulus package

passed. He suggests the market is pricing in too much stimulus. “I’ll give this present market sentiment no more than 5%-10% chance that it’s right. “Rather, a modest fiscal easing (tax cuts to corporates and probably

individuals), de-regulation of some parts of energy production and some

protectionist noise seem a much more likely outcome – which would mean

that risky assets might give half their post-election gain back during

the next 3-6 months.

“And I would happily ascribe a 20%-30% probability to a very messy

presidency, dominated by conflict with Congress and others, completely

clouding policy making within the next 6-9 months - with all the

confusion that would cause in markets,” says Nielsen.

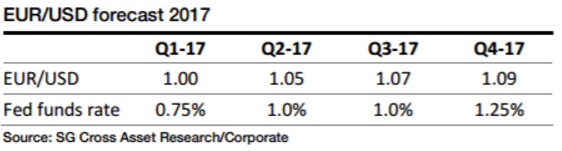

Société Générale's EUR/USD forecasts (parity!) & the "splintering of Europe"

The bullish US macro-economic 'reset' following the election success of Donald Trump has governed financial markets and sparked the bond market rout and USD buying but it is the threat of political tail risk and splintering of Europe that could decide if EUR/USD tests parity for the first time since 2002.

1. Same place, different time The election victory of Trump was the catalyst for EUR/USD to retreat below 1.06 and close in on levels only observed three times since early 2015. EUR/USD traded at a 1.0458 low shortly after the ECB launched the first purchases of government bonds in March 2015. This marked a bottom that would be followed by a rise to 1.1467 in May. The 1.05 level was revisited in the lead-up to the ECB meeting nearly a year ago on 3 December when President Draghi had signalled strong policy action. In the event, the ECB disappointed and EUR/USD shot up from a 1.0524 low to a high of 1.1376 in February.

2. Parallels with 2013 Italian election? The last leg of EUR/USD to below 1.06 coincided with the widening of 10y Italian BTP/Bund yields to just over 180bp on Friday, the highest level since May 2014. This coincided with a rise in the co-movement (Rsq) between the two variables to 0.44. This compares with an Rsq of just 0.15 for EUR/USD and the 10y US/EUR IRS spread. Closer analysis shows that 10y Italian yields became unstuck and started moving away from 1.40% towards 2.10% two weeks before the US election, but this was not picked up by EUR/USD as it rallied from 1.0880 to 1.1140 before the US election on 7 November. However, this has changed over the past week.

3. And then there is the US The timing and scale of the USD upswing caught virtually everyone by surprise. A clear out of dollar assets was anticipated on a Trump victory, but the U-turn we got instead was not pencilled in until later once the administration had laid out the specifics of its pro-growth and low-tax election agenda.

We expect EUR/USD to touch parity in 1Q 2017 before rising back to 1.09 by the end of 2017. The forecast is based on two rate increases by the Fed next year, but this comes with the risk of more. Before the election of Trump we had anticipated a peak for the Fed funds rate this cycle of 1.25%-1.50%, but we now look for 1.75%-2.0%. For the ECB, our economists believe tapering will start in March with the objective of ending asset purchases in early 2018, market conditions permitting.

Euro To Dollar Rate Forecasts: Short-term EUR/USD Pullback But Parity In 2017, Recovery In 2018

Leading foreign exchange institutions are targeting parity for the EUR to USD exchange rate in 2017 on FED/ECB central bank policy divergence

- The Euro to Dollar exchange rate today: 1.05871.

- The Pound to Euro exchange rate today: 1.17846.

- The Euro to Pound exchange rate today: 0.84856.

- Euro vs dollar FX forecast: Calls for EUR/USD parity is on the cards by top strategists like Goldman Sachs.

While both the eurozone and the US posted strong macroeconomic numbers, the markets are still focused on the forthcoming political events in Europe.

The expectations of a repeat of the populist vote, similar to Brexit and US Presidential elections is pressurizing the euro.

Economic data from the US continues to be strong

Americans are feeling confident about future growth prospects under Donald Trump, shows the Reuters/Michigan consumer sentiment index, which increased to 93.8, a six-month high.

The durable goods orders rose 4.8% over the previous month, its fastest rise in a year. The Markit PMI also clocked higher at 53.9 in November, a 13-month high.

The strong economic data paves way for the US Federal Reserve to hike rates in December. The minutes of the November meeting affirmed what we already know, the Fed members are in favor of a rate hike “relatively soon”.

The FedWatch Tool is factoring in a 93.5% probability of a rate hike at the next meeting.

Top 10 FX Trades For 2017 - Morgan Stanley

USD has entered its last leg within a secular bull market. We expect USD to be driven by widening rate and investment return differentials.

USD strength should be front-loaded against low-yielding currencies, particularly JPY and KRW.

Later in the cycle we see USD strength broadening out with the help of rising US real rates, specifically hitting high-yielding currencies. Higher real rates should eventually tighten financial conditions, increasing the headwinds for the US economy and marking the turning point for USD after 1Q18.

1) Long USD/JPY: Yield differentials driving outflows from Japan and higher inflation expectations.

2) Long USD/KRW: Diverging growth and monetary policy to increase outflows from Korea.

3) Short EUR/GBP: No new negative UK news allows the undervalued GBP to recover.

4) Long USD/NOK: Norway government's slower fiscal support to make long NOK positions adjust.

5) Short AUD/CAD: Reflects the diverging US-China economic growth stories.

6) Short SGD/INR: Relative external sector dependence, China exposure and debt overhangs.

7) Long USD/CNH: RMB weakens from capital outflows and diverging monetary policy from the US.

8) Long BRL/COP: We expect reform momentum and high yields to cushion external risks.

9) Long RUB/ZAR: Continued tight monetary policy should help RUB outperform.

10) Long CHF/JPY: Yield differentials weaken JPY, while CHF is a good eurozone political risk hedge.

British Pound to Euro Exchange Rate Forecast Back Above 1.20 in 2017

The rally in GBP/EUR is by no means over says a leading foreign exchange analyst.

The GBP/EUR pair has risen from the 1.09s of the October flash crash to November highs at 1.18 with a good boost being provided by the US election result on November 9.

The pair has however been unable to breach the resistance point at 1.18 with questions being asked if the uptrend is in danger of stalling and reversing.

Our technical analysis of the pair suggests it is still to early to argue the uptrend is over, however other studies do see signs of weakness.

For a fundamental spin on the the outlook we have received a timely note from Lloyds Bank Commercial Banking’s Gahan Mahadevan which argues that the period of appreciation for GBP/EUR is not yet done.

Mahadevan sees more upside for the pair into 2017.

A difference in the path of interest rates, set by the central banks of the UK and Eurozone, is said to underpin the current rise in GBP/EUR.

And importantly, the divergence is tipped to extend.

UK interest rates are expected to remain broadly unchanged whilst in the Eurozone they are expected to fall, or at least remained at low levels due to the European Central Bank’s (ECB’s) policies.

The note comes as the ECB's Mario Draghi tells the European Parliament on Monday, November 28 that the ECB will do all it can to keep policy accommodative enough to boost inflation.

Thus, the Bank may announce an extension of its QE programme as early as next week’s ECB meeting while the likelihood of a similar extension to the Bank of England's QE programme remains remote at best.

This is likely to keep a cap on Euro upside and keep the Pound underpinned as the UK's interest rates advantage attracts more foreign capital which in turn strengthens the currency.

"The recent GBP/EUR rally has been well supported by interest rate divergence. Having bottomed-out in August, and held support in October, UK yields (5-year and 10-year) have been on a sharp upward trajectory," says Mahadevan.

Further upside for the Pound is seen as government bond yields stay elevated as they chase US yields higher after Trump’s victory.

EUR/USD: To trade into a 1.00-1.10 range next year: 2 reasons

From analysts at the Royal Bank of Scotland:

EURUSD looks set to trade into a lower 1.00-1.10 range in 2017 after marking a 1.05-1.15 range for the last two years.

First, the European Central Bank is set to extend its €80bn a month of asset purchases when it meets on December 8 until the end of 2017. Chart 3 shows the ECB continues to face inflation well below its de facto 2% target. October's headline CPI reached 0.5%y/y on the back of energy base effects and RBS expects it to rise as high as 1.6%y/y in 2017. But core inflation remains stuck at 0.8%y/y. October's ECB minutes said 'underlying inflation had still not shown clear signs of an upward trend' and this week President Draghi said there was 'no sign yet of consistent underlying price pressure'. RBS forecasts core inflation will only be 0.7% in 2017 and 0.9% in 2018, prompting the ECB to extend quantitative easing throughout next year.

Second, the Eurozone faces key elections including the Netherlands' on 15 March, France's two rounds for its presidential elections on April 23 and May 7 and Germany's federal election in H2'16.

Ahead of next year's elections, Italy holds its constitutional referendum on December 4. The risk that Italy's government falls if it loses next month's vote or the Dutch and French elections lead to political parties taking office committed to leaving the EU will keep the EUR weak throughout H1'17.

The key upside risk for the EUR is the ECB tapering asset purchases before the end of 2017. Long term fair value for EURUSD is around 1.15-1.20. If the ECB considers exiting its bond buying it will allow the EUR to start recovering its losses.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Goldman Sachs Top Ten Market Themes for 2017

Chief Credit Strategist Charles Himmelberg says 2017 will be "High growth, higher risk, slightly higher returns"