EUR/USD: 'Torturing The Bears': What's Next? - BofA Merrill Themes: the Fed in the driver’s seat. Our last report argued that the March ECB meeting would be the most difficult in recent years; the price action that followed has confirmed it. In our view, the ECB delivered more than what markets had expected, but markets were not impressed and EUR/USD is now stronger. The FX market did not like Draghi's comment that there would be no more rate cuts, but subsequent offsetting comments by other ECB officials failed to weaken the Euro. Surprisingly dovish comments by Yellen in March also supported the Euro.

We have argued that FX markets have stopped focusing on data and what central banks actually do, and are now focusing on what central banks may or may not do ahead. Indeed, further easing by a number of central banks this year (BoJ, ECB, RBNZ, Riksbank, Norges Bank) has failed to weaken the respective currencies.

We expect balanced short-term EUR/USD risks, but would still sell any rallies as our medium-term outlook remains bearish.We will have to wait for the second half of this year to see if the ECB needs to ease policies again. Our economists expect the next Fed hike only in June. For now, higher US inflation leads to lower real yields, which is weighing on the USD. However, we expect divergence of monetary policies to weaken the Euro eventually. In our baseline of a continued global recovery, the Fed will have to hike, while the ECB cannot stop QE before its inflation target comes within reach. Our year ahead EUR report had argued that this would be a frustrating year for EUR bears and this is what we have seen so far.

Forecasts*: The choppy road to parity. We continue to expect EUR/USD to weaken to below 1.10 by June and as low as parity by end-2016. We expect this move to be consistent with the data, which should address the Fed's concerns about the strong USD. Our projections are consistent with a temporary undervaluation of EUR/USD, which however we explain by the ECB's monetary policy stance relatively to that of the Fed.

Risks: balanced. We have recently argued that the Euro is not pricing Brexit uncertainty and risks and that shorting EUR could be a way to hedge against Brexit. More broadly, EUR positioning is light and flows could swing the currency both ways, if the ECB or the Fed surprise markets.

EUR/USD: Failing To Break Current Range; Staying Bullish Next Week - BTMU The euro has stabilized against the US dollar at higher levels over the last week, while US dollar has held up better than expected in the face of still broad-based selling pressure triggered by the more dovish policy shift from the Fed, notes BTMU.

"As a result, EUR/USD has failed to break above the top of current trading range between the 1.1000 and 1.1500 levels.

We expect the US dollar to remain on the defensive in the near-term although there are signs that weakness may already have overshot helping to limit scope for further downside.

The main focus in the week ahead will be the latest US retail sales and CPI reports, and comments from a number of Fed officials. A pick up in US growth in Q2 and more sustained evidence that inflation has firmed are needed to offer greater support for the US dollar.

In contrast, the main downside risk for the euro in the current quarter is posed by the building risk of Brexit which should intensify in the coming months beginning to weigh more on the euro," BTMU argues.

BTMU is bullish on EUR/USD going into next week seeing the pair trading in a 1.12-1.15 range.

EUR/USD And Real Rates

Key quotes from the BNPP FX report

EUR/USD Real rates are key

We have long argued that, with a number of major central banks reaching a lower bound for nominal policy rates, real rates should become key for G10 FX. This is because at the lower bound, non-conventional policies increasingly work through inflation expectations. When nominal rates have little room to move, market reaction to central bank policy action should be mainly captured through inflation expectations and their impact on real rates.

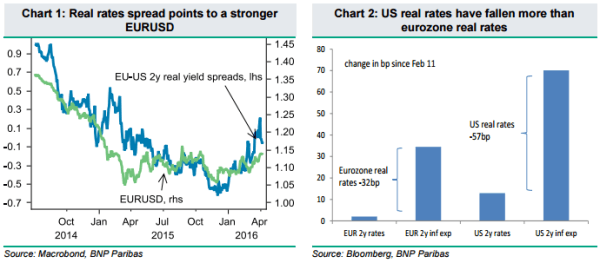

Real rates spreads are currently sending a bullish signal for EUR/USD (Chart 1). Drilling into the details of what moved the eurozone-US 2y real rate spread suggests that, while both eurozone and US real rates declined recently, US rates fell by nearly twice as much as eurozone rates. As highlighted in Chart 2, US real rates fell because a 70bp rise in US inflation expectations from mid-February far outpaced the 13bp rise in 2y yields. Meanwhile, eurozone inflation expectations rose by a smaller 35bp and nominal yields were little changed.

Rate Spreads

In our view, real rate dynamics capture well the market impact of recent central bank policy announcements. Markets went into the March ECB meeting with a rate cut priced in and came out with the perception that the ECB has reached the lower bound for the deposit rate. Subsequently, the eurozone 2y yield is not far from where it was nearly two months ago. At the same time, the ECB still has a hard time raising domestic inflation expectations, which remain stuck below levels that prevailed around the start of the ECB’s quantitative easing programme in 2015, as measured by shorter-term measures such as the 2y inflation swap as well as the longer-term 5y5y measure, which is the ECB’s preferred gauge.

As mentioned above, most of the move in real rate differentials in favour of EUR/USD is actually explained by the US side of the equation. A rebound in risk sentiment, equities and oil prices has triggered a recovery in US inflation expectations since mid-February. However, US front-end yields have been restrained by the Fed’s dovishness, implying a sizeable drop in US real rates. Thus, as long as Fed expectations remain mired at the current very dovish levels, the dollar should struggle to take advantage of either the improvement in global sentiment or the uptick in US inflation.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use