You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

EUR/USD continues retreat from 5-month highs, amid hawkish Fed signals EUR/USD fell mildly on Wednesday extending losses from the previous three sessions, amid hawkish signals from the Federal Reserve that it could accelerate the pace of its first tightening cycle in the last decade over the coming months.

The currency pair traded in a broad range between 1.1159 and 1.1221, before settling at 1.1179, down 0.0042 or 0.37%. Following its fourth consecutive losing session, the euro closed under 1.12 versus the dollar for the first time in nearly a week. Last week, the euro soared to five-month highs against its American counterpart after the Fed left interest rates unchanged and lowered its outlook for future rate hikes.

EUR/USD likely gained support at 1.0538, the low from December 3 and was met with resistance at 1.1496, the high from Oct. 15.

Since the Federal Open Market Committee (FOMC) unexpectedly downgraded its rate outlook at last week's two-day March meeting, a number of key policymakers have reversed course in recent days by striking an aggressively hawkish tone. Addressing an audience of bond traders on Tuesday night at the Money Marketeers of New York University's conference on Growth and the Role of Economic Policies, Federal Reserve Bank of Philadelphia president Patrick Harker Patrick Harker squarely aligned himself with his hawkish colleagues on the Federal Open Market Committee (FOMC). Citing continued improvement in the economy, Harker said the Fed should consider raising interest rates as early as its next meeting on April 28-29 and that he prefers at least three rate hikes before year's end. Harker, who became president of the Philadelphia Fed in mid-2015, is a non-voting member of the FOMC until the start of next year.

read more

Avoid USD/CAD, NZD/USD, GBP/USD - DB Technical Scorecard EUR/USD tops Deutsche Bank's technical scorecard in G10 space.

"The currency pair is highly trending to the topside with VHF at 94th percentile. It has smooth price action in terms of realized and implied volatility metrics and is the least stretched pair as per the RR measure, suggesting the move higher should be chased via options.

Avoid USD/CAD and NZD/USD as the currencies are no longer trending, and GBP/USD due to the choppiness in the price action as measured by the volatility metrics," DB notes.

5 Things to Watch on the Economic Calendar This Week 1. Fed Chair Yellen speaks

Federal Reserve Chair Janet Yellen is due to speak about the U.S. economic outlook and monetary policy at the Economic Club of New York at 15:30GMT, or 11:30AM ET Tuesday.

Yellen struck a surprisingly dovish tone following the conclusion of the Fed’s policy meeting on March 16, however hawkish comments from a handful of Fed officials last week sparked speculation that the U.S. central bank could give serious consideration to a rate hike at its April meeting.

2. U.S. nonfarm payrolls report

The U.S. Labor Department will release its March nonfarm payrolls report at 12:30GMT, or 8:30AM ET, on Friday.

The consensus forecast is that the data will show jobs growth of 205,000 last month, following an increase of 242,000 in February, the unemployment rate is forecast to hold steady at 4.9%, while average hourly earnings are expected to rise 0.2% after falling 0.1% a month earlier.

An upbeat employment report would help support the case for the Fed to steadily tighten monetary policy this year.

3. U.S. ISM manufacturing PMI survey

The U.S. Institute of Supply Management is to release data on March manufacturing activity at 14:00GMT, or 10:00AM ET, on Friday. The gauge is expected to rise 1.5 points to 51.0, the first reading above the 50.0-mark which signals expansion in four months.

4. China manufacturing PMIs

The China Federation of Logistics and Purchasing is to release data on March manufacturing sector activity at 1:00GMT on Friday, or 9:00PM ET Thursday, followed by the Caixin manufacturing index at 1:45GMT, or 9:45PM ET.

The official China's manufacturing purchasing managers' index is forecast to inch up 0.3 points to 49.3, while the Caixin survey is expected to rise to 48.3 from 48.0 in the preceding month.

A reading below 50.0 indicates industry contraction.

5. Euro zone flash March inflation figures

The euro zone will publish flash inflation figures for March at 9:00GMT, or 5:00AM ET, Thursday. The consensus forecast is that the report will show consumer prices declined 0.1%, compared to a drop of 0.2% in February, while core prices are expected to rise 0.9%, accelerating from a gain of 0.8%.

The European Central Bank rolled out fresh easing measures following the conclusion of policy meeting on March 10 in a bid to boost sluggish inflation and a weakening economy.

US Stock Futures Drop Before Yellen Clarifies Fed's Next Move US equity futures are signaling falls at the market open on Tuesday, as all eyes turn to a speech by Federal Reserve (Fed) Chair Janet Yellen later in the session, as she may clarify whether a rate hike is possible in April.

Futures for the Standard & Poor's 500 index lost 0.34% to trade at 2,021.15 ahead of the market open.

Fed Chair Yellen is due to speak on "Economic Outlook and Monetary Policy" at the Economic Club of New York luncheon later in the day.

She may give more hints about whether a rate hike in April is possible, as suggested by some Fed officials earlier this month. However, many analysts think the US central bank will remain on hold next month and move interest rates in June at the earliest.

"Given other Fed officials have repeated that April is 'live', it will be interesting to hear whether Yellen decides to repeat that message today," analysts at Bank of Tokyo-Mitsubishi said, adding that it will be interesting to see whether she "attempts to alter the impression left at that press conference that the FOMC was no longer 'data-dependent' and more willing to take some risks that may result in an overshoot of the 2% inflation target mandate."

Moreover, San Francisco Fed President John Williams stated that rate hikes will be gradual and that the bank's 2% inflation target will be reached within the next two years. He also added that the US economy is close to, or has already hit, the maximum employment.

Dallas Fed President Robert Kaplan will be speaking on Tuesday as well.

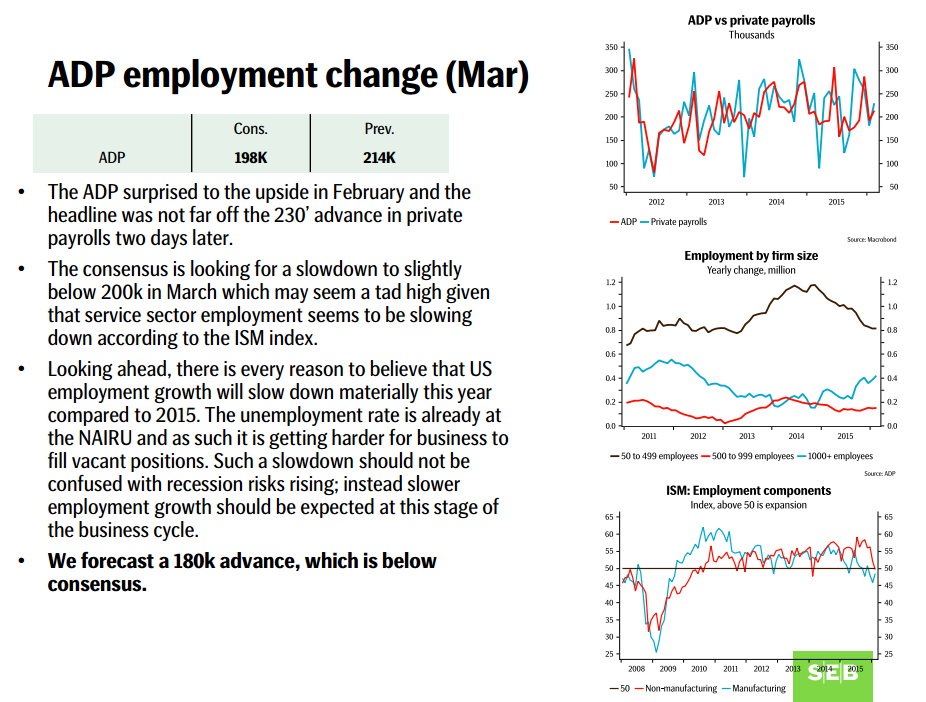

Preview: ADP Employment (March)

US Payrolls Preview: Watered-Down Wages to Worm Their Way Up Again The US unemployment rate has been sitting below 5% recently, a level most economists would say is pretty much its natural low point. Yet even though the supply of unemployed workers has thinned out appreciably after a rapid burst of hiring in the last two years, employees have not yet been able to negotiate substantial wage hikes.

In fact, a budding acceleration in wages was aborted in February. Having been trending between 1.9% - 2.1% through much of the recovery, the year-over-year increases in average hourly earnings of all employees began moving up in the latter half of 2015, culminating in an average gain of 2.5% in the six months ending January 2016.

February's 0.1% monthly decline broke the streak, but the early spring could bring better news. Economists expect average hourly earnings to rebound 0.2% in March. Although a bounce would be encouraging, given the inherent volatility of the data, a clear uptrend would have to be confirmed by subsequent readings.

Federal Reserve Chair Janet Yellen still seemed skeptical about wage trends during her March press conference. We have heard anecdotal reports of stronger wage pressures, she said, but those were still limited to certain sectors.

"The fact that we have not seen any broad-based pickup is one of the factors that suggests to me that there is continued slack in the labor market, but I would expect wage growth to move up some," Yellen said on March 16.

Wage pressures should continue to build in the months ahead, as the jobless rate continues to decline below the so-called non-accelerating inflation rate of unemployment (NAIRU).

For March, markets are expecting another 205,000 jobs to be added. The unemployment rate should hold steady at 4.9% following a series of increases in labor force participation.

read more

5 Things to Watch on the Economic Calendar This Week 1. FOMC meeting minutes

Investors will be focusing on minutes of the Federal Reserve’s March policy meeting due on Wednesday at 18:00GMT, or 2:00PM ET, for some clarity on where the U.S. central bank stands on its path toward rate hikes.

The Fed surprised markets following the conclusion of its policy meeting on March 16 by cutting its rate hike projection for this year to two from the four it had previously projected, citing the potential impact from weaker global growth on the U.S. economy.

2. Fed speakers

Market players will be paying attention to a handful of FOMC member speeches during the week to further judge the balance of opinion among policymakers on the prospect of further rate hikes.

On Monday, Boston Fed President Eric Rosengren, Minneapolis Fed President Neel Kashkari and Dallas Fed President Rob Kaplan are scheduled to speak throughout the day.

On Wednesday, Cleveland Fed President Loretta Mester, St. Louis Fed President James Bullard and Dallas Fed President Rob Kaplan are on tap.

Fed Chair Yellen is scheduled to participate in a panel discussion at the International House, in New York, on Thursday.

Finally, Kansas City Fed President Esther George is due to speak about the U.S. economy, in Nebraska, on Friday.

3. U.S. ISM non-manufacturing PMI survey

The U.S. Institute of Supply Management is to release data on March service sector activity at 14:00GMT, or 10:00AM ET, on Tuesday. The gauge is expected to rise 0.6 points to 54.0, which would be a three-month high.

4. Reserve Bank of India rate decision

The Reserve Bank of India is expected to cut its key repo rate by 25 basis points to 6.50% on Tuesday. There is also a high possibility of RBI going for a 50 basis points rate cut as inflation running at record lows and the economy in danger of slowing down spur policymakers into action.

5. Reserve Bank of Australia policy meeting

The RBA's latest interest rate decision is due on Tuesday at 4:30GMT, or 12:30AM ET. Most economists expect no policy change, while some believe the central bank can surprise with a 25 basis point rate cut in an effort to boost inflation and spur economic activity.

Preview: ISM Non-Manufacturing Survey (March)

Top 5 Things to Know In the Market on Tuesday 1. Dollar tumbles to 17-month low against the yen

The dollar fell to its lowest level in 17 months against the safe-haven yen on Tuesday, prompting speculation over a possible intervention to halt the appreciation of the Japanese currency.

USD/JPY hit lows of 110.30, the weakest level since October 31, 2014 and was last at 110.38 by 9:56GMT, or 5:56AM ET, off 0.86% for the day. The pair has fallen more than 8% so far this year.

The yen’s gains fueled speculation over how much higher the currency can climb before Japanese officials act to weaken the currency.

2. Oil sinks to 4-week lows

Oil prices extended losses from the prior session on Tuesday, falling to fresh four-week lows as investors are starting to doubt whether there will be an agreement between top oil producers of a coordinated freeze at a meeting in Doha, set to take place on April 17.

U.S. crude was down 24 cents, or 0.67%, to $35.46 a barrel, while Brent shed 31 cents, or 0.82%, at $37.38.

3. Global stock markets slammed

European stocks were deep in negative territory on Tuesday, with Germany’s DAX down more than 2.5%, as a decline in oil prices weighed on investor sentiment and dragged down resource companies.

Meanwhile, U.S. stock futures pointed to a sharply lower open, with the Dow futures falling more than 120 points, amid mixed messages from Federal Reserve policymakers on the outlook for U.S. interest rate rises and as market players awaited service sector data due later in the session.

Earlier, markets in Asia closed mostly lower following losses in U.S. equities overnight amid fresh declines in oil prices.

4. Allergan (NYSE:AGN_pa) shares plummet 20% in pre-market

Shares of Allergan Plc (NYSE:AGN) plunged 22.5% to $215.00 ahead of the opening bell, following news of the U.S. Treasury Department's new steps to curb tax-avoiding inversion deals in which a U.S. company reincorporates overseas after the purchase of a foreign company.

Dublin-based Allergan has agreed to be bought by Pfizer (NYSE:PFE) in the biggest inversion deal ever. Shares of Pfizer were up 2.9% at $31.62 in pre-market trading.

5. Central bank roundup: India, Australia

The Reserve Bank of India cut its benchmark interest rate by 25 basis points to 6.5%, the lowest since January 2011, in a widely anticipated move. The RBI hinted at another rate cut later this year if inflation trends stay benign.

Elsewhere, Australia's central bank left interest rates at a record-low 2.0%, where they have been for nearly a year, citing evidence of continued growth at home despite an unhelpful rise in the local dollar.

source

Market Testing BoJ, While ECB Can't Talk Down The EUR Who would have expected divergence of monetary policies to weaken the USD?

The Fed has now adopted a third mandate, of global market stability, suggesting that a USD rally is unlikely as long as markets remain fragile. Rising US inflation could force the hand of the Fed, but it may take a while.

At the same time, the market is testing the BoJ for the first time since Abenomics was introduced, while the ECB cannot talk the Euro down, as they cannot ease policies again in the short term, after having eased in March.

The result is a strong JPY despite a risk-on market move and a weaker EUR despite recent ECB easing.

A strong USD needs an almost perfect scenario of strong data in the US and abroad and buoyant global markets, which would allow the Fed to hike without concerns.

A USD rally is unlikely as long as markets remain fragile. We remain bearish USD/JPY.

source