Mario Draghi And The European Central Bank Can't Ignore This Chart

The European Central Bank will meet on Thursday and announce any changes to its already easy monetary policy.

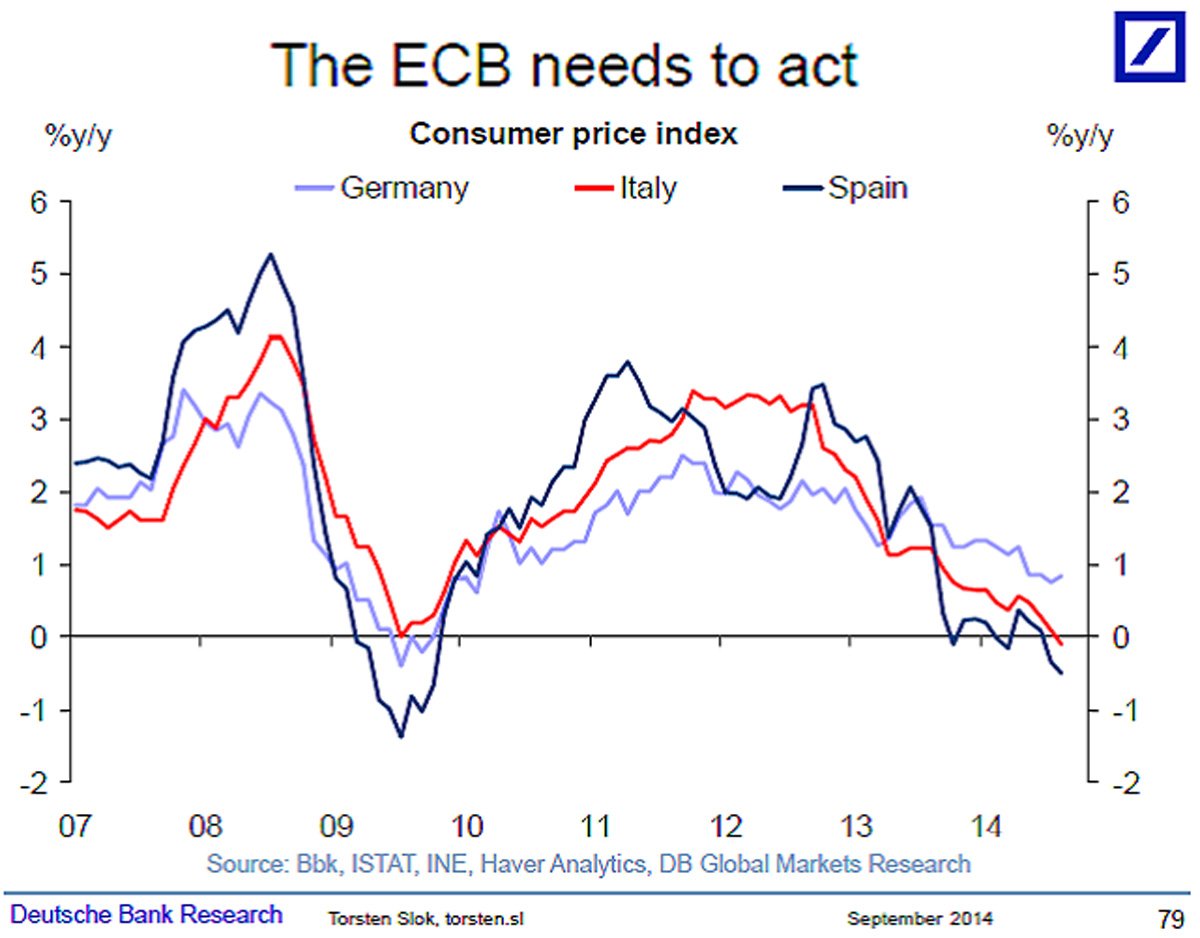

The meeting follows an ugly series of depressing economic reports. And amid broad evidence of slowing, it's become very clear that inflation is getting closer to zero.

On Friday, we learned consumer prices in the 18-country eurozone climbed by just 0.3% in August, a slight tick down from 0.4% in July. Prices in Italy actually fell 0.2% year-over-year.

This lack of inflation should provide the ECB with the flexibility to ease policy further.

However, the consensus is for the ECB to make no change in its policy, which includes a main refinancing rate of 0.15%, a marginal lending facility rate of 0.4%, and a deposit facility rate of -0.1%.

Deutsche Bank's Torsten Slok is among the economists who believe ECB President Mario Draghi will act.

"It is difficult to see how the ECB next week is going to ignore the trend we have seen over the past two years in this chart," wrote Slok in an email that included the chart above. "And note that this trend is not just driven by Ukraine or temporary factors. It is going to take some time to reverse this downtrend in European inflation and as a result US rates are going to look attractive for at least a few more months."

Indeed, while the forces initially slowing Europe down appear to have come from within, we can't ignore the fact that Putin's control over Europe's gas supply only keeps downside risks elevated.

They can ignore it and they will ignore it. The new jobs that we are going to get is being drafted to army for a 5 euro a day and a whole lot of "Euro patriotism" as a solution for unemployment

Quantitative easing hopefuls may be disappointed as Draghi plays for time

Expectations for further policy action at the European Central Bank's meeting on Thursday are running high after ECB President Mario Draghi pledged to use all available tools to keep prices in check.

But investors may be in for disappointment as resistance to quantitative easing (QE) remains stiff, particularly in Germany, while there is an increasing recognition that the ECB may not be able to solve Europe's problems alone.

Draghi told a central bank conference in Jackson Hole on Aug. 22 that financial market inflation expectations were falling significantly and the ECB would use "all available instruments needed to ensure price stability".

In a dramatic departure from debt-cutting orthodoxy, he also said there was scope for fiscal policy - more government spending - to play a greater role in reviving growth, an apparent acknowledgement of the limits of the ECB's powers.

German Chancellor Angela Merkel and Finance Minister Wolfgang Schaeuble were reported to have called Draghi seeking clarification and Schaeuble later said he had been "overinterpreted".

Either way, the ECB president's monthly news conference will be under minute scrutiny for signs that he is sticking to or diluting his Jackson Hole speech which departed from the text, leading some economists to believe Draghi had gone out on a limb as with his 2012 "whatever-it-takes" to save the euro speech.

Several economists now see a larger chance of the ECB embarking on QE in the coming months.

"QE is now largely unavoidable because inflation continues to persistently undershoot," said Citigroup economist Guillaume Menuet. He expects the ECB to announce such plans in December.

A Reuters poll put a 40 percent chance on the ECB conducting outright purchases of sovereign bonds by March next year.

Action on this front is unlikely on Thursday, though, and with the main interest rate at a record low 0.15 percent and the deposit rate below zero there is little scope for action there either.

The ECB is also waiting to see the impact of its new four-year loan program. Under the plan announced in June, banks can take up to 400 billion euros in September and December, and even more next year if they keep lending into the real economy.

To start printing money now would be to acknowledge the failure of the long-term loans before they have even started.

Nordea analyst Jan von Gerich said: "I don't think they want to be seen panicking. And doing something other than a broad-based asset purchase program, for example with the interest rates, would seem to make little sense."

NEW FORECASTS

The ECB's update of its economic projections will be key.

Disappointing euro zone growth data and inflation moving closer toward zero and further away from the ECB's target of close to 2 percent will likely prompt yet another downward revision of its staff forecasts on Thursday.

In June, it said inflation would only get back to 1.5 percent in the last quarter of 2016 compared with its March forecast of 1.7 percent.

The market-based inflation expectation rate Draghi cited in Jackson Hole - the five-year, five-year forward breakeven rate - has picked up since his speech.

On Monday, Draghi met French President Francois Hollande in Paris. An official in the president's office said they agreed deflation and weak growth were threatening Europe's economy.

The French government has consistently called for the ECB to do more to bring down the euro exchange rate to boost competitiveness. Over the last month, the euro has dropped from near $1.37 to around $1.31.

The ECB is already "moving fast forward" with preparations to buy securitized loans, Draghi said in Jackson Hole, and economists expect further details on a possible asset-backed securities (ABS) program on Thursday.

"The easiest way for them would be to confirm that they've agreed to do ABS and that they are in the final stages of dotting the 'i's and crossing the 't's," said Citigroup's Menuet.

"I'm not sure they are willing yet to give us a number - I think that anywhere around 50 billion (euros) is the minimum they can announce, and perhaps that's the sort of intermediate stage they can agree on before spending the next three months building a QE strategy."

Others are not so sure.

With euro zone bond yields already at record lows, the impact of a QE program could be limited while banishing any pressure on governments to pursue structural economic reforms.

"The ECB council will likely worry about the moral hazard aspects of QE, which could easily tempt governments in Italy, France and elsewhere to go even slower on reforms," Morgan Stanley analysts said in a research note.

QE remained a measure of last resort, they said.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The European Central Bank meeting on Thursday is the prime event for markets seeking clarity on the bank's response to a stalled recovery, disappearing inflation and the sluggish pace of reform in the euro zone.

Inflation in the 9.6 trillion euro economy dropped to a fresh five year low of 0.3 percent in August and as the months fly by, the bloc's cushion against Japan-style deflation is getting smaller and smaller.

Increased geopolitical risks from the intensifying conflict in Ukraine forced Europe to impose sanctions on its third biggest trade partner Russia, a move which dented the faltering economic rebound even further.

"Pressure for the ECB to do more has returned, not only because of weak output/inflation data, but mostly following (ECB's President Mario) Draghi's speech in Jackson Hole," said Frederik Ducrozet, senior euro zone economist at Credit Agricole.

Draghi struck a new, for some a groundbreaking, tone trying to cajole European governments into agreeing a common approach to reforming their economies - a drive he sees as necessary to allow the stagnant euro zone to grow with verve.

He will have a hard time selling his message. Countries like the euro zone's second and third largest economies France and Italy are not growing and lag behind significantly with reforms.

So the ECB may have to reach deeper into its policy toolbox, with some analysts even betting on an interest rate cut at the bank's meeting on Thursday.

"We expect the ECB to cut all key interest rates by a further 10 basis points, thereby delivering a larger negative deposit rate (-0.20 pct) as well as a refi rate even closer to zero (0.05 pct)," Nomura wrote in its global market research.

Beyond the euro zone, the week is packed with monetary policy meetings, with Sweden’s Riksbank, the Bank of Canada, the Bank of Japan and the Bank of England all taking the stage. The latter will be closely watched as investors seek guidance on the timing of an expected tightening.

Although no policy action from the Bank of England is foreseen on Thursday, it is still expected to be the first major central bank to lift interest rates when it makes a move early next year, just ahead of the U.S. Federal Reserve.

source