Will ECB Flip The Playing Field?

Last December, we explained why central bankers are terrified of economies that slip into a very difficult to stop deflationary spiral. European policymakers are not yet terrified, but it is fair to say they are concerned about what has been persistent low inflation. From Reuters:

Euro zone price inflation fell unexpectedly in May, increasing the risks of deflation in the currency area and all-but sealing the case for the European Central Bank to act this week. Annual consumer inflation in the 18 countries sharing the euro fell to 0.5 percent in May from 0.7 percent in April, the EU’s statistics office Eurostat said on Tuesday.Fed Casts A Wider Economic Net

Unlike the European Central Bank (ECB), the Federal Reserve has a “maximum employment goal”, which was added to The Federal Reserve Act in 1997 via the “dual mandate” clause:

“The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.”ECB To Become More Like Fed?

With low inflation and somewhat stagnant employment opportunities, some in the eurozone are calling for a more Fed-like approach to European central banking. From Euronews:

Antonio Tajani, the European Commissioner for industry, has said the value of the euro against the dollar is currently too high, and there should be a rethink of the European Central Bank’s role so it focuses more on stimulating job creation. Tajani told a conference in Milan that the euro at just under $1.40 is hurting “the economies of Spain, Italy, France and, in the long run, Germany”. He wants the ECB to be more like the Federal Reserve in the US, focused not just on inflation but also on stimulus to reverse low unemployment.ECB Set To Join Currency Wars

Since the ECB has to deal with input from 18 countries, they tend to move slowly when it comes to a major shift in policy. From The Wall Street Journal:

The European Central Bank is poised to join the currency wars. But investors shouldn’t expect a shock-and-awe campaign. The central bank is widely expected to further loosen monetary policy Thursday. This is likely to take the form of charging banks to hold money with the ECB and emphasizing that the central bank expects to keep borrowing rates near zero for a long time yet. It may also try measures to boost bank lending to companies.A Weaker Euro Impacts The U.S. Dollar

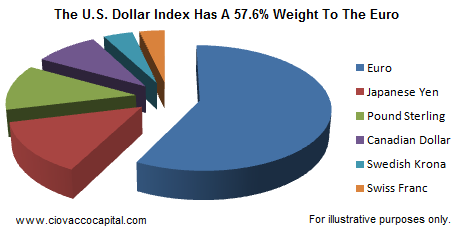

Currencies are valued in relative terms, which means if one country wants a weaker currency, it can put upward pressure on the currencies of other nations. For example, the U.S. Dollar Index (NYSE:UUP) is valued via the following inputs:

EUR: Don’t Rule Out A Post-ECB Bounce

EUR: Don’t Rule Out a Post ECB Bounce

The title of our daily note yesterday was “Why Negative Rates Could Drive EUR Down 3%.” We provided charts and examples outlining the potential for a deep sell-off but if you read through the piece, our core argument was that the euro is completely different from the Danish and Swedish Kronas and therefore not likely to experience the same sell-off. In fact, the euro could actually bounce after the ECB rate decision if the central bank refrains from signaling plans to follow the move with Quantitative Easing. Back in November when the central bank cut interest rates by 25bp, EUR/USD collapsed on the day of the announcement but the bottom of 1.33 was also set on that very day. In the month that followed, the euro gained approximately 5 cents versus the U.S. dollar, rising to a high above 1.38. Interest rate cuts are suppose to drive a currency lower but in the case of the euro investors were impressed by the European Central Bank’s aggressiveness and believed that it would be enough to revive the Eurozone economy. Here are 5 reasons why easing by the ECB may not be completely negative for the EUR/USD:

- The EUR/USD is a very liquid currency

- Eurozone has a current account surplus in the billions and not millions

- EONIA curve shows investors have completely discounted the move

- Strong action by ECB could attract more investment flows

- Anything short of a 4 pronged move (refi cut, depo cut, end SMP sterilization, LTRO) could help the euro

It is important to realize that the EUR/USD is an extremely liquid currency, which means there should be more two-way action with bargain hunters attracted by the decline for a currency with a current account surplus in the billions and not millions like Denmark and Sweden. For most of this year, euro was also supported by the return of funds that fled the region during the sovereign debt crisis and strong action by the ECB could make foreign investors more confident and willing to invest in Eurozone assets. At the same time, the EONIA curve shows that the market has already priced in easing by the central bank. In order to minimize the volatility caused by their decision, they have made their plans abundantly clear which means that the risk is for them to under-deliver. At this stage, they are widely expected to lower the refinancing rate, cut the deposit rate, end SMP sterilization and provide another LTRO for banks. Anything short of these 4 moves could end up lifting the euro. For EUR/USD to fall 3%, the ECB would need to signal plans to initiate a broad scale asset purchasing program or Quantitative Easing. While they are discussing this possibility, we don’t believe they are prepared to resort to this nuclear option. However if they suggest that it is becoming more feasible, EUR/USD will decline with a sell-off that should be limited to 1.35/1.3450.

ECB ready to cut rates and push banks into lending

The European Central Bank is poised to impose negative interest rates on its overnight depositors, seeking to cajole banks into lending instead and to prevent the euro zone falling into Japan-like deflation.

At its meeting on Thursday, ECB policymakers may also launch a loan program for banks with strings attached to make sure the money actually gets out into the euro zone economy.

It will be the first of the "Big Four" central banks - ECB, Bank of England, Bank of Japan and U.S. Federal Reserve - to go the negative interest rate route, essentially charging banks to deposit with it.

Even though the risks are limited of the euro zone entering a spiral of falling prices, slowing growth and consumption, the ECB is increasingly concerned that persistently low inflation and weak bank lending could derail the recovery.

The economy grew just 0.2 percent in the first quarter, and euro zone annual inflation unexpectedly slowed to 0.5 percent in May, official data showed this week, piling additional pressure on the central bank to step in.

"Consensus for action is high so there is a ... risk the ECB under-delivers relative to the market's lofty expectations," said Andrew Bosomworth, a senior portfolio manager at bond fund Pimco in Munich.

Since ECB President Mario Draghi last month signaled the Governing Council's readiness to act in June, policymakers have come out in force to discuss the ECB's toolbox, feeding expectations that a broader stimulus package is in the making.

This is likely to consist of a cut in interest rates, which would push the deposit rate for the first time into negative territory and the offer of longer-term loans linked to further lending. Large-scale asset purchases remain a distant prospect.

Cutting the deposit rate below zero would see the ECB charge banks for parking their excess money at the central bank - a step it hopes will prompt them to lend out the money instead.

Economists in a Reuters poll expected the ECB to cut its main refinancing rate to 0.10 percent from 0.25 percent and the deposit rate to -0.10 percent from zero, on top of launching a refinancing operation aimed at funding firms.

They expect bank lending to rise as a result of such measures, but foresee only a marginal impact on the euro.

The euro has fallen about 4 U.S.-cents against the dollar since the ECB's May meeting, hitting $1.3586 last Thursday.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

While US equity implied volatility has been flat to slightly higher in the last week (as stocks have soared), FX volatility has remained near record lows... until today. Ahead of Draghi's big day tomorrow, EURUSD implied volatility has spiked from around 5 to over 17 - its highest since Dec 2011 - as investor anxiety over Draghi disappointing mixes with a record high short position in EUR FX Futures... it seems more than a few are concerned that Draghi's promise is more hope than reality.

source