Here Comes QE In Financial Drag: Draghi's New ABCP Monetization Ploy

Yes, the ECB is now energetically trying to revive the a market for asset-backed commercial paper (ABCP)—-the very kind of “toxic-waste” that allegedly nearly took down the financial system during the panic of September 2008. The ECB would have you believe that getting more “liquidity” into the bank loan market for such things as credit card advances, auto paper and small business loans will somehow cause Europe’s debt-besotted businesses and consumers to start borrowing again—- thereby reversing the mild (and constructive) trend toward debt reduction that has caused euro area bank loans to decline by about 3% over the past year.

What they are really up to, however, is money-printing and snookering the German sound money camp. That is, the ECB is getting set to launch QE in financial drag by purchasing or discounting ABCP while loudly proclaiming that it’s not “monetizing” any stinking sovereign debt!

And that gets to the heart of monetary central planning. It doesn’t matter what the central bank buys with the digital credits it transfers to sellers. Purchasing government debt, Fannie Mae securities, IBM bonds or corporate equities, as has been done by the BOJ and Bank Of Israel under the new Fed Vice-Chairman, has a common effect. That is, it raises the price of the purchased “assets” relative to what would obtain in the unfettered market, and injects fiat liquidity into the financial system in a manner that promotes speculation and excessive risk-taking.

Thus, if some clever Wall Street operators could figure out how to bundle sea shells and securitize them, central bank purchase of the resulting ABCP would be no different than purchase of treasury notes or Fannie Mae paper.

Unfortunately, the German keepers of the flame of financial orthodoxy have been too narrow in their focus on central bank “monetization” of government debt. To be sure, they are correct in maintaining that central bank purchase of sovereign debt inexorably promotes fiscal profligacy among the politicians. The fact that the debt of nearly ever DM government has soared to 100% of GDP and beyond since the era of monetary central planning got going in the 1990s is undeniable evidence.

But the true economic sin lies in the fiat credit generated by central banks monetization, not the particular type of “asset” purchase by which it is accomplished. Stated differently, debt which is priced at honest market rates and is funded by new savings from businesses or households is economically healthy; it involves a deferral of current consumption in order to finance a longer-lived project or productive asset that promises a return in excess of the funding cost.

By contrast, central bank balance sheet expansion—that is, monetization of government debt or asset-backed sea shells—results in borrowing without saving; investment without honest hurdle rates; and the re-rating of existing asset prices based on carry trades, not an elevation of expected economic returns.

So in clearing the way to “monetization” of ABCP, the ECB is simply heading down the path of Bernanke/Yellen style quantitative easing though a transparent gimmick that may or may not bamboozle the Germans. But it most certainly will succeed in snookering the financial press as the post below from the ever gullible Brian Blackstone of the WSJ clearly conveys.

But here’s the thing. The ABCP market is not a place where hard-pressed business borrowers or consumer’s can find a new source of credit outside the banking system. Instead, it is a financial engineering arena in which banks will have a chance to mint phony overnight profits through an accounting expedient known as “gain-on-sale”.

What that means is that when credit card receivables or small business loans are “bundled” by their commercial bank issuers and sold into an off-balance conduit which issues ABCP against these “assets”, the life-time profits of these loans can be booked instantly. Indeed, modern technology allows the credit card swipe to be booked as a profit nearly the same nanosecond as it happens, and accounting convention allows the profits from a 7-year car loan issued at 110% of the vehicle’s value to be recorded virtually at the time it rolls off the dealer lot.

The smoking gun with respect to the current ECB ploy is contained in the graph below for the US ABCP market. As is evident, it went parabolic in the run-up to the 2008 meltdown, but has virtually vanished since. In fact, current outstandings of about $250 billion are 80% below the July 2007 peak.

But there is nary a word in the financial press about credit card or auto loans being too “tight” in the US for a simple reason. Banks are more than happy to issue new loans to credit-worthy business and consumer borrowers and hold them to maturity on their own balance sheets. After all, with $2.7 trillion of “excess reserves” parked at the New York Fed, “funding” is not an issue. Moreover, the whole point of the Fed’s interest rate repression regime is to create an artificially large profit spread on bank loan books in order to revive dodgy balance sheets.

Exactly the same as FED QE

ECB expected to slash rates, hold back on QE bazooka

Expect easing measures, lots of easing measures.

It’s soon time for the monthly European Central Bank meeting and this time it seems almost a done deal that more monetary stimulus is on the table. And not just one, or two different measures, but a whole package to help the struggling euro zone fight off low inflation, a too-strong currency and slow growth.

Most economists expect the central bank to take deposit rates into negative territory for the first time ever, accompanied by various liquidity shots. But could it get even wilder than that?

Maybe. Yves Mersch, member of the Executive Board at the ECB, said in mid-May that the Governing Council is working on a broader range of instruments that “might even strike the most fertile imagination.” That’s something, for a central bank that has been sitting on its hand for quite some time, despite calls for action.

Markets are also largely banking on some kind of action. The euro EURUSD -0.18% is down almost 3% since ECB President Mario Draghi at the May meeting hinted at some kind of easing operations in June.

The discussions, the speculations and the predictions about potential ECB easing will likely dominate in the week ahead, but there’s plenty of other stuff that could roil the markets as well. Think Bank of England decision, euro-zone inflation data, PMI numbers and the oh-so-important U.S. jobs report.

ECB meeting: As sketched out above, THE main event next week in Europe. And if Draghi & Co. doesn’t do anything this time, it’ll sure be felt in the market (considering how many hints the policy makers have given the past month). The euro would soar. Equity markets would fall. A gasp of surprise and disappointment would probably be heard in financial centers. The rate decision is out at 12:45 p.m. London time (7:45 a.m. Eastern Time) on Thursday, followed by Draghi’s news conference at 13:30 p.m. London time.

So, what options does the central bank actually have? Cutting interest rates by 10 basis points seems to be one of most like options, according to economists. That means the main refi rate would stand at an all-time low of 0.15% and that the deposit rate at -0.1%, the first time ever for the deposit rate to go into negative.

This means banks will have to pay to store cash with the ECB, which in theory should spur them to increase lending. However, Philip Shaw, chief economist at Investec Securities, pointed out that the main effect would be to prompt liquid banks to repay their excess funds to the ECB.

To avoid a liquidity squeeze in the euro-zone system, economists therefore expect the central bank to launch some kind of liquidity measures along with the negative rates. Some mention another round of long-term refinancing operations, aka LTRO, while others expect the ECB to suspend the sterilization of the SMP program (which is a bit technical, but would mean less money is drained from the euro-zone system).

And then there’s QE. Although it’s certainly the talk of the town, quantitative-easing measures seem extremely unlikely at this point. But the ECB has surprised before, so it can’t completely be ruled out.

Whatever The ECB Does This Week, It Won't "Deliver A Significant Impulse To The Real

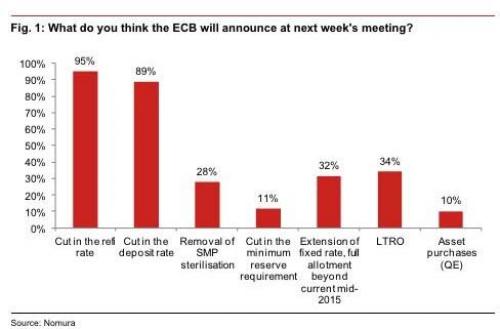

Ahead of this Thursday's ECB meeting, speculation is rife about what Mario Draghi will announce, and as the following Nomura chart highlights most pundits are convinced that the most likely announcement is a cut in the refi and deposit rate with a probability of around 90%, an LTRO in distant third at 34%, and a full blown QE dead last with 10%.

However, as SocGen predicts, which is rather aggressive in its assumptions expecting a negative deposit rate of -0.1%, a targeted LTRO to "boost lending to the private sector", and a "signal" of €300 billion in asset purchases, the bulk of this new-found liquidity will almost exclusively go to boost capital markets, and the wealth effect. As for the broader economy? "We do not expect the 5 June measures to deliver a significant impulse to the real economy. Should euro area policy makers step back further from austerity, this would lift the economy in the short-term. Ultimately, however, the euro area needs deep structural reform. For all the energetic talk and many promises, actual progress on this front remains all too slow."

Which, as is all too clear by now, is precisely what QE does: it stimulates risk assets, and does little if anything to promote actual economic growth: for that Keynesian doctrine demands a surge in loan and credit-money creation, something Europe, with its -2.0% annual contraction in lending to the private sector, will hardly experience.

More observations from SocGen on what Draghi may announce this week:

With just four days left to the 5 June ECB meeting, the excitement is palpable. When President Draghi announced the OMT back in the summer of 2012, the impact on financial markets was spectacular; spreads narrowed, equities rallied and the euro appreciated. Consensus growth estimates, however, tracked lower (!) as the forecast for 2013 dropped from 0.5% to -0.4%. Granted, the ECB must be given some credit for the 1.2% growth now forecast for 2014. Notably, in easing market pressure on governments, fiscal drift also provided part of the answer. Recovery in key export markets was an additional boon.

Should the ECB deliver a truckload of liquidity on 5 June, we have no doubt that financial markets will rally. Short of announcing monetary financing of fiscal stimulus, which is forbidden by the Treaty, we believe that the impact on the real economy is likely to be very modest. As Italy prepares to take over the European Presidency, the hope is that Prime Minister Renzi will be able to drive a new European agenda delivering growth and jobs. Our concern remains that this will prove all too slow to give the medium-term growth outlook, of around 1.5%, the boost it really needs.

5 June shopping list: Negative deposit rate, targeted LTRO, ....

With numerous possibilities on the table, most forecasts for the ECB resemble a shopping list, with lots of items but not all equally important. Our ECB preview offers all the details, but of the major items we expect (1) a negative deposit rate (-0.1%), (2) a targeted LTRO to boost lending to the private sector, and (3) a signal of asset purchases – we look for €300bn of purchases in 2H14, split between €100bn of ABS and €200bn of European issues (EFSF/ESM, EIB, etc.) and liquid, high-grade privates assets.

ECB Update: Easing Rates is Easy, What Comes Next Is Not

The European Central Bank may have waited too long before it faced the inevitable combination of slowing inflation and even slower growth in the Eurozone with its assumed package of rate cuts and lending support later this week, and some are questioning now whether the historic response will impact the region's fundamental struggles - suggesting even more controversial measures could yet be deployed.

Inflation figures published Monday by Germany's statistics office underline the problem of persistently low inflation embedding itself into even the most resilient of economies: harmonized consumer prices rose only 0.6% on the year in May, Destatis said, undershooting the MNI median estimate of a 0.9% pace and teeing-up a downward surprise for the flash Eurozone HICP release Tuesday from Eurostat, which experts had forecast at 0.6%.

The inflation data followed a disappointing series of May manufacturing PMI data from around the region in which only Spain managed to build on its April gains and France showed worrying signs of slipping into negative growth for the second quarter after a flat 0.0% GDP in the first three months of the year. Collectively, the Eurozone PMI reading slipped to 52.2 from a flash estimate of 52.5. The number still indicates expansion, but with area credit still contracting, it's going to be increasingly challenging to arrest the slowing pace of GDP growth when the quarter limps to the June 30 finish line.

Both scenarios paint a grim picture for an ECB that appears to prefer patience over action - for better or for worse - as it prepares to make perhaps its most significant monetary policy push since the early months of the global financial crisis.

Senior Eurosystem sources have told MNI that a main refinancing rate cut, a negative deposit rate - the first ever for the ECB - and a programme of conditional bank liquidity tied to SME lending are likely to come from the Thursday gathering in Frankfurt.

However, one senior source also expressed concern that the historic package may not stoke the currency area's inflation furnace and in fact suggested ECB staff forecasts were far too upbeat.

"There is more at hand than just the price adjustment in the periphery that is responsible for this low inflation," the source said. "And I think on the ECB staff they were much too positive about the rebound in inflation that they expect in the medium term, by 2016."

Others questioned the impact of a small deposit rate cut in the face of the region's ongoing bank health check.

"We believe Euroland's credit crunch is being driven by banks' concerns about their capital adequacy in the face of imminent asset quality reviews and stress testes by the ECB," wrote HFE chief economist Carl Weinberg. "Banks that are worried about their balance sheets do not write new loans, regardless of whether the ECB charges a few basis points to hold reserves safely."

And having weathered six months of market expectations - during which time GDP momentum has eroded, inflation has touched multi-year lows, unemployment has barely budged and voters have given austerity-supporting lawmakers a sound thrashing at the European elections - the ECB appears both ready to break new ground and retreat into a protective shell.

ECB President Mario Draghi has hinted at reducing the number of monetary policy meetings in the future in order to avoid the annoying habit of investors and analysts expressing their "expectations" of Eurotower action. This may not happen until the start of next year, but it may also coincide with the uncomfortable realisation that area inflation isn't speeding towards the ECB's (already subdued) estimates, let alone its preferred "close to but below" 2% target.

And if it doesn't, the market will be begin raising the expectations of another unprecedented ECB policy action - the deployment of outright quantitative easing - just as the ECB starts to ease back on its monthly schedule of meetings and press conferences during which the merits and difficulties of such an option are explained.

Thursday's meeting, then, might be the last of the "easy" decisions the Bank takes for quite some time. Everything after that starts to look very tricky indeed.

What's Priced In?: 5 EUR Risks Into The ECB - BNP Paribas

BNP Paribas' base case for the ECB policy meeting on Thursday calls for a package of measures that will bring front end rates lower and set the foundation for EUR weakness.

This, according to BNPP, includes a 10 basis point cut in the main refinancing rate and in the deposit rate, a plan akin to a funding for lending scheme, and liquidity boosting measures.

So, how can the ECB surprise the markets on Thursday?BNPP looked at the following 5 key EUR risks:

1- No cut in the deposit rate.

Such an outturn would see EURUSD through 1.40, gaining traction with a move in EONIA.

2- Equity market rally.

An upside EUR risk stems from equity market strength following any announcement of ECB easing. Given their strong correlation, such a reaction could have spill-over effects on the EUR notwithstanding a move lower in front-end rates.

3- Unchanged staff projections.

The EUR will strengthen to the extent they are left unchanged.

4- An ECB bond buying program.

A downside surprise for the EUR will come as the ECB introduces details of a bond buying program. A strong hint in the press conference could help build expectations for quantitative easing (QE) later this year (our economists expect EUR 300-500bn of asset purchases).

5- Stronger verbal intervention would weigh on the EUR.

Admittedly, it has depreciated by 1% in tradweighted terms since the last ECB meeting, with EURUSD around 4 figures below its peak. However, as has been flagged by governing council members, EUR strength has been a key factor behind weaker inflation and a source of discomfort for the ECB.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The European Central Bank is meeting next week in Frankfurt, Germany to talk over and update the world on its monetary policy.

The ECB is scheduled to announce its latest monetary policy decision at 7:45 am ET on Thursday June 5. That'll be followed by a press conference with ECB president Mario Draghi slated for 8:30 am ET.

Because growth has been sluggish and inflation has been low, market watchers will be looking for two major things from the ECB: a cut in interest rates and the signaling of an asset purchase program.

Economists at Goldman will also be looking closely at not just what Draghi says, but how he says it. Goldman recently wrote that, "it will be the tone of Mr. Draghi's communication that matter for market developments, more than the mechanics of a negative deposit facility rate."

Hints From The May Meeting

At its May meeting, the ECB kept its benchmark interest rate unchanged at 0.25% and its deposit facility rate unchanged at 0.0%.

In his press conference following the meeting, Draghi suggested the central bank would be comfortable taking action at its June meeting if needed.

Since the ECB's May meeting, the Euro has weakened against other major currencies.

European sovereign debt has been in rally mode since the beginning of the year, and remains so ahead of next week's meeting.Interest Rates Are Getting Cut

Economist Anthony O'Brien and his team at Morgan Stanley expect the ECB to cut both its benchmark interest rate and deposit facility rate 15 basis points.

Economists at Goldman expect the same.

At Nomura, Lewis Alexander and his team expect the ECB to cut these rates by 10 basis points.

Marc Chandler, head of global currency strategy at Brown Brothers Harriman, noted that the ECB also maintains a third marginal lending rate, currently set at 0.75%. Chandler believes there is a "moderate" likelihood the ECB cuts this rate.

Michael Martinez at Societe General sees the ECB cutting the marginal lending rate 25 basis points to 0.5%, while cutting both the benchmark and deposit facility rates 10 basis points.

Asset Purchases Are A Maybe

There has also been speculation surrounding the potential for the ECB to signal an asset purchase program to begin at some point this year.

Most economists see this as a somewhat unlikely development at this point. However, measuring the possibility, and probability, of an asset purchase program is on the mind of economists, and is reminiscent of speculation last year surrounding when the Federal Reserve would begin tapering its monthly asset purchases.

Analysts at Capital Economics think the ECB will eventually be forced to do more.

At Nomura, Alexander put a 25% probability on the ECB announcing an asset purchase program by year-end.

The Global Currency Research Team at Morgan Stanley wrote in a May 29 note that, "should inflation remain at low levels, we do not rule out Draghi using much more aggressive measure in the months ahead. Full-scale quantitative easing or even [foreign exchange] intervention are possibilities."

Chandler recently wrote that, "the signals from policy makers seem to suggest an inclination for several measures that stop short of quantitative easing."

At Societe Generale, Michael Martinez believes the ECB will signal an asset purchase program totaling EUR 25 billion per month beginning in the second half of the year.

As far as what Draghi says next week, Martinez says that the market risk is for the central bank to disappoint (emphasis ours):

"We expect the ECB staff to marginally cut its growth and inflation outlook, but the ECB would give clear indications that the asset purchase programme could be expanded substantially by buying government bonds later, if the inflation outlook deteriorates. Market expectations are high, as experienced by the fall of the euro since the May press conference and the risk is that the ECB disappoints. Medium-term, ECB action will be welcome, but we have doubts on the effectiveness of any ECB action, even if the ECB contemplates a large QE programme. Indeed, structural reforms would be much more powerful to improve the fate of the European economy."

Draghi's Latest Comments

Last week, the ECB held its first forum on central banking in Sintra, Portugal. Among the speakers at the event were Draghi and IMF president Christine Lagarde.

Draghi's speech dealt with the problems facing monetary policy in a low inflation environment.

Draghi reiterated that the ECB's goal is for 2% inflation, saying, "there is no debate about [the ECB's] goal, which is to return inflation towards 2% in the medium term." Over the last year, Eurozone inflation has consistently run south of 1%.

Draghi also addressed the various tools the ECB may use in response to credit conditions throughout the Eurozone, acknowledging that it could use asset purchases to reduce any a drag in the recovery due to credit supply constraints.

The question is: will they?

source