looks like some were right

it will never end.....

looks like some were right it will never end.....

They are not going to change what gives results that they wanted : the rich getting richer and for the rest who cares. It is a new way how they are shifting the money from our pockets to the pockets of the rich ones and we are "happy" that the crisis is over.

They seemed quite happy today

and we should be happy, they could of made it much worse for us

1mill a pip should make most happy

damn if only i knew the news in advance

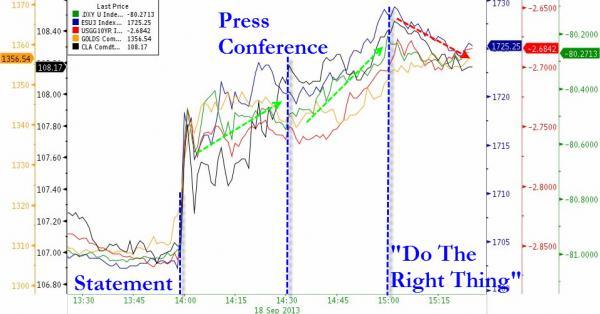

As Bernanke Blows A Bigger Bubble, Everything Is Bought

"We have got to turn the page on this kind of bubble-and-bust mentality that helped to create this mess in the first place,we have got to build a housing system that’s durable and fair and rewards responsibility for generations to come. That is what we have got to do,"Barack Obama, August 6, 2013

The economy is bad enough to warrant no taper so you BTFATH; and so bonds, stocks, gold, oil, and HY credit are screaming higher still as the money-printing will continue until morale improves. Bernanke just explained not only why there's no froth (and they'll communicate to "avoid any sharp moves"), but that 7% unemployment threshold was indicative ('just kidding'). Bernanke summed it all up well himself on the over-optimism of the Fed's projections - they are already "stretching the bounds of credibility."

- *BERNANKE SAYS FED WILL DO THE RIGHT THING FOR THE ECONOMY

That sounds very close "whatever it takes," eh, Ben; and seemed to make buyers a little nervous...

From the statement: S&P +26pts, 10Y -18bps, USD -1%, WTI +1.1%, Gold +$52

Charts: Boomberg

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The U.S. Federal Reserve said on Wednesday that it would continue buying bonds at an $85 billion monthly pace for now, surprising financial markets that were braced for a reduction in the central bank's economic stimulus.

Citing strains in the economy from tight fiscal policy and higher mortgage rates, the Fed decided against the tapering of asset purchases that investors had all but priced into stock and bond markets.

"The committee decided to await more evidence that progress will be sustained before adjusting the pace of its purchases," the U.S. central bank said in a statement announcing its decision. Esther George of the Kansas City Fed again dissented, saying she was worried about financial bubbles due to the Fed's low rate policy.

Fed Chairman Ben Bernanke will hold a news conference at 2:30 p.m. (1830 GMT) to elaborate on the central bank's thinking.

The move comes against the backdrop of a somewhat gloomier outlook for economic growth from U.S. Fed officials. In a new set of quarterly forecasts, the Fed now sees growth in a 2 percent to 2.3 percent range this year, down from 2.3 percent to 2.6 percent in its June estimates. The downgrade for next year was even sharper: 2.9-3.1 percent from 3.0-3.5 percent.

Most policymakers, 12 out of 17, also projected the first official interest rate hike will come in 2015. That's despite forecasts for unemployment to potentially reach 6.5 percent, the threshold at which rate hikes will begin to be considered, sometime next year.

To temper any market jitters from a slowing in its purchases, the Fed reiterated that it will not start to raise rates at least until unemployment falls to 6.5 percent, so long as inflation does not threaten to go above 2.5 percent. The U.S. jobless rate in August was 7.3 percent.

source ...