All About Successful Forex Trading

The forex market is a rewarding proposition for individuals willing to take calculated risks and expecting rewarded for them. However, a forex trader always needs to be on his toes and expect the "unexpected." He is also expected not to get wrapped up with past success stories and take forex profits or losses in equal stride. Let us access some easy-to-follow yet highly effective tips with this article.

A forex trader should always be clear in his thoughts and should not repent a decision, if it proves wrong. This is because there can be times when the forex market can go opposite no matter how efficiently you come up with a trading decision. It is important that the trader maintains an objective outlook on his strategy and the market so that a wrong decision does not derail him in the long term and a mistake is taken as a lesson and not a reason enough to shut down.

Signaling Software

No one mentioned Signaling Software . There are many software packages out there

that offer signals of when to enter and exit a trade. This way you make your own

choices based on what you see. Just throwing another suggestion out there .

Great!!

Thank you so much for sharing this, must read..

...

Whenever I hear the term "Forex Trading Machine", my mind will conjure up an image of a formidable metal robot, fashioned out in the style of a huge gigantic monster of a machine, capable of transforming into any other shape at will, stomping its way into the huge arena called the Trading Floor and smashing anything that happens to stand in its way.

Perhaps a Forex Trading Machine would be capable of smashing any hurdles to successful trading in its way, and if there is such a machine that can almost guarantee profits to one and sundry who uses it to good effect, then I would want to own one immediately!

But what will constitute a Forex Trading Machine in the field of forex trading?

I find many traders, especially newer traders and beginners to be looking for the holy grail of trading, and to them, a forex trading machine would be the next best thing to the holy grail.

Now, let's look at some aspects of a forex trading machine- the topic of our discussion today:

1. It has to be a trading technique capable of identifying without emotion forex trading signals, so that there is no room for ambiguity. Clear signals have to be generated and the trading signals taken without emotion.

2. It has to be based on a trading algorithm that is robust, does not optimise and change its trading signals based on future data in order to optimise to maximum profits. A trading system that changes a trading signal from a buy to a sell, for example, in the light of the forward date that has occurred as historical data would not qualify.

3. Ease of use - The Forex Trading Machine must be easy to use for all traders, and not based on complex indicators that take a long time to interpret and add on to the confusion during trading.

4. High Profit Rate - The Forex Trading Machine must be tested and shown to generate a good return or profit. By "good" it must be shown to produce a high Winning-Losing ratio for trading signals generated at least during simulation tests.

5. High Reward-Risk Ratios - The Forex Trading Machine must return high reward-risk ratios at least during simulated tests, so that the signals generated will produce big rewards or profits at small risks.

Is there such a trading machine for forex traders?

Whenever you are presented with what is seemingly a fascinating method or technique to trade the forex that promises you results, do NOT just take things as gospel truth, and neither should you look at it with disdain or outright rejection.

Use the 5 point test above to prove its viability and to determine the truth about the claims presented.

Why should we do this? This is because there are many successful traders in forex who have "gone through the mill", fashioning their own special and successful "forex trading machines" in the process.

Many forex traders have their very own "forex trading machines" to help them earn a living off forex trading, some becoming very wealthy in the process.

Prove every claim and you will discover your own forex trading machine which will serve you well in your quest to multiply and create massive personal wealth.

This was a very useful information for me. Can you send me more information regarding Trading in Forex?

Thanks for the information given above. Making money online is a real business and as such requires massive planning, hard work, time and effort to see result. Forex market is a huge financial market with worldwide networking where lots of traders try their luck but only few of them gets success and rest of them gets fail. Those who have good knowledge of trading can make huge profits but if your basic is not strong then how would you earn here. Forex trading is an online process, where the traders and the investors invest their currency to convert it from one form to another form. It could be done from any of the corner of the world.Forex trading market has many advantages which are the main reason behind the trader's attraction towards forex world.

Thanks for the information given above. Making money online is a real business and as such requires massive planning, hard work, time and effort to see result. Forex market is a huge financial market with worldwide networking where lots of traders try their luck but only few of them gets success and rest of them gets fail. Those who have good knowledge of trading can make huge profits but if your basic is not strong then how would you earn here. Forex trading is an online process, where the traders and the investors invest their currency to convert it from one form to another form. It could be done from any of the corner of the world.Forex trading market has many advantages which are the main reason behind the trader's attraction towards forex world.

Thanks for sharing your thoughts. I really believe this

Thanx a lot, i think this is very useful for all the beginners...

There are three ways to Forex according to your Forex trading education and your available time for trading.

• The first way is on your own, with your trade platform, analyzing charts, information and with your own trade strategies. Clearly, you need to have a high level of education on Forex, experience in the Forex trading market, as well as information and time for exclusive trading. When you trade, you cannot do anything else.

• The second way is to mirror expert’s trades. You need the same education and experience as if it you were on your own, but you save time. Once you have selected and adjusted the systems that you are interested in, everything is automatic.

• And finally, the third way is through accounts managed by experts. You don’t need any Forex education, nor time. Soon, we will have news about this method for trading.

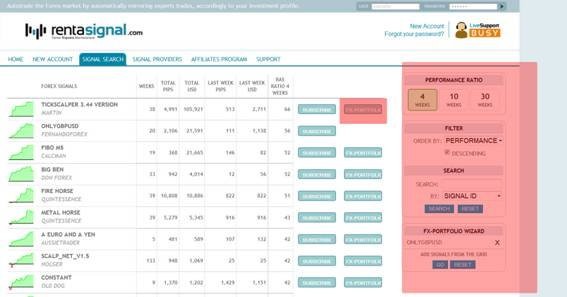

Rentasignal is focused on those who have some education in the Forex market, but want to save time. Therefore, our clients only need to select one or few signals for mirroring their trades, and use the risk settings to adjust them according to their risk profile and size of their accounts. Once selected and adjusted, our clients only need to check if the result is what they were looking for, and act accordingly as everything is automatically done.

Adjusting the risk settings to your risk profile and size account is a must if you want to succeed. Rentasignal offers the most complete settings for accurately managing your risk. That is one of our strengths, everything you may need can possibly be done with Rentasignal.

How to start? There are several ways and possible settings to automatically manage your trading risk, but it is really simply just following the next steps:

1. How many times are you going to check the performance of your signals portfolio? Naturally, this is completely a personal decision. What I do is to follow the big numbers once or twice per day, and then deeply checking once per week, during the weekend when the market is closed. At that time I analyze the performance of each signal and per account during the week, also the equity/balance highs and drawdown.

2. What is the max account you can risk per week? This is really important. You have to take into consideration the margin of your broker trading account and how many signals you want to trade. For example if you decide to allow a max risk as of 25% of your account and you want to trade three signals, for diversifying your risk, you may have in mind to limit also the risk per signal around 8% (25%/3) of your account. Just a sample:

• Account Size = $3,000• Max weekly drawdown = 25% ($750)

• Number of signals to be traded = 3

• Max weekly drawdown per signal = $750/3 = $250

3. How to adjust the signals according to that risk settings? You must use the FX-PORTFOLIO WIZARD to calculate the Size Multiplier required for automatically adjusting the size of the orders sent by the signal provider. Of course, all the information you are going to handle is hypothetical and based on past performance. You must know that past results don’t guarantee any future result. However, past hypothetical performance is the only information we can handle to have an idea about the performance we could get.

.

To add the signals to your portfolio you should click on FX-Portfolio.

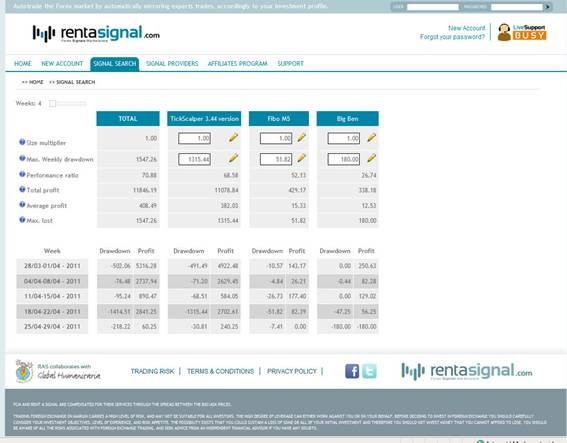

With FX-PORTFOLIO WIZARD, you will be able to back-test your selected signals to analyze their performance during the previous weeks with your settings.

You can compare weekly EQUITY DRAWDOWNS with weekly EQUITY PROFITS of multiple signals by applying different multipliers and max weekly loss amounts to see how you would have done in the past.

Therefore, FX-PORTFOLIO WIZARD is the ideal tool to:

• Estimate how much money of your account is exposed.

• Calculate how much revenue you could have obtained in the past using a specific group of settings.

• Calculate potential profit if the signal continues to perform in the same manner as previous weeks.

• Calculate optimal Max Weekly Drawdown to increase your protection.

• Choose signals whose past performance resulted in more money, but have a lesser risk in equity.

• Avoid EQUITY BURNER signals that use too much equity.

I hope all this information may help you to autotrade FX signals better.

All the best!I would also like to thank you... this was a very useful article for me...

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

There are three ways to Forex according to your Forex trading education and your available time for trading.

Rentasignal is focused on those who have some education in the Forex market, but want to save time. Therefore, our clients only need to select one or few signals for mirroring their trades, and use the risk settings to adjust them according to their risk profile and size of their accounts. Once selected and adjusted, our clients only need to check if the result is what they were looking for, and act accordingly as everything is automatically done.

Adjusting the risk settings to your risk profile and size account is a must if you want to succeed. Rentasignal offers the most complete settings for accurately managing your risk. That is one of our strengths, everything you may need can possibly be done with Rentasignal.

How to start? There are several ways and possible settings to automatically manage your trading risk, but it is really simply just following the next steps:

.To add the signals to your portfolio you should click on FX-Portfolio.

With FX-PORTFOLIO WIZARD, you will be able to back-test your selected signals to analyze their performance during the previous weeks with your settings.

You can compare weekly EQUITY DRAWDOWNS with weekly EQUITY PROFITS of multiple signals by applying different multipliers and max weekly loss amounts to see how you would have done in the past.

Therefore, FX-PORTFOLIO WIZARD is the ideal tool to:

I hope all this information may help you to autotrade FX signals better.

All the best!