can you name 5 keywords that what make daily pip around +60 to +130 while keeping daily loss at -80 (not more loss)

could show us few visual chart to show what will WORK (overall, monthly)

I think you have to know the games that traders are playing at that period of time -- e.g. I stay on the safe side with low volatility pairs today (realising , lost could be BIG today for the risk / reward type quickie people)

Hi guys,

Trading has been a bit slow lately, as I am working on a bunch of different projects. But yesterday we had a perfect setup, which I want to share with you all. Take a look on the picture below (attatched). This a simple Symmetrical Triangle, and I was looking for a break out. I simply waited for the pair to close below the pattern, of at least a 1 or 4 hour candle. This picture is a weekly chart, so you can see the pattern. Now look at the picture below that one (attatched). This is a one-hour chart. I took a trade when I had the first one-hour candle close below the support level right at 0.8693. My stop loss was some 26 pips above at a decent resistance level and my take profit was open. I closed the trade right after we got some news today so it gave a total of some 50 pips. My stop loss was moved to break even after the initial 30 pips were reached. This is a good example of my typical type of trades. Stay tuned for more updates.

http://rentasignal.com/signal/view/31158

Please see attachment or go to the page above:

Advanced Statistics (last calculation on 2010-05-06 07:41:49)

Max Lot size 30.00

Min Lot size 15.00

Max active trades 17

Min active trades 1

Summary P/L 424589.47

Number of winning trades 83 (532538.00)

Number of losing trades 9 (-107948.53)

Max summary P/L 424589.47

Largest losing trade

Largest winning trade 35700.00 USD, 118 pips Details

Max consecutive wins 47 (193792.85)

Max consecutive losses 4 (-59724.83)

Max consecutive profit 217995.15 (18)

Max consecutive loss -59724.83 (4)

Balance Max drawdown 59724.83

Profit factor 4.93

Info

Active orders 0

Closed orders 100

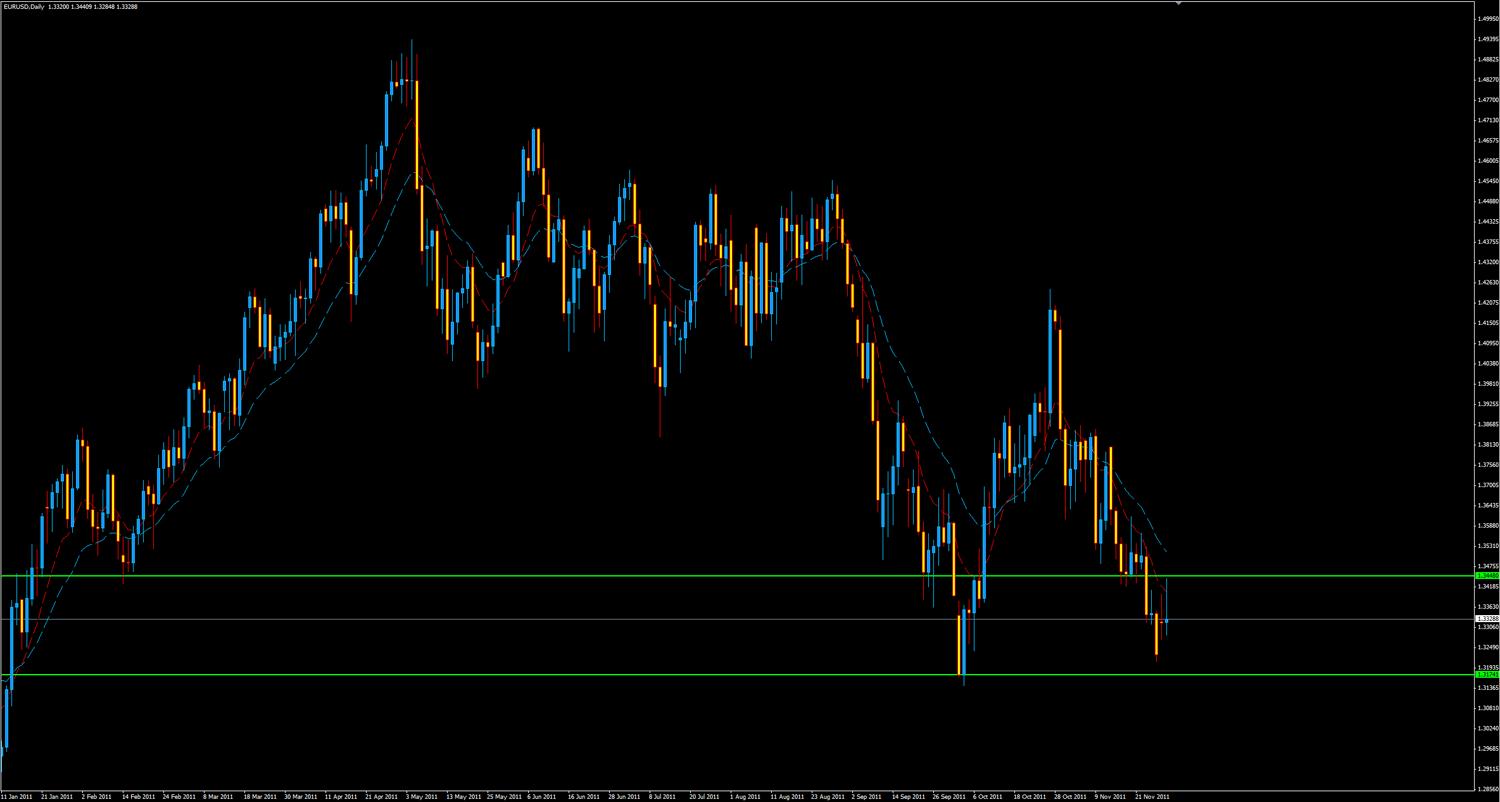

We have seen significant downside on this pair during the latest month. EUR/USD is trading close to 1000 pips lower than where is just about one month ago. The pair currently trades around the 1.3230 level, and it looks like we easily could see further downside. Both the latest daily candle and weekly candle closed as strong bearish candles, but we need to pay attention to the 1.3170 level which proved to be a strong level of support last time it was tested. Not only can we expect more news about the worrying situation in the EURO zone, but we also have a bunch of scheduled releases for the upcoming week. Keep in mind that we are seeing a very volatile market these days and we need to be careful! Read about the Storm Warning here.

Bias

There is not a whole lot of reason to look for possible upside on EUR/USD at this moment, other than that a natural pullback could be in the cards due to some possible profit taking, and a heavy level of support around the corner as mentioned above. With that being said, my bias is clearly to the downside on this pair and I will continue to look for pullbacks in order to get in on short trades.

Pre-News Sentiment

As mentioned above, we do have an interesting upcoming week, with some fundamental news releases which are likely to move the market. My bias on further continuation to the downside is partially based on the expectations for the releases on the upcoming week, where everything, as of now, points in direction of further $ strength; needless to say that this can be changed the split second when the actual figures are released but until this happens, any pre-news sentiment is likely to be in the direction of further downside on EUR/USD.

Technical Perspective

From a technical standpoint, this also indicates further downside on EUR/USD. We had a strong daily and weekly close on the pair. For now we will focus on the 4-hour chart, and here things are slightly more ambiguous.

As always, when we have seen a strong move down, a pullback is possible, and something we need to take into consideration. The pair currently trades at the 1.3230 level. We have a key level of support at 1.3170, whereas the next level of resistance is at 1.3340 and then 1.3440. Because of this, if does not make sense to take a short from here (in my opinion), as the possible risk:reward of the trade simply isn’t there. I would prefer to wait for a pullback to the 1.3340 level and look for clues to a possible reversal. If no sign of a reversal is in place, I would wait for a retest of the 1.344 and look for a short. With either of these two levels getting hit, a short trade should be in the cards with a good risk:reward. Specially the first resistance level seems like a good bet, as this would line up with the in-between level of the 10 and 21 EMA.

Ideas

With the above mentioned aspects in mind, I am only looking for possible short trades.

I will wait for a possible pullback to the 1.3340 level and look for a possible 4-hour reversal candle and then take a short trade with somewhere around a 50 pip stop loss. If we don’t get any kind of reversal candle, wait and see if we get another thrust to the upside and look for possible reversal candles around the 1.3440 level and look for a similar short trade. With that being said, I would prefer to get in short around the first level mentioned. The best scenario would be a move to the upside during the upcoming Asian session and look for a short around London open. If we see continuation to the upside during the beginning of the London session, I would look for mentioned short setup, around US open.

In yesterdays post, I mentioned a possible setup for a short trade. We took a short trade at 1.3374 and if you got in on this trader, there was a possibility to grab around 90 pips in total. As we did have an initial 50 pip stop loss, I was hoping for a bit more and chose to move my stop loss to break even, but we had a strong pullback during the Asian session, and the trade is now close to the entry level. I hope you had a chance to grab some pips from this trade.

Bias

As mentioned in the post yesterday, my overall bias is still to the downside. However, things do look slightly different for now, and I think a short term pullback might be in the cards. This is partially based on correlation with other USD pairs, price action and our two EMA´s. However, we still have an upper trend line which is likely to show us some resistance so I think today might be a good day to wait for a really proper setup, before jumping in. Trading forex is all about planning your trade and trading your plan. If the plan is unclear, its more often than not, a good idea to stay on the sideline and wait for a no-brainer setup.

Technical Perspective

There is not a whole lot more to cover here, since the post yesterday. One key thing to pay attention to is yesterday’s daily candlestick formation, which clearly shows up a possible reversal, and since the close, we have seen upside on EUR/USD. The pair currently trades at the 1.3364 level. We do have resistance about 30 pips higher both from yesterday’s high, the upper trend line and finally that the level itself is somewhat of a psychological level (read; 1.3400). So this is clearly a level to pay attention to. In addition to this, we have the same level of resistance at the 1.3440 level as mentioned yesterday, which is another level I will pay attention to.

Price Action

Now here is one of the key reasons why I might wait a bit, before looking for another short trade. Price action wise on the 4-hour chart, we are now starting to see higher lows but so far not higher highs. With another higher high, I would be careful with any short trades.

Make sure to plan your entry on the right time of the day. If we do see continuation to the upside during London open, I would wait to look for a possible short around London close. Another thing to keep in mind is that correlating pairs, specially AUD/USD and Cable, clearly looks like further upside for now. Because of this, we are also likely to see EUR/USD head higher and another reason why we should be careful with any short trades for now.

Ideas

As mentioned above, we do a mixed picture this morning and I am open for both long and short trades but they will be based on a short term price action setup.

From the 4-hour charts, I think we are better off, looking for a possible short around London close. I am paying attention to the same key levels as mentioned in yesterday’s post. For any short term entry setups, I will be paying close attention to the price action just around London open, and if we do get an initial move down, I might wait for a small pullback and then take a short trade with a tight stop loss. It all depends.

For those of you who read today’s outlook Trading Forex - A Bit of Possible Upside had an idea I was looking for a possible short around the 1.3440 level. Unfortunately I wasn’t able to place a trade today once the level was reached but if you did, this would have been close to a perfect trade. The level was spot on as solid resistance, and the pair is now trading back down at the 1.3330 level. So basically the pair is right back at the same level as where it started the day. So where do we go from here?

Bias

My bias hasn’t changed. News from US has been mixed for the first two days, but the Euro zone situation continues to take the main attention and with no significant deviation on US news, I see no reason for a change in bias, other than what I have mentioned in earlier posts regarding some possible profit taking. Tomorrow we will get ADP Non-Farm Employment Change from US, expected to come out at 131 compared to 110K previous release, so any kind of pre-news sentiment should also be to the downside for EUR/USD.

Technical Perspective

As mentioned in todays post, on the 4-hour chart we are still seeing higher highs and higher lows. However, this almost start to look more and more like an inverse flag formation which also gives us a clue of possible further downside. However, the most interesting thing is the daily candlestick formation. Well the day is not over yet, but unless we see a significant move within the next 45 minutes, we are likely to get a good reversal candlestick formation, also indicative of possible further downside.

It is possible that we could see some upside during the Asian session, but I actually think that the pair is very likely to start a move down shortly after EOD. But who knows. I will be asleep shortly and hence I would prefer to wait for tomorrow morning around London open, to look for a possible short trade.

Ideas

With the above mentioned aspects in mind, I still prefer to look for a short trade.

I will pay attention to price action around London open tomorrow morning and look for a possible short trade. The best case scenario in my opinion would be that the pair trades around the current level (Read; 1.3330) and look for a short trade with close to a 50 pip stop loss. Of course, if price starts to move up, right around London open, I will wait on the sideline for an entry short, at a higher level. 1.3440 is still at key level to have in mind.

In yesterday’s post Trading Forex - Perfect 1.3440 Re-Test, I mentioned the possibility for a short trade, and early in yesterday´s London session, I took a short trade with a 50 pip stop loss. The trade came up to around 60 pips of profit, so hopefully those of you who were in on the trade had a chance to move stop loss to break even. Once news hit the wire about the coordinated action from central banks, I got stopped out at break even. Yesterday’s price action is a perfect reminder that we should always make sure to have a stop loss in place when taking any trades.

As major central banks agreed to lower swap rates on USD , all USD crosses was heavily affected and we had an immediate move up on EUR/USD to the 1.3530 level – a rally of close to 240 pips in a matter of minutes. With events like this, there is no particular reason to look at the pair from a technical perspective – fundamentals and risk sentiment is the only force in play and we need to think deeper in order to get an idea of further possible direction.

Now actually I think this rally is giving up a very favorable price for a possible short trade, maybe in the upcoming week. I think we will see further upside throughout the rest of this week, but I would be careful only looking for long trades, specially in the upcoming week. Keep in mind that we had the ADP coming out better than expected yesterday, and tomorrow NFP will hit the wire. This will definitely give us some market volatility. Going back to the coordinated action from major central banks, there is a very good read over at BabyPips.

“Risk assets love this news this morning. The euro is jumping and stocks are rocking and rolling...good for financial market players, but we've seen this before--credit thrown on top of credit to solve a problem that was caused by too much credit in the first place. It seems a dangerous game that lacks any form or imagination. But maybe this time is different.”

Read the rest of the post here

I do have a couple of ideas for possible trades today, but I have decided to stay on the sideline and let the market calm down. As mentioned above, I think we will see further upside on EUR/USD today and an entry around 1.3450 with a 50 pip stop loss seems like a fairly good bet. However, I see no reason to jump in today. I would prefer to wait for the market calm down, so we also have a chance to base our trading on a more technical setup.

Remember to play things safe, keep your risk exposure low and always have a stop loss in place.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use