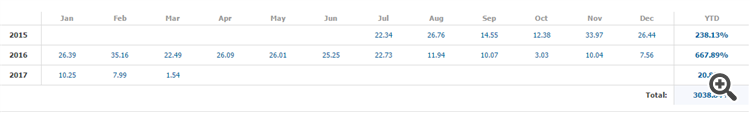

dbuckle: On the signal details page, on the Growth tab there are percentages on the right in the YTD column.

For 2017, how do you get 20.89% ? It can't be just the sum of Jan, Feb, Mar since that totals 19.78.

In the same way, how is the Total of 3038.84% reached when the YTD figures are 238.13, 667.89, 20.89 ?

What am I missing?

Could they be calculating it in Compound form and not in Simple form?

EDIT: Just tested it, and it is indeed in Compound form and not in Simple form.

Example for 2017: ( (1 + 10.25%) * (1 + 7.99% ) * (1 + 1.54%) - 1 ) = 20.89%

Alternative representation: ( (100% + 10.25%) * (100% + 7.99% ) * (100% + 1.54%) - 100% ) = 20.89%

EDIT2: The Compound formula is the correct way to calculate things because each month's gain compounds onto the previous month's gain.

https://www.mql5.com/en/forum/10773#q23

How is the Growth in Signals Calculated?

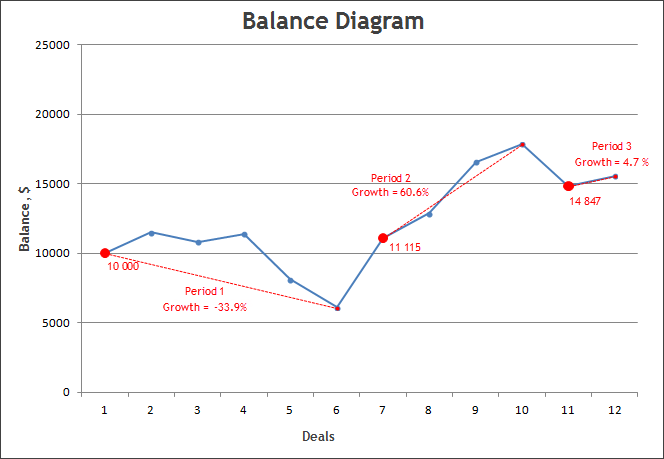

The growth shows how the balance of an account grows. It is

calculated so that the influence of deposits and withdrawals is avoided.

The entire trade history of an account is divided into periods

between balance operations (deposits and withdrawals). First, the total

growth coefficient (K) is calculated by multiplying the growth

coefficients computed for each period between the balance operations

(BO) and then the growth in percentage terms is calculated.

Growth in Percentage Terms = (К - 1) * 100%

On the chart below, the balance operations are marked with big red dots and the dashed lines indicate the periods of growth calculation:

Growth in Percentage Terms = (K-1) * 100% = (1.1 - 1) * 100 = 10%

Despite the current balance is about 50% higher than the initial deposit, the real growth due to trade operations is only 10%.

How is the Growth in Signals Calculated?

The growth shows how the balance of an account grows. It is

calculated so that the influence of deposits and withdrawals is avoided.

The entire trade history of an account is divided into periods

between balance operations (deposits and withdrawals). First, the total

growth coefficient (K) is calculated by multiplying the growth

coefficients computed for each period between the balance operations

(BO) and then the growth in percentage terms is calculated.

On the chart below, the balance operations are marked with big red dots and the dashed lines indicate the periods of growth calculation:

In this case, the total growth for the account is calculated as follows:

Despite the current balance is about 50% higher than the initial deposit, the real growth due to trade operations is only 10%.

Actually, I think you may have copied the wrong section because the more appropriate answer, as per the OP's query "How is Signal Growth YTD calculated?", comes from point 24 of that very link (and I quote):

We use a compound rate when calculating YTD. This means that the YTD rate is calculated not by a simple addition of growth for several periods of time, but by their multiplication. Every period growth is superimposed on total cumulative growth of previous periods. This can be shown by an example.

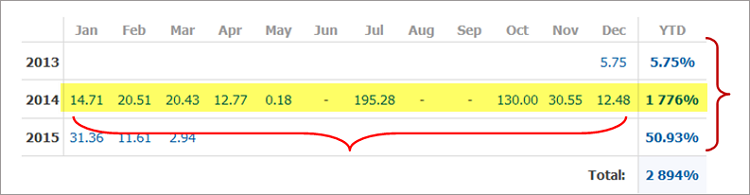

In 2014 the signal had following monthly growth values:

January February March April May June July August September October November December Annual data Growth, % 14.71 20.51 20.43 12.77 0.18 - 195.28 - - 130.00 30.55 12.48 1 776 Growth ratio for the period 1.1471 1.2051 1.2043 1.1277 1.0018 1 2.9528 1 1 2.3000 1.3055 1.1248 18.76 Total growth ratio for the period 1.1471 1.3823 1.6648 1.8774 1.8808 1.8808 5.5535 5.5535 5.5535 12.7731 16.6753 18.7563

- There was 14.71% growth in January. That means that a trading account has been multiplied by 1.1471 this month. This is what we call the growth ratio for the period.

- There was 20.51% growth in February, so the growth ratio in February is equal to 1.2051.

The growth ratio for the period is calculated according to the formula: (Growth in percentage terms) / 100% + 1.0. The growth ratio in January = (14.71%/100%)+1.0 = 1.1471.

You have to multiply together growth ratios of January and February of 2014 and get the general growth ratio for these months to calculate the growth for the period.

Total growth ratio = 1.1471 * 1.2051 = 1.3823

The total growth ratio helps us get the ratio in percentage terms as (Total growth ratio - 1) * 100% = Growth for the period

Growth for January-February of 2013 in percentage terms = (1.3823 - 1.0) * 100% = 38.23%

As you can see, there was 38.23% growth in these two months. And it differs greatly from simple addition of percents for every month ( 38.23% != 14.71% + 20.15%)

So if you want to get a year growth ratio, you need to multiply together growth ratios for each month, then subtract 1.0 from the product and multiply the result by 100%. This will be the compound year-to-date rate (YTD).

You need to do the same with annual growth values to see the growth for all years of trading.

Actually, I think you may have copied the wrong section because the more appropriate answer, as per the OP's query "How is Signal Growth YTD calculated?", comes from point 24 of that very link (and I quote):

I have a signal whose growth in the first month was -100%. In this case, could -100% in the first month affect all the rest of the calculations?

By the way, this is the signal: [link was deleted by moderator]

I have a signal whose growth in the first month was -100%. In this case, could -100% in the first month affect all the rest of the calculations?

By the way, this is the signal: [link was deleted by moderator]

Yes please Let us know the answer I also have same thing when I was about -60-70% I filled my acount again and now I have about 700$ but the stats still shows -100% is there any way to refresh it?

As far as I remember - the growth is calculated from initial deposit (which is 67.54 USD in your case).

Yes please Let us know the answer I also have same thing when I was about -60-70% I filled my acount again and now I have about 700$ but the stats still shows -100% is there any way to refresh it?

No, you can't refreh it, account growth relfects the compounding results of a trading account since inception.

Yet, if you have an account that had an initial deposit of 300, and now has a current 360, common sense will say that it is currently growing at a 20% rate.

I find this growth calculation mostly misleading to evaluate the performance of a signal.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

On the signal details page, on the Growth tab there are percentages on the right in the YTD column.

Lets look at [name of the signal was deleted by moderator] signal as an example:

For 2017, how do you get 20.89% ? It can't be just the sum of Jan, Feb, Mar since that totals 19.78.

In the same way, how is the Total of 3038.84% reached when the YTD figures are 238.13, 667.89, 20.89 ?

What am I missing?

Thanks in advance.