You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

The next lesson in free futures trading course which covers bull spreads and bear spreads in the futures market.

Trading Risk Management - Tight Stops

Forum

Indicators: ATR_MA_Oscillator

newdigital, 2013.10.23 18:52

An Easy and Advanced Way to Set StopsTalking Points:

- Stops are a necessity because no trading strategy wins 100% of the time

- Traders can use ATR to calculate stop distances based on recent price activity

- Price Action can be used to set stops in trending, or ranging market environments

As traders, we know we need them, but it’s much like the advice of ‘get your annual checkup with a Doctor,’ where most of us simply don’t want to do it.But in the field of trading, risk management isn’t just a preference; it’s a necessity.

And the reason for this is simple: Because you cannot tell the future. And this means that no matter how hard you try, or how great a trader you become, you will simply never be able to avoid losing entirely. And as a natural extension of that fact, since you will lose on some trades, having sloppy risk management means that one or two losers can wipe away the gains of many small winners.

I know this may sound too simplistic; but this is exactly what was found to be The Number One Mistake that Forex Traders Make: They often win more frequently than they lose - but they lose so much when they are wrong that it wipes away all of the gains from their winners and then some.

Average losses (in red) far outpace average wins (in blue) :

The first step to avoiding The Number One Mistake Forex Traders Make is to set a stop. This allows you to cap the risk on any one trade, so that if it doesn’t go in your direction, you can stem the bleeding before it becomes too unbearable.

Below, we’re going to look at two popular, yet different ways of setting stops. One easy way that is often employed by professional traders for the sake of simplicity; and another more advanced method that may suit certain trading styles more adequately.

The Easy Way

First off, just because this is an easier way of setting a stop does not make it any less valid. This is classified as ‘the easy way’ simply because most traders can pick this up right now, and begin using it instantly with a minimum of instruction.

Average True Range is a favorite indicator of many professional traders, and one of the great things about it is that it’s rather simple in its design. While many indicators wear multiple hats and try to do a few different things at once, ATR is just a measure of price movements over a specific period of time.

If those movements increase in value, ATR goes up. If those movements decrease, ATR goes down (see below).

ATR measures volatility, and this allows traders to set stops based actual market behavior :

There are a few nuances of ATR that traders need to know before applying. We cover these, in depth in the article Managing Risk with ATR. The first is the format with which the indicator displays values. While it looks like an oscillator like RSI, and moves similar to an indicator like ADX; the real value of ATR is in its value. It will measure the ‘Average True Range’ of the last x periods, where x is the input you choose. The default, and most common input for ATR is 14 periods. The value of ATR will read in the price format of the currency pair being analyzed. So, for instance; if a value of .00760 is shown on EURUSD, that means 76 pips (4th place to the right of the decimal is a single pip in the quote).

ATR displays values in the format of the currency pair’s price :

There is a slightly easier option, and for traders that are using short-term techniques this can be extremely helpful. There is a custom indicator available for Trading Station desktop that automatically calculates, and displays ATR on the chart in a very easy-to-read format. This is completely free, and can be downloaded from the FXCM App Store at this link (link). As you can see below, not only does it display ATR, but it even rounds the ‘.6’ fractional pip as appropriate.

The ‘ATR_Pips’ Indicator displays Average True Range in an easy-to-read format :

The Advanced Way

Price Action can have a huge impact on a trader’s performance. Inclusion of price action into an approach will often take place regardless of the trader or type of trading being done. Price action can help traders read trends, find support and resistance, and perhaps most importantly - manage risks.

Because, after all - if prices are trending higher, and we’re seeing continuous higher-highs, and higher-lows, wouldn’t it be reasonable to consider closing the trade if the trend reversed?

Remember, this is the number one mistake traders make, and this is the reason stops are so important. If the trend reverses, the trader’s best advice is often to close the trade and look for greener pasture elsewhere... because if the reversal continues against the trader, one loss can wipe away a lot of gains.

If traders are trading a trend, they can look to the previous opposing-side swing for stop placement. So, if an up-trend is being traded, we should be able to see higher-highs, and higher-lows. If we are buying to take part in the up-trend, we can look to place our stop below the prior swing-low (see picture).

During an up-trend, stops can be placed below the previous swing-low :

On the other hand, if we’re selling in a down-trend, we would want to look to place our stop above the prior swing-high.

During down-trend, stops can be placed above the previous swing-high

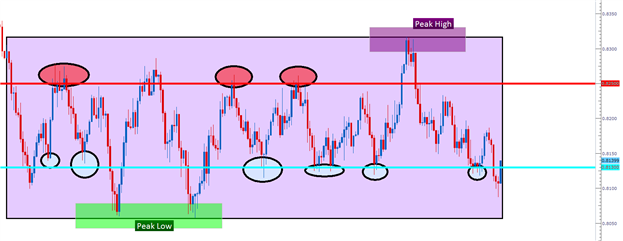

In How to Analyze and Trade Ranges with Price Action, we look at stop placement in

range-bound markets. If a range is being traded, the ‘peak-high’ and ‘peak-low’ should be identified (see below).

Traders can look to place their stop just outside of the peak of the opposing side of their position. So, if buying, traders would look to place their stop just below the peak-low; and if selling just above the peak-high. This way, if the range turns into a breakout against the trader, the bleeding can be stopped before one loser wipes away the gains from a lot of winners.

If you’d like to become a better Price Action trader, we’ve put together the basics into a Brainshark curriculum. The link below will take you directly to the lesson, and after filling in a few pieces of information into the guestbook the session will begin.

24. How to trade a flag pattern in Forex Part 1

Video 1 of 2 - In this Forex training video we discuss how to identify a flag. We go through a simple identification process and discuss the flag's main characteristics. It is important that you master the identification process first before you learn how to trade the flag.

Price Bar Reversals (1 of 9) - An Intro to a series discussing short term price bar reversals such as the bearish rejection, the bullish rejection, the open close reversal, the closing price reversal, the hook reversal, the key reversal, the island reversal and the pivot point reversal.

Video 2 of 2 - In this part of the Forex trading course we discuss how to trade a flag. We will guide you through the entry, exit, stop loss and profit target process that will ensure you trade the flag like a pro. The way in which we trade the flag is the simplest way possible making this an absolutely fantastic pattern to trade in the Forex markets.

What are Fractals?

Forum on trading, automated trading systems and testing trading strategies

Indicators: Fractals

newdigital, 2013.12.16 11:23

The Fractal Indicator

The fractals are technical indicators, part of the Bill Williams’ indicators. Unlike any other indicators, this one is not a line or histogram bars; it is just a simple arrow on top of or below the bars of the price chart. These fractals are formed when five consecutive bars align in a strict manner. There are two types of fractals:

Bearish fractals: this fractal forms over a bar in the price chart, only if the high of this bar is higher than the high of the previous two and next two bars. In real-life trading this fractal indicates a possible bearish movement.

Bullish fractals: this fractal forms below a bar in the price chart, if the low of this bar is lower than the low of the previous two and next two bars. When you see this fractal, you should expect a bullish movement.

It is important to mention that the Bill Williams’ fractals are illustrated a bit late on the chart, because you need the fifth bar to close, in order to determine the highest high or lowest low. The fractals are trading signals, but they are far too insufficient to count on them alone: the buy fractal indicates a possible buy order and vice versa.

Use in ForexThe fractals point out the strong levels. You can easily draw a line to connect multiple fractals to form either a resistance or a support line. These levels work exactly the same as the trend lines. If you take a look at the image, you will see the resistance line and the buy signal. We get this signal, because the price breaks the strong resistance level. However, if you take a close look at the chart before this moment, you will see a couple of sell signals. This clearly points out how inconclusive are the fractals alone.

If you have paid attention on the Trend Lines page, you already know that some traders use the fractals to build their trend line. We really like this strategy, but it is not something revolutionary.

Bill Williams’ fractals and Alligator indicator. These two indicators share great synergy and we will take a quick glance in the image. It is the same as the previous, but we have added the Alligator and this changes the picture quite a lot. Take a look at the buy signal; do you see now why we have not opened a sell order before the buy signal? The price moved above the Alligator and we needed to see a breach of the indicator’s levels and a couple of sell fractals, but did not see that. Instead, the price kept on moving above the Alligator and it even broke the resistance level, which gave us a clear idea of the future movement – buy and take profit.

26. How to trade a triangle or wedge in Forex Part 1

Triangles and wedges look very similar and are traded in exactly the same way. In this video we discuss how to define both the triangle and a wedge in order to make it easy for you to identify them in your charts. We also discuss profit targets along with other pattern characteristics you need to keep in mind

Price Action Forex Trading Strategies By Nial Fuller

This video is based on the following article : Pin Bar Forex Trading Strategy – Pin Bar Definition

In this price action forex trading strategies tutorial video, I discuss how to use price action to trade with the dominant trend using the pin bar and inside bar fakey reversal setup with confluence to make a high probability entry on the GBPUSD 4hr chart

Price Bar Reversals (2 of 9) - The Bearish Rejection Pattern

Price Bar Reversals (2 of 9) - The Bearish Rejection Pattern - Part 2 of a video series discussing short term price bar reversals such as the bearish rejection, the bullish rejection, the open close reversal, the closing price reversal, the hook reversal, the key reversal, the island reversal and the pivot point reversal.

It is important to remember the following guidelines relating to bearish reversal patterns:

Read more about it here

200. Volume and Open Interest in Futures Trading

The next lesson in free online futures video trading course covering open interest and volume in the futures market.