XAGEUR: 16.1913

EURAUD: 1.4499

XAGAUD: 23.4718

Enter Short 1 Lot XAGEUR.

This means that I sell -100000 XAG and I get + 1619130 EUR

I now want to balance the position so I sell the euros I’ve got -1619000 EUR (16.19 Lots) buying 2347388 AUD (16,19*1,4499)

Finally I buy back then XAG to finalize the hedging selling my 2347388 AUD: 2347388/23.4718 = 100008 XAG.

It makes your numbers much easier to follow if you include commas, not only for us readers, but you yourself.

"This means that I sell -100,000 XAG and I get + 1,619,130 EUR"

This assumes that 1 Lot of XAGEUR is 100,000 units.

Broker's lot sizes for metals are not all the same and probably 1 lot, with Silver is 5,000 or 10,000 units with most?

Anyway, don't waste your time trying to make money with hedging in this way. If you manage the perfect hedge, then you will never recover the spread.

Hi,

thanks for you hint.

As i told at the very beguinning, I agree with you that arbitrage is not praticable. I'm only trying to understand fundamentals (pricing, tickvalue, lots...) and, if I'm not able to size an hedge, means that I miss something on fundamentals.

Is all about practice and studing.

Your clue makes much sense. Do you know if there is a MT4 function to query how many units is one lot for each symbol?

Maybe MarketInfo with MODE_LOTSIZE is a good start.

Thank you very much once again.

Hi,

thanks for you hint.

As i told at the very beguinning, I agree with you that arbitrage is not praticable. I'm only trying to understand fundamentals (pricing, tickvalue, lots...) and, if I'm not able to size an hedge, means that I miss something on fundamentals.

Is all about practice and studing.

Your clue makes much sense. Do you know if there is a MT4 function to query how many units is one lot for each symbol?

Maybe MarketInfo with MODE_LOTSIZE is a good start.

Thank you very much once again.

Hi,

I’ve added LOTSIZE to the logic, but still it fails.

Here are the initial conditions:

XAUEUR: 982.7 LOTSIZE: 100

EURTRY: 2.7266 LOTSIZE: 100000

XAUTRY: 2679.42 LOTSIZE: 100

This is the logic:

- Buying 1 lot of XAU (100 units) by selling -98,270 EUR (100*982.7)

- Now I buy back the 98,270 EUR (0.98 Lots) by selling -267,206.8 TRY (98,270 * 2.7266)

- Finally I sell then 100 XAU I have buying back +267,942 TRY. (100*2679.42)

Everything but 735 TRY seems to be balanced: 100XAU-100XAU, -98,270 EUR+98,270 EUR, -267,206.8 TRY +267,942 TRY

Does it sound ok?

Still there should be some fault because the position drift:

Can you still see a bug in the logic?

Thank you very much.

I think that your logic is probably ok.

Exotic pairs can have huge spreads at times and that is the probable cause of the net loss.

What was the net loss at the time that you placed the trades?

At the very time the positions had been opened, when only the spread was paied, the loss was -123 EUR.

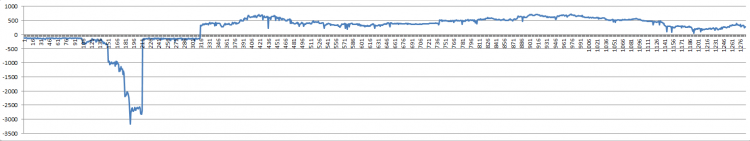

But, even better, this time I've logged the position profit with 1 minute sampling. This is the chart showing how the profit has been moving:

Since every mark is one minute, has you can see the position has been down to -3000 for siveral minutes continiusly, was not just matter of a spike or anomalous spread.

After that, the position turned in net profit after the spreads.

Either the following:

1) my logic is wrong

2) it would have been veary easy to arbitrage by buying at the bottom and selling at the top (and viceversa)

Since I dont beleave the second is possibile, my logic must be faulty... but I cannot find the bug.

Thanks.

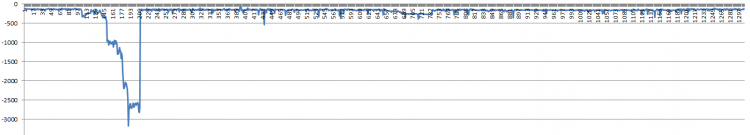

Sorry, I took a wrong column producing the chart. This is the good one:

This makes more sense now... it is easy to see that the position constantly stays down at spreads level, as expected.

Still looks very strange that drop at -3000, which could have been traded succesfully. I will monitor the position for a few days and see if this happen again.

By the way I'm happy with that bescouse the chart confirms that the logic was good.

Thanks for your precious hints.

I imagine that the large drop is due to spread widening on the exotics. If that was the case, you wouldn't be able to capitalise by buying at the bottom, because of the initial loss due to the spread.

Interesting that it not only went into profit, but stayed in profit for such a long time.The question is whether those prices on the exotics are for information only and whether you will be re-quoted when trying to close the positions.

Maybe you have found a broker that has mistakes in its pricing structure. ;)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi,

I’m trying to understand how Headging could work. I want to make it clear that I don’t mean to arbitrage, since I’m aware of every problem that makes it impraticable.

I just want to understand where my logical mistake is on sizing the lots for an almost ‘perfect’ hedged position.

I consider this trio, and I show the rates I entered on them (demo account):

XAGEUR: 16.1913

EURAUD: 1.4499

XAGAUD: 23.4718

Enter Short 1 Lot XAGEUR.

This means that I sell -100000 XAG and I get + 1619130 EUR

I now want to balance the position so I sell the euros I’ve got -1619000 EUR (16.19 Lots) buying 2347388 AUD (16,19*1,4499)

Finally I buy back then XAG to finalize the hedging selling my 2347388 AUD: 2347388/23.4718 = 100008 XAG.

So, only 8 XAG remains uncovered, and this should guarantee small and very slow drift (if any) of the position.

Could you please point out where my logic is wrong?

Because it does not seem to work in reality, the position drifts a lot and very quickly.

Look at the following screenshot.

9:05, right after opening. Profit accounts only spreads

9:31

10:56

So, the position profit drifted from -735 EUR (which is just the spreads I paied) to -2003 ERU, to 2574 EUR.

Note: it is not matter of spikes, the position is moving in a very continuous manner from the very bottom to the very up in a couple of hours.

For sure there is a mistake, otherwise arbitraging would be feasible and easy, but I cannot find where I’m wrong.

So, I’m asking your help on highlighting where the problem come from.

Thank you very much.