I agree on bullish long trend

Yes, I agree - bullish: Chinkou Span line crossed the price on historical data.

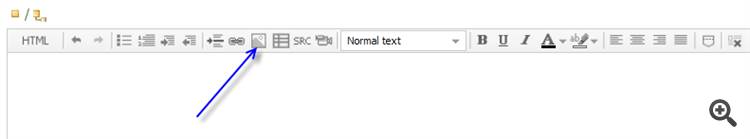

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

eurusd bullish

By the way, most funny thing is the following: this is flat for now. This is the first flat breakout I see in my life :)

if it is boring so watch this video :

EUR/USD - Why, When and How to Trade EUR USD

If you can not watch youtube video so - this is the text from this video :

====================

Out of the major currency pairs the most popular is the EUR/USD. This video could be extremely helpful for people who are about to start trading forex.

Do you know what the most widely traded vehicle on the planet is?

It's not gold, and it isn't Oil either. And while Stocks draw a lot of interest in the financial media and retirement planners, it's not stocks either.

The most widely traded vehicle on the planet earth is the EUR/USD currency pairing.

EUR/USD is the cross pair created from the exchange rate of the currency of the world's two largest economies.

If a European country wants to make an investment in US Treasuries, they are likely going to need to make a trade in EURUSD first. Or likewise, if a US company wants to buy Greek bonds, they would need to first buy euros so that they can make the purchase. And to buy euros with their dollars, they need to go long on the euro-dollar.

This massive liquidity can provide quite a few benefits....

Trading costs can be significantly lower; often a few hundredths of a cent between the buy and the sell prices. These price deviations are so small that they have their own name, commonly referred to as 'pips.' Throughout the day, prices move up and prices move down but the difference between the buy and the sell price functions like a commission on the trade.

But all of this extra liquidity doesn't mean that the EUR/USD is any easier to trade than any of those other markets. Many of the same principals apply whether we're trading currencies or whether we're trading stocks or futures. Price movements can be unpredictable, and trading in any of these markets brings up a potential to lose money.

As such, its often best to focus our trading activities in a manner that could be conducive to our long-term success....

So, on the euro-dollar - prices move 24 hours a day.... The market never closes. But the period of the day in which Europe is open before the United States, between 3:00AM-8:00AM can often be best for trading in this market. Once The United States opens, banks begin quoting prices across the Atlantic, and volatile price movements can increase, making it more difficult for retail traders to speculate EUR/USD.

Don't feel like waking up at 4:00 AM? That's ok - most other traders feel the same way. In the forex market, we have a litany of tools that can allow you to trade in these markets without you needing to press the trigger for each and every buy and sell decision. We'll talk a little more about that in a moment...

Volatility is something that needs to be expected in EUR/USD. With a representation of the world's 2 largest economies, EURUSD can often bring wild and extended price movements.

This leads many traders to focus on trading what are called 'breakouts' in EUR/USD. A Breakout takes place when price makes a new intermediate-term high or low. This strategy employs an element of Newtonian logic in expecting things in motion to tend to stay in motion; and using the presumption that prices making new highs or lows will continue on to make further high or lows.

And if price doesn't go on to make higher highs or lower lows, a tight stop can be used so that the trader can exit the trade at a minimum of a loss. But, if prices can continue running, the potential reward could be huge relative to the amount of risk taken on.

Bullish did not start after flat because it is flat continuing on D1 and ranging market condition (as a secondary trend) on H4 :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

eurusd d1 flat continuing

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

eurusd d1 flat continuing

newdigital, 2013.07.30 17:01

2013-07-30 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Consumer Confidence (CCI)]

- past data is 82.1

- forecast data is 81.5

- actual data is 80.3 according to the latest press release

If actual > forecast = good for currency (for USD in our case)

==========

U.S. Consumer Confidence Pulls Back Off Five-Year High In July :

With consumer expectations regarding the short-term outlook weakening in July, the Conference Board released a report on Tuesday showing that U.S. consumer confidence for the month fell by more than economists had anticipated.

The Conference Board said its consumer confidence index dropped to 80.3 in July from a revised 82.1 in June. Economists had been expecting the index to dip to 81.0 from the 81.4 originally reported for the previous month.

The bigger than expected decrease by the consumer confidence index came after it reached a more than five year in June.

"Consumer Confidence fell slightly in July, precipitated by a weakening in consumers' economic and job expectations," said Lynn Franco, Director of Economic Indicators at The Conference Board. "However, confidence remains well above the levels of a year ago."

Reflecting the weakening in consumer expectations, the expectations index fell to 84.7 in July from 91.1 in June.

The Conference Board said the percentage of consumers expecting business conditions to improve over the next six months fell to 19.1 in July from 21.4 in June, while consumers expecting conditions to worsen remained virtually unchanged at 11.2 percent.

Consumers' outlook for the labor market was also less upbeat, with those expecting more jobs in the months ahead falling to 16.5 percent from 19.7 percent, while those expecting fewer jobs rose to 18.1 percent from 16.1 percent.

Meanwhile, the report said the present situation index climbed to 73.6 in July from 68.7 in June, as consumers' appraisal of current conditions continued to improve.

Consumers saying business conditions are "good" rose to 20.9 percent from 19.4 percent, while those saying conditions are "bad" fell to 24.5 percent from 24.9 percent.

The Conference Board noted that the assessment of the job market was also more positive, as those saying jobs are "plentiful" climbed to 12.2 percent from 11.3 percent, while those saying jobs are "hard to get" dipped to 35.5 percent from 37.1 percent.

"Consumers' assessment of current conditions continues to gain ground and expectations remain in expansionary territory despite the July retreat," Franco said.

She added, "Overall, indications are that the economy is strengthening and may even gain some momentum in the months ahead."

Last Friday, Thomson Reuters and the University of Michigan released a separate report showing that consumer sentiment improved to its best level in six years in July

The report showed that the consumer sentiment index for July was upwardly revised to 85.1 from the preliminary reading of 83.9. Economists had expected the index to be upwardly revised to 84.0.

With the upward revision, the index was above the final June reading of 84.1 and at its highest level since July of 2007.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Chinkou Span line of Ichimoku indicator is crossing historical price from below to above for bullish continuing after. Price is above the cloud for primary bullish and it was the flat as secondary trend for whole the week - price was going along Sinkou Span A support line. If the price will cross 1.3295 resistance so we can see good uptrend continuing for the coming week. If the price will break 1.3089 support line so trend will be reversed to bearish on D1 timeframe.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for the next week)

2013-07-29 14:00 GMT | [USD - Pending Home Sales]

2013-07-30 06:00 GMT | [EUR - German Gfk Consumer Confidence Survey]

2013-07-30 09:00 GMT | [EUR - Consumer Confidence Indicator (CCI)]

2013-07-30 12:00 GMT | [EUR - German Consumer Price Index]

2013-07-30 14:00 GMT | [USD - Consumer Confidence (CCI)]

2013-07-31 07:55 GMT | [EUR - German Unemployment Change]

2013-07-31 09:00 GMT | [EUR - Consumer Price Index core]

2013-07-31 12:15 GMT | [USD - ADP Employment Change]

2013-07-31 12:30 GMT | [USD - Gross Domestic Product (GDP)]

2013-07-31 18:00 GMT | [USD - Interest Rate]

2013-08-01 01:00 GMT | [CNY - NBS Manufacturing PMI]

2013-08-01 01:45 GMT | [CNY - HSBC Manufacturing PMI]

2013-08-01 11:45 GMT | [EUR - ECB Interest Rate]

2013-08-01 12:30 GMT | [EUR - ECB Press Conference]

2013-08-01 14:00 GMT | [USD - ISM Manufacturing PMI]

2013-08-02 09:00 GMT | [EUR - Producer Price Index]

2013-08-02 12:30 GMT | [USD - Non-farm Payrolls]

SUMMARY : bullish

TREND : bullish continuing

Intraday Chart