(09 FEBRUARY 2019)WEEKLY MARKET OUTLOOK 2:INR Robust Whilst Upside Risk Amid Dovish RBI

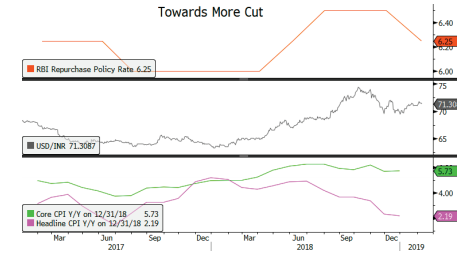

The Reserve Bank of India (RBI) seems to have made a major turn back, adopting a full dovish rhetoric after having favored a hawkish stance in the past, a move that surprised the market, which was expecting a neutral posture given Fed’s recent monetary policy meeting. However, RBI’s committee decided differently, cutting its Repurchase Rate by 25 bps to 6.25% following a rise in August 2018, the first drop since August 2017. While another cut in April 2019 remains very likely. Indeed, it seems that this return of situation makes the business of PM Narendra Modi party Bharatiya Janata, whose electoral promises focus on more lending to support rural areas and expansion of tax cuts for middleclass families amid general elections taking place in May 2019. The measure is expected to provide the government with the opportunity of borrowing at lower costs, although the risk of a wider fiscal deficit beyond budget targets could have negative consequences on both Indian rupee as well as longer-end treasuries. Furthermore, the question arising is whether the RBI stays as independent as it should be since despite a low headline inflation figure of 2.20% in December, largely at the lower end of RBI’s target band of 2% – 6, core inflation, which removes the effects of food and energy prices, remains elevated at 5.70%, in line with 1-year average. Also noting that as for the CPI headline figure, food prices account for over 45% of the basket. Accordingly, regardless of current robustness in INR, which closed last week flat (year-to-date: 2.20%), we would favor long USD/INR positions as potential of progression persists.

By Vincent Mivelaz