sathish kumar / Profil

HAI, I AM TRADER. I HOPE YOU ALL DOING WELL.

I USE FIBONACCI RETRACEMENT, SUPPORT AND RESISTANCE

I USE FIBONACCI RETRACEMENT, SUPPORT AND RESISTANCE

Freunde

546

Anfragen

Ausgehend

sathish kumar

Beitrag Key events coming up - Westpac veröffentlicht

Sean Callow, analyst at Westpac noted the key events apart from the Aussie jobs data coming up, released at 11:30am Syd/8:30am Sing/HK. Westpac’s forecast of -20k change in total employment is at the bottom of the range (-20k to +15k, median -10k...

sathish kumar

Beitrag AUD/USD: all about the jobs data veröffentlicht

The Australian dollar extended its decline against its American rival down to 0.7188 this Wednesday, weak amid falling commodities and despite the dollar's sell-off...

sathish kumar

Beitrag NZD/USD bid and staying there after RBNZ veröffentlicht

NZD/USD has stabilized on the bid in the aftermath of the RBNZ interest rate decision having caught out many of the shorts on a squeeze that took the bird up to the mid point of the 0.67 handle where spot now oscillates. The RBNZ cut interest rates by 0...

sathish kumar

Beitrag RBNZ interest rate decision break down - ANZ veröffentlicht

Analysts at ANZ said that the RBNZ’s decision to cut the OCR today was of course against our own view. Key Quotes: "But when all is said and done, we can’t really quibble with it. In many ways the cut was of last week’s ECB-style easing; a cut was delivered, but it was of the hawkish variety...

sathish kumar

Beitrag RBNZ cut, NZD rallied...oops, it happened again - Socgen veröffentlicht

Kit Juckes, economist at Societe Generale explained that the RBNZ, as expected by the majority of people who forecast RBNZ moves, cut the Cash Rate to 2.5%. Key Quotes: "The Kiwi took off like a grouse and so far, the FX market has not been able to shoot it down. A bit like the Euro...

sathish kumar

Beitrag Forex economic events 10.12.2015 veröffentlicht

10.12.2015 00:00Consumer Inflation Expectation (December) Currency: AUD, Importance: Medium...

sathish kumar

Beitrag US stocks extend losses into third session veröffentlicht

US stocks closed with losses for third straight session on Wednesday, having taken a negative turnaround following a positive opening. The Dow Jones Industrial Average fell 75.36 points, or 0.43%, to 17,492.64. The S&P 500 dropped 15.95 points, or 0.77%, to 2,047.64...

sathish kumar

Hat den Code Kaufen und verkaufen zur selben Zeit veröffentlicht

Dieser EA implementiert eine Grid-Strategie mit dem Platzieren von Kauf und Verkaufsorders zur selben Zeit.

In sozialen Netzwerken teilen

1654

11772

sathish kumar

Beitrag USD/CAD outlook remains bullish – Scotiabank veröffentlicht

According to Eric Theoret, FX Strategist at Scotiabank, the pair’s outlook remains bullish in the near term. Key Quotes “USDCAD’s breakout to fresh multi-year highs has coincided with a renewed bullish turn in both trend and momentum indicators”. “There are few major resistance levels ahead of 1...

sathish kumar

Beitrag GBP/USD breaks above 1.5100, turns positive for the week veröffentlicht

The US dollar faced another wave of selling at the beginning of the New York session sending GBP/USD to fresh weekly highs above 1.5100. GBP/USD has already taken back Monday and Tuesday losses and is trading in positive ground for the week, with a high posted at 1.5141 in recent dealings...

sathish kumar

Beitrag WTI regains $38.00 and beyond veröffentlicht

Prices for crude oil keep recovering ground on Wednesday, now managing to retake the $38.00 handle as USD-selling intensifies. WTI firmer ahead of EIA After hitting fresh multi-year lows near $36...

In sozialen Netzwerken teilen · 1

142

sathish kumar

Beitrag Gold above 23.6% Fib on USD weakness veröffentlicht

Gold prices took out USD 1080.48/Oz; 23.6% Fib retracement level Oct 15 high-Dec 3 low; on the back of a broad based USD weakness. Clocks a high of 1085.47 The metal clocked a high of USD 1085.47/Oz, before the momentum stalled around USD 1083/Oz levels...

sathish kumar

Beitrag US Dollar collapses to 97.60 veröffentlicht

The US Dollar Index, which gauges the greenback vs. its main competitors, is giving away further ground today, testing lows around 97.60. US Dollar challenges post-ECB low The index is testing post-ECB lows recorded last week in the 97...

In sozialen Netzwerken teilen · 1

100

sathish kumar

Beitrag AUD/USD reverses losses and retests highs veröffentlicht

The Aussie managed to bounce from below 0.7200 and reversed early losses against the greenback, as even commodity currencies are taking advantage of a weaker US currency. AUD/USD rebounded from a daily low of 0.7170 and climbed back above 0.7200 to retest daily highs at the 0.7230/35 zone...

In sozialen Netzwerken teilen · 1

109

sathish kumar

Beitrag EUR/USD: Above 50-DMA, at post-ECB high veröffentlicht

The USD is being offered across the board in the US session, taking the EUR/USD pair above its 50-DMA at 1.0956 levels. Eyes 1.10 The currency pair bounced off from the strong support at 1.0890 (38.2% of 1.1495-1...

In sozialen Netzwerken teilen · 1

102

sathish kumar

Beitrag US Dollar falls further vs. JPY, breaches 122.00 veröffentlicht

The offered tone around the dollar remains unabated on Wednesday, now sending USD/JPY to break below the key support at 122.00 the figure. USD/JPY weaker as USD-selling picks up pace The greenback continues to lose ground vs...

sathish kumar

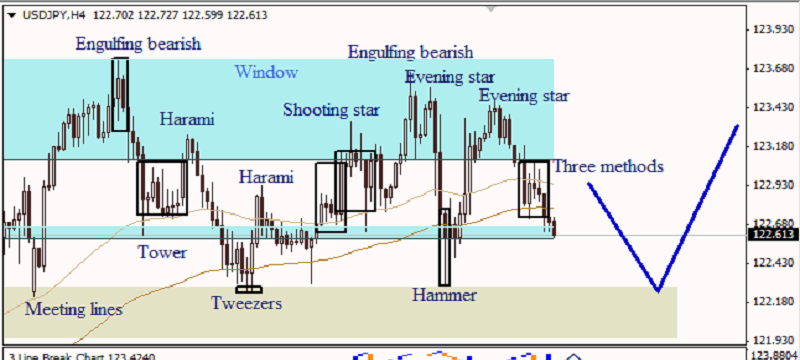

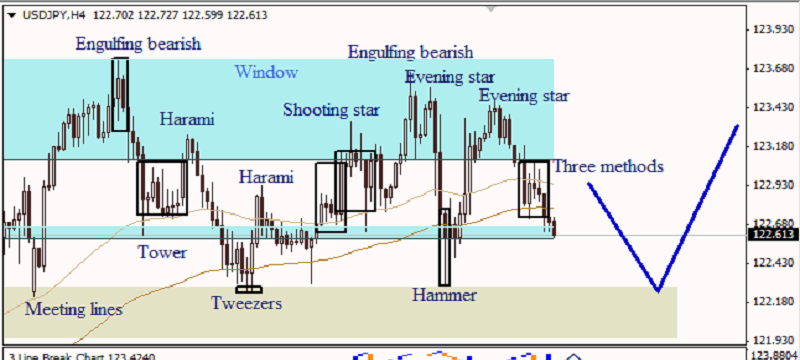

USDJPY 4 HOUR Japanese Candlesticks Analysis 09.12.2015

9 Dezember 2015, 14:53

USD JPY, “US Dollar vs. Japanese Yen” At the H4 chart of USD JPY, bearish Three Methods pattern indicates a descending movement. The downside Window may provide support. Three Line Break chart shows a bullish direction; Heiken Ashi candlesticks confirm a bearish movement...

sathish kumar

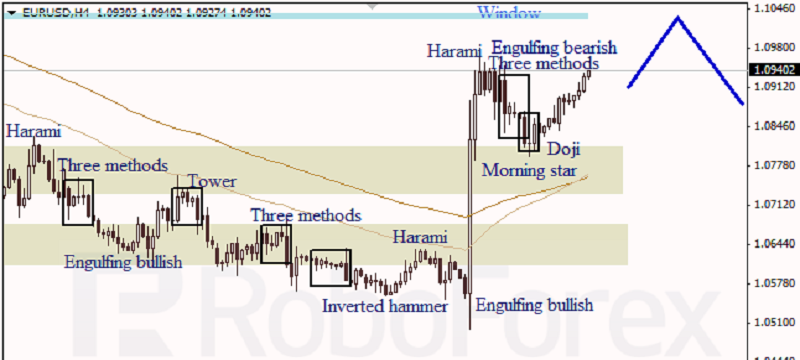

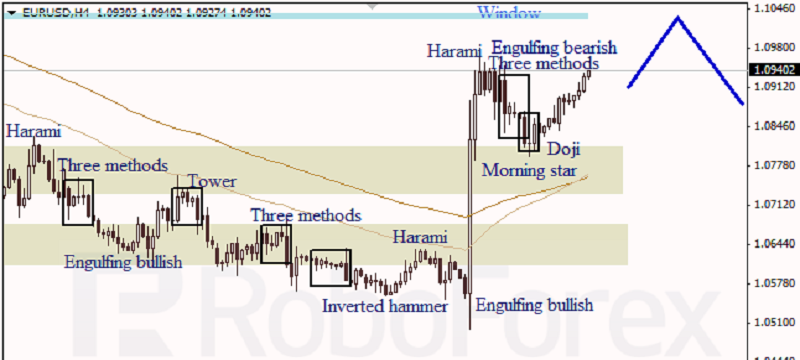

EURUSD 1 HOUR Japanese Candlesticks Analysis 09.12.2015

9 Dezember 2015, 14:51

EUR USD, “Euro vs. US Dollar” The H1 chart of EUR USD shows a sideways correction. Three Methods pattern, Three Line Break chart, and Heiken Ashi candlesticks confirm an ascending movement...

In sozialen Netzwerken teilen · 1

119

sathish kumar

EURUSD 4 HOUR Japanese Candlesticks Analysis 09.12.2015

9 Dezember 2015, 14:49

EUR USD, “Euro vs. US Dollar” At the H4 chart of EUR USD, Morning Star pattern near the support level indicated an ascending movement. The closest Window provides resistance. Three Line Break chart and Heiken Ashi candlesticks confirm a bullish direction...

In sozialen Netzwerken teilen · 1

114

sathish kumar

Beitrag Gold: gains capped by 5-DMA veröffentlicht

The two-day rally seen in gold appears to lose steam near 5-DMA placed at 1079 levels and the price drifted lower amid positive sentiment on the European stocks. Gold: Higher lows on daily charts, breakout in sight? Currently, gold trades marginally higher at 1076...

In sozialen Netzwerken teilen · 1

105

: