Roberto Jacobs / Profil

- Information

|

10+ Jahre

Erfahrung

|

3

Produkte

|

78

Demoversionen

|

|

28

Jobs

|

0

Signale

|

0

Abonnenten

|

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Roberto Jacobs

EUR/NZD Analysis for June 30, 2016 Recently, EUR/NZD has been moving sideways at the price of 1.5600. According to the 30M time frame, I found responsive reaction from sellers at the price of 1.5705, which confirmed a supply trend line...

In sozialen Netzwerken teilen · 2

152

Roberto Jacobs

U.S. Weekly Jobless Claims Rise From Nearly Two-Month Low Reflecting a rebound from a nearly two-month low, the Labor Department released a report on Thursday showing that first-time claims for U.S. unemployment benefits rose by a little more than expected in the week ended June 25th...

In sozialen Netzwerken teilen · 2

110

Roberto Jacobs

Gold Analysis for June 30, 2016 Since our previous analysis, gold has been trading sideways at the price of $1,318.50. According to the 30M time frame, I found the key point of control from the massive bullish day in the background is set at the price of $1,317.50...

In sozialen Netzwerken teilen · 2

114

Roberto Jacobs

Gold Slides Near $1320, Fed's Bullard In London Gold futures eased Thursday morning as stocks were set to pause after a volatile period brought on Britain's vote to leave the European Union. It appears the worst of the Brexit crisis has passed, but traders remain attracted to gold as a safe haven...

Roberto Jacobs

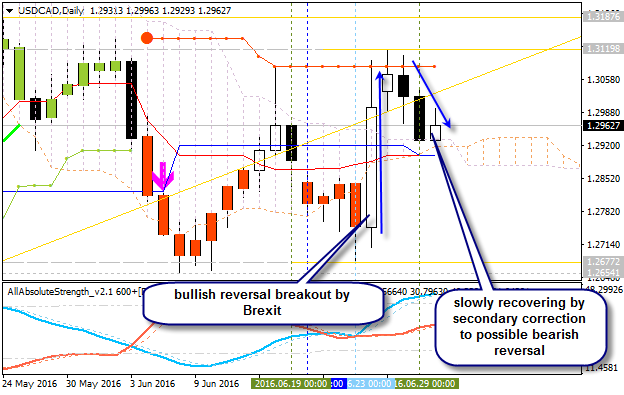

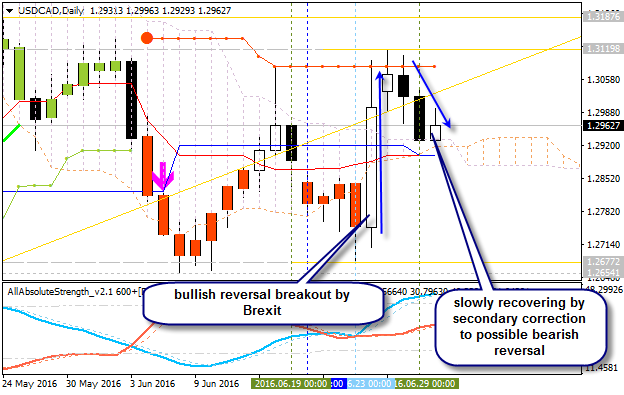

USD/CAD Trade Idea Major Support – 1.2920 (90 4H EMA) Loonie has slightly recovered after making a low of 1.29310. It is currently trading around 1.2949. Short term trend is bullish as long as resistance 1.31204 (Jun 27th 2016 high) holds. Any break above 1.3125 will take the pair to next level 1...

In sozialen Netzwerken teilen · 2

138

Roberto Jacobs

CHF/JPY Trades Well Above 105, Jump Till 106.56/107.60 Is Possible Major resistance – 105.10 (3 day EMA) Major support – 103.50 The pair has broken major resistance 105.10 and jumped till made a high of 105.48 at the time of writing. It is currently trading around 105...

Roberto Jacobs

Sergey Golubev

Kommentar zum Thema Press review

USD/CAD Recovers But Still Far From Pre-Brexit Levels (based on the article ) " The Canadian dollar advanced against the U.S. dollar as Brexit fears that triggered a sell off have abated. There has

Roberto Jacobs

FxWirePro: USD/CAD Faces Strong Support Around 1.2930, Good to Sell on Rallies Major Support – 1.2920 (90 4H EMA) Loonie has slightly recovered after making a low of 1.29310. It is currently trading around 1.2949. Short term trend is bullish as long as resistance 1...

In sozialen Netzwerken teilen · 2

189

Roberto Jacobs

FxWirePro: AUD/CHF Faces Strong Resistance at 0.7380, Good to Buy at Dips Major resistance – 0.7380 (61.8% retracement of 0.7574 and 0.70323) Major support – 0.7160 (200 4H MA) AUD/CHF has retreated sharply after making a high of 0.73170. It is currently trading around 0.72710...

In sozialen Netzwerken teilen · 2

207

Roberto Jacobs

FxWirePro: Sterling Likely to Drop Below Parity Against Dollar

30 Juni 2016, 10:39

FxWirePro: Sterling Likely to Drop Below Parity Against Dollar You might be thinking, looking at the call, “What the hell?” or “This is too far”. We know, even Billionaire investor and legendary George Soros isn’t calling for such a number...

In sozialen Netzwerken teilen · 2

203

Roberto Jacobs

Wave Analysis of Gold for June 30, 2016 Gold has completed 5 waves up in the short term from $1,305 to $1,328 and also made a corrective pullback towards the 61.8% Fibonacci retracement...

In sozialen Netzwerken teilen · 2

155

Roberto Jacobs

Technical Analysis of EUR/GBP for June 30, 2016 EUR/GBP is expected to continue its bullish rebound. The pair has posted a pullback and is rebounding on its support at 0.8200. Even though a continuation of the consolidation cannot be ruled out, its extent should be limited...

In sozialen Netzwerken teilen · 2

143

Roberto Jacobs

Technical Analysis of AUD/USD for June 30, 2016 AUD/USD is expected to trade with a bullish bias. The pair eventually broke above the key resistance at 0.7380 before rallying further. It has reversed a bearish pattern of lower highs while establishing a bullish trading channel at the same time...

In sozialen Netzwerken teilen · 2

130

Roberto Jacobs

Technical Analysis of USD/JPY for June 30, 2016 USD/JPY is expected to trade in a higher range and is supported by a rising trend line. On Wednesday, US stock indices kept rallying along with global markets, led by financial and energy shares. The Dow Jones Industrial Average gained another 1...

In sozialen Netzwerken teilen · 2

109

Roberto Jacobs

Technical Analysis of USD/CHF for June 30, 2016 USD/CHF is expected to trade with a bullish bias above 0.9760. The pair remains bullish on an intraday basis. In addition, a strong support base around 0.9760 should limit any downward attempts...

In sozialen Netzwerken teilen · 2

130

Roberto Jacobs

Technical Analysis of NZD/USD for June 30, 2016 NZD/USD is expected to extend its upside movement. The pair has been supported by a rising trend line since June 28 and is likely to challenge the horizontal resistance at 0.7155 in sight...

In sozialen Netzwerken teilen · 2

135

Roberto Jacobs

Technical Analysis of GBP/JPY for June 30, 2016 GBP/JPY is expected to trade with a bullish bias. The pair has been supported by a rising trend line, as well as the 20-period and 50-period moving averages and continues its rebound. The relative strength index stays above 50...

In sozialen Netzwerken teilen · 2

127

Roberto Jacobs

Technical Analysis of EUR/JPY for June 30, 2016 General overview for 30/06/2016: The market is trying to develop a clear, corrective, choppy bounce from the lows at the level of 109.55...

In sozialen Netzwerken teilen · 2

136

: