Teresinha Moraes Correia / 卖家

已发布的产品

A MetaTrader 4 indicator is a tool used in the MT4 trading platform to help traders analyze price data. It uses mathematical formulas based on price, volume, or time to show patterns or trends on a chart. Indicators can help traders decide when to buy or sell by showing possible entry and exit points. There are many types, such as trend indicators, oscillators, and volume tools. Traders can also create custom indicators to suit their strategies and improve their trading decisions.

Using colors that reflect the prevailing market direction, the indicator is designed to show when the current trend is still dominant. This helps to filter out potential market noise and guides the trader to avoid false signals. By clearly visualizing trend strength and consistency, the tool assists in identifying higher-probability trade setups. It enhances precision by allowing traders to focus on movements that align with the broader market context. As a result, decision-making becomes more

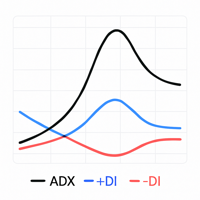

Custom ADX Indicator Based on Open Price Only The standard ADX indicator is usually calculated using the High, Low, and Close prices. This produces a smooth and visually appealing line that represents price action. However, ️ it lacks precision — as the candle moves, the ADX, +DI, and -DI values also change suddenly, potentially triggering false signals based on the candle’s initial plotting. A curious observation: even when the input is modified to use the Open price in the indicator se

Statistical Time-Based Indicator – Directional Candle This indicator analyzes all candles from the past month (30 days) on the current timeframe, identifying at which exact time (hour and minute) bullish or bearish candles occur most frequently. Based on this data, it emits real-time BUY (CALL) or SELL (PUT) signals whenever the behavioral repetition reaches the configured percentage. The statistical logic is based on exact hour and minute . For example, if at 14:15 over the last 30 day

A gap is a space on the chart between two consecutive candlesticks where no trading occurred between the close of one candle and the open of the next. In the Forex market, gaps mainly appear at the weekly open, reflecting events or expectations from the weekend. Technically, a gap may indicate an imbalance between supply and demand. Strategies use gaps as signals of possible trend continuation or reversal, offering opportunities for technical analysis based on liquidity and momentum.

` SMS MOMENTUM SR ARROW | Precision in Momentum and Support/Resistance`

` Overview: A Convergence of Momentum and Key Levels`

The SMS MOMENTUM SR ARROW indicator is a specialized technical tool designed for traders who base their strategies on the critical interplay between momentum shifts and significant support/resistance (S/R) levels. This indicator operates on a clear, two-stage logic: first, it identifies a genuine momentum reversal using a refined oscillator-based calculation; se

指标技术说明 – Delta Profile for MetaTrader 5 Delta Profile 是为 MetaTrader 5 开发的一款指标,用于在指定的 K 线区间内对成交量流进行详细分析。它能够在不同的价格水平上对正向成交量(与上涨相关)和负向成交量(与下跌相关)的不平衡进行结构化和可视化展示。最终,用户可以清晰地识别图表中成交最为集中的区域,以及真实的市场不平衡形成的位置。 以下是该指标的主要技术特征与参数说明。 核心概念 指标会识别 价格水平 ,并将其分类为正向成交量、负向成交量,以及净 Delta(正负成交量的差值)。 每个价格水平会在图表中以 水平条形 显示,帮助用户直观观察市场活跃区和不平衡区域。 用户可自由控制 分析的 K 线数量 、 价格精度(小数位数) 、 显示的最大水平数量 以及 可视化样式 。 主要功能 价格水平映射 :根据设定的精度对价格进行四舍五入,并累计对应 K 线的成交量。 净 Delta 计算 :显示正负成交量的差值,提供每个价格区间的客观数值。 最强 Delta 水平突出显示 :自动识别 Delta 绝对值最大的价格水平,并用特殊颜色标

SR POC VOLUME 指标适用于 MetaTrader 5,用于识别、聚合和可视化从蜡烛图数据中得出的控制点(POC),可在用户可配置的回溯周期内进行分析。该指标旨在通过累积的成交量和 Delta 分布,为交易者提供结构化的方法,以识别潜在的支撑和阻力区域,从而更好地理解市场中关键兴趣点的位置。 核心功能 POC 计算 指标会在指定的回溯范围内为每根蜡烛计算 POC。 POC 定义为蜡烛最高价与最低价的中点。 每个 POC 同时关联一个 Delta 值,该值基于成交量和方向性偏差(收盘价高于开盘价为正,否则为负)。 Delta 值经过缩放,以突出买卖方之间的方向性不平衡。 聚类形成 POC 会根据用户设定的价格百分比容差进行聚类。 容差确定 POC 之间必须多接近才能被视为同一聚类的一部分。 每个聚类会聚合以下数据: 聚类覆盖的最低价和最高价。 累积 Delta 总和,反映买方或卖方的主导情况。 聚类内 POC 的数量。 聚类的最新时间参考。 聚类的最少 POC 要求 聚类只有在包含至少指定数量的 POC 时才被确认。 该功能防止孤立或无意义的数据点被高亮,仅显示有意义的价格集中

The indicator simply delivers a large number of consecutive wins by issuing signals in which you can determine the start time and end time in the settings where the signals should begin and stop being issued, thus allowing it to be used in automation programs to perform automatic trades. ️ It can be used in multiple timeframes, recommended in 1 minute, 5 minutes, 15 minutes. Trading mode > For the same candle in which the signal occurs.

️ The signal occurs at the beginning of the current

该指标通过复杂的概率计算来提供交易信号。它不仅仅是简单的箭头提示,而是结合了用户设定的开始与结束时间,对当天的市场环境进行全面读取与分析,从而在合适的时刻发出信号。 用户可以灵活设置交易时段,指标会在这些时间范围内自动进行数据采集与判断,确保信号与市场节奏保持一致。 在某些关键时刻,指标会在蜡烛图的上方或下方显示一个特殊符号,用来确认信号的强度。这意味着由于实时市场变化,信号可能会更具可靠性和力量。 位于右上角的文本信号则进一步展示当前蜡烛的强度百分比。百分比越高,蜡烛沿着建议方向发展的可能性就越大。 值得注意的是,该指标不仅能在短周期内提供高频信号,还能在较长周期中保持稳定性。通过结合概率计算、实时确认符号以及百分比显示,交易者能够更清晰地理解市场趋势,从而在不同时间框架下做出更精准的决策。 总体而言,这个系统为交易者提供了多层次的参考:概率分析、符号确认、百分比强度展示,使得信号更加透明和可靠,帮助用户在复杂的市场环境中保持优势。