zerosix fundamental / Профиль

Trader

в

Интересуюсь финансовыми рынками ....

Более 7 лет опыта торговли ....

Более 7 лет опыта торговли ....

zerosix fundamental

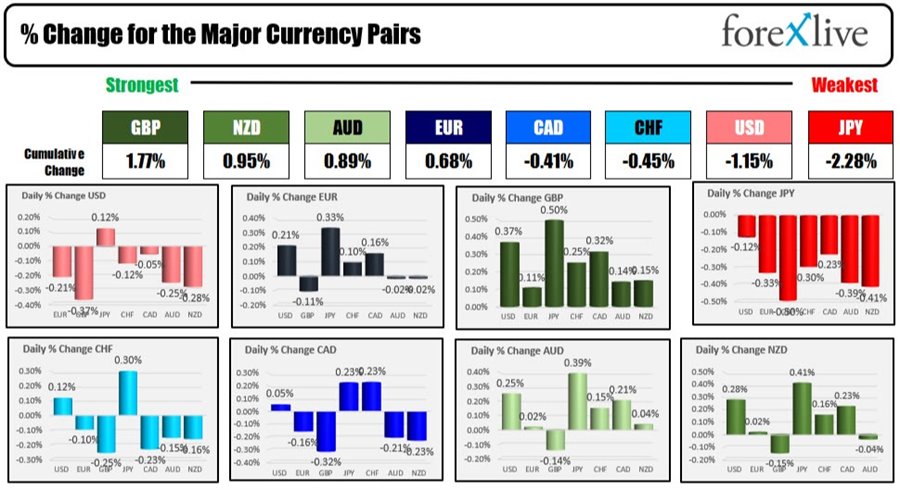

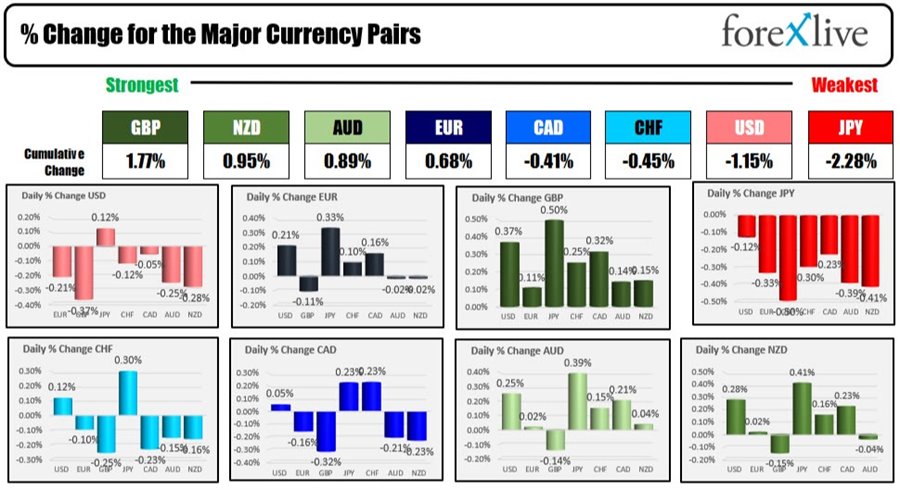

The GBP is the strongest and the JPY is the weakest as the North American session begins

Today, the US will release the next cut for their third-quarter GDP (estimate 2.1% versus 2.1% on the last release. Released at 8:30 AM ET). The Chicago Fed national activity index November will also be released along with existing home sales (6.52 M versus 6.30 M last month (released at 10 AM ET), consumer confidence (10 AM ET) and the weekly crude oil inventory data. The private crude oil data released late yesterday showed a larger than expected decrease in inventories of -3.7 MB. Gasoline inventories did rise by 3.7 MB while distillates fell by -0.8 MB (day to be released at 10:30 AM ET) data.

US stocks are near unchanged levels after yesterday's sharp move higher. Crude oil is trading near unchanged as well. US rates are showing lower rates further out the yield curve. Yesterday the treasury auctioned off $20 billion of 20 year notes with strong demand.

A look at other markets currently shows:

Spot gold is up $4.25 or 0.24% at $1792.68.

Spot silver is up $0.13 or 0.59% at $22.63

WTI crude oil futures are trading near unchanged at $71.15.

Bitcoin is trading at $48,864. The high price reached $49,600 still below the $50,000 level.

A look at the premarket estimates (from the futures) for US stocks shows mixed but modest changes:

Dow industrial average up 46 points

S&P index up 1.27 points

NASDAQ index is down -19 points

In the European equity markets, the major indices are little changed:

German DAX +0.1%

France's CAC, unchanged

UK's FTSE 100 unchanged

Spain's Ibex +0.3%

Italy's FTSE MIB -0.1%

Today, the US will release the next cut for their third-quarter GDP (estimate 2.1% versus 2.1% on the last release. Released at 8:30 AM ET). The Chicago Fed national activity index November will also be released along with existing home sales (6.52 M versus 6.30 M last month (released at 10 AM ET), consumer confidence (10 AM ET) and the weekly crude oil inventory data. The private crude oil data released late yesterday showed a larger than expected decrease in inventories of -3.7 MB. Gasoline inventories did rise by 3.7 MB while distillates fell by -0.8 MB (day to be released at 10:30 AM ET) data.

US stocks are near unchanged levels after yesterday's sharp move higher. Crude oil is trading near unchanged as well. US rates are showing lower rates further out the yield curve. Yesterday the treasury auctioned off $20 billion of 20 year notes with strong demand.

A look at other markets currently shows:

Spot gold is up $4.25 or 0.24% at $1792.68.

Spot silver is up $0.13 or 0.59% at $22.63

WTI crude oil futures are trading near unchanged at $71.15.

Bitcoin is trading at $48,864. The high price reached $49,600 still below the $50,000 level.

A look at the premarket estimates (from the futures) for US stocks shows mixed but modest changes:

Dow industrial average up 46 points

S&P index up 1.27 points

NASDAQ index is down -19 points

In the European equity markets, the major indices are little changed:

German DAX +0.1%

France's CAC, unchanged

UK's FTSE 100 unchanged

Spain's Ibex +0.3%

Italy's FTSE MIB -0.1%

zerosix fundamental

Big thanks to Ryan this week. The US economic calendar picks up

Big thanks to Ryan Paisey for covering for Justin for the past three days. We'll have him back soon and you can follow him @pripusIQ on twitter in the meantime.

For today, the US economic calendar gets much more lively, starting with US GDP at the bottom of the hour. It's the final Q3 release so it's stale at this point and highly unlikely to move the market but at least it's some news to digest.

Big thanks to Ryan Paisey for covering for Justin for the past three days. We'll have him back soon and you can follow him @pripusIQ on twitter in the meantime.

For today, the US economic calendar gets much more lively, starting with US GDP at the bottom of the hour. It's the final Q3 release so it's stale at this point and highly unlikely to move the market but at least it's some news to digest.

zerosix fundamental

EUR/USD remains vulnerable below 1.1300 on USD rebound, ahead of US data

EUR/USD is retreating from 1.1300, snapping a two-day uptrend. Cautious mood revives the US dollar's safe-haven demand, despite weaker yields. US inflation expectations recover ahead of GDP and Consumer Confidence data. Omicron news and Biden's speech eyed as well

EUR/USD is retreating from 1.1300, snapping a two-day uptrend. Cautious mood revives the US dollar's safe-haven demand, despite weaker yields. US inflation expectations recover ahead of GDP and Consumer Confidence data. Omicron news and Biden's speech eyed as well

: