Fabio Belsanti / Профиль

- Информация

|

10+ лет

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

I'm graduated in history with a specialization in economy and war.

I have a master's degree in geopolitics and I wrote a thesis on the modern currency war.

I developed several strategies and EAs that are constantly updated according to market conditions and the ongoing studies.

I'm always looking for new investment/business opportunities and new trading systems.

Most of my trades are automated and technical, but sometimes I perform manual operations on trends resulting from fundamental analysis.

I have a master's degree in geopolitics and I wrote a thesis on the modern currency war.

I developed several strategies and EAs that are constantly updated according to market conditions and the ongoing studies.

I'm always looking for new investment/business opportunities and new trading systems.

Most of my trades are automated and technical, but sometimes I perform manual operations on trends resulting from fundamental analysis.

Fabio Belsanti

Gold: is it the same pattern as in 2008-2011?

Current gold price in dollars (April 21, 2020): USD 1680 (approximately)

Bullish Theoretical Target (2022-2023): 4500 Usd

The technical situation of the gold price, however complex, seems to be in a fundamental critical development point, perfectly in line with the historical, chaotic and conflictual period in which we are living.

I would not like to underline too much the exceptional nature of a present in eternal transformation that can sometimes appear as a sort of banal, boring, eternal return, but as far as human history has always been full of crises, conflicts and contradictions, it can be noted that such as the stalemate of nuclear MAD on the one hand (which has led, so far, to the end of the conventional conflicts between superpowers) and the collapse of the Berlin wall on the other, with the consequent acceleration of the geopolitical kaos, as well as the frenetic development of finance supported by network technologies that have created virtual worlds that are very difficult to govern (de facto ungovernable as they are conceived), is creating a sort of "showdown" between the socio-economic systems (and the philosophies that inspired them) adopted so far.

In this crucial phase, regardless of the outcomes and the directions that markets, the economy and human history will take, gold, precisely for its material and cultural values sedimented in the space-time of so many peoples of the earth, will be certainly a primary actor in the redefinition of power structures (he will also be primary in his improbable, spectacular exit from the scene: in a serene utopian world no longer regulated by the concept of money).

As pointed out by various analysts, the pandemic has highlighted and detonated (and we are only at the beginning) the great contradictions, and tensions, of the financial, social and political systems and structures of both the so-called "descendants" liberal democracies, and of the ascendant "Asian model" ruled by China who shaped the original formula of "socialism with Chinese characteristics" at the end of the tumultuous last century (a system that could perhaps be defined as "State Capitalism" with Confucian historical-cultural elements, a mix that makes orthodox Marxist-Leninists tremble).

The perception of the "common" man (assuming that this elusive, hyper-standardized "common man" exists) of finance, price trends and stock market values is a mixture of fluctuating emotions, fomented by the media, ranging from fear reverential, paranoid hatred, frustration, religious acceptance of an ineffable order.

On a personal level, thanks to my humanistic training as a historian who preceded my studies of technical-financial and geopolitical analysis, I find the charts of global cyberfinance fascinating for their ability to represent, in an almost mystical-esoteric way at times, the clash of the great forces that I would call "psycho-material" of the actors, large and small, of our planet.

The chart, or rather the charts, of the gold price have been telling us (predicting?) Many things for several years, but after this first quarter of 2020 we are probably at an epochal turning point.

The rather obvious fundamental fact is that the world central banks are responding to this new crisis, only triggered by the pandemic, but practically inevitable in the long run, doing what they have already done in 2008: huge liquidity injections.

A trivial assumption is that the value of a physical safe haven such as gold, when the quantity of money, created from "nothing" by central banks, increases exponentially to stabilize the terrified, irrational markets, cannot nothing but increase.

With violent movements, which at times might even seem to be reversals, this rise in price has been taking place with some clarity since the beginning of the new millennium which has seen three major moments of crisis and theoretical restructuring so far: 2001-2008-2020.

The well-known paradox, totally logical from a capitalistic point of view (the capitals go to those who own the capital), of the great liquidity injections are the famous corporate buybacks. Extreme simplification: if money costs little or nothing, it is easy to fictitiously increase the value of my company's shares.

In hindsight, since the end of the Gold Standard and the progressive end of the balance of power of the Bretton-Woods agreements, gold could only embark on a bullish path.

Obviously, this trend and vision can be objected that in reality the price of gold was even higher during the crisis of the seventies of the last century by applying the inflation filter. In reality, even using this filter, the trend remains confirmed, the world of paper money is in crisis and the value of gold, thanks to its history deeply rooted in human culture, continues to rise despite the fact that central banks don't like it at all.

But what does this mean from a technical point of view?

My idea, in the end, is quite simple. I believe that the movement in the gold price will repeat the pattern of 2008-2011 (in part it is already doing it) but with greater strength and, at times, greater unpredictability.

The movement in 2008-2011 was characterized by a rather marked drop in price (-30%) between mid-March and the end of October 2008, which largely followed the sell-off of the shares of the main global indices, from which it then originated, supported by quantitative easing of the world central banks, an increase of about 300% in the following three years.

As is well known, although gold is a safe-haven asset, during periods of violent descents investors may be in a hurry of liquidity and are therefore "forced" to sell part of their gold reserves to cover losses and recover lifeblood (an explanation only partial that we will not elaborate for brevity).

In March 2020, a situation very similar to that of 2008 occurred. Generalized collapse of the markets and simultaneous violent drop in the price of gold. It is not entirely clear whether this descent, much faster, but less profound in percentage terms than that of 2008 (decrease of 15% in 2020 compared to 30% in 2008), is to be considered completed, but even if it were not, the general fundamental framework remains in support of the hypothesis of the principle of a large rise in the price in the future (2020-2023).

On the other hand, the "triangle" with bullish breakout (end of 2017) highlighted in the weekly chart technically involves a first theoretical target around 2500.

The confirmation of this movement took place already last year with the overcoming of the important resistance at 1375 which marked a range of about two years, immediately after the end of the descent at the end of 2015 (descent from the peak of 2011).

Now, if as above, the pattern is repeated in 2008-2011, the target by 2022-2023 is around 4,500.

If such a massive growth occurs (or will be in some way strongly opposed), many socio-economic and geopolitical aspects of the world can be expected to change in the near future.

Current gold price in dollars (April 21, 2020): USD 1680 (approximately)

Bullish Theoretical Target (2022-2023): 4500 Usd

The technical situation of the gold price, however complex, seems to be in a fundamental critical development point, perfectly in line with the historical, chaotic and conflictual period in which we are living.

I would not like to underline too much the exceptional nature of a present in eternal transformation that can sometimes appear as a sort of banal, boring, eternal return, but as far as human history has always been full of crises, conflicts and contradictions, it can be noted that such as the stalemate of nuclear MAD on the one hand (which has led, so far, to the end of the conventional conflicts between superpowers) and the collapse of the Berlin wall on the other, with the consequent acceleration of the geopolitical kaos, as well as the frenetic development of finance supported by network technologies that have created virtual worlds that are very difficult to govern (de facto ungovernable as they are conceived), is creating a sort of "showdown" between the socio-economic systems (and the philosophies that inspired them) adopted so far.

In this crucial phase, regardless of the outcomes and the directions that markets, the economy and human history will take, gold, precisely for its material and cultural values sedimented in the space-time of so many peoples of the earth, will be certainly a primary actor in the redefinition of power structures (he will also be primary in his improbable, spectacular exit from the scene: in a serene utopian world no longer regulated by the concept of money).

As pointed out by various analysts, the pandemic has highlighted and detonated (and we are only at the beginning) the great contradictions, and tensions, of the financial, social and political systems and structures of both the so-called "descendants" liberal democracies, and of the ascendant "Asian model" ruled by China who shaped the original formula of "socialism with Chinese characteristics" at the end of the tumultuous last century (a system that could perhaps be defined as "State Capitalism" with Confucian historical-cultural elements, a mix that makes orthodox Marxist-Leninists tremble).

The perception of the "common" man (assuming that this elusive, hyper-standardized "common man" exists) of finance, price trends and stock market values is a mixture of fluctuating emotions, fomented by the media, ranging from fear reverential, paranoid hatred, frustration, religious acceptance of an ineffable order.

On a personal level, thanks to my humanistic training as a historian who preceded my studies of technical-financial and geopolitical analysis, I find the charts of global cyberfinance fascinating for their ability to represent, in an almost mystical-esoteric way at times, the clash of the great forces that I would call "psycho-material" of the actors, large and small, of our planet.

The chart, or rather the charts, of the gold price have been telling us (predicting?) Many things for several years, but after this first quarter of 2020 we are probably at an epochal turning point.

The rather obvious fundamental fact is that the world central banks are responding to this new crisis, only triggered by the pandemic, but practically inevitable in the long run, doing what they have already done in 2008: huge liquidity injections.

A trivial assumption is that the value of a physical safe haven such as gold, when the quantity of money, created from "nothing" by central banks, increases exponentially to stabilize the terrified, irrational markets, cannot nothing but increase.

With violent movements, which at times might even seem to be reversals, this rise in price has been taking place with some clarity since the beginning of the new millennium which has seen three major moments of crisis and theoretical restructuring so far: 2001-2008-2020.

The well-known paradox, totally logical from a capitalistic point of view (the capitals go to those who own the capital), of the great liquidity injections are the famous corporate buybacks. Extreme simplification: if money costs little or nothing, it is easy to fictitiously increase the value of my company's shares.

In hindsight, since the end of the Gold Standard and the progressive end of the balance of power of the Bretton-Woods agreements, gold could only embark on a bullish path.

Obviously, this trend and vision can be objected that in reality the price of gold was even higher during the crisis of the seventies of the last century by applying the inflation filter. In reality, even using this filter, the trend remains confirmed, the world of paper money is in crisis and the value of gold, thanks to its history deeply rooted in human culture, continues to rise despite the fact that central banks don't like it at all.

But what does this mean from a technical point of view?

My idea, in the end, is quite simple. I believe that the movement in the gold price will repeat the pattern of 2008-2011 (in part it is already doing it) but with greater strength and, at times, greater unpredictability.

The movement in 2008-2011 was characterized by a rather marked drop in price (-30%) between mid-March and the end of October 2008, which largely followed the sell-off of the shares of the main global indices, from which it then originated, supported by quantitative easing of the world central banks, an increase of about 300% in the following three years.

As is well known, although gold is a safe-haven asset, during periods of violent descents investors may be in a hurry of liquidity and are therefore "forced" to sell part of their gold reserves to cover losses and recover lifeblood (an explanation only partial that we will not elaborate for brevity).

In March 2020, a situation very similar to that of 2008 occurred. Generalized collapse of the markets and simultaneous violent drop in the price of gold. It is not entirely clear whether this descent, much faster, but less profound in percentage terms than that of 2008 (decrease of 15% in 2020 compared to 30% in 2008), is to be considered completed, but even if it were not, the general fundamental framework remains in support of the hypothesis of the principle of a large rise in the price in the future (2020-2023).

On the other hand, the "triangle" with bullish breakout (end of 2017) highlighted in the weekly chart technically involves a first theoretical target around 2500.

The confirmation of this movement took place already last year with the overcoming of the important resistance at 1375 which marked a range of about two years, immediately after the end of the descent at the end of 2015 (descent from the peak of 2011).

Now, if as above, the pattern is repeated in 2008-2011, the target by 2022-2023 is around 4,500.

If such a massive growth occurs (or will be in some way strongly opposed), many socio-economic and geopolitical aspects of the world can be expected to change in the near future.

EderMilitao

2023.05.10

The result of many years of work of a person who has devoted his life to science most often is the writing of a dissertation. This is a very long and painstaking work, which requires a lot of attention and a serious approach. Since here you need to be very careful about every little thing. But no matter how hard a person works, for some reason he may not be able to write this work on his own. In this case, you need a dissertation on order - https://www.nursingpaper.com/examples/planned-parenthood-essay/. These are experts in writing scientific work with many years of experience.

Fabio Belsanti

In a silent Monday I managed to complete the annual update of my 2015 thesis in geopolitics: "AI and Robots in the Cyber-Financial Wars (2008-2019)"

The full document is available on Academia.Edu:

https://www.academia.edu/38126893/AI_and_Robots_in_the_Cyber-Financial_Wars_2008-2019_

I hope this work can offer some data and an interesting point of view to anyone who decides to read it.

The full document is available on Academia.Edu:

https://www.academia.edu/38126893/AI_and_Robots_in_the_Cyber-Financial_Wars_2008-2019_

I hope this work can offer some data and an interesting point of view to anyone who decides to read it.

Fabio Belsanti

Today I decided to publish on the portal Academia.edu (this is my page: https://lnkd.in/gCBjiaV) my essay in Geopolitics (2015), with an update (2018), which analyzes the trend of global markets in light of theoretical and practical investigations into the development of automatic trading strategies in the global cyber-financial wars. I hope that my analysis will be useful for those who will be able to read them.

Fabio Belsanti

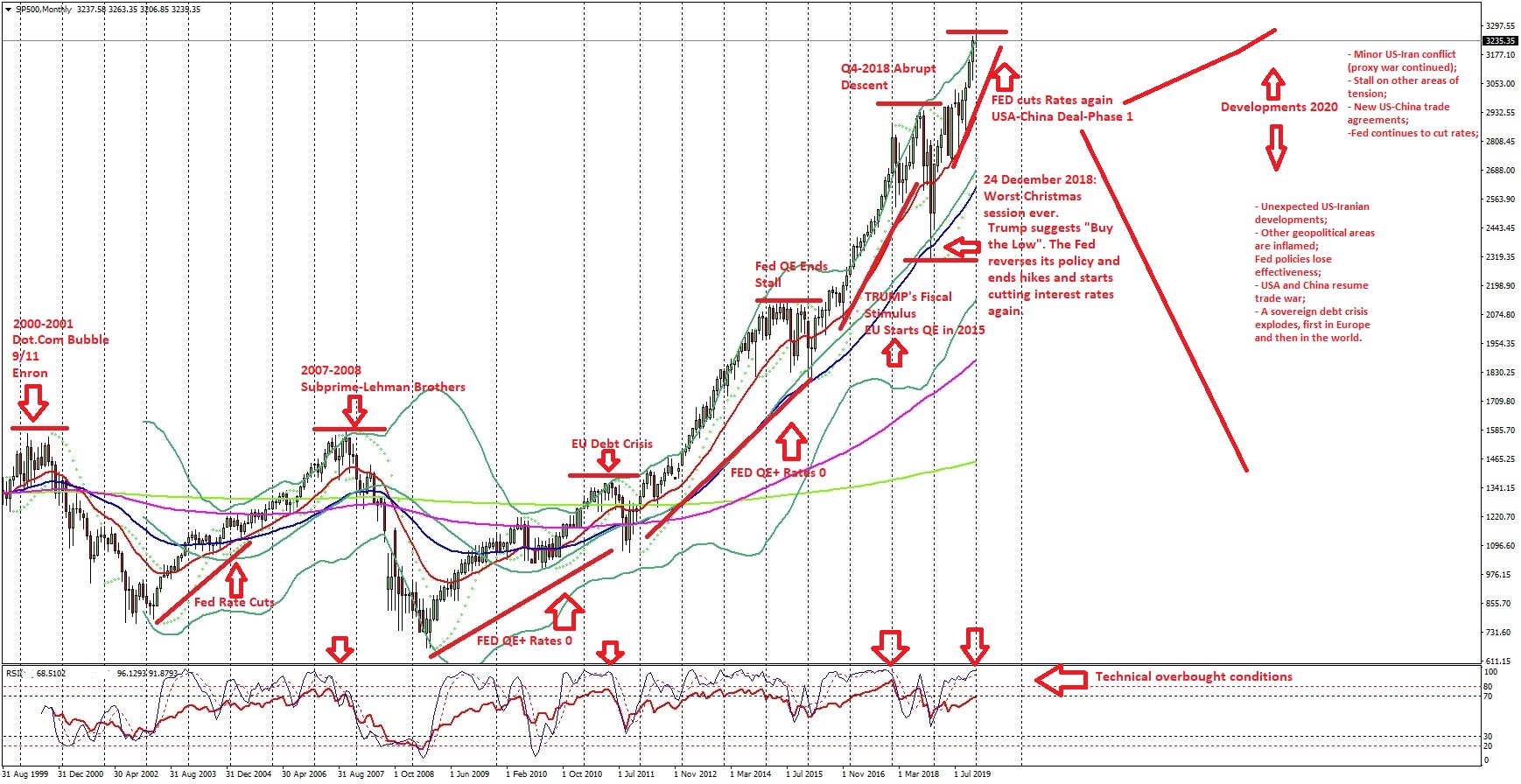

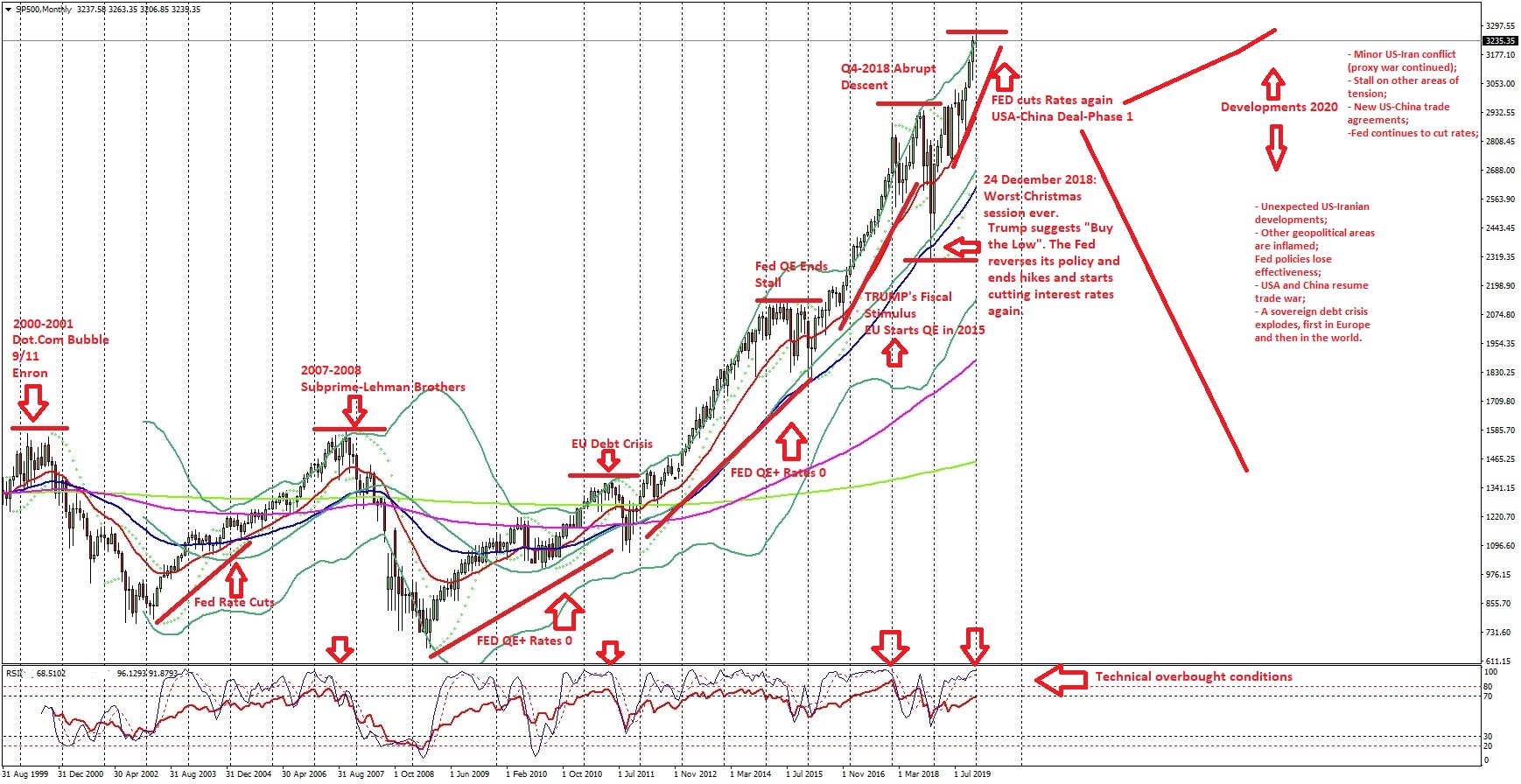

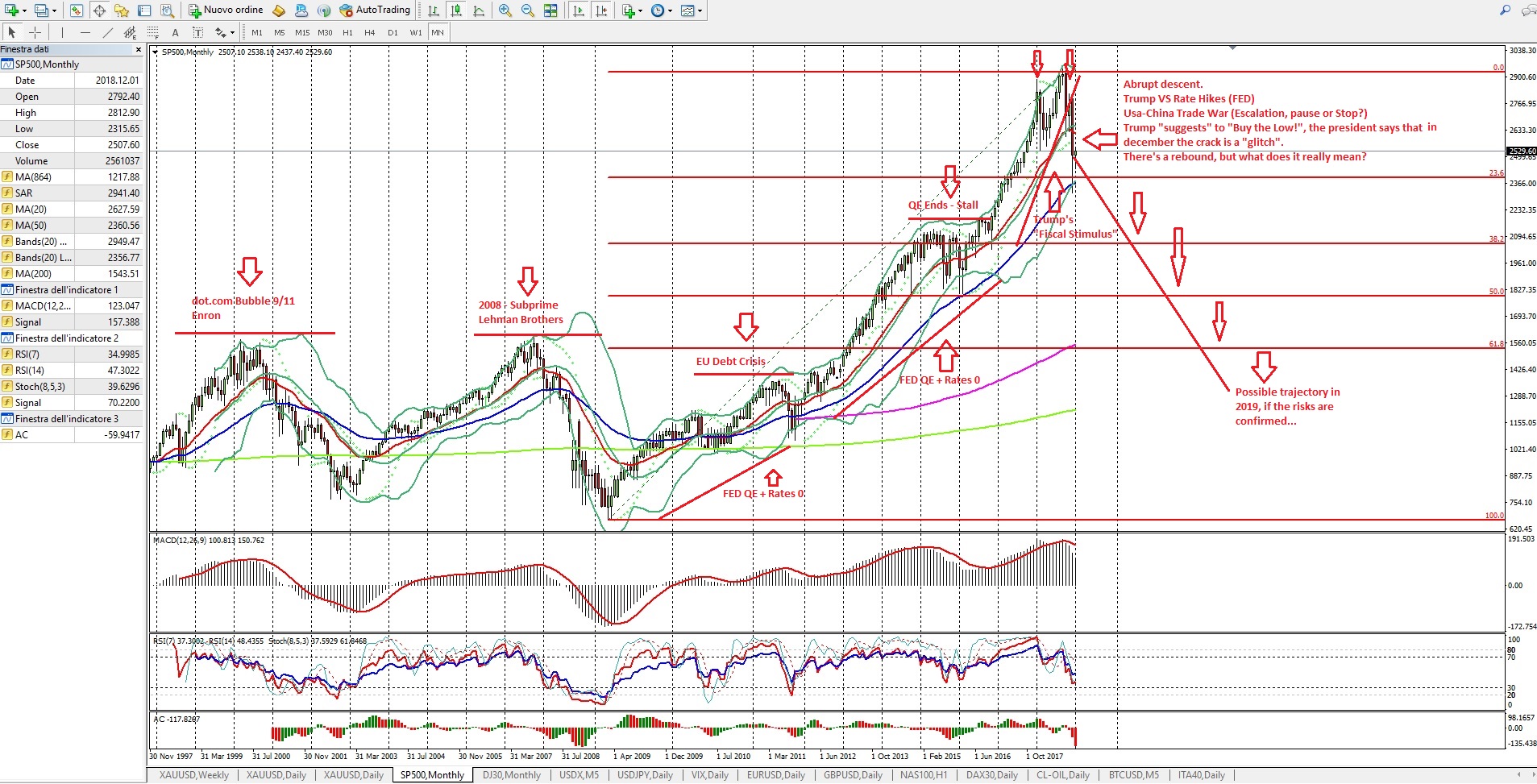

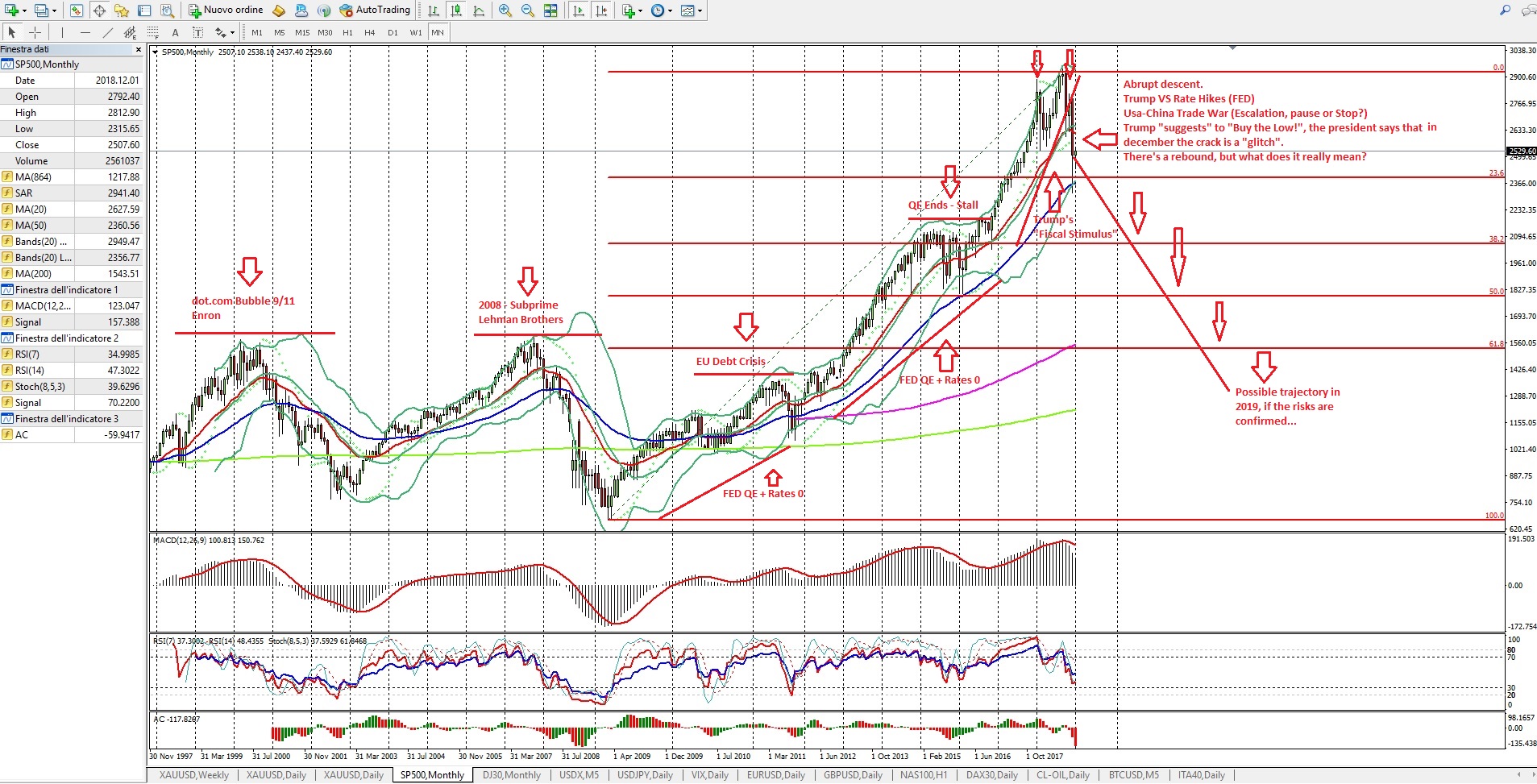

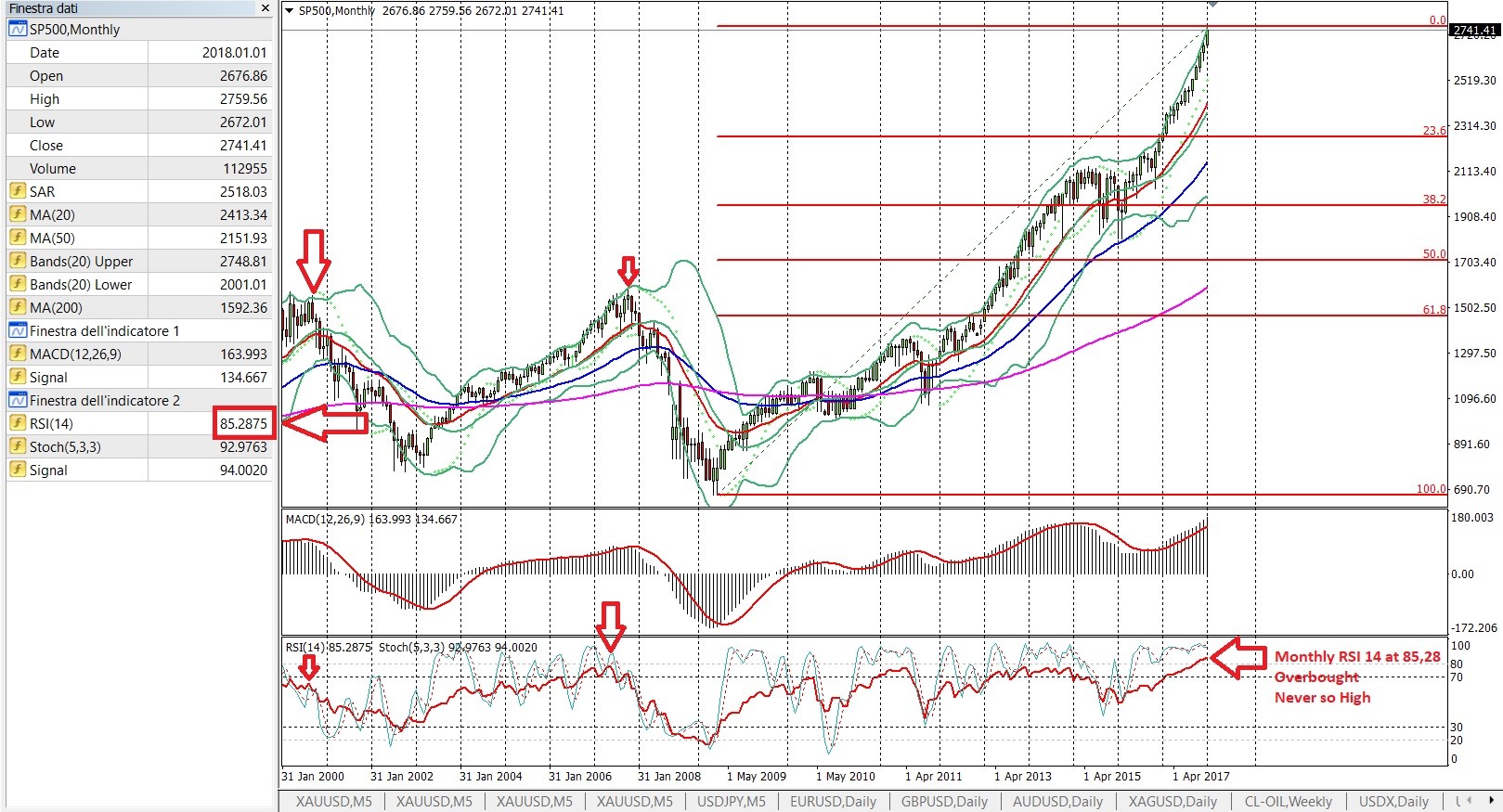

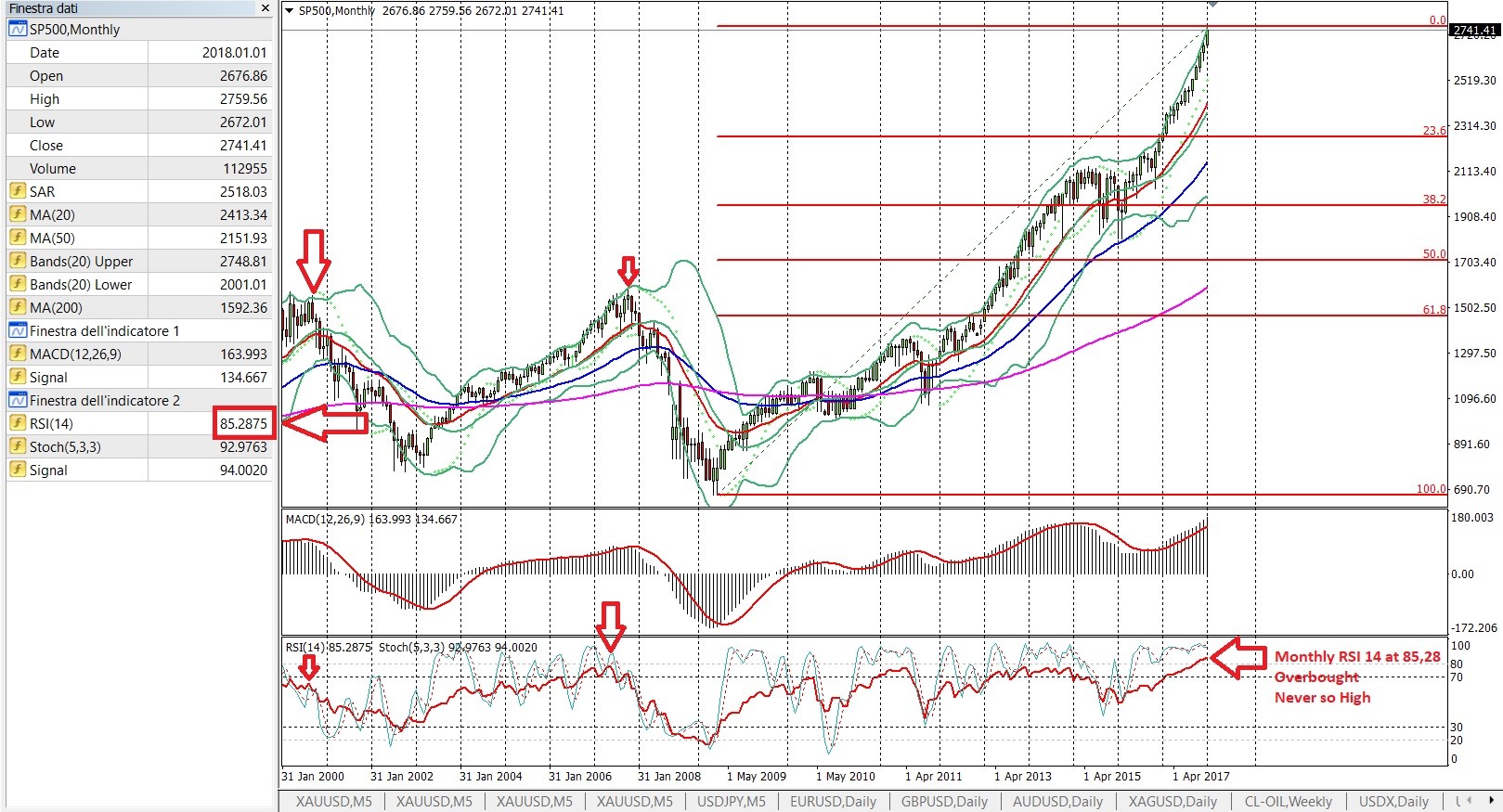

Today the RSI-14 on the monthly chart the SP500 (and similarly the DJ and Nasdaq) reached a value over 85.

The situation is far beyond the standard parameters of 70 or 80.

As I write (12,30 GMT+1), on the 5 min chart, it seems that an inversion of the short-term trend is taking place.

Technically a serious correction or the end of the bull market should arrive soon.

The situation is far beyond the standard parameters of 70 or 80.

As I write (12,30 GMT+1), on the 5 min chart, it seems that an inversion of the short-term trend is taking place.

Technically a serious correction or the end of the bull market should arrive soon.

: