Christophe Fiacre / Профиль

- Информация

|

11+ лет

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

Christophe Fiacre

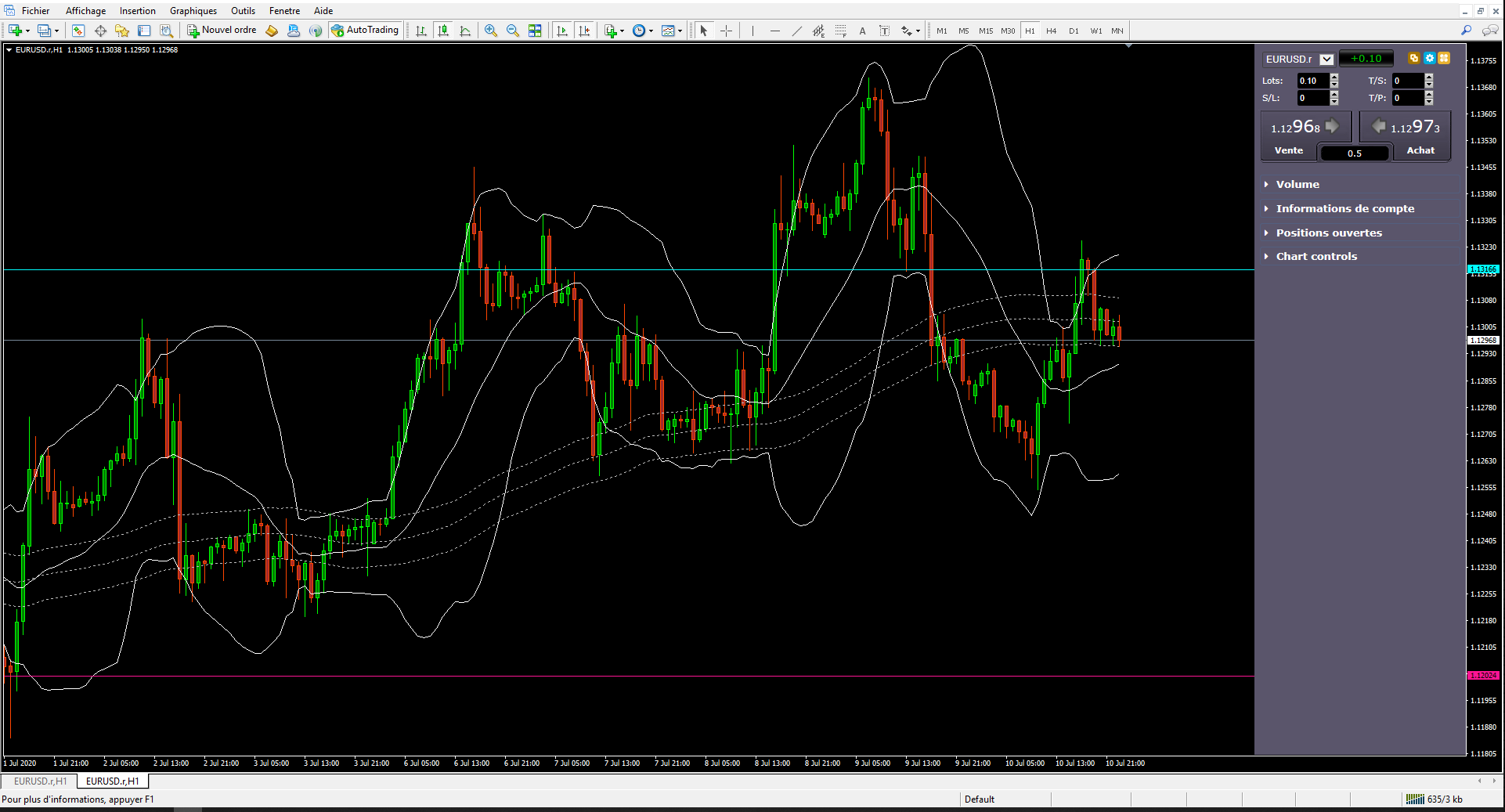

Need an Expert Advisor that works with two indicators, Bollinger Bands and a Channel, to open position. We will always take the closest indicator to the current price, to open or close a position.

[Instrument : EURUSD]

[Time Frame : H1]

Indicators :

----------

- Bollinger bands (Period 20 / Shift 0 / Deviations 2 / Apply to Close)

- Moving average (Period 100 / Shift 0 / Method Simple / Apply to High)

- Moving average (Period 100 / Shift 0 / Method Simple / Apply to Close)

- Moving average (Period 100 / Shift 0 / Method Simple / Apply to Low)

- Mini Terminal proposed for example by Pepperstone to determine the value of the surplus lot balance. (1)

The 3 moving averages form a channel and only the outer terminals are considered.

Conditions of entry :

-------------------

General rule : The candle should close on the other side of the indicator closest to the current price.

BUY entry conditions:

The candle should close above the indicator closest to the current price.

SELL entry conditions:

The candle should close below the indicator closest to the current price.

Conditions of exit :

------------------

General rule: When the reverse condition of the entry occurs.

BUY exit conditions:

When a SELL input condition occurs.

SELL exit conditions:

When a BUY entry condition occurs.

Money Management :

----------------

When an entry condition occurs, open the lot value according to the value of your capital.(2)

When an exit condition occurs, close the positive position of the entry condition (when it appears), closest to the current price, and open the opposite position.

(1)the new position's lot value must be calculated in order to obtain a surplus balance between Buy and Sell. It will be for example a difference of 0.10 lots in a direction. The objective is not to create a hedging but to establish a superior buying or selling force until we do benefit.

(2)Example of money management for a capital of 1000 € :

0.20 lots for a Drawdown between 0 and 10% of the Capital

0.10 lots for a Drawdown between 11 and 20% of the Capital

0.05 lots for a Drawdown between 21 and 30% of the Capital

0.02 lots for a Drawdown between 31 and 40% of the Capital

0.01 lots for a Drawdown between 41 and 50% of the Capital

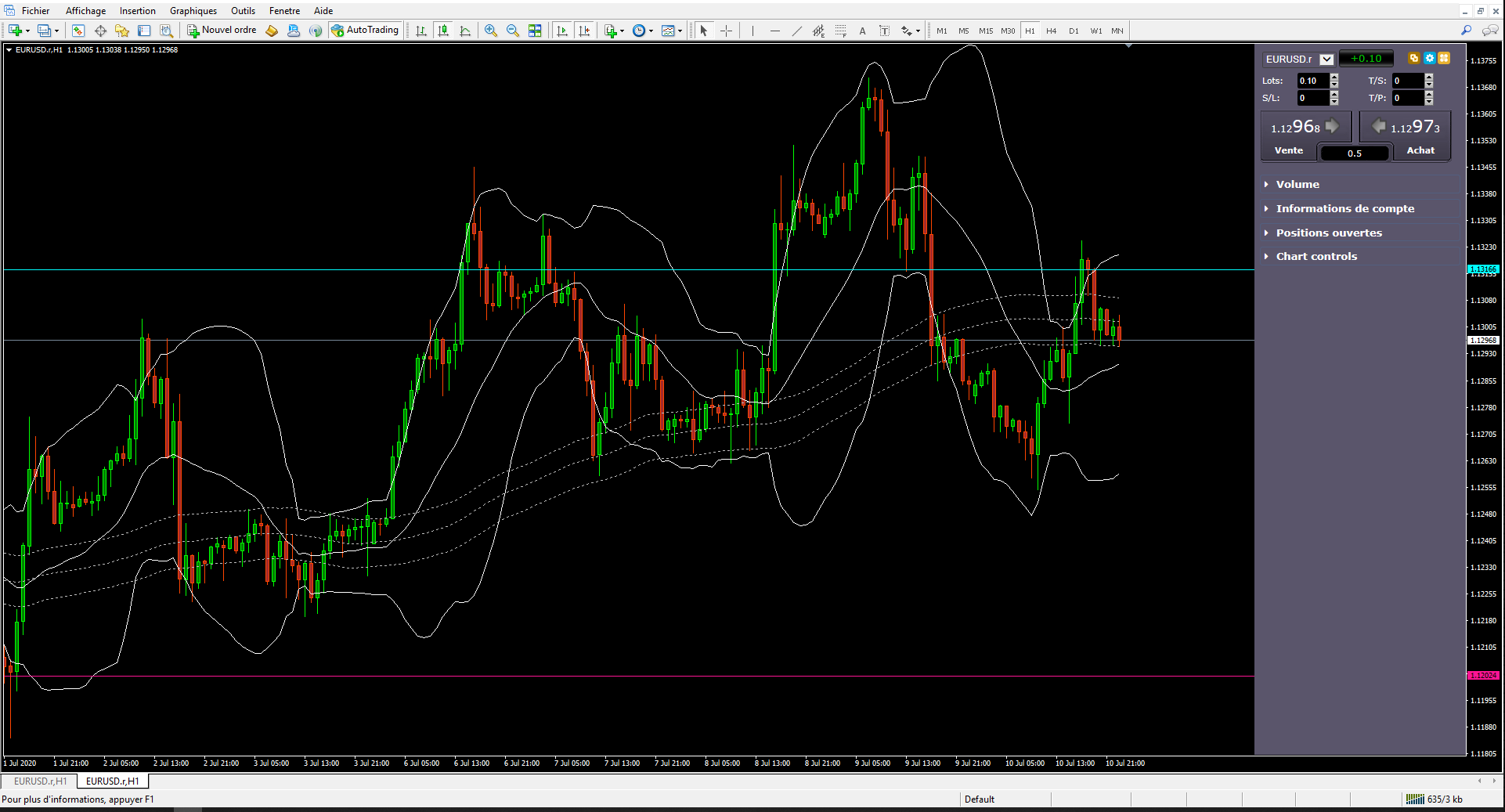

[Instrument : EURUSD]

[Time Frame : H1]

Indicators :

----------

- Bollinger bands (Period 20 / Shift 0 / Deviations 2 / Apply to Close)

- Moving average (Period 100 / Shift 0 / Method Simple / Apply to High)

- Moving average (Period 100 / Shift 0 / Method Simple / Apply to Close)

- Moving average (Period 100 / Shift 0 / Method Simple / Apply to Low)

- Mini Terminal proposed for example by Pepperstone to determine the value of the surplus lot balance. (1)

The 3 moving averages form a channel and only the outer terminals are considered.

Conditions of entry :

-------------------

General rule : The candle should close on the other side of the indicator closest to the current price.

BUY entry conditions:

The candle should close above the indicator closest to the current price.

SELL entry conditions:

The candle should close below the indicator closest to the current price.

Conditions of exit :

------------------

General rule: When the reverse condition of the entry occurs.

BUY exit conditions:

When a SELL input condition occurs.

SELL exit conditions:

When a BUY entry condition occurs.

Money Management :

----------------

When an entry condition occurs, open the lot value according to the value of your capital.(2)

When an exit condition occurs, close the positive position of the entry condition (when it appears), closest to the current price, and open the opposite position.

(1)the new position's lot value must be calculated in order to obtain a surplus balance between Buy and Sell. It will be for example a difference of 0.10 lots in a direction. The objective is not to create a hedging but to establish a superior buying or selling force until we do benefit.

(2)Example of money management for a capital of 1000 € :

0.20 lots for a Drawdown between 0 and 10% of the Capital

0.10 lots for a Drawdown between 11 and 20% of the Capital

0.05 lots for a Drawdown between 21 and 30% of the Capital

0.02 lots for a Drawdown between 31 and 40% of the Capital

0.01 lots for a Drawdown between 41 and 50% of the Capital

: