Florin Tudor / Профиль

- Информация

|

нет

опыт работы

|

2

продуктов

|

4

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

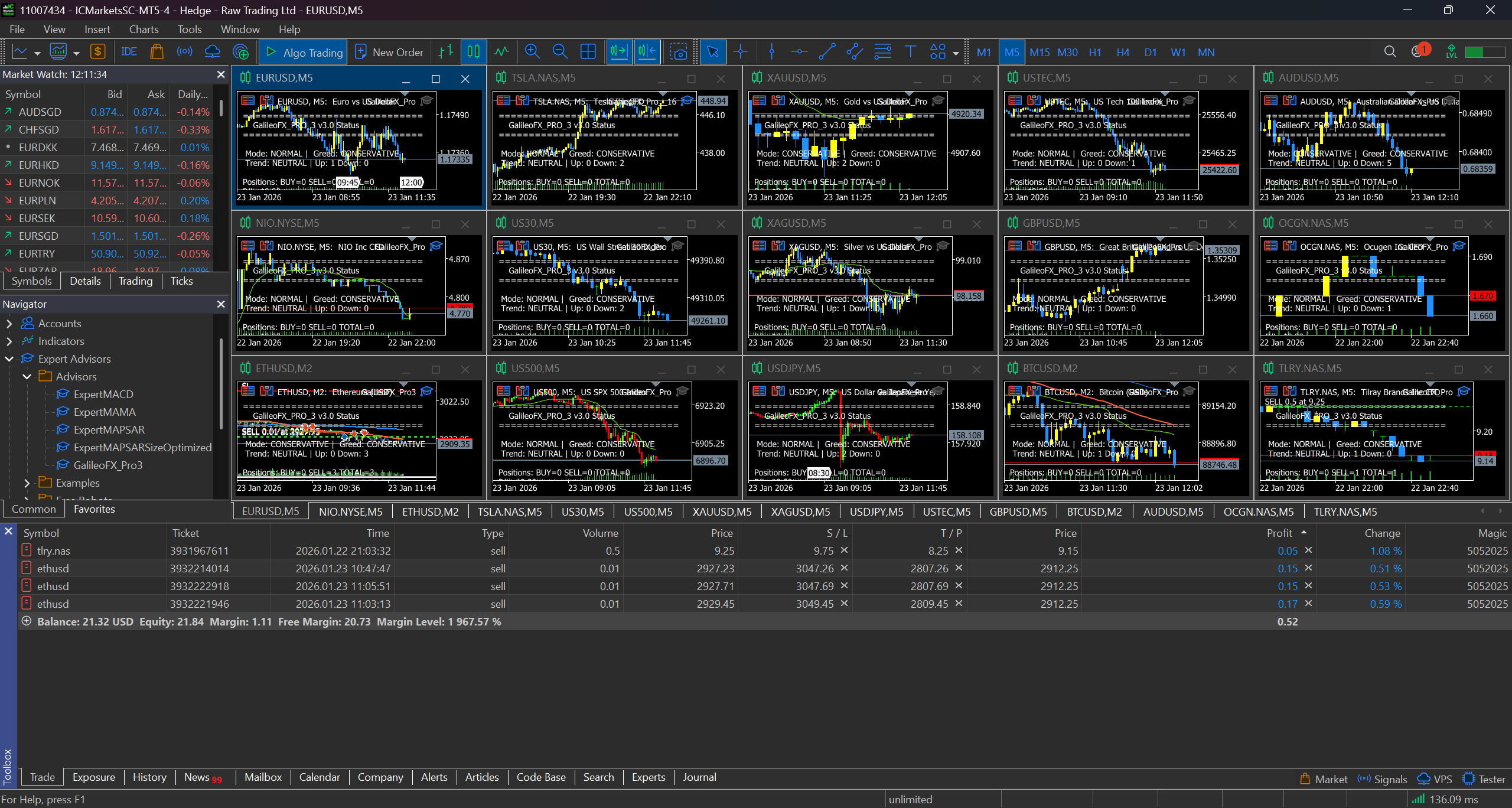

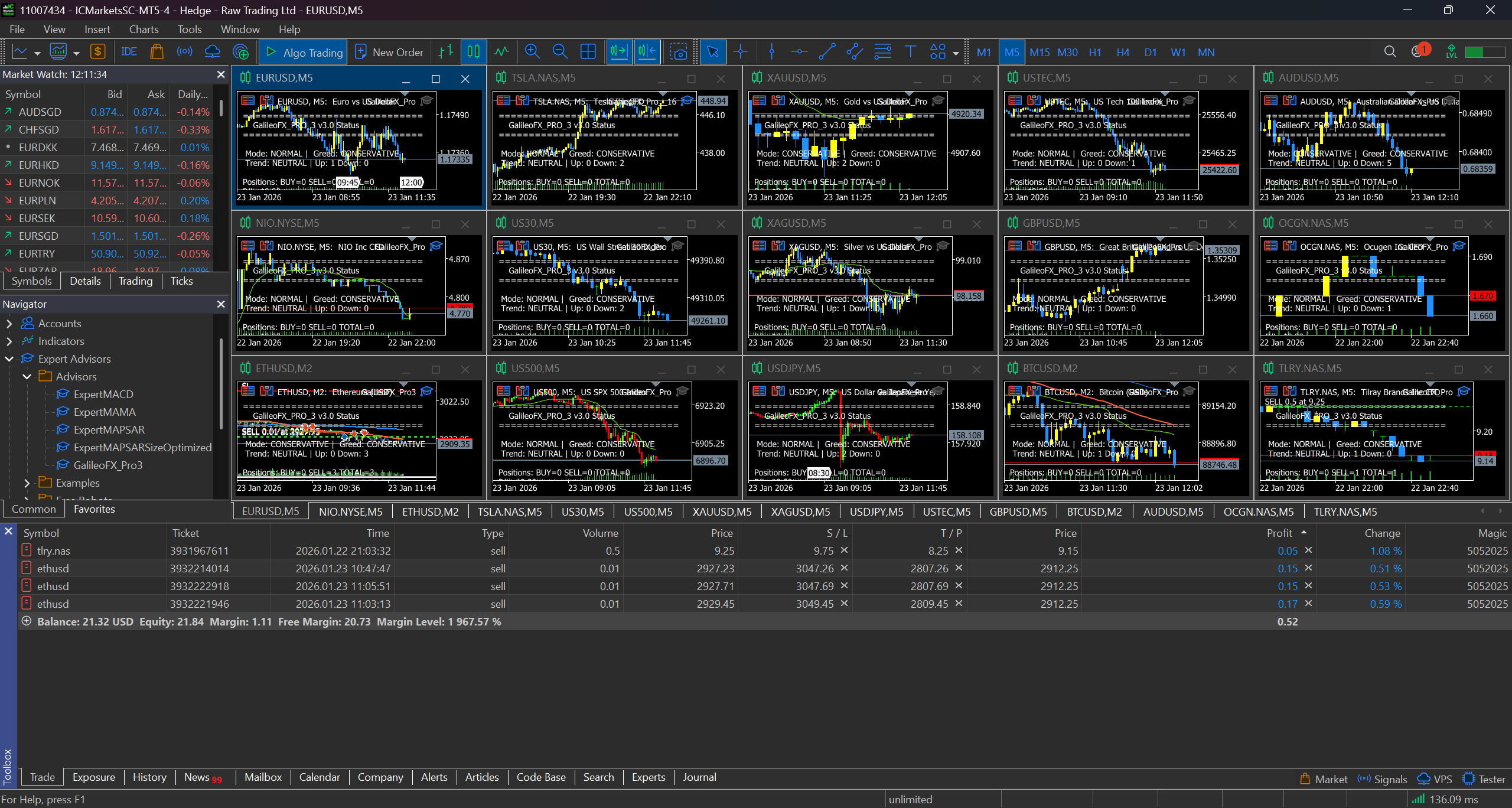

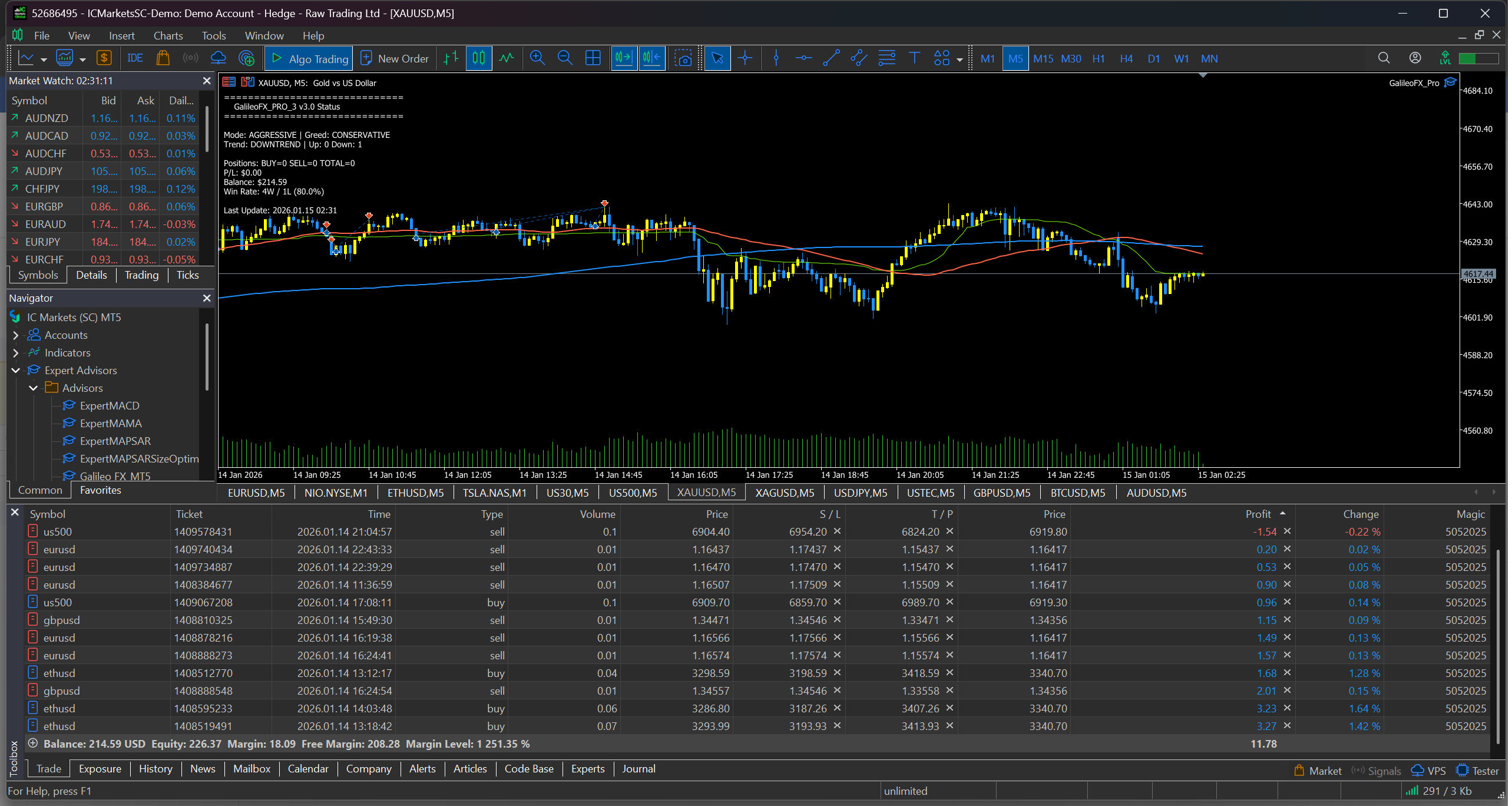

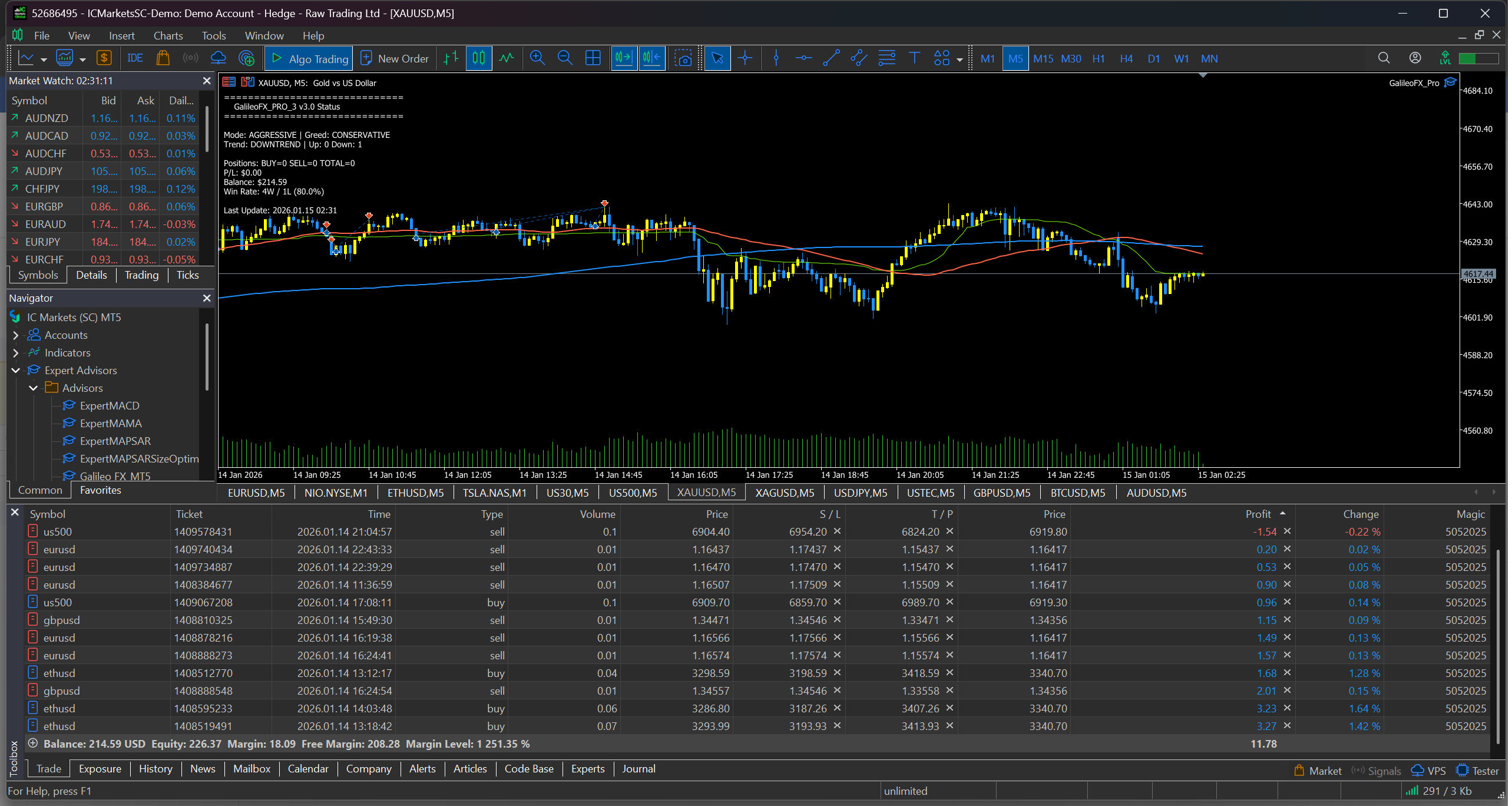

I'm m a Forex en stocks trader ho made this expert advisor Galileo Pro 3 whit hard work en a lot of time to test the best market on a real account not demo! This is made by a trader for traders

Florin Tudor

just let GalileoPro_3 on charts to scan the market don't allow trade to all charts a few days en he will know where to enter when you activate en allow him to trade on eney chart you have on your screen

Florin Tudor

поделился продуктом

my first work ,the bullish/bearish consecutive signals en volume filter+volume spike ,close all trades at x profit en enter in next trading day makes Galileo Pro verry powerful

GalileoFx Pro — это экспертный советник для MetaTrader 5 , который автоматизирует входы в рынок и управление позициями. Он использует настраиваемый набор фильтров и правил с целью дисциплинированного управления рисками и исполнением сделок. Кратко о возможностях: Торгует только в выбранные дни и часы. Использует управление рисками: фиксированный лот или процент риска на сделку, с ограничением количества открытых позиций. Устанавливает Take Profit и Stop Loss, с поддержкой трейлинг-стопа и

Florin Tudor

Galileo FX Pro_3 is an MT5 Expert Advisor designed for automated trading with layered risk controls, time filters, and adaptive behavior. Below is a clear, practical guide to using it and understanding its strongest functions.

How to use (quick start)

1) Install the EA in MetaTrader 5 and attach it to the chart/symbol you want to trade.

2) Enable Algo Trading/AutoTrading in MT5.

3) Open the Inputs tab and set your trading hours, risk, and protection features.

4) Test on a demo account first, then move to live only after you are satisfied.

Core usage settings (most important)

- MagicNumber: unique ID so the EA manages only its own trades.

- StartHour / EndHour + TradeMonday?TradeSunday: control when the EA is allowed to trade.

- RiskPercent or LotSize: use risk-based sizing (RiskPercent) or fixed lots (LotSize). If LotSize = 0, risk % is used.

- TakeProfit / StopLoss (pips): base target and protection for each trade.

- MaxOpenTrades: maximum simultaneous positions.

- MinSpread: avoid trading when spread is too high.

- Slippage: max allowed execution slippage.

Powerful functions (what makes it strong)

- Cooldown after losses: prevents revenge trading by pausing for a set number of bars.

- Trailing Stop: locks in profit after a defined pip gain.

- Breakeven Stop: automatically moves SL to entry after profit threshold.

- Auto-Close Profit (with trailing): closes all trades after reaching a target USD profit and can trail for extra gains.

- Safe Balance Mode: automatically reduces risk and max trades if balance drops below a threshold.

- Consecutive Bar Signals: uses streaks of bullish/bearish candles as exhaustion signals; can be applied to normal bars or synthetic tick-bars.

- Volume Filter: blocks trades when volume is too weak (tick or real volume).

- DOM (Order Book) Filter: confirms trades only if liquidity and order imbalance meet requirements (for ECN brokers).

- Sentiment + Adaptive Trading: tracks wins/losses, adjusts risk (aggressive vs conservative), and can adapt SL/TP based on performance.

- Signal Strength Mode: switches between GREEDY / MODERATE / CONSERVATIVE behavior based on signal strength.

Suggested setup flow

1) Choose trading hours and days.

2) Decide risk control: set RiskPercent or LotSize.

3) Set TP/SL and MaxOpenTrades.

4) Enable protections: Cooldown, Breakeven, Trailing, Auto-Close.

5) Add filters: MinSpread, Volume, DOM (if ECN), Consecutive Bars.

6) Optional: turn on Adaptive Trading for dynamic risk and performance-based adjustments.

“Powerful functions (what makes it strong)”:

Bullish/Bearish signal tiers (with volume confirmation):

Aggressive mode: triggers on 1–3 bullish/bearish signals, confirmed by the Volume Filter settings.

Moderate mode: triggers on 4–6 bullish/bearish signals, confirmed by the Volume Filter settings.

Notes

- Time settings can use broker time or local PC time via TimezoneOffset.

- Conservative settings help in volatile markets; aggressive settings may increase risk.

- Always validate settings with Strategy Tester before real trading.

How to use (quick start)

1) Install the EA in MetaTrader 5 and attach it to the chart/symbol you want to trade.

2) Enable Algo Trading/AutoTrading in MT5.

3) Open the Inputs tab and set your trading hours, risk, and protection features.

4) Test on a demo account first, then move to live only after you are satisfied.

Core usage settings (most important)

- MagicNumber: unique ID so the EA manages only its own trades.

- StartHour / EndHour + TradeMonday?TradeSunday: control when the EA is allowed to trade.

- RiskPercent or LotSize: use risk-based sizing (RiskPercent) or fixed lots (LotSize). If LotSize = 0, risk % is used.

- TakeProfit / StopLoss (pips): base target and protection for each trade.

- MaxOpenTrades: maximum simultaneous positions.

- MinSpread: avoid trading when spread is too high.

- Slippage: max allowed execution slippage.

Powerful functions (what makes it strong)

- Cooldown after losses: prevents revenge trading by pausing for a set number of bars.

- Trailing Stop: locks in profit after a defined pip gain.

- Breakeven Stop: automatically moves SL to entry after profit threshold.

- Auto-Close Profit (with trailing): closes all trades after reaching a target USD profit and can trail for extra gains.

- Safe Balance Mode: automatically reduces risk and max trades if balance drops below a threshold.

- Consecutive Bar Signals: uses streaks of bullish/bearish candles as exhaustion signals; can be applied to normal bars or synthetic tick-bars.

- Volume Filter: blocks trades when volume is too weak (tick or real volume).

- DOM (Order Book) Filter: confirms trades only if liquidity and order imbalance meet requirements (for ECN brokers).

- Sentiment + Adaptive Trading: tracks wins/losses, adjusts risk (aggressive vs conservative), and can adapt SL/TP based on performance.

- Signal Strength Mode: switches between GREEDY / MODERATE / CONSERVATIVE behavior based on signal strength.

Suggested setup flow

1) Choose trading hours and days.

2) Decide risk control: set RiskPercent or LotSize.

3) Set TP/SL and MaxOpenTrades.

4) Enable protections: Cooldown, Breakeven, Trailing, Auto-Close.

5) Add filters: MinSpread, Volume, DOM (if ECN), Consecutive Bars.

6) Optional: turn on Adaptive Trading for dynamic risk and performance-based adjustments.

“Powerful functions (what makes it strong)”:

Bullish/Bearish signal tiers (with volume confirmation):

Aggressive mode: triggers on 1–3 bullish/bearish signals, confirmed by the Volume Filter settings.

Moderate mode: triggers on 4–6 bullish/bearish signals, confirmed by the Volume Filter settings.

Notes

- Time settings can use broker time or local PC time via TimezoneOffset.

- Conservative settings help in volatile markets; aggressive settings may increase risk.

- Always validate settings with Strategy Tester before real trading.

: