Dominik Patrick Doser / Профиль

- Информация

|

2 года

опыт работы

|

3

продуктов

|

165

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

The Strong Trend Catcher is a powerful and reliable Expert Advisor that can help you to catch big market movements. This EA is based on the Breakout Trading method, which was popularized by the well-known Forex traders Raja Banks and Don Vo. The Breakout Trading method consists of waiting for the breakout of prices from a resistance or support area and then trading in the direction of the breakout. The Strong Trend Catcher uses a price action pattern to determine the

Disclaimer : Keep in mind that seasonal patterns are not always reliable. Therefore, thoughtful risk management is crucial to minimize losses. Seasonal patterns in the financial world are like a well-guarded secret that successful investors use to their advantage. These patterns are recurring price movements that occur during specific periods or around special events. Additionally, there are also intraday patterns that repeat. For example, Uncle Ted from Forex Family suggests examining

Disclaimer : Keep in mind that seasonal patterns are not always reliable. Therefore, thoughtful risk management is crucial to minimize losses. Seasonal patterns in the financial world are like a well-guarded secret that successful investors use to their advantage. These patterns are recurring price movements that occur during specific periods or around special events. Additionally, there are also intraday patterns that repeat. For example, Uncle Ted from Forex Family suggests examining

🚀 We're thrilled to introduce the latest update to Tactical Pip Hunter - the ultimate tool for savvy traders! Get ready for a trading experience like never before, with a host of new features.

📉 Dynamic Stop-Loss Adjustment: With this update, Tactical Pip Hunter now boasts the incredible ability to dynamically reduce the stop-loss distance by 1 point after every x ticks. What does this mean for you? Imagine a trade that lingers longer than expected; now, your risk diminishes progressively! Tactical Pip Hunter adapts to market conditions, giving you an edge like never before.

🛡️ Smart Risk Management: But that's not all! We've taken risk management to the next level. Tactical Pip Hunter now includes a balance threshold feature. This means the EA will smartly refrain from trading if your account balance drops below a set threshold. It's like having a guardian angel for your trading account, ensuring your hard-earned capital remains secure.

I've introduced a fresh set file for the Tactical Pip Hunter 1.1, available for your own testing. Feel free to reach out if you have any inquiries or feedback. Your support is greatly appreciated.

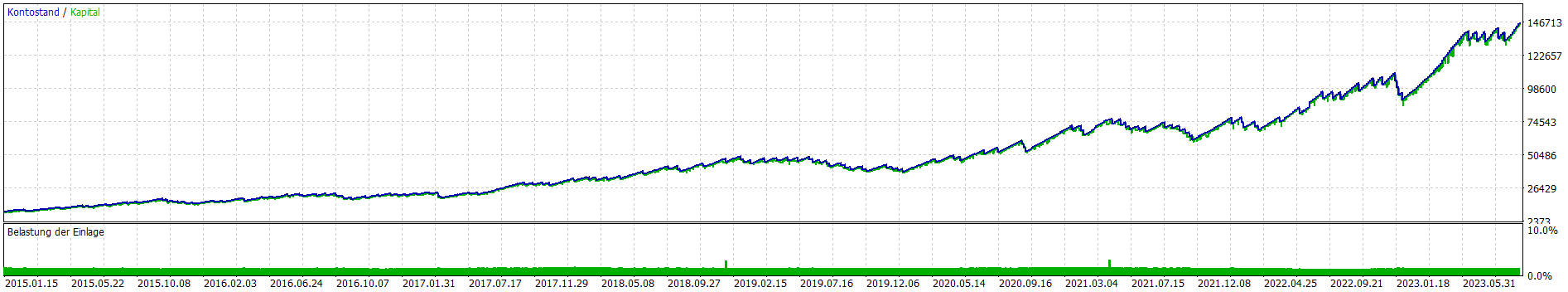

Displayed below is the backtest of EURUSD spanning from January 1, 2015, to September 20, 2023, using this set file.

🚀 We're thrilled to introduce the latest update to Tactical Pip Hunter - the ultimate tool for savvy traders! Get ready for a trading experience like never before, with a host of new features.

📉 Dynamic Stop-Loss Adjustment: With this update, Tactical Pip Hunter now boasts the incredible ability to dynamically reduce the stop-loss distance by 1 point after every x ticks. What does this mean for you? Imagine a trade that lingers longer than expected; now, your risk diminishes progressively! Tactical Pip Hunter adapts to market conditions, giving you an edge like never before.

🛡️ Smart Risk Management: But that's not all! We've taken risk management to the next level. Tactical Pip Hunter now includes a balance threshold feature. This means the EA will smartly refrain from trading if your account balance drops below a set threshold. It's like having a guardian angel for your trading account, ensuring your hard-earned capital remains secure.

The Strong Trend Catcher is a powerful and reliable Expert Advisor that can help you to catch big market movements. This EA is based on the Breakout Trading method, which was popularized by the well-known Forex traders Raja Banks and Don Vo. The Breakout Trading method consists of waiting for the breakout of prices from a resistance or support area and then trading in the direction of the breakout. The Strong Trend Catcher uses a price action pattern to determine the

A stop loss is a predetermined level of exit that limits the maximum loss per trade. It is one of the most important tools for risk management and capital preservation in trading. However, some traders may be tempted to trade without a stop loss, hoping that the market will eventually turn in their favor and erase their losses. This is a very risky and irresponsible way of trading that can lead to disastrous consequences.

Here are some reasons why you should always use a stop loss in trading:

A stop loss protects you from unexpected market movements and volatility. The market can be unpredictable and influenced by various factors, such as news events, economic data, political developments, etc. These factors can cause sudden and sharp price movements that can go against your position and result in huge losses.

A stop loss can prevent you from losing more than you can afford by closing your position automatically when the price reaches a certain level.

A stop loss helps you control your emotions and stick to your trading plan. Trading without a stop loss can make you emotionally attached to your position and reluctant to admit your mistake. You may hope that the market will reverse and give you a chance to break even or make a profit. However, this hope can turn into denial and desperation as the market continues to move against you and your losses accumulate.

A stop loss can help you avoid this psychological trap by forcing you to accept your loss and move on to the next opportunity.

A stop loss enables you to apply a proper risk-reward ratio and optimize your performance. Trading without a stop loss exposes you to unlimited risk for a limited reward. You may win some trades, but one big loss can wipe out all your profits and more. A stop loss allows you to define your risk and reward ratio before entering a trade, and adjust it according to your trading strategy and objectives. You can aim for a higher reward than your risk, which means that you can be profitable even if you lose more trades than you win.

Trading with a fixed stop loss is not a guarantee of success, but it is a sensible and prudent way of managing risk and protecting capital. Trading without a stop loss is like driving without a seat belt. You may get away with it for a while, but sooner or later you will crash and burn. Therefore, I advise you to always use a stop loss in your trading, with or without an EA, and never risk more than you can afford to lose.

Are you looking for a reliable and profitable trading robot that can adapt to different market conditions and trading styles? Do you want to trade with the price action signals without relying on lagging indicators? Do you want to manage the risk and reward ratio with dynamic take profit and stop loss levels? If you answered yes to any of these questions, then you might be interested in the Tactical Pip Hunter expert adviser.

Tactical Pip Hunter is a MT5 expert adviser that is based on price action trading, which is a method of technical trading that relies on observing price movements and patterns. It can capture trend phases as well as be used as a scalping tool. The settings allow both options. It can also adjust the take profit and stop loss levels dynamically according to the market conditions by using the average daily range (ADR).

The Tactical Pip Hunter does not use any martingale or grid systems, but always sets a stop loss. Therefore it has a huge advantage over other trading robots.

This MT5 expert adviser is based on price action trading , which is a method of technical trading that relies on observing price movements and patterns. It can capture trend phases as well as be used as a scalping tool. The settings allow both options. You can also adjust the take profit and stop loss levels dynamically according to the market conditions by using the average daily range (ADR) . However, you should always do your own backtests with your data and understand that profits are not