К сожалению "Eurusd Hidden Gap Trader" недоступен.

Вы можете ознакомиться с другими продуктами GEORGIOS VERGAKIS:

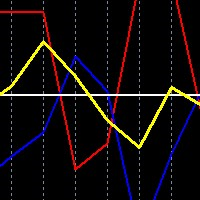

This is the original, simpler version of our core EURUSD algorithm (it calculates and displays 2 lines rather than 3), but it is still capable of detecting levels in the market where EURUSD will likely move to. These levels are indicated by unusual large gaps, formed by the two lines.

Detailed guidance is given to users. All in all it works on the very short term, and more importantly on the daily chart.

The differences between this and our top EURUSD indicator, is that this one only dis

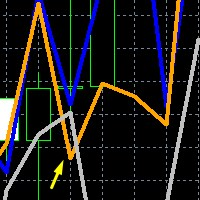

This is a simple free tool for simulating trades when trading both AUDUSD and NZDUSD in a hedge strategy, you can drop the indicator on either market chart. It is essential because you cannot tell at a glance, what a combined trade would be like, just by looking at the two individual charts separately.

New premium low cost indicator

How to use: Drop the indicator on either AUDUSD or NZDUSD chart, or any other chart, it will work.

You choose ploting period, to the number of days/weeks

FREE

Caution! This indicator is mainly for investors and medium term traders, Day-trading is not possible! This is because correlation is a medium to long term thing. Ideal use of this indicator is for currency Option sellers, where they can deploy sure fire profiable Option selling over few days to several weeks out. We provide further advice on this plus an optional hedge strategy idea and indicator on long time rentals*.

This indicator keeps performing very well, in all market conditions,

For the new traders of this strategy please remember the convention:

FORWARD trade = BUY AUDUSD and SELL NZDUSD at equal lot size

REVERSE trade = SELL AUDUSD and BUY NZDUSD at equal lot size

Risk is mittigated by the opposing nature of the trades, one tends to offset the other almost 70% of the time, and for when this is not the case we rely on the indicators accordingly - no stops are used in correlation hedge!

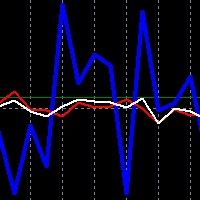

This is an enhanced oscillator like analysis of the relationship betw

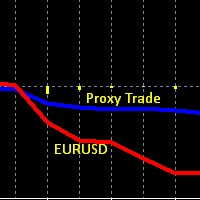

This is an obscure Hedge Fund like strategy, based one of our early indicators on EURUSD originally intended for day trading, while developing and testing the indicator we found out that the data used in this indicator (set of 4 currency pairs) follows EURUSD in a very peculiar way. On one hand these two are correlated, but the 4 currency proxy set tends to lag behind EURUSD, it lags on a day to day basis, and then catches up eventually after several days. And therefore can be used as a proxy

This powerful and insightful indicator is based on a leading version of the EURUSD proxy trade, such that the day's underlying direction can be inferred through the intraday volatility and market noise.

It can do daytrading, as well as monthly predictions!

Market price action is deceptive, misleading, no one has ever profitted consistently by just following latest price action. This also fools single market and momentum based indicators, since the main data used is market price.

Intermar

Development of this indicator goes back several years, we have successfully used this latest algorithm since 2019, and it generally works well enough to be profitable. It was originally attempted to make it work on the daily chart, but as you will see in practice it doesn't work so well on the daily chart, while it works extremely well on the weekly chart, for the period setting between 0 and 2, (0 is the latest running week candle, 1 is the latest candle plus the previous one, 2 weeks combine