Mirza Baig / 프로필

- 정보

|

12+ 년도

경험

|

0

제품

|

0

데몬 버전

|

|

0

작업

|

0

거래 신호

|

0

구독자

|

::: You must expect to be stung by bees when in search of honey :::

::: He who is not courageous enough to take risks will accomplish nothing in life :::

::: He who is not courageous enough to take risks will accomplish nothing in life :::

Mirza Baig

Sergey Golubev

주제에 코멘트하기 Press review

Credit Agricole with Week Ahead: Relative Value Trades With Degrees of Separation From The Brexit Trade (adapted from the article ) Credit Agricole was analysiing the Brexit situation onto the forex

소셜 네트워크에 공유 · 1

Mirza Baig

Sergey Golubev

주제에 코멘트하기 Press review

Weekly Outlook: 2016, July 10 - July 17 (based on the article ) Rate decision in the UK and Canada, Employment data in the US and in Australia, US Producer Prices, Inflation data, Retail sales

소셜 네트워크에 공유 · 1

Mirza Baig

Sergey Golubev

주제에 코멘트하기 Press review

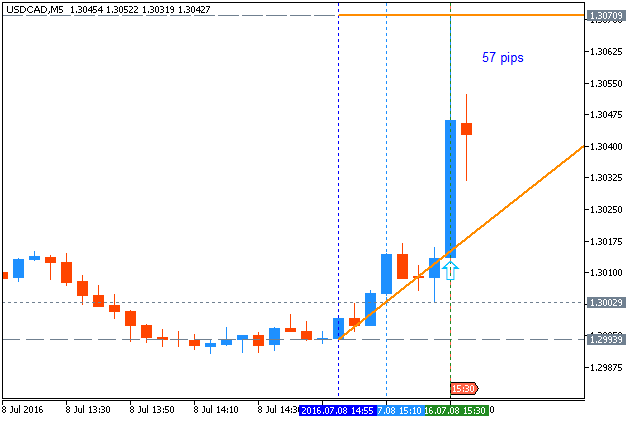

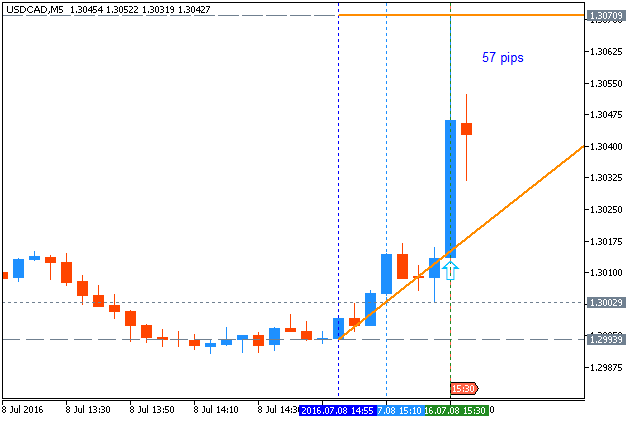

USD/CAD Intra-Day Fundamentals: Canada's Employment Change and 57 pips price movement 2016-07-08 12:30 GMT | [CAD - Employment Change] past data is 13.8K, forecast data is 6.5K, actual data is -0.7K

소셜 네트워크에 공유 · 1

Mirza Baig

Sergey Golubev

주제에 코멘트하기 Press review

EUR/USD Intra-Day Fundamentals: Non-Farm Payrolls and 66 pips price movement 2016-07-08 12:30 GMT | [USD - Non-Farm Employment Change] past data is 11K, forecast data is 180K, actual data is 287K

소셜 네트워크에 공유 · 1

Mirza Baig

Sergey Golubev

주제에 코멘트하기 Press review

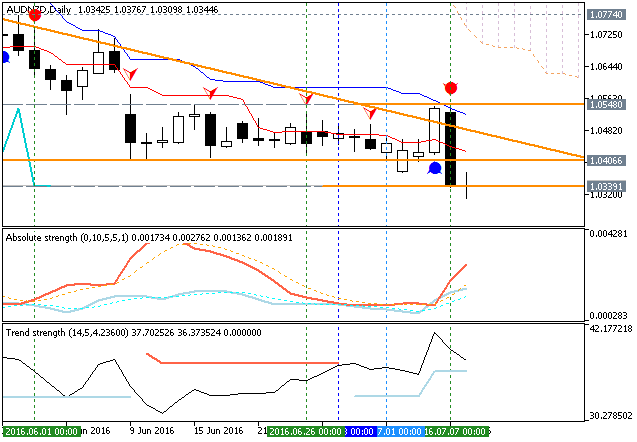

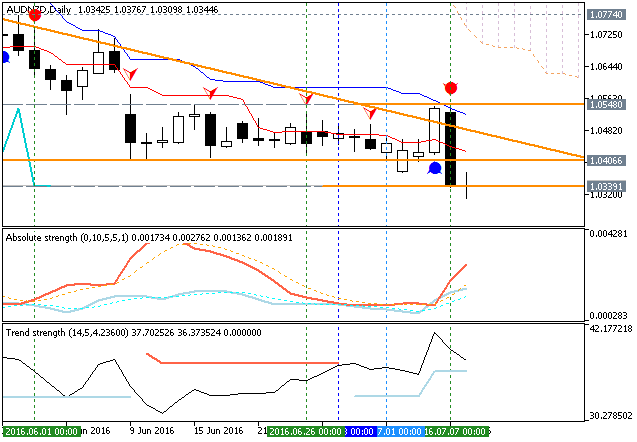

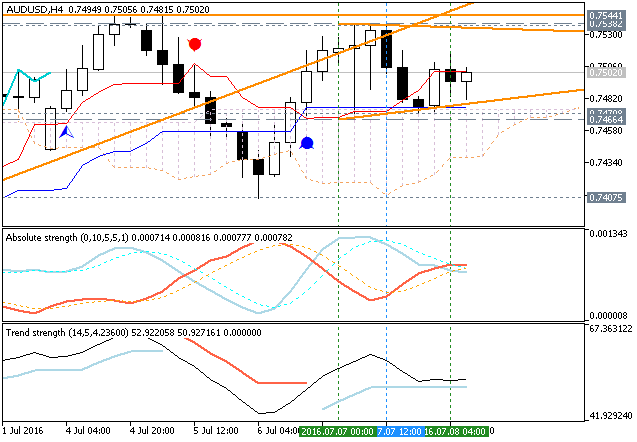

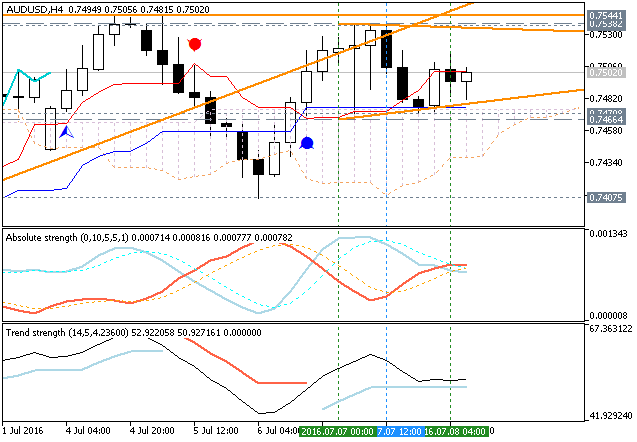

Technical Targets for AUD/USD by United Overseas Bank (based on the article ) H4 price is on ranging to be above Ichimoku cloud in the bullish area of the chart. The price is located within the

소셜 네트워크에 공유 · 1

Mirza Baig

Sergey Golubev

주제에 코멘트하기 Press review

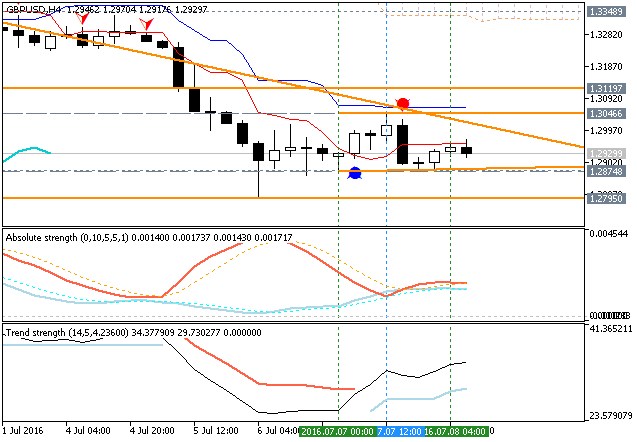

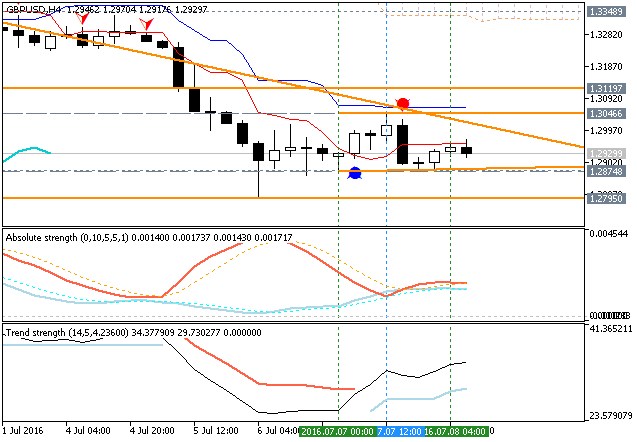

Technical Targets for GBP/USD by United Overseas Bank (based on the article ) H4 price is located below Ichimoku cloud for the bearish ranging within narrow support/resistance levels: 1.3119

소셜 네트워크에 공유 · 1

Mirza Baig

Sergey Golubev

주제에 코멘트하기 Press review

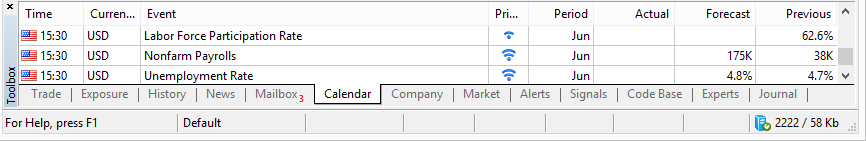

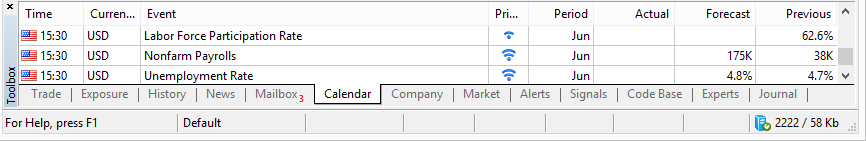

Trading News Events: U.S. Non-Farm Payrolls by Barclays, TD, Goldman (adapted from the article ) Barclays : "For the June US employment report, we expect nonfarm payrolls to rise by 175k , private

Mirza Baig

Sergey Golubev

주제에 코멘트하기 Press review

Trading platform market share war hots up as MetaTrader 5 goes viral in Asia Indeed, in Western markets, exchange traded derivatives are often reserved for the highly capitalized global electronic

소셜 네트워크에 공유 · 1

Mirza Baig

Sergey Golubev

주제에 코멘트하기 Press review

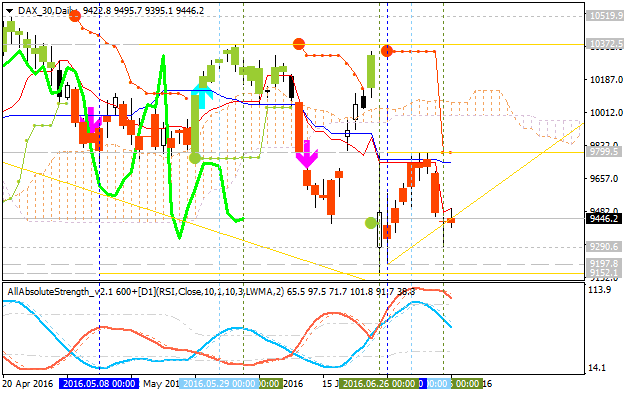

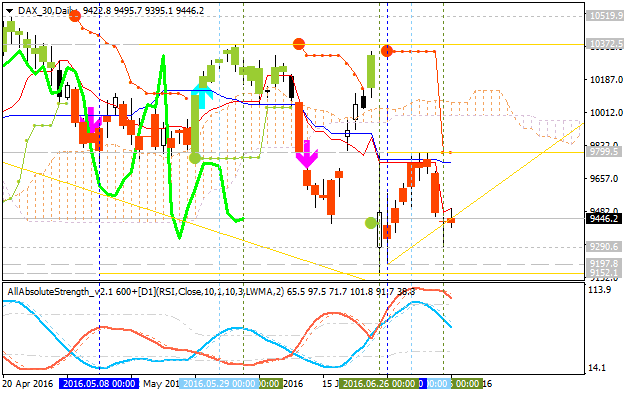

DAX Index Technical Analysis: bearish ranging within key narrow levels (adapted from the article ) Daily price is located below Ichimoku cloud on the bearish area of the chart for the ranging within

소셜 네트워크에 공유 · 1

Mirza Baig

Sergey Golubev

주제에 코멘트하기 Forecast for Q3'16 - levels for US Dollar Index

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.07.09 13:46 Fundamental Weekly Forecasts for Dollar Index, GBP/USD, USD/JPY, AUD/USD

소셜 네트워크에 공유 · 1

Mirza Baig

Sergey Golubev

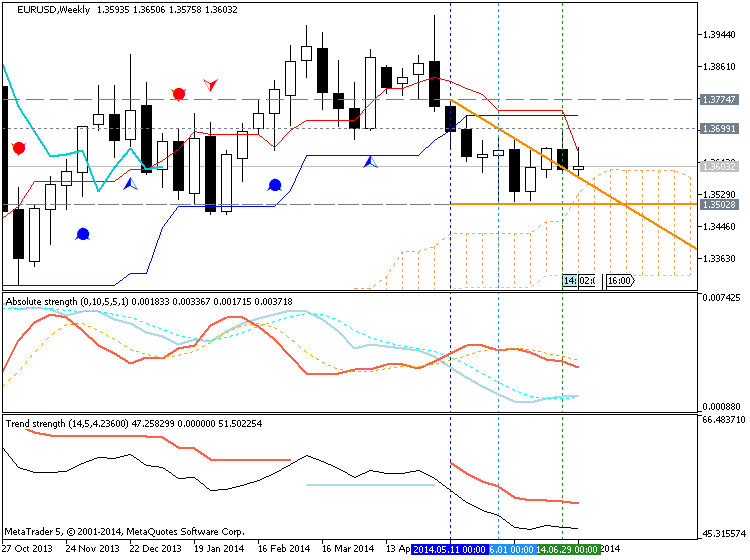

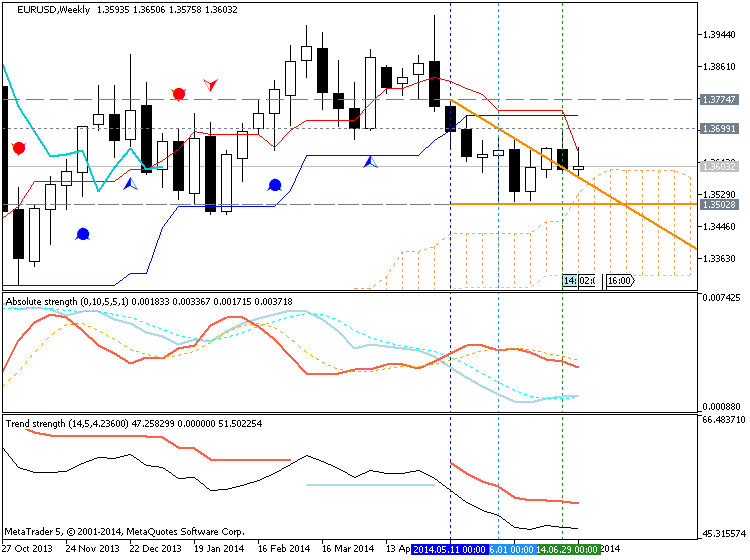

EURUSD Technical Analysis 2014, 13.07 - 20.07: Ranging Bearish

D1 price is ranging between 1.3699 resistance and 1.3575 support levels within primary bearish market condition. H4 price is on flat within primary bearish; Chinkou Span line of Ichimoku indicator is very near to be crossed with historical price for

소셜 네트워크에 공유 · 1

Mirza Baig

Sergey Golubev

The EUR/USD pair tried to rally during the course of the week, but as you can see gave back quite a bit of the gains in order to form a shooting star. Nonetheless, the market seems to be stuck between the 1.35 level as support, and the 1.37 level as resistance...

1

Mirza Baig

Sergey Golubev

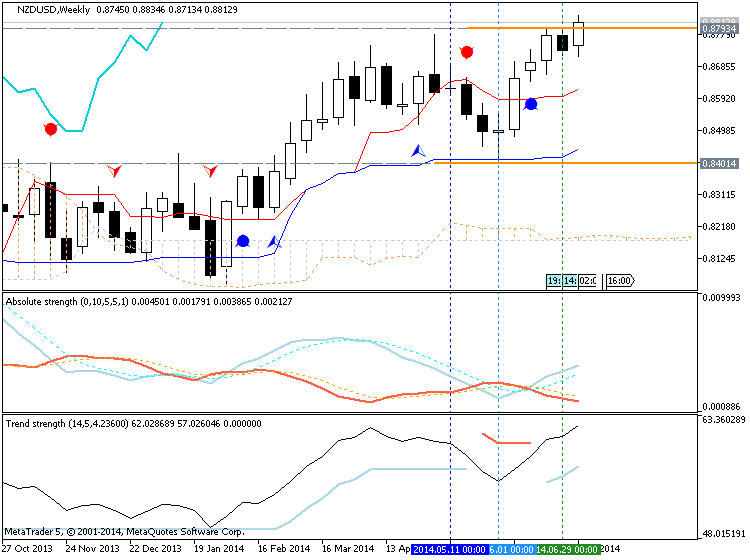

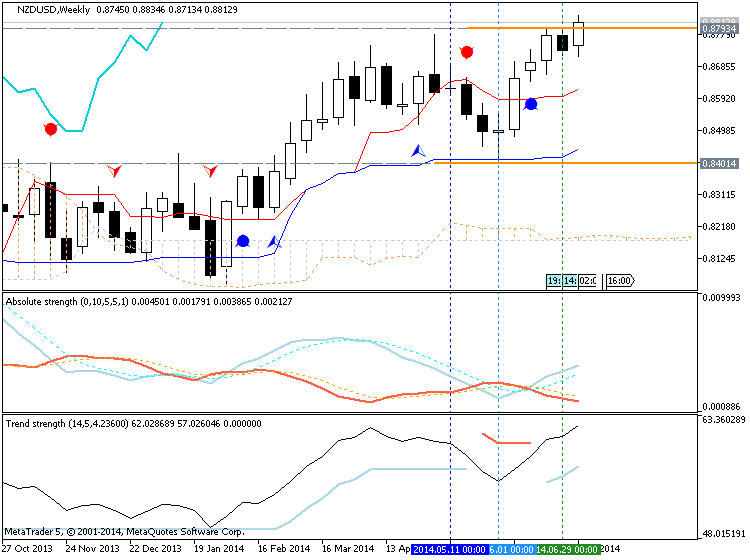

NZDUSD Technical Analysis 2014, 13.07 - 20.07: Bullish

D1 price is on primary bullish stopped by 0.8834 resistance level. H4 price is on flat with ranging between 0.8793 support and 0.8832 resistance with primary bullish. W1 price is on primary bullish crossing 0.8793 resistance level on open bar for

소셜 네트워크에 공유 · 1

: