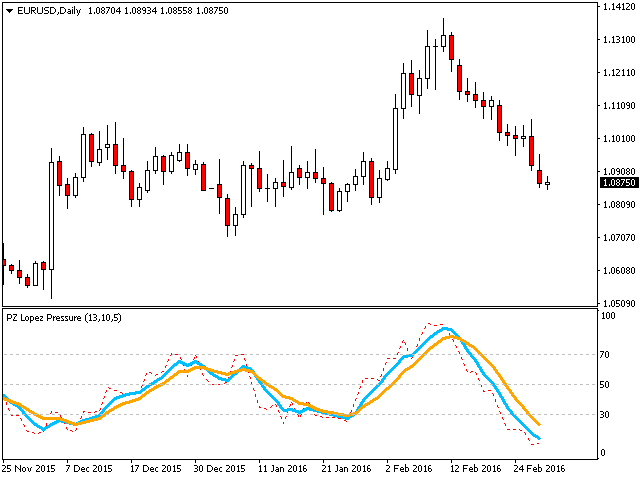

PZ Lopez Pressure

- 지표

- PZ TRADING SLU

- 버전: 1.2

- 업데이트됨: 9 8월 2019

- 활성화: 20

Your swiss army knife to ancipate price reversals

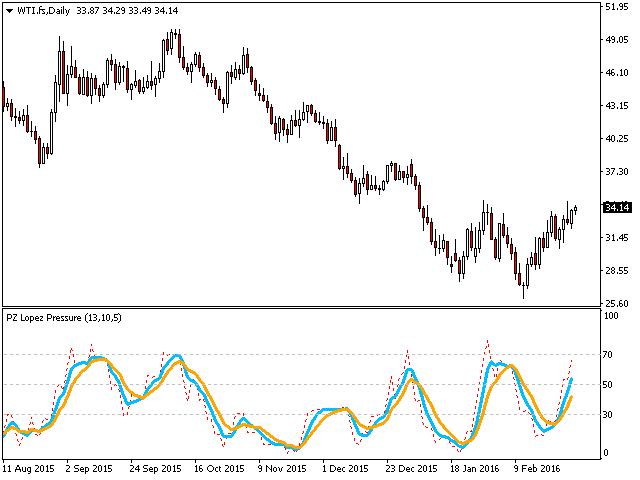

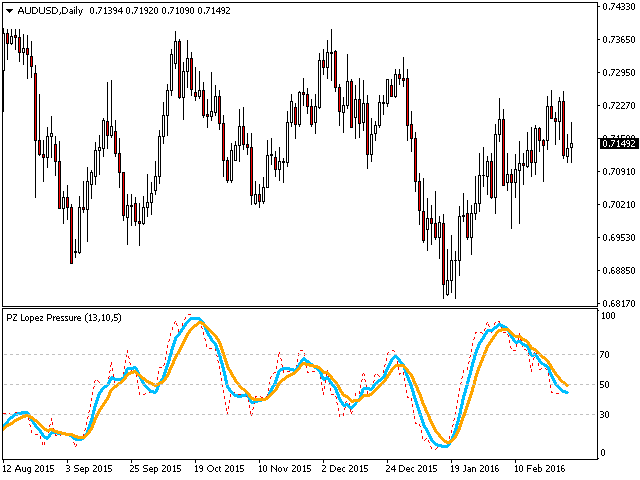

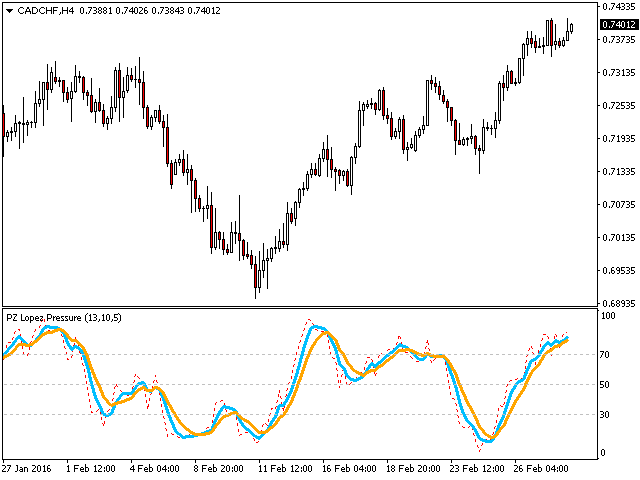

This indicator anticipates price reversals analyzing bullish and bearish pressure in the market. The buying pressure is the sum of all the accumulation bars over a certain number of days, multiplied by the volume. The selling pressure is the sum of all of the distribution over the same number of bars, multiplied by the volume. It gives you a measure of the buying pressure as a percentage of the total activity, which value should fluctuate from 0 to 100. It implements two moving averages, fast and slow, to identify changes in pressure trends and look for trades accordingly.

[ Installation Guide | Update Guide | Troubleshooting | FAQ | All Products ]

- A ratio of 50 means the market is balanced

- A ratio over 70 means the market is overbought

- A ratio below 30 means the market is oversold

- The red dotted line is the current ratio

- The blue line is the signal line

- The orange line is the main line

It has straightforward trading implications.

- Look for buying opportunities when the market is oversold

- Look for selling opportunities when the market is overbought

- If the signal line is above the main line the pressure is bullish

- If the signal line is below the main line the pressure is bearish

Input Parameters

- Period: Number of bars studied to calculate the pressure

- Fast MA: Fast averaging period for the histogram

- Slow MA: Slow averaging period for the histogram

Author

Arturo López Pérez, private investor and speculator, software engineer and founder of Point Zero Trading Solutions.