Hi, everyone. Below are my early thoughts on how to integrate trading for Bitcoin into my newest advisor "Gold Chaser".

Bitcoin is not easy. Nor it is like other symbols. It seems like Bitcoin was nothing before 2013. It started growing exponentially about 10 years ago from nothing to something everyone desperately needed.

As there is no reliable history, I suggest to myself I should better turn to the 8-hour chart. Thus, I will still have 2 options. First, waiting for a big move up or down like it was in 2013, and then later in 2020, and then again in 2021 to the highest peak of 65K in Autumn of 2021. And then a huge fall to below 25K in 2022. And second, I can still trade in seemingly ever-lasting flat channels, like those in the second half of 2022 and then several times in 2023.

It will be a different approach, overall. It will be different from anything. Previously, I thought Gold was different from the major symbols. Gold pushes huge swaying moves. A Gold move feels like a trend almost every day. But Bitcoin is different from Gold, which is different from the major symbols.

I am going to do a million tests (as usual) for Bitcoin in the 8-hour chart to check if it is a good approach. My best hope I will be able to integrate this symbol to the advisor "Gold Chaser" in December, and it will work as one solid and even more reliable strategy.

It's cool that Oil and Bitcoin have been added. I tried to test them yesterday, but encountered some difficulties. After some manipulation, it became clear that the problem was with the BTCUSD pair. When I changed the 'name for bitcoin' parameter to '___', the tests proceeded. All this was on the Roboforex broker.

Recently, Roboforex decided to discontinue service for the BTCUSD instrument, and from December, opening a trade is technically not possible. I decided to look for other brokers. Flipped through about 10 of them))) slightly less.

The BTC test worked somewhat with brokers FxPro and FXTM...

But even there, in a very narrow range of the years 2022-2023.

I want to separate trading for each instrument into different accounts so that a failure on one pair does not collapse trading on the others. Accordingly, I want to determine the optimal parameters for %-volume for each pair. For this, I'm trying to go through each year (2013-2024) separately for each pair with a different % parameter in the tester.

Can you recommend a broker with a broader range of years for BTC testing? )))

And another question has arisen recently:

- Neural networks can have such an artifact as overfitting. In this case, going beyond the boundaries of a new time period that the network has not yet been trained on can result in a significant distortion of expectations.

It's cool that Oil and Bitcoin have been added. I tried to test them yesterday, but encountered some difficulties. After some manipulation, it became clear that the problem was with the BTCUSD pair. When I changed the 'name for bitcoin' parameter to '___', the tests proceeded. All this was on the Roboforex broker.

Recently, Roboforex decided to discontinue service for the BTCUSD instrument, and from December, opening a trade is technically not possible. I decided to look for other brokers. Flipped through about 10 of them))) slightly less.

The BTC test worked somewhat with brokers FxPro and FXTM...

But even there, in a very narrow range of the years 2022-2023.

I want to separate trading for each instrument into different accounts so that a failure on one pair does not collapse trading on the others. Accordingly, I want to determine the optimal parameters for %-volume for each pair. For this, I'm trying to go through each year (2013-2024) separately for each pair with a different % parameter in the tester.

Can you recommend a broker with a broader range of years for BTC testing? )))

And another question has arisen recently:

- Neural networks can have such an artifact as overfitting. In this case, going beyond the boundaries of a new time period that the network has not yet been trained on can result in a significant distortion of expectations.

P.S. Thanks for the Christmas discount!!!

Gold and Silver have history beyond 2016. Oil and cryptos don't have a solid history beyond 2016. Robo works for bitcoins and other cryptos, I have trades. ICMarket is also great.

Overfitting is a problem. I keep loss 0.17-0.16 for training, validation and test. Test is not part of the learning process, so anything that keeps the low loss in the test should be good. This is my newest approach.

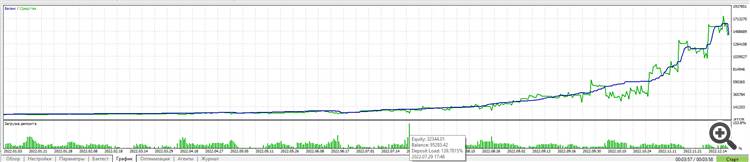

These are test statistics for trading at only two pairs(XAGUSD + BRENT). The cut-off is strictly a year. Deposit at the beginning of the cycle - $7500

Years earlier, it had one stopout at year, but even there got managed to multiply the deposit by 25-140 times 8))

Min volume for Oil is 0.5?

It should be 0.01 for 1000 USD or 0.05 for 5000 USD of deposit.

Exclude Oil if you cannot accept its risk.

1.68 million from 7500 in one year is not what you should expect from Forex. I am currently fighting for a profit 10 times the deposit in one year. It should go with an acceptable risk.

It should be 0.01 for 1000 USD or 0.05 for 5000 USD of deposit.

Exclude Oil if you cannot accept its risk.

1.68 million from 7500 in one year is not what you should expect from Forex. I am currently fighting for a profit 10 times the deposit in one year. It should go with an acceptable risk.

At the ICMarkets broker with its leverage of 1:30, the test result with the same parameters and starting at $7,500 at the beginning of 2022, by the end of the year the balance was $32,505 versus $1,680,891 for Roboforex with a leverage of 1:1000

At the ICMarkets broker with its leverage of 1:30, the test result with the same parameters and starting at $7,500 at the beginning of 2022, by the end of the year the balance was $32,505 versus $1,680,891 for Roboforex with a leverage of 1:1000

The 4 symbols Oil, Bitcoin, Gold and Silver have different inputs. I am trying to understand. This new approach is: because there is very little history, do not rely on history. In a million tests I have done, the worse it is in the history, the better it is in the unknown period of the future. It is not the last version. I am more doing tests.

So this is it. Gold has broken it. For the first time in history, Gold is exploring the price of over 2100 USD. We are living it, and we should be proud about it? Happy about it? Or worried about it?

The good thing to know is it can't grow endlessly. It must fall. There is no level that is higher than 2100. So no target value to reach and to roll back. It can roll back any day. Any time. Can it roll back today?

The bad thing, or the bad consequence is evident. No one expected it to grow that high. It just broke all indicators. It has made us incur losses and suffer the pain of frustration. It is not fair! Go back, you brick of bright shiny gold! Go back now!

My two advisors - Gold Chaser and Neural Rabbit - both trade Gold. Their neural model for Gold is identical, and it could not foresee the trend beyond 2100 because it has never happened in the history on which it was trained. Clearly, I will have to retrain the model. To avoid that kind of miscalculation in the future, I am going to try the following ways:

1) Extend the training period.

2) Drop the trade-off between a good historical chart and a good performance on the unseen future data. What this means, is I tried with these 2 advisors to accomodate the 2 approaches. I wanted to please those traders who want to be sure it can pass the history well. And I tried to find such values of neural loss which would allow the strategy make correct trading decisions on the unseen future data. That is why it broke. No more trade-offs! Trade-offs don't work! Or else they work until the market spirals out of control.

3) My latest approach is to leave out 75% of training data to avoid repetitions in the training dataset and make it less addicted to such repetitions. The following validation includes a 100% of the dataset, so I can always make sure it is a valid neural model.

We do not succumb to the frustration wrought by the power of the unwinding market! We adapt and we become stronger! Profit will be ours!

What's up, guys. It looks like I have found a better neural model which would have been able to handle the Gold breaking the lifelong upper limit this month.

What it requires is to drop the trade-off between a good historical chart and a real performance on the unseen future data. If I try to find this trade-off, it turns out it is too risky. And it can hardly handle unpredictable price moves like the Gold move this month.

Below are 2 pictures from the other advisor QuantumPip, which I consider my best system so far.

2 pictures are better than 2 thousand words, so here we go.

The new training will be in the next update of Gold Chaser within a few days.

Hi, everyone! I am going to update Gold Chaser now according to my newest approach. I have decided to update everything I have, starting with QuantumPip.

The new approach uses days and does not use weeks and months to analyze the market. So it should react much quicker to the changing environment. And help avoid long-running drawdowns. And of course it should trade more actively.

It has been mostly buy positions for Gold for many weeks. I guess it will (because it should) change with the new update this week.

here is a set file that works for me, because on many brokers xagusd is 5000oz and it can create hefty drawdown (the brokers with 1000oz xagusd cannot cover xbrusd, so just xauusd, xagusd, and btcusd for these brokers) . These pairs do not revert to the mean that easily so more signals per pair complicates things, as the different pairs can cover each other to reach higher profit target using 1 signal (that is, the bot will swatch it off on a reverse signal). So, the author or anyone else please test this setfile on their broker and give me any opinion as to its performance ... thanks

p.s. (to the author) please an advice on lot sizing, i.e. what percent would it be most suitable

Miko #: here is a set file that works for me, because on many brokers xagusd is 5000oz and it can create hefty drawdown (the brokers with 1000oz xagusd cannot cover xbrusd, so just xauusd, xagusd, and btcusd for these brokers) . These pairs do not revert to the mean that easily so more signals per pair complicates things, as the different pairs can cover each other to reach higher profit target using 1 signal (that is, the bot will swatch it off on a reverse signal). So, the author or anyone else please test this setfile on their broker and give me any opinion as to its performance ... thanks

The issue arises from the different margin bases. So it calculates a profit differently for Volume=0.01. Below is my solution (did not test Oil).

just a short note: most brokers use xag on 5000oz, xbr/xti on 0.01, us30/500 on 0.01... that is why I need oil in order to balance xag with 5000oz...as opposed to icmarkets (uses 1000oz xag, us30/500 0.1 (instead of 0.01) xbr on 0.05 (instead of 0.01))...

just a short note: most brokers use xag on 5000oz, xbr/xti on 0.01, us30/500 on 0.01... that is why I need oil in order to balance xag with 5000oz...as opposed to icmarkets (uses 1000oz xag, us30/500 0.1 (instead of 0.01) xbr on 0.05 (instead of 0.01))...

correction: on us30/500, there are different variations , some use 0.01, some 0.05, some 0.1 start lot...

Hi, everyone. Below are my early thoughts on how to integrate trading for Bitcoin into my newest advisor "Gold Chaser".

Bitcoin is not easy. Nor it is like other symbols. It seems like Bitcoin was nothing before 2013. It started growing exponentially about 10 years ago from nothing to something everyone desperately needed.

As there is no reliable history, I suggest to myself I should better turn to the 8-hour chart. Thus, I will still have 2 options. First, waiting for a big move up or down like it was in 2013, and then later in 2020, and then again in 2021 to the highest peak of 65K in Autumn of 2021. And then a huge fall to below 25K in 2022. And second, I can still trade in seemingly ever-lasting flat channels, like those in the second half of 2022 and then several times in 2023.

It will be a different approach, overall. It will be different from anything. Previously, I thought Gold was different from the major symbols. Gold pushes huge swaying moves. A Gold move feels like a trend almost every day. But Bitcoin is different from Gold, which is different from the major symbols.

I am going to do a million tests (as usual) for Bitcoin in the 8-hour chart to check if it is a good approach. My best hope I will be able to integrate this symbol to the advisor "Gold Chaser" in December, and it will work as one solid and even more reliable strategy.

P.S. Thanks for the Christmas discount!!!

P.S. Thanks for the Christmas discount!!!

Gold and Silver have history beyond 2016. Oil and cryptos don't have a solid history beyond 2016. Robo works for bitcoins and other cryptos, I have trades. ICMarket is also great.

Overfitting is a problem. I keep loss 0.17-0.16 for training, validation and test. Test is not part of the learning process, so anything that keeps the low loss in the test should be good. This is my newest approach.

These are test statistics for trading at only two pairs(XAGUSD + BRENT).

The cut-off is strictly a year.

Deposit at the beginning of the cycle - $7500

Years earlier, it had one stopout at year, but even there got managed to multiply the deposit by 25-140 times 8))

These are test statistics for trading at only two pairs(XAGUSD + BRENT).

The cut-off is strictly a year.

Deposit at the beginning of the cycle - $7500

Years earlier, it had one stopout at year, but even there got managed to multiply the deposit by 25-140 times 8))

Min volume for Oil is 0.5?

It should be 0.01 for 1000 USD or 0.05 for 5000 USD of deposit.

Exclude Oil if you cannot accept its risk.

1.68 million from 7500 in one year is not what you should expect from Forex. I am currently fighting for a profit 10 times the deposit in one year. It should go with an acceptable risk.

Min volume for Oil is 0.5?

It should be 0.01 for 1000 USD or 0.05 for 5000 USD of deposit.

Exclude Oil if you cannot accept its risk.

1.68 million from 7500 in one year is not what you should expect from Forex. I am currently fighting for a profit 10 times the deposit in one year. It should go with an acceptable risk.

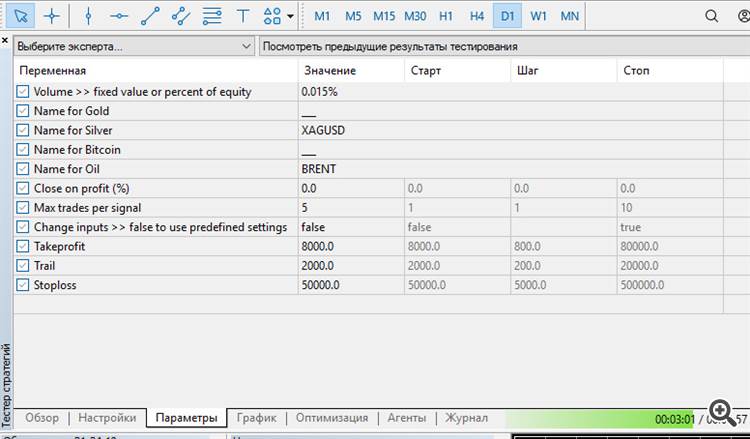

Leverage is - 1:1000

Volume is - 0.015%

first minimal lot at 7500$ and 0,015% on OIL is 0.11 (in my test trade history)

Link at trade history: https://docs.google.com/spreadsheets/d/1dj8A_jECwAVu1COI039I4lq2aLvJsKaBJZFZmWBmZQY/

Leverage is - 1:1000

Volume is - 0.015%

first minimal lot at 7500$ and 0,015% on OIL is 0.11 (in my test trade history)

Link at trade history: https://docs.google.com/spreadsheets/d/1dj8A_jECwAVu1COI039I4lq2aLvJsKaBJZFZmWBmZQY/

I should add.

At the ICMarkets broker with its leverage of 1:30, the test result with the same parameters and starting at $7,500 at the beginning of 2022, by the end of the year the balance was $32,505 versus $1,680,891 for Roboforex with a leverage of 1:1000

I should add.

At the ICMarkets broker with its leverage of 1:30, the test result with the same parameters and starting at $7,500 at the beginning of 2022, by the end of the year the balance was $32,505 versus $1,680,891 for Roboforex with a leverage of 1:1000

Just now purchased and testing in Demo Account, after checking a month i will post my review with full proof

Thank You

So this is it. Gold has broken it. For the first time in history, Gold is exploring the price of over 2100 USD. We are living it, and we should be proud about it? Happy about it? Or worried about it?

The good thing to know is it can't grow endlessly. It must fall. There is no level that is higher than 2100. So no target value to reach and to roll back. It can roll back any day. Any time. Can it roll back today?

The bad thing, or the bad consequence is evident. No one expected it to grow that high. It just broke all indicators. It has made us incur losses and suffer the pain of frustration. It is not fair! Go back, you brick of bright shiny gold! Go back now!

My two advisors - Gold Chaser and Neural Rabbit - both trade Gold. Their neural model for Gold is identical, and it could not foresee the trend beyond 2100 because it has never happened in the history on which it was trained. Clearly, I will have to retrain the model. To avoid that kind of miscalculation in the future, I am going to try the following ways:

1) Extend the training period.

2) Drop the trade-off between a good historical chart and a good performance on the unseen future data. What this means, is I tried with these 2 advisors to accomodate the 2 approaches. I wanted to please those traders who want to be sure it can pass the history well. And I tried to find such values of neural loss which would allow the strategy make correct trading decisions on the unseen future data. That is why it broke. No more trade-offs! Trade-offs don't work! Or else they work until the market spirals out of control.

3) My latest approach is to leave out 75% of training data to avoid repetitions in the training dataset and make it less addicted to such repetitions. The following validation includes a 100% of the dataset, so I can always make sure it is a valid neural model.

We do not succumb to the frustration wrought by the power of the unwinding market! We adapt and we become stronger! Profit will be ours!

What's up, guys. It looks like I have found a better neural model which would have been able to handle the Gold breaking the lifelong upper limit this month.

What it requires is to drop the trade-off between a good historical chart and a real performance on the unseen future data. If I try to find this trade-off, it turns out it is too risky. And it can hardly handle unpredictable price moves like the Gold move this month.

Below are 2 pictures from the other advisor QuantumPip, which I consider my best system so far.

2 pictures are better than 2 thousand words, so here we go.

The new training will be in the next update of Gold Chaser within a few days.

>>>>> >>> >>>>>

Hi, everyone! I am going to update Gold Chaser now according to my newest approach. I have decided to update everything I have, starting with QuantumPip.

The new approach uses days and does not use weeks and months to analyze the market. So it should react much quicker to the changing environment. And help avoid long-running drawdowns. And of course it should trade more actively.

It has been mostly buy positions for Gold for many weeks. I guess it will (because it should) change with the new update this week.

here is a set file that works for me, because on many brokers xagusd is 5000oz and it can create hefty drawdown (the brokers with 1000oz xagusd cannot cover xbrusd, so just xauusd, xagusd, and btcusd for these brokers) . These pairs do not revert to the mean that easily so more signals per pair complicates things, as the different pairs can cover each other to reach higher profit target using 1 signal (that is, the bot will swatch it off on a reverse signal). So, the author or anyone else please test this setfile on their broker and give me any opinion as to its performance ... thanks

p.s. (to the author) please an advice on lot sizing, i.e. what percent would it be most suitable

here is a set file that works for me, because on many brokers xagusd is 5000oz and it can create hefty drawdown (the brokers with 1000oz xagusd cannot cover xbrusd, so just xauusd, xagusd, and btcusd for these brokers) . These pairs do not revert to the mean that easily so more signals per pair complicates things, as the different pairs can cover each other to reach higher profit target using 1 signal (that is, the bot will swatch it off on a reverse signal). So, the author or anyone else please test this setfile on their broker and give me any opinion as to its performance ... thanks

The issue arises from the different margin bases. So it calculates a profit differently for Volume=0.01. Below is my solution (did not test Oil).

For a deposit 5000 USD on ICMarkets:

BTCUSD Daily chartXAUUSD Daily chart

name_gold=XAUUSD

name_silver=XAGUSD

name_bitcoin=None

name_oil=None

volume=0.05

magic=12345

name_gold=None

name_silver=None

name_bitcoin=BTCUSD

name_oil=None

volume=0.01

magic=54321

I see an update... Like te improvements, but, can you please also leave an option for oil. Thanks

Alright, I will bring it back in the next update.

Alright, I will bring it back in the next update.

just a short note: most brokers use xag on 5000oz, xbr/xti on 0.01, us30/500 on 0.01... that is why I need oil in order to balance xag with 5000oz...as opposed to icmarkets (uses 1000oz xag, us30/500 0.1 (instead of 0.01) xbr on 0.05 (instead of 0.01))...

just a short note: most brokers use xag on 5000oz, xbr/xti on 0.01, us30/500 on 0.01... that is why I need oil in order to balance xag with 5000oz...as opposed to icmarkets (uses 1000oz xag, us30/500 0.1 (instead of 0.01) xbr on 0.05 (instead of 0.01))...

correction: on us30/500, there are different variations , some use 0.01, some 0.05, some 0.1 start lot...

correction: on us30/500, there are different variations , some use 0.01, some 0.05, some 0.1 start lot...

You can start the EA with different options on several charts, too.