Audusd Nzdusd Correlation Hedge Strategy 2

- 지표

- GEORGIOS VERGAKIS

- 버전: 1.0

- 활성화: 5

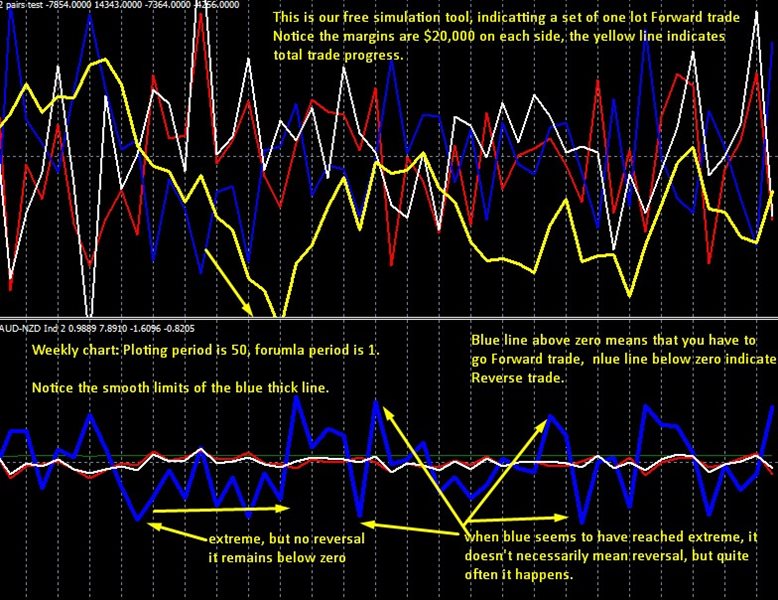

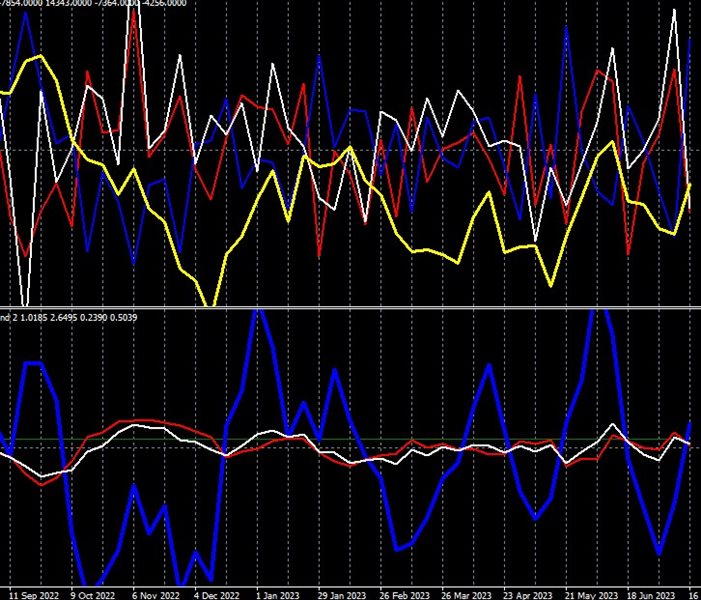

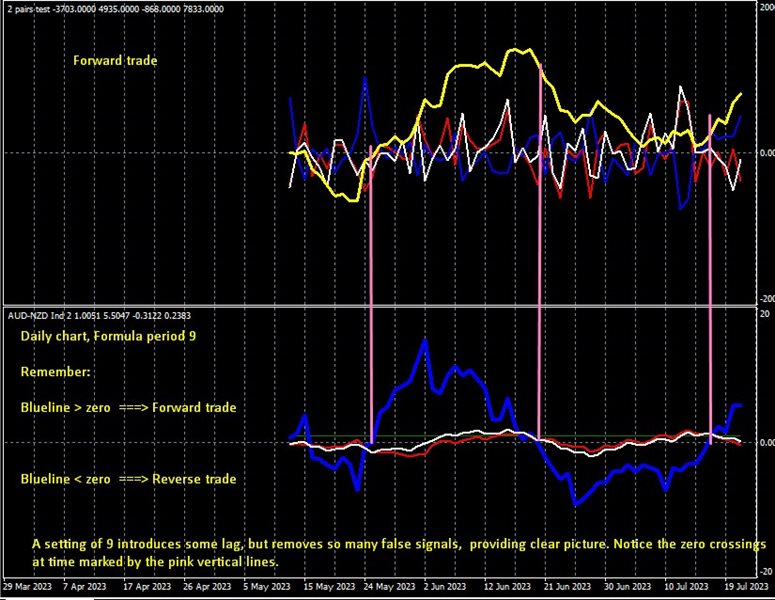

For the new traders of this strategy please remember the convention:

FORWARD trade = BUY AUDUSD and SELL NZDUSD at equal lot size

REVERSE trade = SELL AUDUSD and BUY NZDUSD at equal lot size

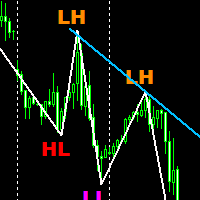

Risk is mittigated by the opposing nature of the trades, one tends to offset the other almost 70% of the time, and for when this is not the case we rely on the indicators accordingly - no stops are used in correlation hedge!

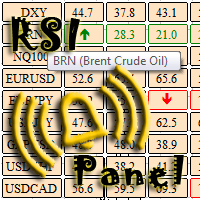

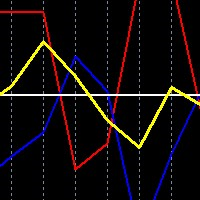

This is an enhanced oscillator like analysis of the relationship between AUDUSD and NZDUSD, which indicated smoother and clearer total trends, less confusing patterns, and extreme levels from where the deeper trend is likely to reverse.

Overall, the hedge correlation strategy is very cool, forgiving of mistakes and bad trades and surprise market reversals, because you can be wrong about either AUDUSD or NZDUSD and still win, or at least break even, or even cover the entire set of trades with an opposing set, and still win in the end, as long as you see enough margin for movement on the oscillator.

In my last few trades of this strategy, I had 2 profitable runs, and one surprise reversal (indicator reversed suddenly along with the market), and still went through an exact offset day (loss at one pair was perfectly offset by the profit on the other) and closed both trades. And then reversed by opening new set of trades in opposite direction. This is impossible to do when trading any single pair!

We are offering this piece of software at an introductory reduced monthly rental rate, and still provide basic tips and training. And explain the differences between different software on AUDUSD-NZDUSD correlation hedge, the limitations, and what you can realistically win in terms of profits.