작업 종료됨

명시

Hello,

I want a Robot/EA that can be able to deal with the ability to identify time frame movements of the market price and deal with changes in market direction in order to take trades towards the direction of the market at every particular time and to also change direction of bids if direction changes.

This can be identified using the historical report or information obtained on daily or time frame basis from the installation of the EA.

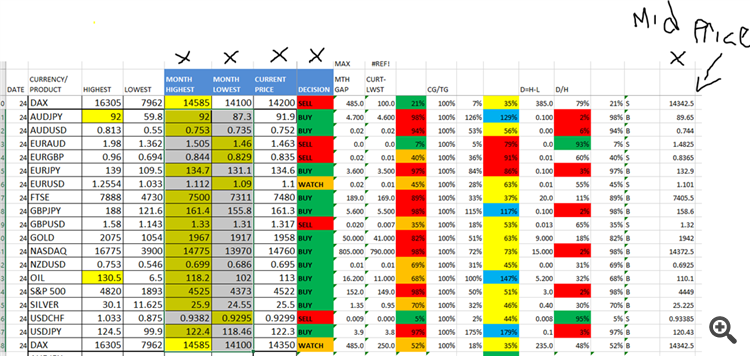

For example, using the following questions, whats the last highest price and lowest price so far to date, whats the current price, is the current price near the highest price or the lowest price, what is the current middle price of the period to date, whats the current middle price of previous day, whats the new extreme price of today ( ie did the high price change higher from yesterday, if Yes, then did the high price change from history, if Yes, then market trend is likely going higher for a BUY market, OR did the Low price change Lower from yesterday, if Yes, then did the Low price change from history Low, if Yes, then market trend is likely going Lower for a SELL market, OR finally ie did the high price change higher from yesterday, if No, then did the Low price change from Low price of yesterday, if Yes, then did the low price change from history, if No, then use current price and compare it with the highest and lowest price to date to see direction of current price based on last trend and take bids towards the direction whether as a BUY or as a SELL.

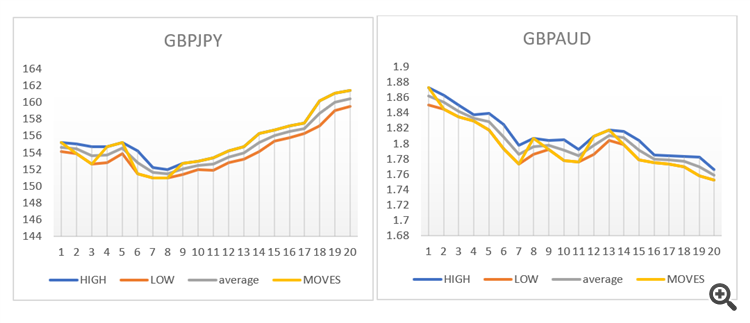

For example in most cases use highest price as 100% and lowest price as 0%, so current price will be compared to the 2 extremes and based on the market movement, a move from lower % to a higher % will result in a BUY while a move to a lower % will result in a SELL.

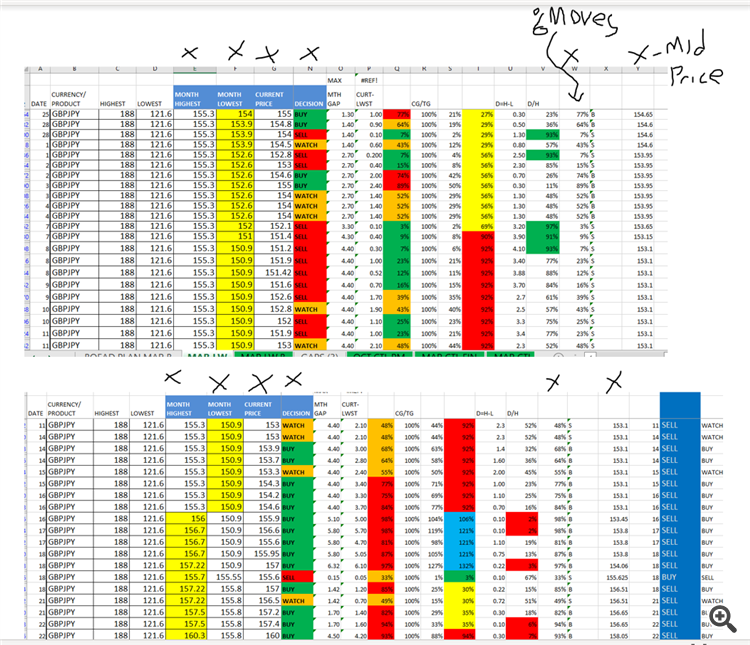

Using extreme of previous time frame can help to lock up profits or take reversal bids based on existing outstanding bids of current direction.

If current direction is Low and price is going lower, then the EA can lock up the price at the previous day/ time frame High price while adjusting itself at specific time frame to a new position daily or twice daily just to update the TP positions.

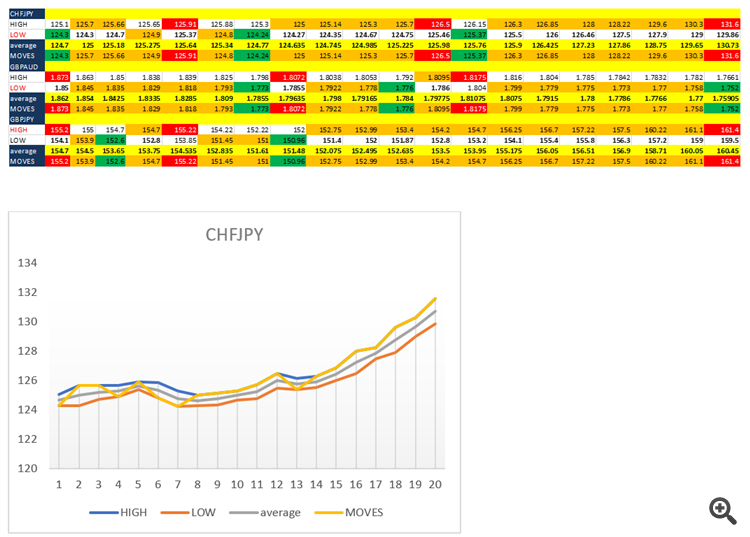

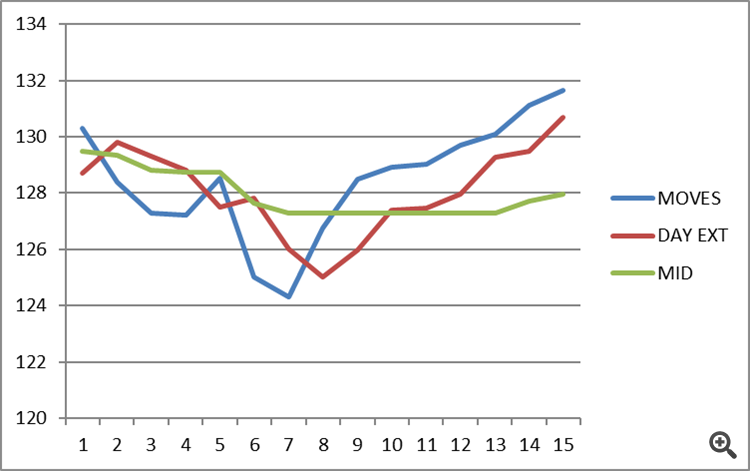

The coloured figures in the above are the daily trend movement based on the price updates, which can be the time frame. So if last time frame is High, then compare new TF to last TF, is the new TF same as old TF direction, If YES, then continue with direction of TF with bids and lock up positions with previous TF uncoloured price. And when TF doesn’t follow trend of Old TF, then use the Other figure for the day. Then compare the value if it Meets previous price extreme to warrant a change of direction, else continue with last changed TF based on the direction of the market, so if High price changed last, then follow prices going higher and take more higher bids while using the average and uncoloured moves price of previous TF to control when market is about to change direction towards the real trend.

So all I want the EA/Robot to do is to be able to identify the trend, using the parameters I have defined and designed and then take trades accordingly. So if price is falling from 90% to 80%, Robot takes a Sell at 90% and if the current high price for day is 85%, EA locks profit at 85%, then if price moves downwards to 60% and todays High is 65% it will change the profit lock from 85% to 65% etc, while the Long term Movement will be to BUY upwards from 55% to above 100% and to sell downwards from 45% to below 0% on the long term. So as robot is getting the TF data, it is also comparing it to the Long term position to know when to change from short term bidding to long term bidding.

So if current direction is Low and Long term bidding is BUY, then take bids on low lot size, but if current direction is High and Long term bidding is BUY, then take High lot size for the bids until it gets to previous or nearer the previous extreme and then begin to use the low lot sizes. And also using the lock up of profit concept.

So you can see from the sample how price has been changing and decisions also from a BUYER to a SELLER from DECISION position,

And also seeing the moves of current price in % Moves on the picture and the Midprice as last X. So % falling from 77% to 7% will be a SELL and moving from 7% to 85% will be a BUY. So check the first picture between the 25 thto 3 rdas shown in the data to see the %Moves and compare them with the Long term DECISION and then use the prices shown in CURRENT to see how it affects the decision and moves while also considering the position of the Current price to the Midprice during the movement.

Looking forward to get a professional expert programmer to work on this perfectly.

All the report is in EXCEL sheet and can be sent on request. Also see some pictures that can help give direction on actions to take by EA. More clarity on documents in word and excel which can be discussed.

I want only serious and immediately available programmers as time is essential. Also please ensure you understand the concept as well.

I will have the following as it relates to the EA

- Source code

- Ownership and Copyright of code

- EA should have a Password input

- I will need as much as 3 weeks to test the accuracy of robot before finalizing payment

- Robot should be usable on any product, currency, indices or stock

Thanks