Piyush Lalsingh Ratnu / Profilo

- Informazioni

|

1 anno

esperienza

|

0

prodotti

|

0

versioni demo

|

|

0

lavori

|

1

segnali

|

0

iscritti

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm 130+ parameters.

Core focus: XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Ai Verified Track Record since 2021:

https://www.piyushratnu.com/most-accurate-xauusd-spot-gold-price-projection-and-ai-verified-research-generated-by-piyush-ratnu-gold-market-research/

XAUUSD Daily Price Projection:

https://www.piyushratnu.com/xauusd-spot-gold-daily-analysis/

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm 130+ parameters.

Core focus: XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Ai Verified Track Record since 2021:

https://www.piyushratnu.com/most-accurate-xauusd-spot-gold-price-projection-and-ai-verified-research-generated-by-piyush-ratnu-gold-market-research/

XAUUSD Daily Price Projection:

https://www.piyushratnu.com/xauusd-spot-gold-daily-analysis/

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Amici

19

Richieste

In uscita

Piyush Lalsingh Ratnu

As projected yesterday at 17.30 hours: XAUUSD target price $2028 achieved. CMP $2029.

Piyush Lalsingh Ratnu

Co-relations Alert:

600 pips crash witnessed in USDJPY

Projected Impact on XAUUSD: $15

Price rise witnessed in XAUUSD: $9

600 pips crash witnessed in USDJPY

Projected Impact on XAUUSD: $15

Price rise witnessed in XAUUSD: $9

Piyush Lalsingh Ratnu

USDJPY CMP $148.350

XAUUSD CMP $2014

XAUUSD: S2 on Radar (2002)

USDJPY: R2 on radar (148.555)

XAUUSD CMP $2014

XAUUSD: S2 on Radar (2002)

USDJPY: R2 on radar (148.555)

Piyush Lalsingh Ratnu

16.01.2024 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

Crucial US Economic Data scheduled today:

17:30 USD Core Retail Sales (MoM) (Dec) 0.2% 0.2%

High Volatility expected: $20-30

Stay Alert, avoid Big lots, implement money management.

🟢Crucial Price Targets:

BZ: $1985/1975/1966

SZ: $2042/2054/2069

17:30 USD Core Retail Sales (MoM) (Dec) 0.2% 0.2%

High Volatility expected: $20-30

Stay Alert, avoid Big lots, implement money management.

🟢Crucial Price Targets:

BZ: $1985/1975/1966

SZ: $2042/2054/2069

Piyush Lalsingh Ratnu

✔️ as projected on 12.01.2024:

♾If USDJPY hits the resistance zone 146.500/146.800, XAUUSD might crash towards $2009 zone.

🆘Today's low witnessed: $2019 CMP

Co-relations witnessed once again, in perfect format.

♾If USDJPY hits the resistance zone 146.500/146.800, XAUUSD might crash towards $2009 zone.

🆘Today's low witnessed: $2019 CMP

Co-relations witnessed once again, in perfect format.

Piyush Lalsingh Ratnu

USDJPY 147.100

XAUXAG 88.59

US10YT 4.067

DXY 103.130

Impact (-) on GOLD: CMP XAUUSD: 2026

XAUXAG 88.59

US10YT 4.067

DXY 103.130

Impact (-) on GOLD: CMP XAUUSD: 2026

Piyush Lalsingh Ratnu

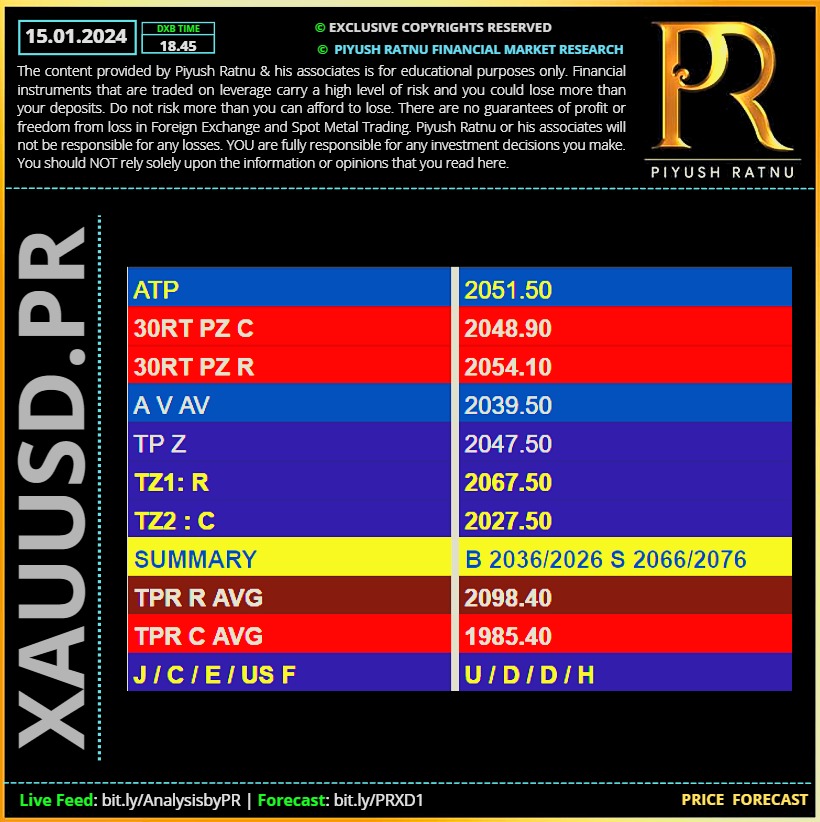

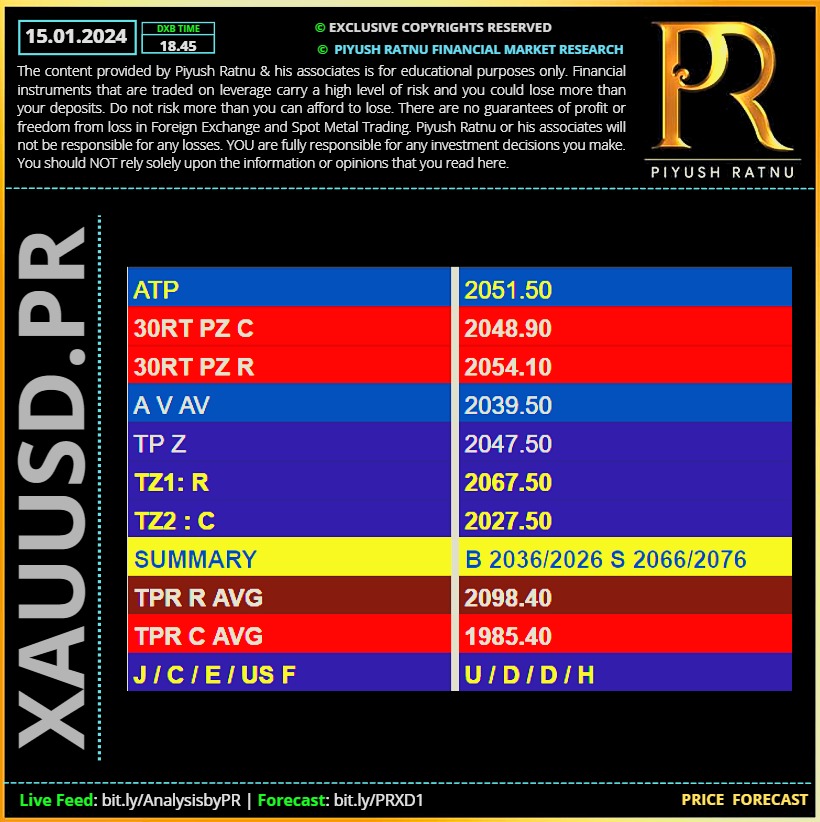

15.01.2024 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

12.01.2024 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🆘 Due to geo-political tensions:

SZ $2069/2096/2121/2145 on radar (XAUUSD)

avoid BIG LOTS | avoid SM/RM/BL

Maintain Money Management | Risk Management

SZ $2069/2096/2121/2145 on radar (XAUUSD)

avoid BIG LOTS | avoid SM/RM/BL

Maintain Money Management | Risk Management

Piyush Lalsingh Ratnu

As alerted and projected yesterday:

If USDJPY hits the price zone 144.800, XAUUSD might breach $2048 zone, XAUUSD CMP $2047

Analysis proved correct once again!

If USDJPY hits the price zone 144.800, XAUUSD might breach $2048 zone, XAUUSD CMP $2047

Analysis proved correct once again!

Piyush Lalsingh Ratnu

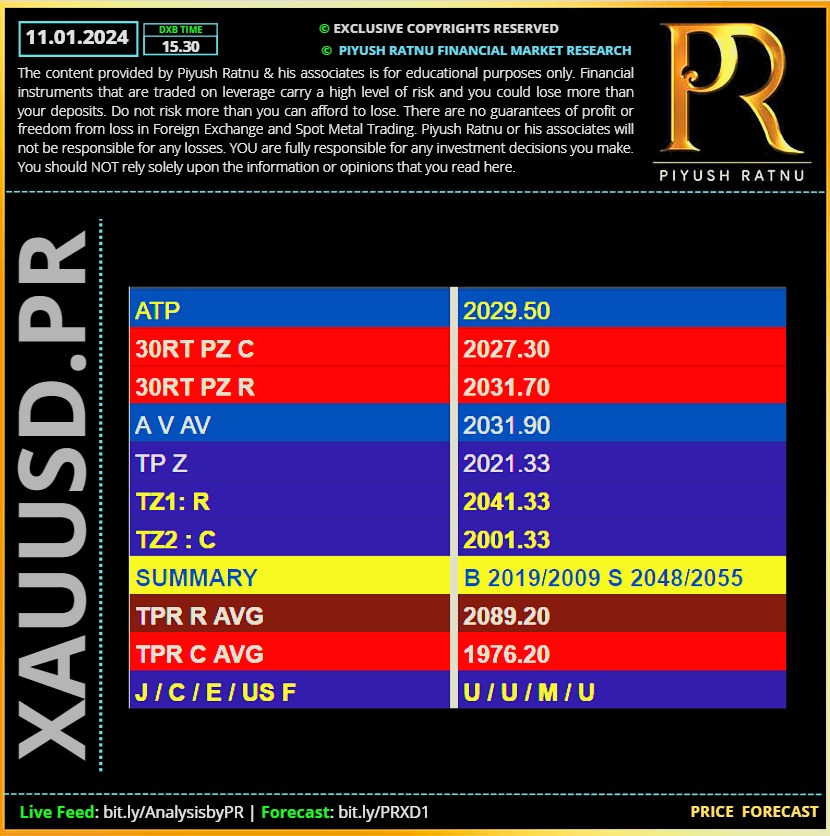

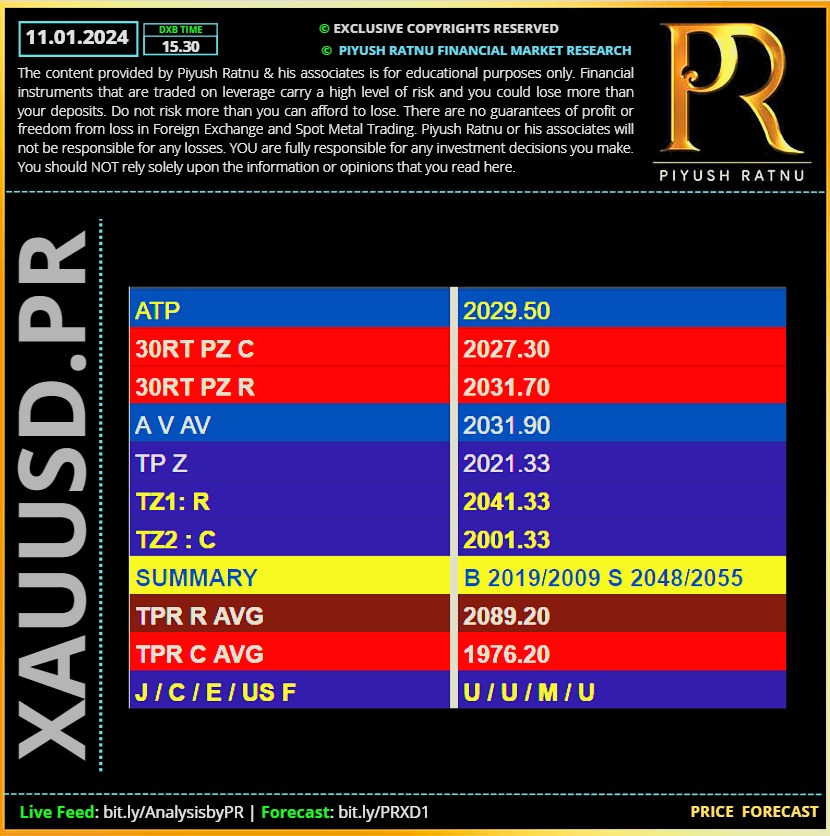

11.01.2024 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

Humble reminder: Kindly close trades in US F 1 2 3

A crash of 100+ points witnessed as projected in advance.

A crash of 100+ points witnessed as projected in advance.

Piyush Lalsingh Ratnu

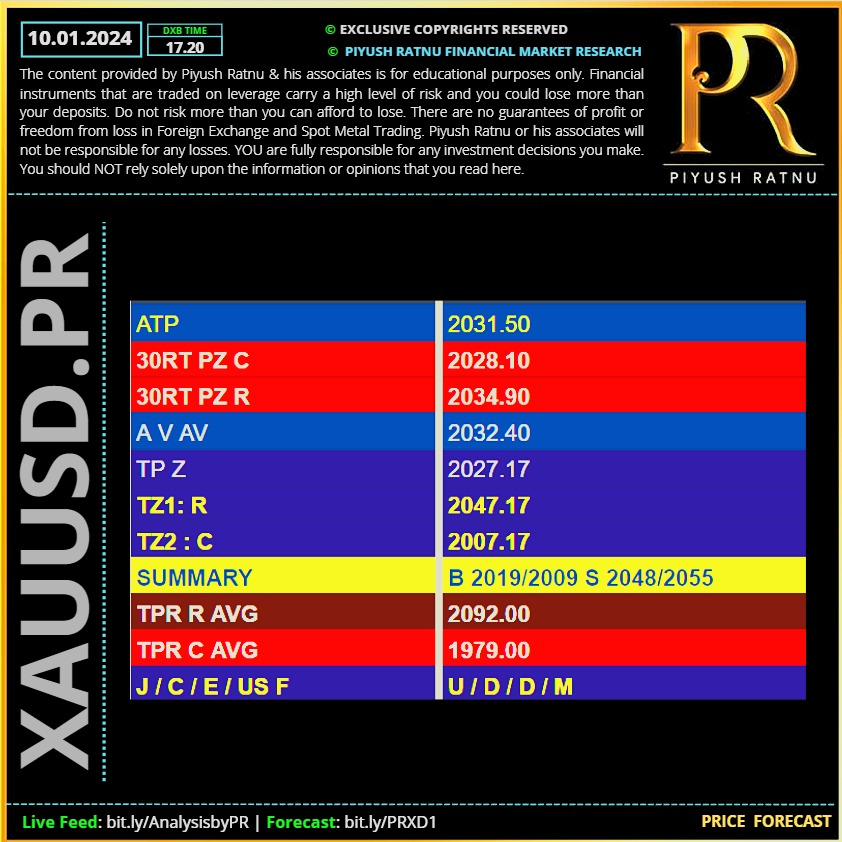

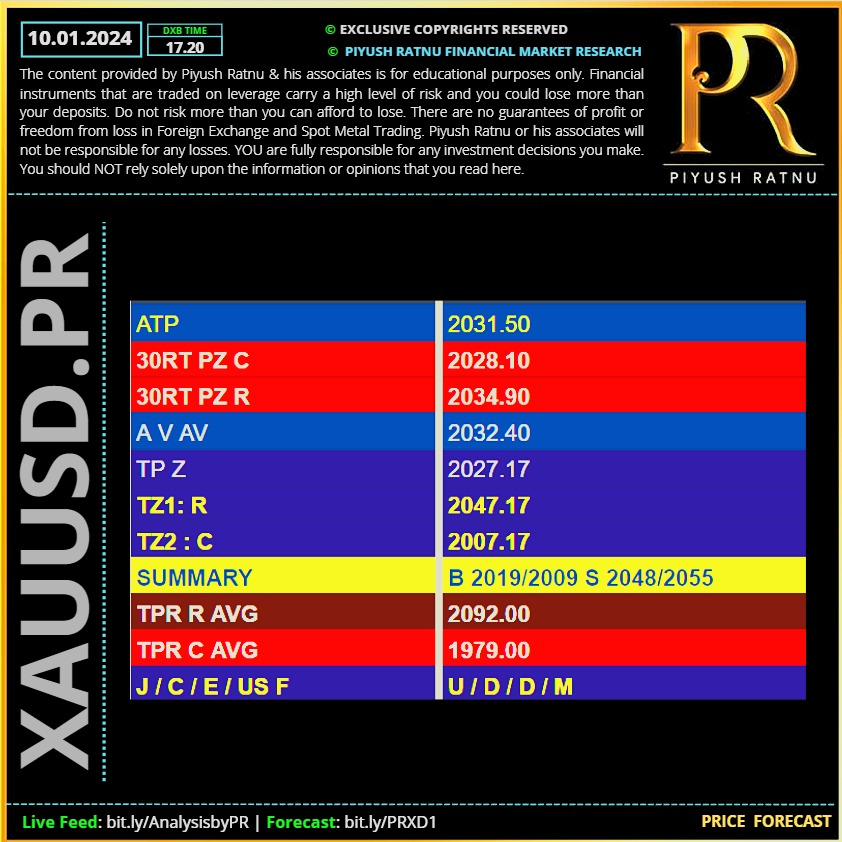

10.01.2024 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

: