Piyush Lalsingh Ratnu / Profilo

- Informazioni

|

1 anno

esperienza

|

0

prodotti

|

0

versioni demo

|

|

0

lavori

|

1

segnali

|

0

iscritti

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm 130+ parameters.

Core focus: XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Ai Verified Track Record since 2021:

https://www.piyushratnu.com/most-accurate-xauusd-spot-gold-price-projection-and-ai-verified-research-generated-by-piyush-ratnu-gold-market-research/

XAUUSD Daily Price Projection:

https://www.piyushratnu.com/xauusd-spot-gold-daily-analysis/

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm 130+ parameters.

Core focus: XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Ai Verified Track Record since 2021:

https://www.piyushratnu.com/most-accurate-xauusd-spot-gold-price-projection-and-ai-verified-research-generated-by-piyush-ratnu-gold-market-research/

XAUUSD Daily Price Projection:

https://www.piyushratnu.com/xauusd-spot-gold-daily-analysis/

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Amici

19

Richieste

In uscita

Piyush Lalsingh Ratnu

Gold price is consolidating the weekly gains above $1,980 early Friday, set to snap a two-week losing streak. Falling US Treasury bond yields aid the Gold price uptrend, but the resurgent United States Dollar (USD) could check the bright metal’s bullish momentum.

Cautious optimism prevails, as Asian stock markets ended mixed while the European markets are likely to see a positive open. Resurfacing US-China trade worries and uncertainty around the US Federal Reserve’s (Fed) interest rate outlook are keeping investors on the edge.

Amidst jittery markets, the safe-haven US Dollar is finding a floor, limiting the upside attempts in Gold price. However, Gold price continues to cheer the recent sell-off in the US Treasury bond yields, as the demand for the US government bonds increased on hopes that the US Fed is done with its hiking cycle, with markets pricing in interest rate cuts by May next year.

The latest run of soft US economic data releases cemented Fed pause expectations, justifying the upsurge in the non-interest-bearing Gold price. Earlier this week, the US Producer Price Index (PPI) fell the most in three-and-a-half years in October after the US Consumer Price Index (CPI) inflation fell to 3.2% YoY in October. Further, Retail sales, which are adjusted for seasonality but not inflation, fell 0.1% in October from the prior month. On Thursday, the US Initial claims rose 13,000 to a seasonally adjusted 231,000 for the week ended Nov. 11.

Against this backdrop, Gold price is likely to maintain its uptrend but the end-of-the-week profit-taking could emerge as a headwind alongside a potential extension in the US Dollar recovery. Meanwhile, the US Housing Starts and Building Permits data are unlikely to have a significant impact on the US Dollar trades.

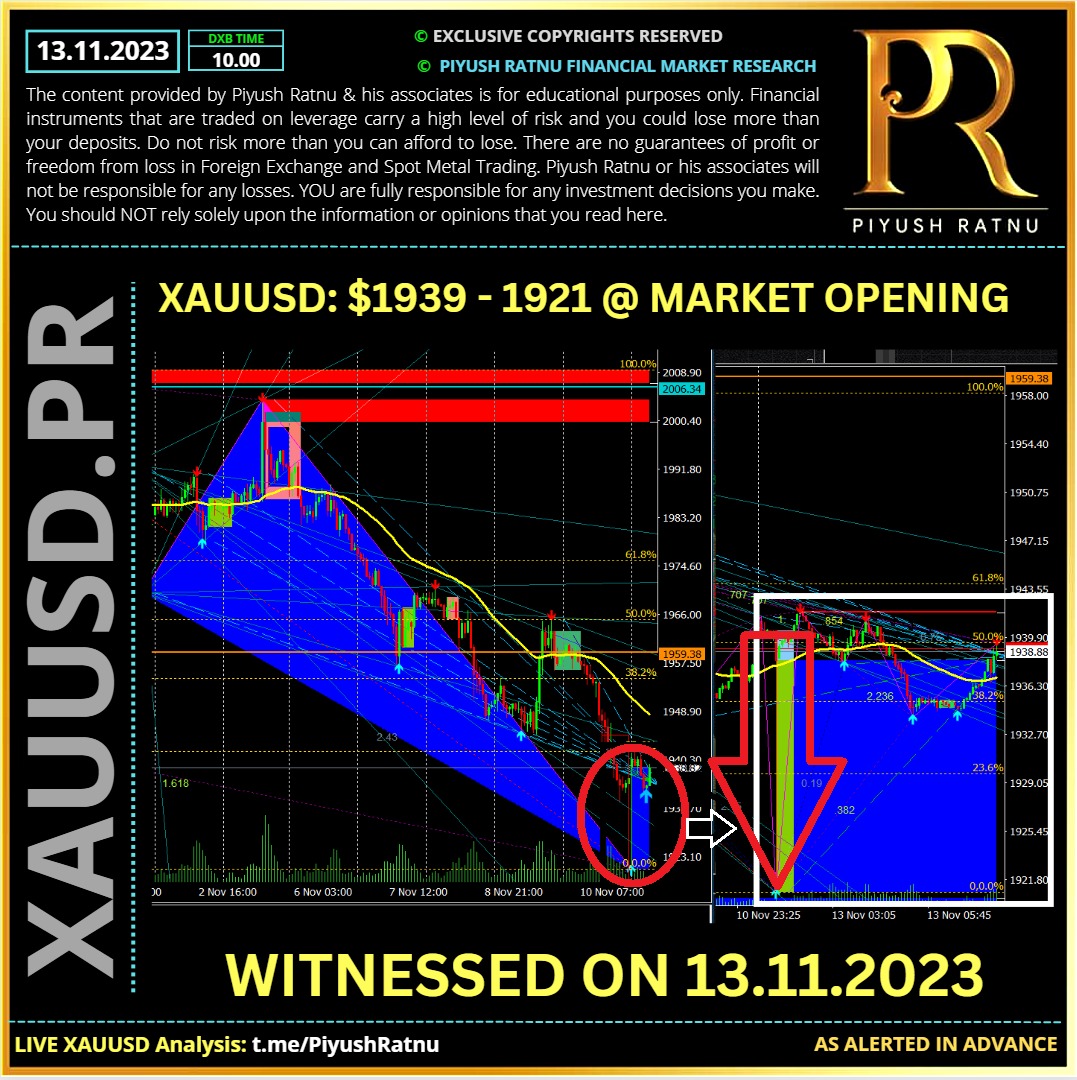

🟢Crucial Price Zones:

C: 1966/1947

R: 2009/2023

Cautious optimism prevails, as Asian stock markets ended mixed while the European markets are likely to see a positive open. Resurfacing US-China trade worries and uncertainty around the US Federal Reserve’s (Fed) interest rate outlook are keeping investors on the edge.

Amidst jittery markets, the safe-haven US Dollar is finding a floor, limiting the upside attempts in Gold price. However, Gold price continues to cheer the recent sell-off in the US Treasury bond yields, as the demand for the US government bonds increased on hopes that the US Fed is done with its hiking cycle, with markets pricing in interest rate cuts by May next year.

The latest run of soft US economic data releases cemented Fed pause expectations, justifying the upsurge in the non-interest-bearing Gold price. Earlier this week, the US Producer Price Index (PPI) fell the most in three-and-a-half years in October after the US Consumer Price Index (CPI) inflation fell to 3.2% YoY in October. Further, Retail sales, which are adjusted for seasonality but not inflation, fell 0.1% in October from the prior month. On Thursday, the US Initial claims rose 13,000 to a seasonally adjusted 231,000 for the week ended Nov. 11.

Against this backdrop, Gold price is likely to maintain its uptrend but the end-of-the-week profit-taking could emerge as a headwind alongside a potential extension in the US Dollar recovery. Meanwhile, the US Housing Starts and Building Permits data are unlikely to have a significant impact on the US Dollar trades.

🟢Crucial Price Zones:

C: 1966/1947

R: 2009/2023

Piyush Lalsingh Ratnu

🆘ALERT:

1000 pips crash observed in USDJPY

Expected impact on GOLD:

$30+ from $1980 zone

Target price Zone: $2009

CMP $1990

I will SELL HIGH with NAP EXIT.

1000 pips crash observed in USDJPY

Expected impact on GOLD:

$30+ from $1980 zone

Target price Zone: $2009

CMP $1990

I will SELL HIGH with NAP EXIT.

Piyush Lalsingh Ratnu

🟢XAUUSD CMP @ R1

R2 and S2 crucial zones

I would prefer:

Sell positions above R2 +3/6/9

Buy positions below S1 -6/9/12 S2

🆘$1985/1955 crucial Price zones

R2 and S2 crucial zones

I would prefer:

Sell positions above R2 +3/6/9

Buy positions below S1 -6/9/12 S2

🆘$1985/1955 crucial Price zones

Piyush Lalsingh Ratnu

US 10YT crashed -1.01%

USD S 49

USDJPY 151.410

XAUXAG 86.22

DXY 105.670

🟢Impact:

XAUUSD should form a V formation, hence I will BUY lows.

USD S 49

USDJPY 151.410

XAUXAG 86.22

DXY 105.670

🟢Impact:

XAUUSD should form a V formation, hence I will BUY lows.

Piyush Lalsingh Ratnu

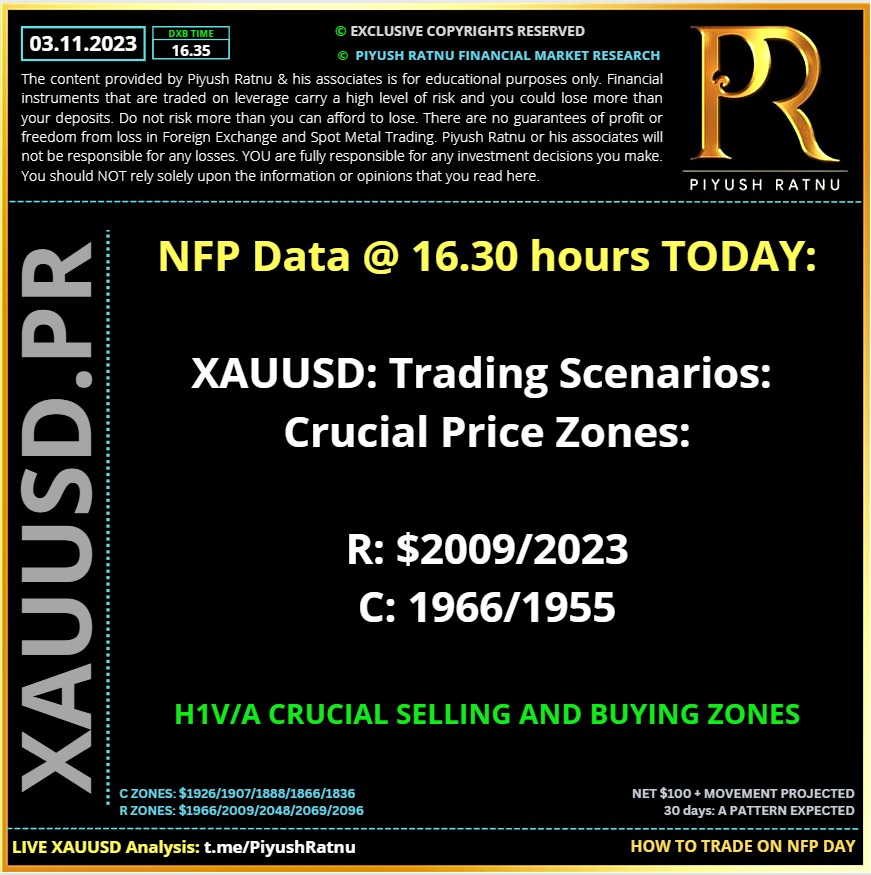

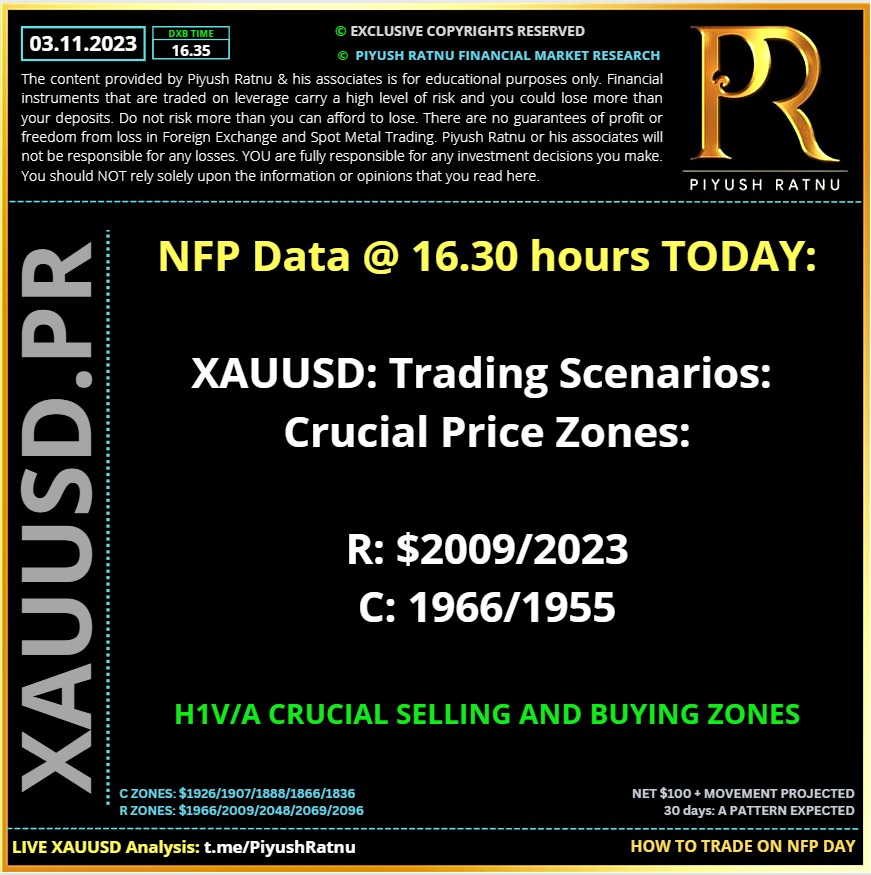

NFP DAY: HOW TO TRADE XAUUSD TODAY?

FACTS:

🟢Gold price treads water below $2,000, awaits US Nonfarm Payrolls for a fresh impetus.

🟢US Dollar stalls sell-off with US Treasury bond yields as risk tone turns cautious.

🟢Gold price is poised for a fresh advance amid a bullish daily technical setup.

Gold price is finding support from a subdued performance in the US Dollar and the US Treasury bond yields, as they struggle to stabilize, following the steep losses incurred in the aftermath of a non-committal US Federal Reserve (Fed) policy outlook.

The sell-off in the US Dollar extended on Thursday, as the benchmark 10-year US Treasury bond yields breached the 4.70% key level on increased expectations that the Federal Reserve is done with hiking rates. Further, a hawkish pause from the Bank of England (BoE) boosted the GBP/USD pair, weighing down on the US Dollar. The BoE kept the policy rate steady at 5.25%, as widely expected but three policymakers voted in favor of a hike, suggesting that the door remains open for future rate hikes.

The sell-off in the US Dollar extended on Thursday, as the benchmark 10-year US Treasury bond yields breached the 4.70% key level on increased expectations that the Federal Reserve is done with hiking rates.

Further, a hawkish pause from the Bank of England (BoE) boosted the GBP/USD pair, weighing down on the US Dollar. The BoE kept the policy rate steady at 5.25%, as widely expected but three policymakers voted in favor of a hike, suggesting that the door remains open for future rate hikes.

🆘XAUUSD: Trading Scenarios: Crucial Price Zones:

R: $2009/2023 SZ

C: 1966/1955 BZ

🔘 EXIT NAP

FACTS:

🟢Gold price treads water below $2,000, awaits US Nonfarm Payrolls for a fresh impetus.

🟢US Dollar stalls sell-off with US Treasury bond yields as risk tone turns cautious.

🟢Gold price is poised for a fresh advance amid a bullish daily technical setup.

Gold price is finding support from a subdued performance in the US Dollar and the US Treasury bond yields, as they struggle to stabilize, following the steep losses incurred in the aftermath of a non-committal US Federal Reserve (Fed) policy outlook.

The sell-off in the US Dollar extended on Thursday, as the benchmark 10-year US Treasury bond yields breached the 4.70% key level on increased expectations that the Federal Reserve is done with hiking rates. Further, a hawkish pause from the Bank of England (BoE) boosted the GBP/USD pair, weighing down on the US Dollar. The BoE kept the policy rate steady at 5.25%, as widely expected but three policymakers voted in favor of a hike, suggesting that the door remains open for future rate hikes.

The sell-off in the US Dollar extended on Thursday, as the benchmark 10-year US Treasury bond yields breached the 4.70% key level on increased expectations that the Federal Reserve is done with hiking rates.

Further, a hawkish pause from the Bank of England (BoE) boosted the GBP/USD pair, weighing down on the US Dollar. The BoE kept the policy rate steady at 5.25%, as widely expected but three policymakers voted in favor of a hike, suggesting that the door remains open for future rate hikes.

🆘XAUUSD: Trading Scenarios: Crucial Price Zones:

R: $2009/2023 SZ

C: 1966/1955 BZ

🔘 EXIT NAP

Piyush Lalsingh Ratnu

03.11.2023 | How to trade on NFP and Crucial Price Zones | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Piyush Lalsingh Ratnu

🟢 Daily Digest XAUUSD Price Movers:

• Gold price trades directionless below the psychological resistance of $2,000 as investors await further development on the Israel-Palestine war and the Fed’s monetary policy decision.

• The precious metal struggles to come out of the woods but a volatile action is widely anticipated after the announcement of the interest rate decision by the Fed on Wednesday.

• Investors hope that easing price pressures and higher US long-term bond yields would allow Fed policymakers to advocate a steady monetary policy decision.

• Fed Chair Jerome Powell and his colleagues are expected to keep doors open for further policy tightening as robust consumer spending and tight labor market conditions could make consumer inflation stubborn.

• 10-year US Treasury yields have eased to 4.84% ahead of the Fed policy announcement but are extremely high and significantly impacting financial conditions in the US economy.

• Cleveland Fed Bank President Loretta Mester said ahead of November's monetary policy that higher bond yields are equivalent to one interest rate hike of 25 basis points (bps). The Fed could use higher Treasury yields as a substitute for further policy tightening.

• The majority of Fed policymakers hope for a ‘soft landing’ from the Fed as price pressures are consistently easing and the US economy is resilient.

• The US Dollar Index (DXY) retreats from 106.40 (supporting Gold) ahead of the Fed’s monetary policy and crucial economic indicators such as private payrolls and the ISM Manufacturing PMI data for October.

• As per the estimates, 150K fresh private jobs were added against 89K added in September. The Manufacturing PMI is seen steady at 49.0, below the 50.0 threshold for the 12th month in a row.

• Investors should note that the survey done by S&P Global on private factories for October showed that private Manufacturing PMI met the 50.0 threshold. US firms remain optimistic that the Fed is done with hiking interest rates.

• The US manufacturing and service sector is recovering faster due to a strong growth outlook amid robust spending by households. Meanwhile, Goldman Sachs hiked their GDP growth projections for the fourth quarter of 2023 and the first quarter of 2024 to 1.6% and 1.7% respectively.

• The near-term appeal for the Gold price remains upbeat as Israeli defense forces (IDF) prepare for a ground assault in Gaza to dismantle Palestine military troops in retaliation for airstrikes from Hamas.

• The IDR moves gradually in Gaza to keep hopes of the release of more than 200 hostages alive.

• Meanwhile, the World Gold Council (WGC) reported that gold demand by Indian jewelers fell annually due to higher prices. The WGC said that global gold demand excluding over-the-counter (OTC) trading slipped 6% in the third quarter, Reuters reported.

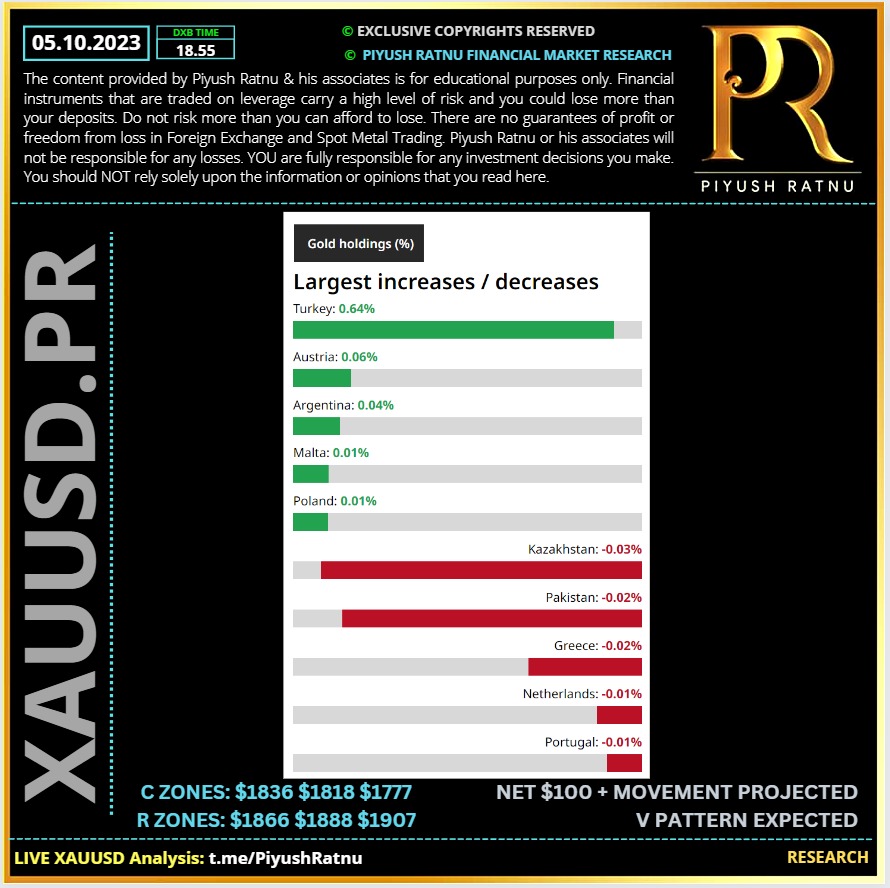

⚠️The WGC hopes that the Gold buying from central banks could reach a new record in 2023.

• Gold price trades directionless below the psychological resistance of $2,000 as investors await further development on the Israel-Palestine war and the Fed’s monetary policy decision.

• The precious metal struggles to come out of the woods but a volatile action is widely anticipated after the announcement of the interest rate decision by the Fed on Wednesday.

• Investors hope that easing price pressures and higher US long-term bond yields would allow Fed policymakers to advocate a steady monetary policy decision.

• Fed Chair Jerome Powell and his colleagues are expected to keep doors open for further policy tightening as robust consumer spending and tight labor market conditions could make consumer inflation stubborn.

• 10-year US Treasury yields have eased to 4.84% ahead of the Fed policy announcement but are extremely high and significantly impacting financial conditions in the US economy.

• Cleveland Fed Bank President Loretta Mester said ahead of November's monetary policy that higher bond yields are equivalent to one interest rate hike of 25 basis points (bps). The Fed could use higher Treasury yields as a substitute for further policy tightening.

• The majority of Fed policymakers hope for a ‘soft landing’ from the Fed as price pressures are consistently easing and the US economy is resilient.

• The US Dollar Index (DXY) retreats from 106.40 (supporting Gold) ahead of the Fed’s monetary policy and crucial economic indicators such as private payrolls and the ISM Manufacturing PMI data for October.

• As per the estimates, 150K fresh private jobs were added against 89K added in September. The Manufacturing PMI is seen steady at 49.0, below the 50.0 threshold for the 12th month in a row.

• Investors should note that the survey done by S&P Global on private factories for October showed that private Manufacturing PMI met the 50.0 threshold. US firms remain optimistic that the Fed is done with hiking interest rates.

• The US manufacturing and service sector is recovering faster due to a strong growth outlook amid robust spending by households. Meanwhile, Goldman Sachs hiked their GDP growth projections for the fourth quarter of 2023 and the first quarter of 2024 to 1.6% and 1.7% respectively.

• The near-term appeal for the Gold price remains upbeat as Israeli defense forces (IDF) prepare for a ground assault in Gaza to dismantle Palestine military troops in retaliation for airstrikes from Hamas.

• The IDR moves gradually in Gaza to keep hopes of the release of more than 200 hostages alive.

• Meanwhile, the World Gold Council (WGC) reported that gold demand by Indian jewelers fell annually due to higher prices. The WGC said that global gold demand excluding over-the-counter (OTC) trading slipped 6% in the third quarter, Reuters reported.

⚠️The WGC hopes that the Gold buying from central banks could reach a new record in 2023.

Piyush Lalsingh Ratnu

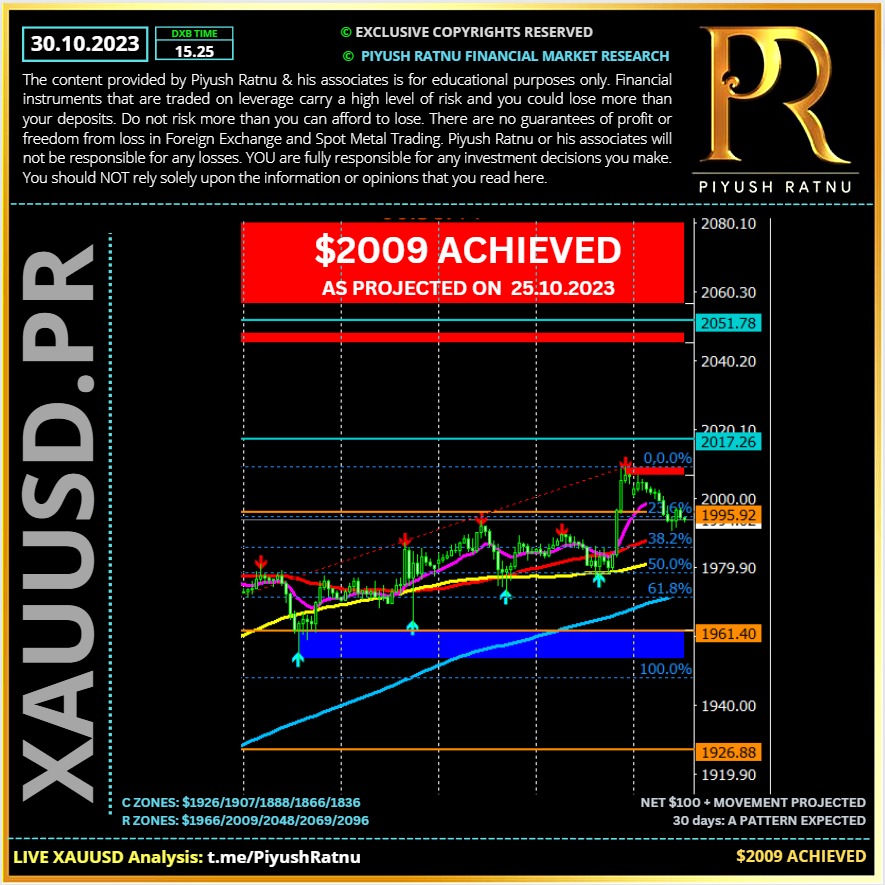

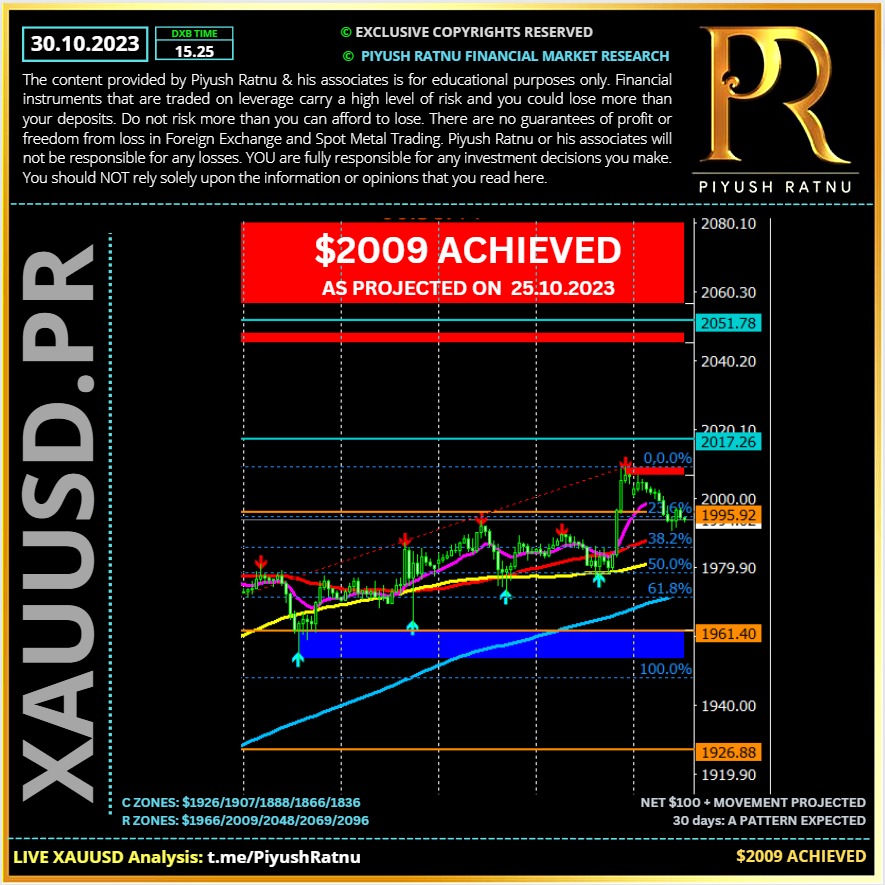

30.10.2023 | As projected by us, XAUUSD touched $2009 | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Piyush Lalsingh Ratnu

⏰XAUUSD current status:

1. below S1 M30AS5 M15AF50 M30AF50

2. @ H1AF382 approaching H1AS5

3. Approaching $1985 zone, today's low $1991

Status of trades: we will HOLD SHORT Positions: SET 3

🟢Set 1 and SET 2 NAP Exit at: $2002 and $1998

1. below S1 M30AS5 M15AF50 M30AF50

2. @ H1AF382 approaching H1AS5

3. Approaching $1985 zone, today's low $1991

Status of trades: we will HOLD SHORT Positions: SET 3

🟢Set 1 and SET 2 NAP Exit at: $2002 and $1998

Piyush Lalsingh Ratnu

20.10.2023 | As alerted by us on 13.10.2023, XAUUSD $1985 Achieved | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Piyush Lalsingh Ratnu

What do the terms"risk-on" and "risk-off" mean when referring to sentiment in financial markets?

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Piyush Lalsingh Ratnu

Which currencies strengthen when sentiment is "risk-off"?

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Piyush Lalsingh Ratnu

As published in my analysis dated 06.10.2023:

🍎"I expect V pattern on M30, H1 and H4 TF chart in sequence in next 7 trading days (short term target) and 18 trading days (long term target). XAUUSD CMP $1821. I will prefer to BUY lows near D1+W1 SR zone mentioned in the above analysis."

♾I had suggested buying lows near and below $1818 zone, on 06.10.2023, in addition I had projected Long target as $1888 for the buying positions to be achieved before 18.10.2023.

♾XAUUSD breached the mark of $1919 today, 5 days before 18.10.2023 | Geo - political tensions, crashing yields, struggling dollar and reversing futures are the key reasons for the sudden rise in GOLD prices, once again.

🍎"I expect V pattern on M30, H1 and H4 TF chart in sequence in next 7 trading days (short term target) and 18 trading days (long term target). XAUUSD CMP $1821. I will prefer to BUY lows near D1+W1 SR zone mentioned in the above analysis."

♾I had suggested buying lows near and below $1818 zone, on 06.10.2023, in addition I had projected Long target as $1888 for the buying positions to be achieved before 18.10.2023.

♾XAUUSD breached the mark of $1919 today, 5 days before 18.10.2023 | Geo - political tensions, crashing yields, struggling dollar and reversing futures are the key reasons for the sudden rise in GOLD prices, once again.

Piyush Lalsingh Ratnu

On 03.10.2023: I had projected $1866/1888 before 18.10.2023

Today’s high: $1885. We closed all our buy positions from $1818 zone in net profit today.

Those who believed in our analysis, am sure made handsome profits in the price rise: $1808 zone - $1888 zone.

Today’s high: $1885. We closed all our buy positions from $1818 zone in net profit today.

Those who believed in our analysis, am sure made handsome profits in the price rise: $1808 zone - $1888 zone.

Piyush Lalsingh Ratnu

I had projected V pattern post NFP:

XAUSD crashed from $1820 to $1810, and reversed back to $1820 before 60 minutes.

🟢CMP $1823 R1 above PPZ.

XAUSD crashed from $1820 to $1810, and reversed back to $1820 before 60 minutes.

🟢CMP $1823 R1 above PPZ.

Piyush Lalsingh Ratnu

05.10.2023 | XAUUSD - US NFP deviation correlations | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Piyush Lalsingh Ratnu

🆘Daily Digest Market Movers:

⏰Gold price juggles ahead of US Employment data

• Gold price falls back while attempting a break above the immediate resistance of $1,830.00 as the US Dollar rebounds after correcting to near 106.50. 10-year US Treasury yields improve to near 4.74%.

• The precious metal failed to capitalize on soft US Institute of Supply Management (ISM) Services PMI and a weak ADP Employment Change report for September.

• The US ADP reported that employers hired 89K fresh talent in September, almost half August’s reading of 180K and lower than expectations of 153K. This was the lowest labor growth since January 2021.

• Nela Richardson, chief economist at ADP said "We are seeing a steepening decline in jobs this month"." Additionally, we are seeing a steady decline in wages in the past 12 months."

• Loosening labor market conditions is expected to dent expectations for one more interest rate increase by the Federal Reserve in the remainder of 2023, which were propelled by hawkish interest rate guidance from Cleveland Fed Bank President Loretta Mester and Fed Governor Michelle Bowman.

• The US Services PMI for September matched expectations at 53.6 but dropped from the 54.5 reading in August. Being a proxy for the US service sector, which accounts for two-thirds of the US economy, the economic data carries weight and importance.

• New Services PMI Orders dropped significantly to 51.8 against the former release of 57.5, indicating a poor demand outlook.

• On the US factory activity front, the Manufacturing PMI for September improved significantly. A revival in the US manufacturing sector is anticipated. New Factory Orders in August expanded by 1.2% vs. expectations of a 0.3% gain on a monthly basis. In July, orders for US-made goods contracted by 2.1%.

• The US Dollar Index (DXY) faced selling pressure after weak US data on Wednesday but has revived gradually as investors appear to have placed less significance on the September ADP Employment Change. The Fed is scheduled to announce its next monetary policy move in November. Policymakers are expected to give more preference to October’s private payrolls data.

• Meanwhile, investors await the NFP report for September, which will provide more clarity about labor market conditions.

• According to estimates, the US labor force is expected to have witnessed fresh additions of 170K employees – lower than the former release of 187K. The Unemployment Rate is seen declining to 3.7% vs. August’s reading of 3.8%.

• In addition to the jobs data, investors will watch out for the Average Hourly Earnings data. On a monthly basis, labor earnings are forecast to have expanded at a higher pace of 0.3% against a 0.2% jump recorded in August. The annual data is seen unchanged at 4.3%. Higher wages could elevate consumer inflation expectations ahead.

⏰Gold price juggles ahead of US Employment data

• Gold price falls back while attempting a break above the immediate resistance of $1,830.00 as the US Dollar rebounds after correcting to near 106.50. 10-year US Treasury yields improve to near 4.74%.

• The precious metal failed to capitalize on soft US Institute of Supply Management (ISM) Services PMI and a weak ADP Employment Change report for September.

• The US ADP reported that employers hired 89K fresh talent in September, almost half August’s reading of 180K and lower than expectations of 153K. This was the lowest labor growth since January 2021.

• Nela Richardson, chief economist at ADP said "We are seeing a steepening decline in jobs this month"." Additionally, we are seeing a steady decline in wages in the past 12 months."

• Loosening labor market conditions is expected to dent expectations for one more interest rate increase by the Federal Reserve in the remainder of 2023, which were propelled by hawkish interest rate guidance from Cleveland Fed Bank President Loretta Mester and Fed Governor Michelle Bowman.

• The US Services PMI for September matched expectations at 53.6 but dropped from the 54.5 reading in August. Being a proxy for the US service sector, which accounts for two-thirds of the US economy, the economic data carries weight and importance.

• New Services PMI Orders dropped significantly to 51.8 against the former release of 57.5, indicating a poor demand outlook.

• On the US factory activity front, the Manufacturing PMI for September improved significantly. A revival in the US manufacturing sector is anticipated. New Factory Orders in August expanded by 1.2% vs. expectations of a 0.3% gain on a monthly basis. In July, orders for US-made goods contracted by 2.1%.

• The US Dollar Index (DXY) faced selling pressure after weak US data on Wednesday but has revived gradually as investors appear to have placed less significance on the September ADP Employment Change. The Fed is scheduled to announce its next monetary policy move in November. Policymakers are expected to give more preference to October’s private payrolls data.

• Meanwhile, investors await the NFP report for September, which will provide more clarity about labor market conditions.

• According to estimates, the US labor force is expected to have witnessed fresh additions of 170K employees – lower than the former release of 187K. The Unemployment Rate is seen declining to 3.7% vs. August’s reading of 3.8%.

• In addition to the jobs data, investors will watch out for the Average Hourly Earnings data. On a monthly basis, labor earnings are forecast to have expanded at a higher pace of 0.3% against a 0.2% jump recorded in August. The annual data is seen unchanged at 4.3%. Higher wages could elevate consumer inflation expectations ahead.

: