Adaptive Stochastic

- Indicatori

- Rasoul Mojtahedzadeh

- Versione: 3.30

- Aggiornato: 11 dicembre 2020

- Attivazioni: 10

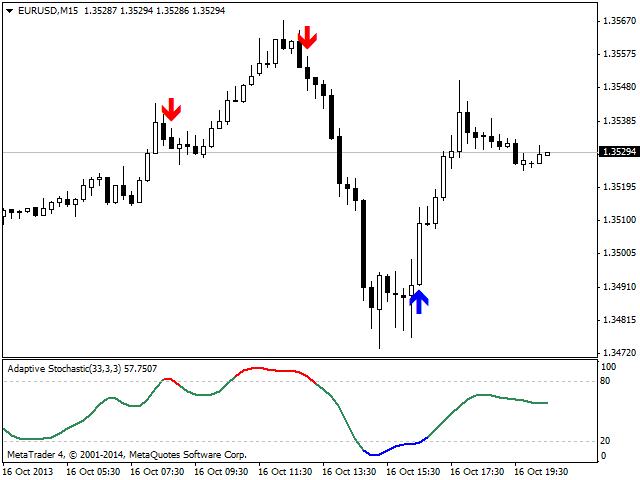

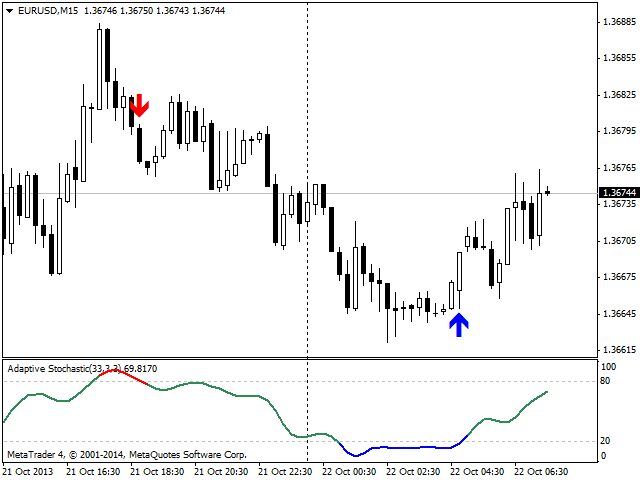

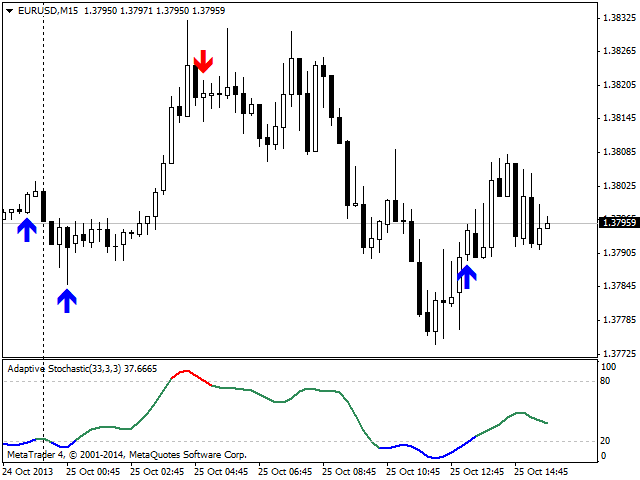

Stochastic Oscillator is one of the most popular and accurate oscillators widely used by traders to capture overbought and oversold areas of price action. Although the Stochastic indicator works fine for an interval of the market, it fails to generate profitable signals when the market conditions change, and hence it produces wrong signals resulting in big losses.

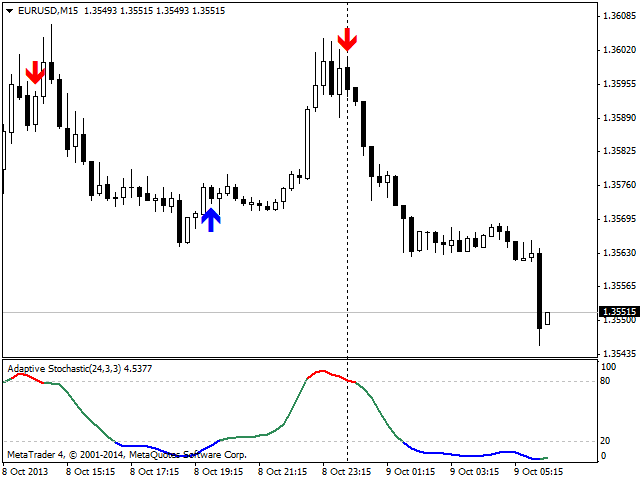

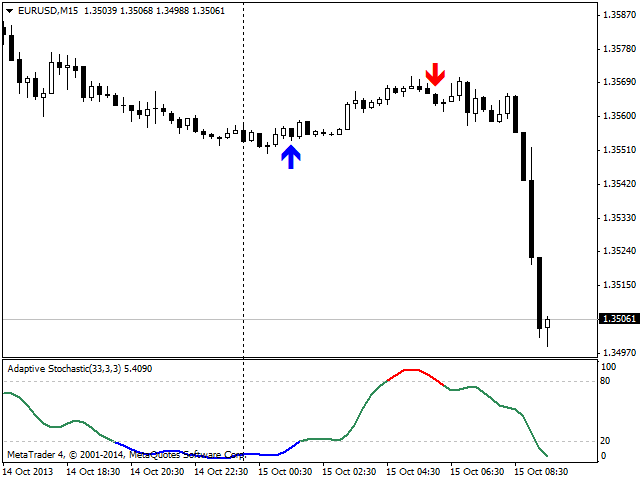

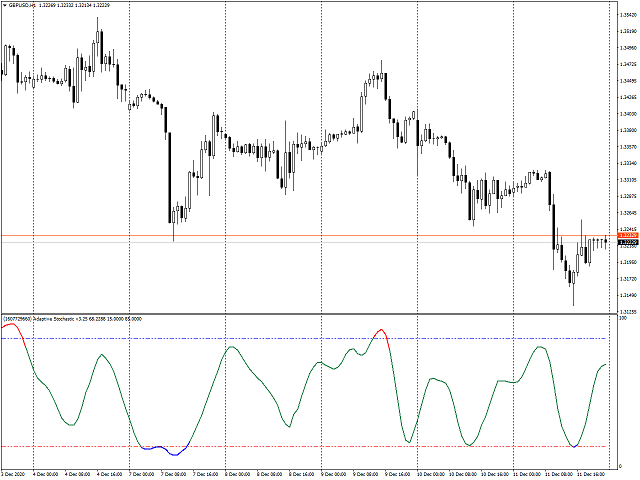

Have you ever thought about an adaptive Stochastic indicator that adapts its period of calculation based on the market conditions? The presented indicator implements an optimization algorithm which identifies the best period for calculation of Stochastic indicator based on maximization of the profit over N-past bars. You can imagine that the optimization process of the strategy tester of MetaTrader is continuously running on live charts to find the best Stochastic period, based on which the profit of trading on the Stochastic signals will be maximized. The values of this indicator, similar to that of the Stochastic indicator, are shown between 0 and 100.

- If the Stochastic value crosses the level 20 upwards, it is assumed to be a BUY signal.

- If the Stochastic value crosses the level 80 downwards, it is assumed to be a SELL signal.

Features

- Automatically determines the best period of the Stochastic Oscillator to adapt to the current market conditions.

- Identifies overbought and oversold areas more accurately than original Stochastic indicator.

- Shows BUY/SELL signal arrows on the bar chart.

- Generates alerts for the signals.

- Highlights overbought and oversold areas with different colors for easier recognition.

- Generates reliable BUY/SELL signals on oversold/overbought areas.

- Works with 4 and 5 digits brokers.

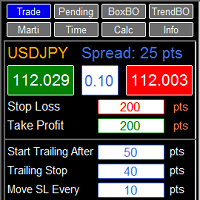

Input Parameters

- Maximum Bars to Look Back: A positive integer number that indicates the maximum past bars, over which the adaptive RSI values will be computed.

- Maximum Past Bars for Optimization: A positive integer number that indicates the maximum past bars, over which optimization (to find the best RSI period) will be performed.

- Minimum K Period for Optimization: A positive integer number (greater than zero) that indicates the minimum K period to take into account in the optimization.

- Maximum K Period for Optimization: A positive integer number that indicates the maximum K period to take into account in the optimization.

- Incremental Step of K Period for Optimization: A positive integer number (greater than zero) that indicates the incremental step of K period to take into account in the optimization.

- %D Period: A positive integer number that indicates %D Period of the Stochastic Oscillator.

- Slowing: A positive integer number that indicates the Slowing parameter of the Stochastic Oscillator.

- Alert Enable/Disable: if true, the alerts will be triggered for the BUY/SELL signals.

- Email Notification?: If it sets to true, when a pattern is recognized, an email will be sent to the address set in the options of MetaTrader 4.

- Mobile Notification?: If it sets to true, when a pattern is recognized, the user will receive a push notification on his/her mobile phone.

- Show Signal Arrows?: if true, BUY/SELL arrows will be shown on the bar chart.

- Overbought Color: The color for highlighting overbought areas.

- Oversold Color: The color for highlighting oversold areas.

- Overbought & Oversold Line Width: Thickness of line for highlighting overbought and oversold areas.

- Moving Average Method: The method of moving average calculation.

- Price Field: The price field of the Stochastic Oscillator.

- Drawing Mode: Choose your desired mode of drawing: Histogram or Line.

- Show Current K Period: If true, it displays the current optimized value of Stochastic period.

Great indicator. I use it as a filter. I like it. It deserves~!