WindExpansion MT5

679 USD

Versione demo scaricata:

272

Pubblicato:

22 gennaio 2019

Versione attuale:

2.23

Non hai trovato un robot adatto?

Ordina il tuo

su Freelance

Vai alla sezione Freelance

Ordina il tuo

su Freelance

Come acquistare un Robot di Trading o un indicatore

Esegui il tuo EA

hosting virtuale

hosting virtuale

Prova un indicatore/robot di trading prima di acquistarlo

Vuoi guadagnare nel Market?

Come presentare un prodotto per venderlo con successo

Ti stai perdendo delle opportunità di trading:

- App di trading gratuite

- Oltre 8.000 segnali per il copy trading

- Notizie economiche per esplorare i mercati finanziari

Registrazione

Accedi

Accetti la politica del sito e le condizioni d’uso

Se non hai un account, registrati

News Data Source

http://ec.forexprostools.com/?columns=exc_currency,exc_importance&importance=1,2,3&calType=week&timeZone=15&lang=1

*Just a reminder*

WindExpansion is an "algosolution" which can be used to pursue different ventures: it really all depend on your risk appetite and "modus operandi".

Someone could choose to run the EA with higher risk, others could choose to run the EA with lower risk while more conservative traders (just like myself) could choose to run the EA with a very low risk in combinations with other experts which they can trust or even in combination with their manual trades if they have specific expertises in the matter.

Default input values is just an example to give a comprehensive idea about the EA operativity, but below you can find original setfiles optimized for two different time frames (M30 and H1) to create your portfolio and other few optimized settings example. Consider them as a starting point and consider every EA more like as a tool than a set&forget solution even if it was designed to trade just like a set&forget, in fact you probably know that the best results you can achieve are the results of doing your homework since there is no solution that satisfies everyone the same way.

Remember that this EA was originally designed to have a multidimensional approach to the market, since the market has different behavior based on magnitude and volatility cycles which can and do change from time to time, so the different settings will try to bring different portion of the market from the smallest wave to the medium and largest waves and this is the purpose to have different trade management that work at the same time.

Of course it is really upon to your preference, you can also choose to run your preferred single setfile or even choose to do customized re-optimization since the parameters are all "open source" with exception of some parameters related with some proprietary formulas.

Welcome traders!

AlgoSystems are quite complex field, in this area there are really too many variables to consider if one want to be profitable, let me explain something

EAs can become obsolete for many reason but mainly we can consider these categories:

a)entry mechanism

b)exit mechanism

c)trade management

d)broker dependence

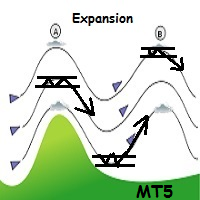

a) Most of EA will use several indicators to pick the entries but indicators unfortunately can't adapt to the recent market environement also they lag and overall are meaningless to the market dynamics (it depend on how indicator is designed), domed to fail for this category, instead a "behaviour pattern" (as the expansion pattern) caused by trader's psycology never change over the time; yes there will be periods much favorable and periods less favorable for these patterns but overall they are effective EVER.

b) EAs need to adapt on different moves amplitude to be really optimized in different situations as EAs can't judge if it is the right time to get out of the trade (can't see sup/res and a dozen of informations that a human trader can see in few minutes) for this reason i designed 4 different set files to capture different moves amplitude on 2 different timeframe (this because sometimes expansion start soon on 30M TF and sometime is more meaningful and start later on H1 TF in a multidimensional fashion)

c) EAs need to lock in profit in several levels and way as the market have many dimension (for the same reason of above as EA can't have any real-time judgment), giving more or less breath to the price, in this way we have a very adaptable trade management module!

d) EAs need to be independent from broker issue; many EA especially traditional scalpers (that in theory can be profitable) will get in trouble with brokers because they aim for very few pips on each trade and a little slippage-requote-commission-you name it can be disastrous on final results

Remember that this EA can be a very flexible tool and you can use it even in the news time only (thanks to the built-in news module: you can find the news data source on the first post) where the price is boosted thanks to fundamentals drivers.

In the picture below, a great master of all times explain the idea behind the built-in algorithm, indeed an universal price behavior.

Enjoy your trading!