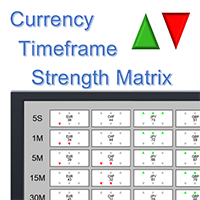

Currency Timeframe Strength Matrix

49 USD

Versione demo scaricata:

70

Pubblicato:

25 ottobre 2017

Versione attuale:

1.7

Non hai trovato un robot adatto?

Ordina il tuo

su Freelance

Vai alla sezione Freelance

Ordina il tuo

su Freelance

Come acquistare un Robot di Trading o un indicatore

Esegui il tuo EA

hosting virtuale

hosting virtuale

Prova un indicatore/robot di trading prima di acquistarlo

Vuoi guadagnare nel Market?

Come presentare un prodotto per venderlo con successo

Ti stai perdendo delle opportunità di trading:

- App di trading gratuite

- Oltre 8.000 segnali per il copy trading

- Notizie economiche per esplorare i mercati finanziari

Registrazione

Accedi

Accetti la politica del sito e le condizioni d’uso

Se non hai un account, registrati

Dear visitors, we have realized that the Free Demo testing version link does not work properly on MT4 and are working to sort this out. Thank you :)

The free version "Currency Timeframe Strength Matrix Demo" is now available on the Market

This is the most I have ever paid to rent an indicator or EA but it is worth the price because the signals are accurate. However with no alerts it is very difficult to catch a trade before the move begins so I will suggest an alert based on the number of arrows per time frames and currencies. For instance for single alerts it can be when a currency or time frames has one 1,2 or 3 arrows pointing down or up or use combined alerts for instance when 1,2 or 3 arrows are in the same direction for a combined time frames. From your first screen shot u can see that CHF has 3 arrows on the 5s 2 on the 1min and 3 arrows on the 5min pointing down so if 2 arrows pointing up or down for a combined time frame is selected it will give an alert.

Thank you for your suggestion, this is a very good idea for traders who are not at the computer constantly and will definitely consider it for development. As short term day traders, my team and I are watching the screens very regularly so we continually watch the evolution of the dashboard.

Personally, most of my trades are counter trend/ mean reversion. Watching the dashboard constantly allows you to see just how the market is breathing over 20 minutes, half hour, an hour, etc. Once you start seeing the action on the quick timeframes, you can go to that pair and make the judgement (based on price action) if you want to catch some of that breakout (this is what you described, and can work very well).

However, more than 50% of the time I will wait for the move to happen, and constantly watch the dashboard until I see one currency overbought and another oversold by a substantial amount. I keep waiting until the dashboard starts to "cool down". At that point I will start to get ready for a trade to catch the snap back (it helps if this cool down also happens at a nice key level on the chart, just for extra confidence). Just keep in mind that this second approach requires a lot more patience, so to each their own!