OrderBlock Engine

- Experts

- Shawntel Wisdom Nyungu

- Versione: 1.23

- Attivazioni: 5

OrderBlock Engine – Smart Money Automation with Full Risk Control

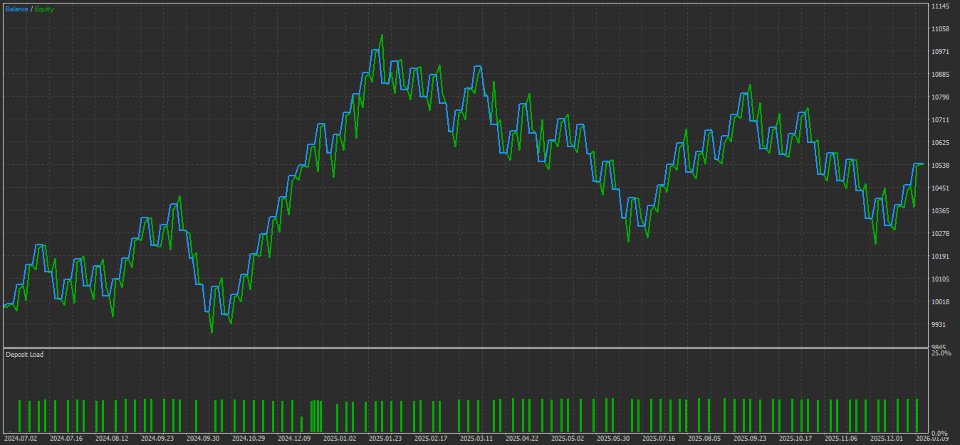

OrderBlock Engine is a fully automated MetaTrader 5 Expert Advisor built around Smart Money Concepts (SMC) and order block–based price action. It is designed to trade the market the way institutions do—by focusing on structure, liquidity, and high-probability zones, while giving the user clear control over risk and behavior.

The EA continuously analyzes price to detect order blocks, fair value gaps, breaks of structure (BOS), and changes of character (CHOCH). Trades are only executed when multiple conditions align, helping to filter out low-quality setups and reduce unnecessary trades.

Trading Logic Overview

OrderBlock Engine follows a structured decision process:

-

Market Structure Analysis

The EA determines bullish, bearish, or neutral bias using swing structure across higher timeframes. -

Order Block & Liquidity Detection

High-probability order blocks and liquidity zones are identified and tracked in real time. -

Confluence Scoring

Each potential trade is scored based on structure alignment, session timing, volume behavior, and price location.

Trades are only allowed when the minimum confluence score is met. -

Execution & Management

Once confirmed, the EA places trades with validated stop-loss and take-profit levels and manages them according to the selected risk rules.

Configurable Inputs Explained

Symbols & Trading Scope

-

Choose which symbols the EA is allowed to trade

-

Limit trading to specific timeframes

-

Control the maximum number of open positions

Risk & Lot Size Control

-

Auto lot sizing based on account balance or equity

-

Optional fixed lot size mode

-

Risk per trade defined as a percentage

-

Total exposure and margin usage limits to prevent over-leveraging

Stop Loss & Take Profit Modes

-

Fixed pip-based SL/TP

-

ATR-based dynamic SL/TP

-

Adaptive stops adjusted to market conditions

-

Optional trailing stop and breakeven logic

All stop levels are automatically validated to meet broker and MQL5 Market requirements.

Market Adaptation

-

Detects trending, ranging, volatile, and low-volatility markets

-

Automatically adjusts risk and behavior depending on market state

-

Helps protect the account during unstable conditions

Session & Safety Filters

-

Trade only during selected sessions (Tokyo, London, New York, or overlaps)

-

Optional news-avoidance buffer

-

Prop-firm style protections:

-

Daily loss limits

-

Maximum drawdown protection

-

Equity-based safeguards

-

Alerts & Visual Tools

-

Optional MT5 alerts

-

Optional Telegram notifications

-

Clean on-chart drawings for order blocks and structure (disabled in backtests)

Key Characteristics

-

Smart Money Concepts & Order Block strategy

-

No martingale

-

No grid

-

No recovery systems

-

Trades selectively, not aggressively

-

Designed to be prop-firm friendly

-

Validation-safe execution logic for MQL5 Market

Who Should Use OrderBlock Engine

This EA is suited for traders who:

-

Prefer price action and structure-based strategies

-

Want automation with clear risk control

-

Trade personal or prop-firm accounts

-

Value consistency and discipline over high-risk approaches

Disclaimer

Trading involves risk. Past performance does not guarantee future results.

Always test on a demo account before using on a live account.