SnapBack Scalper

- Experts

- Marcus Vinicius

- Versione: 2.0

- Aggiornato: 3 aprile 2025

SnapBack Scalper is an advanced Expert Advisor designed to identify overbought and oversold zones in the forex market using the RSI technical indicator. It also integrates a weekly forex calendar to keep track of important events that could impact trading. To optimize entries, the EA filters signals based on the ADX, opening buy or sell positions only when the ADX Main Line is above 25, indicating a strong trend in the market.

SnapBack Scalper offers flexibility in risk management, allowing the setting of a fixed lot size or the dynamic calculation of lots based on the percentage of risk in relation to the account balance, ensuring that trades are aligned with the trader's risk management strategy. In addition, it incorporates an intelligent Trailing Stop system, where the value of the trailing stop is determined by the Parabolic SAR, freeing the trader from the need to set it manually and maximizing profit protection in favorable market movements.

Position Opening Conditions:

- The EA checks if there are no open positions with the same Magic Number.

- If the ADX Main Line is above 25 and the current spread is below the user-set maximum limit, the EA checks the RSI conditions:

Overbought (RSI > 70): Indicates that the asset may be overbought. The EA checks for a crossing of the +DI and -DI lines of the ADX (from above to below) and opens a sell position.

Oversold (RSI < 30): Indicates that the asset may be oversold. The EA checks for a crossing of the +DI and -DI lines of the ADX (from below to above) and opens a buy position.

Parameters

| PARAMETER | DESCRIPTION | DEFAULT |

|---|---|---|

| Magic Number | Unique number to identify orders generated by the EA | 12345678 |

| Timeframe | Time period used for analysis (default is the current chart) | PERIOD_M30 |

| Deviation | Deviation tolerance in points for pending orders | 5 |

| Currency (Forex Calendar) | Currency to synchronize the week's news | USD |

| Bull Candle Color | Bullish Candle Color | Branco |

| Bear Candle Color | Bearish Candle Color | Vermelho |

| Chart Up Color | Bullish Candle Border | Branco |

| Chart Down Color | Bearish Candle Border | Vermelho |

| Chart Background | Graph background color | |

| Chart Foreground | Color of graphic elements | |

| Takeprofit | Target profit level, in points | 1000 |

| Stoploss | Maximum loss level, in points | 500 |

| Trailing Step | The Trailing Step is the trigger that activates the Trailing Stop. Once activated, the trailing stop is adjusted only if the price moves 30 points relative to the last adjustment of the Parabolic SAR. | 100 |

| Lotsize | Fixed lot size | 0.7 |

| Dynamic Lot | True = Lot based on risk percentage, False = Fixed lot size | false |

| Risk Percentage | Percentage of risk (%) | 2% |

| RSI Period | The period used to calculate the Relative Strength Index (RSI). | 14 |

| ADX Period | The period used to calculate the Average Directional Index (ADX) | 14 |

| RSI HIGH THRESHOLD | RSI maximum limit | 70 |

| RSI LOW THRESHOLD | RSI minimum limit | 30 |

Observations and Recommendations

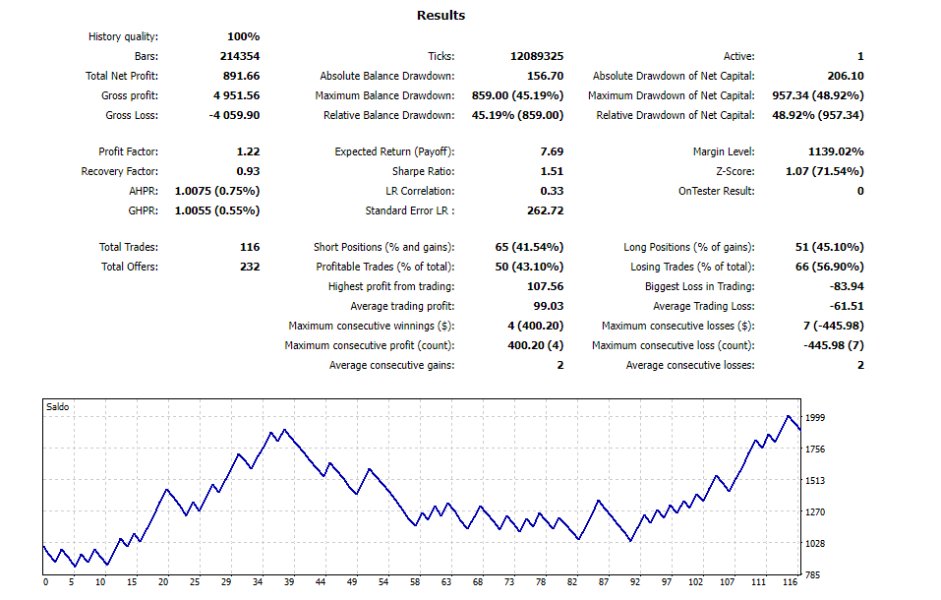

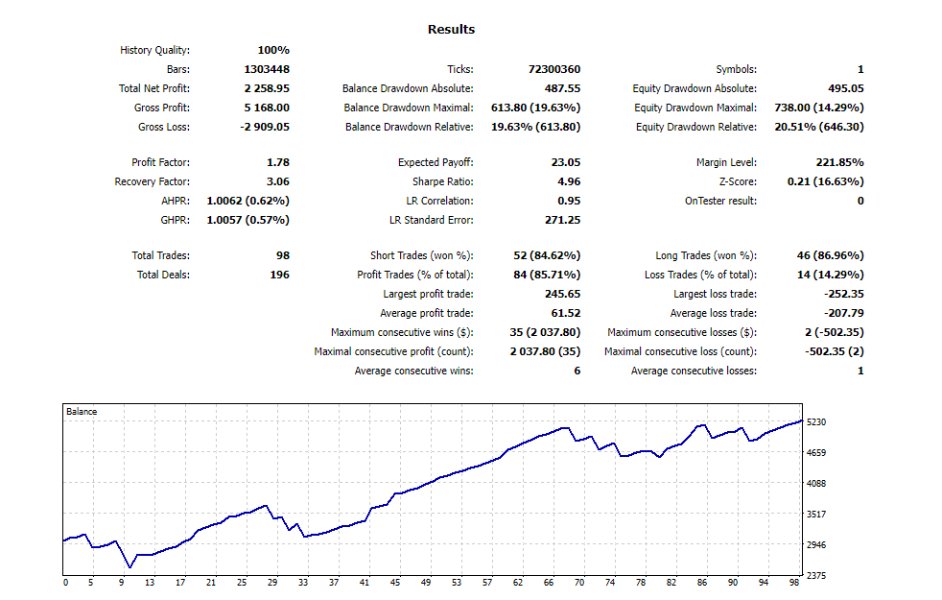

The key to successful scalping lies in managing leverage and lot sizes. I recommend using the lowest leverage possible, preferably 1:50. Please leave a review and request a personalized SET that has proven to be highly profitable, as demonstrated in the backtest.

📢 CHECK OUT OUR ALGO FORGE CHANNEL! Stay up to date with the best automated strategies, analyses, and the latest news on algorithmic trading!

Don't miss out on this opportunity—enhance your trading journey today!