Binary Hedger FV

1 100 USD

Versione demo scaricata:

27

Pubblicato:

21 agosto 2023

Versione attuale:

8.23

Non hai trovato un robot adatto?

Ordina il tuo

su Freelance

Vai alla sezione Freelance

Ordina il tuo

su Freelance

Come acquistare un Robot di Trading o un indicatore

Esegui il tuo EA

hosting virtuale

hosting virtuale

Prova un indicatore/robot di trading prima di acquistarlo

Vuoi guadagnare nel Market?

Come presentare un prodotto per venderlo con successo

Ti stai perdendo delle opportunità di trading:

- App di trading gratuite

- Oltre 8.000 segnali per il copy trading

- Notizie economiche per esplorare i mercati finanziari

Registrazione

Accedi

Accetti la politica del sito e le condizioni d’uso

Se non hai un account, registrati

Hi

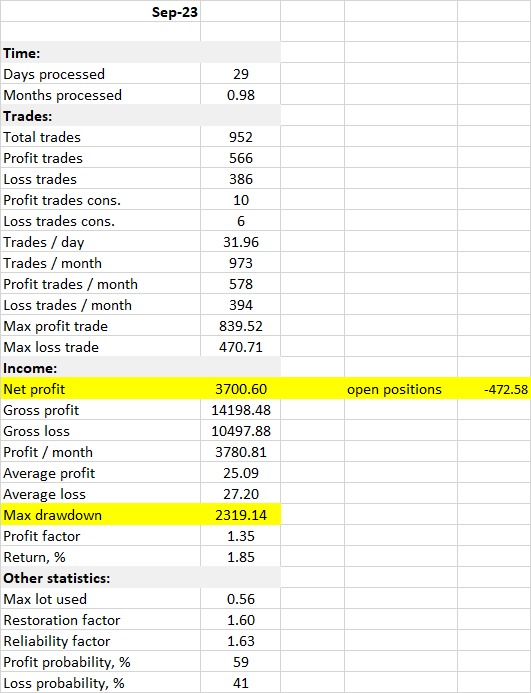

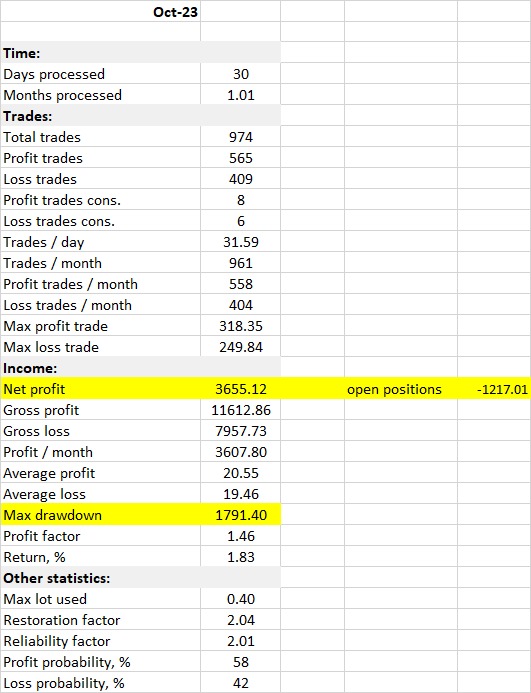

I did open new demo account on tickmil broker (this week)

to test my EA on live market with these settings >>

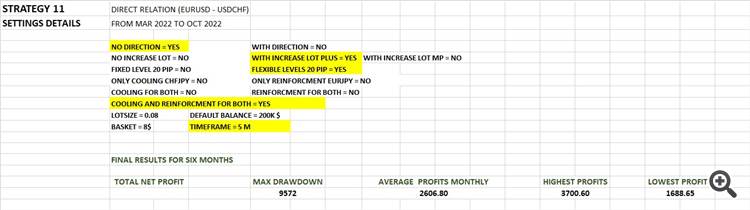

INVERSE RELATION (EURUSD - USDCHF)

NO DIRECTION = YES

WITH INCREASE LOT PLUS = YES

FLEXIBLE LEVELS 20 PIP = YES

COOLING AND REINFORCMENT FOR BOTH = YES

LOTSIZE = 0.05

DEFAULT BALANCE = 10K $

BASKET = 5$

TIMEFRAME = 5 M

link ..

https://www.mql5.com/en/signals/2056223?source=Site+Signals+Page

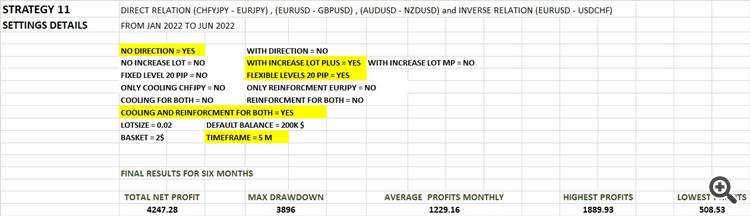

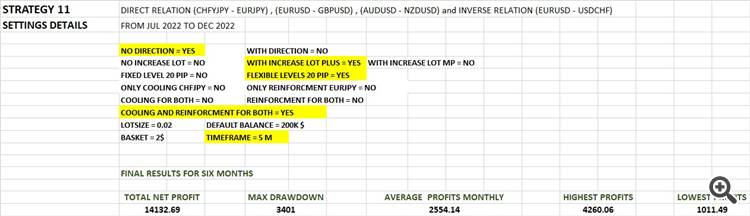

"After numerous experiments with the "Binary Hedger FV" Expert Advisor in the recent period, I have come to two essential conclusions/settings. These settings are likely to be the final configurations for the Expert Advisor after confirming their performance in live trading conditions.

We can either operate with the cooling and boosting settings - without trends - without multiplier. Then, we await cumulative profits over several months, perhaps three months or more. For instance, the Expert Advisor might achieve a $2000 profit in a given month, but the drawdown could also reach as low as -$2000. The surprising part is that the drawdown won't increase significantly beyond this value but will revolve around it in the subsequent months. By the end of the fourth month, you may find that the profits/losses of open positions are less than $500, meaning these settings are profitable in the long run, but they require patience.

Alternatively, you can work with the cooling and boosting settings - without trends - with accumulation multipliers. These settings are profitable in the short term but have shown high risk in some months, such as June and July 2022. To address this significant issue, I have created an auxiliary Expert Advisor. This EA closes all open trades when a certain equity profit is achieved. More details can be found in this link...

https://www.mql5.com/en/market/product/105174?source=Site+Profile+Seller

I will provide numerous examples related to the mentioned statements in the upcoming comments."

For example, the EUR/USD and USD/CHF pairs have achieved significant success in the first six months of the current year, 2023. That is, from January 2023 to June 2023. (Screenshot)

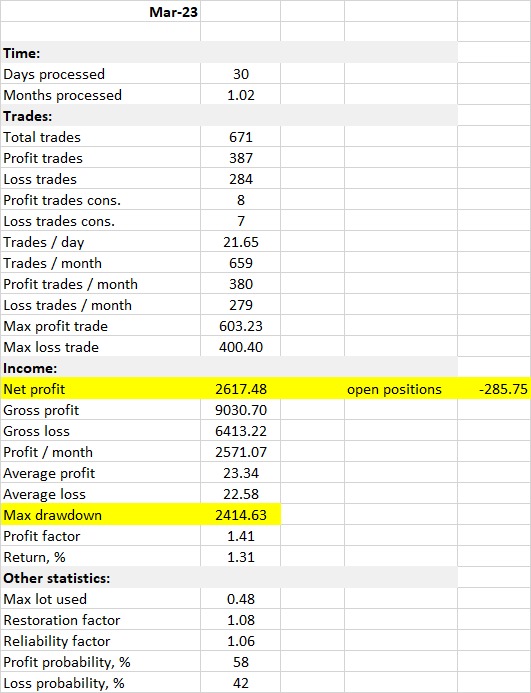

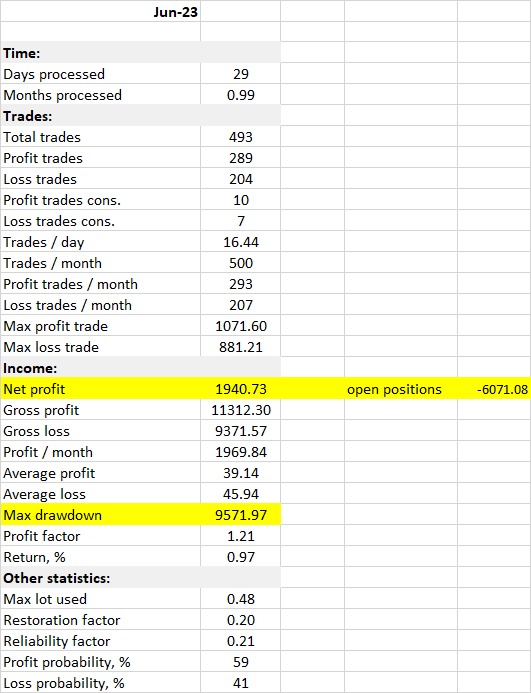

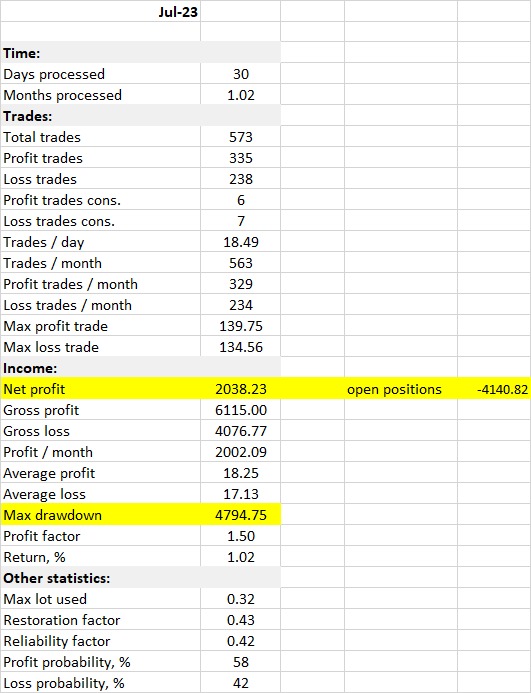

However, when we look at what happened in some months in 2022, it was a disaster, especially in June and July of the same year. (Screenshot)

Of course, I mean that all these results are related to these settings: cooling and reinforcement - without trends - plus multipliers (1,2,3,4,...).

Therefore, it was essential to find a perfect solution to reduce risk and maintain the EA's profits consistently. This is where the idea of the auxiliary Expert Advisor 'Equity Profits' came into play, and it has indeed proven to be the best solution so far.

Let's see the significant difference that occurred when running the 'Equity Profits' Expert Advisor or not running it. For example, let's take a look at the results for the month of June 2022 without running the 'Equity Profits' Expert Advisor. (Screenshot)

Now, what if we run the 'Equity Profits' Expert Advisor on the same month of June 2022, with an increase of $8 in equity for each round and a lot size of 0.08? Look at the remarkable results. (Screenshot)

The results we are discussing here are for the EUR/USD and USD/CHF pairs with inverse correlation.

I have placed about 10 screenshots on the main page of the Expert Advisor. The results of 6 months for 10 (20/2) correlated pairs, some of which are inversely correlated and some directly. Here is a list of the pairs I have tested:

These correlated pairs were identified based on the 'iCorrelationTable v3' indicator. I have tested all of them and found that the following pairs yielded the best results:

Therefore, I recommend working only with these pairs and ignoring the rest.

Results (Screenshots):

These are the results for one and a half years of working with these eight pairs, with the 'Equity Profits' Expert Advisor activated, at $200 per round. You can download the 'Equity Profits' Expert Advisor from this link.

https://www.mql5.com/en/market/product/105174?source=Site+Profile+Seller

Additionally, here are links to three demo accounts for testing the Expert Advisor in the live market with three different settings:

First Account:

https://www.mql5.com/en/signals/2056223?source=Site+Profile+Seller

Second Account:

https://www.mql5.com/en/signals/2064416?source=Site+Profile+Seller

Third Account:

https://www.mql5.com/en/signals/2075095?source=Site+Profile+Seller

I am betting on these pairs and settings as they have yielded the most successful results, according to the attached data.

It seems that there are many secrets in the expert and its settings that have not yet been discovered.

https://www.mql5.com/en/signals/2064416?source=Site+Profile+Seller

Third Account:

https://www.mql5.com/en/signals/2075095?source=Site+Profile+Seller