Spécifications

Hi programmers,

I am looking for a serious and immediately available programmer to develop an expert that utilizes a breakout strategy to identify market direction and execute trades in the correct direction. The breakout condition will be based on an automatic or manual setting. The manual setting involves two prices and breaks out when the market price is either above or below both prices.

1. Setting up the two prices

2. Actual market price will identify the opportunity for the breakout when the actual price goes out of the range for the first set of prices.

3. EA will first identify the opportunity without taking trades at the first position, but it will send a message for an opportunity by alert.

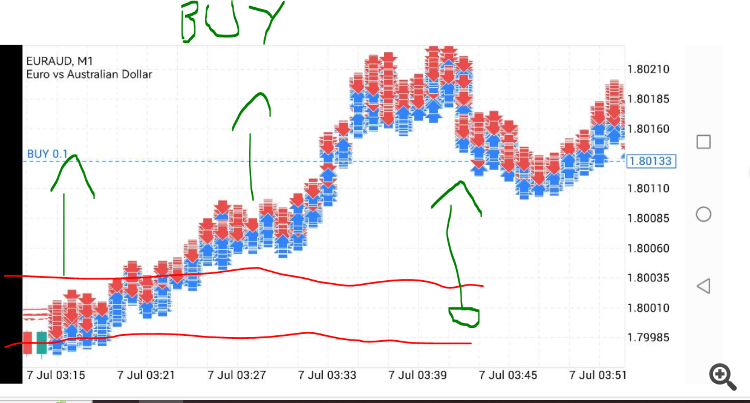

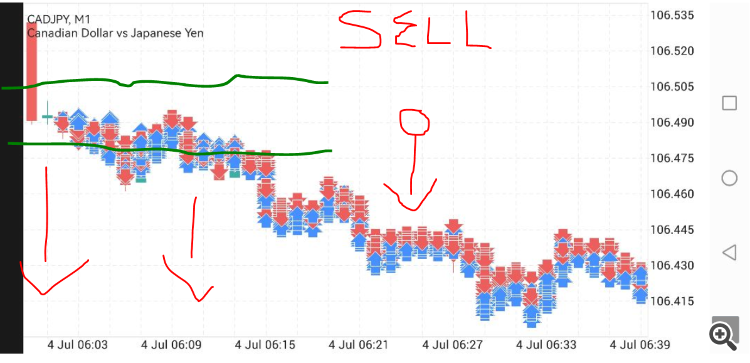

4. After the opportunity has been identified, EA will set a timer as a variable to take the first trade using the backup only for the opposite side. So, EA will consider the market going against the first identified move and will position to take trades accordingly.

5. EA will then ensure it takes trades towards the correct direction using the updated position when market prices go to one side of the defined prices in the settings.

6. EA will take a BUY bid if the market price goes upwards and a SELL bid if the market price goes below the setting prices.

7. EA will ensure it monitors and triggers the activated bids to close in profits or at least break even.

8. EA can take multiple trades within the range of setup from extreme after the first bid has activated, eg, take a BUY from the lowest price after a distance is achieved, or SELL downwards using the Highest price until the distance is achieved downwards.

9. All setting variables must be in real time prices and not in pips. so a 90 variable means 90 in real time price, a 0.02 variable means an 0.02 in real price.

10. For the automatic settings, the EA will use the extreme prices to activate the bid after a distance in price has been achieved, and then it lock the 2 prices as a manual setting to take the trades upwards or downwards.

11. EA can also implement a multiplier concept to increase lot sizes of bids within the trades position of the breakout. eg lower prices below the BUY breakout or higher positions above the SELL breakout.

see example of picture concepts

Note that their will be a period of 6 to 8 weeks testing to ensure all steps are adequately followed in the development.

Payment will be made upon satisfaction of a testing period in real time for about 1 week before conclusion of project

Source code will be given at end of project.

Thanks