Mohammed Abdulwadud Soubra / Profile

- Information

|

8+ years

experience

|

7

products

|

1086

demo versions

|

|

134

jobs

|

0

signals

|

0

subscribers

|

"Я в форексе с 2005 года.

Ознакомьтесь с этим продуктом:

https://www.mql5.com/en/users/soubra2003/seller

Многообещающие торговые сигналы по US30 и американским акциям:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Для мгновенной поддержки, присоединяйтесь к этой группе в WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W "

Ознакомьтесь с этим продуктом:

https://www.mql5.com/en/users/soubra2003/seller

Многообещающие торговые сигналы по US30 и американским акциям:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Для мгновенной поддержки, присоединяйтесь к этой группе в WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W "

Friends

8601

Requests

Outgoing

Mohammed Abdulwadud Soubra

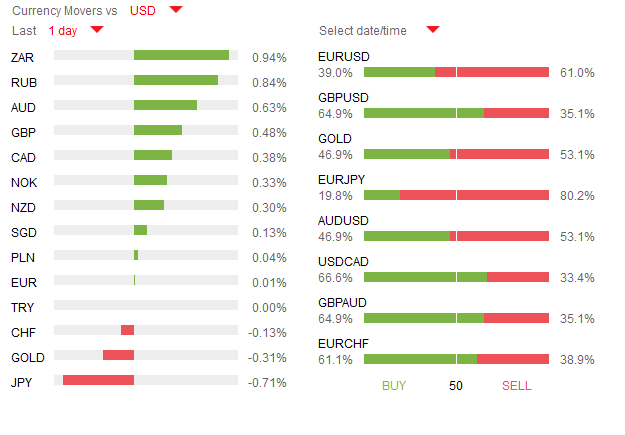

Commodity Dollars at Risk on Dour Mood Before 1Q Earnings Season Talking Points: Commodity bloc FX recovers, Yen falls as risk appetite firms in Asian trade Quiet economic data docket puts sentiment trends in focus into the week-end Worries about soft 1Q earnings season may unleash renewed risk a...

Share on social networks · 1

65

Mohammed Abdulwadud Soubra

Pre US Open, Daily Technical Analysis Friday, April 08, 2016

8 April 2016, 12:18

Pre US Open, Daily Technical Analysis Friday, April 08, 2016 Please note that due to market volatility, some of the below sight prices may have already been reached and scenarios played out. EUR/USD Intraday: key resistance at 1.1405. Pivot: 1.1405 Most Likely Scenario: short positions below 1...

Share on social networks · 1

69

Mohammed Abdulwadud Soubra

Risk aversion envelops global markets

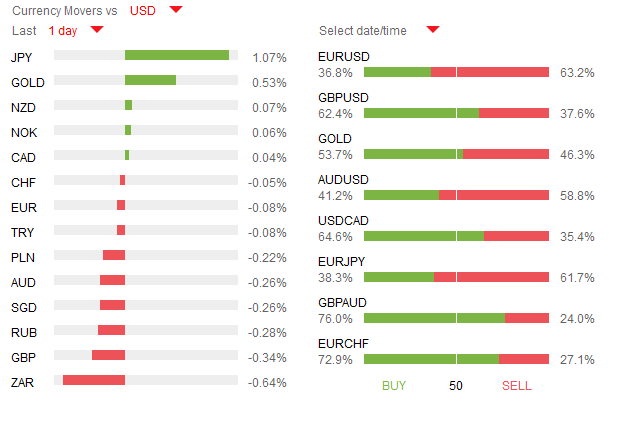

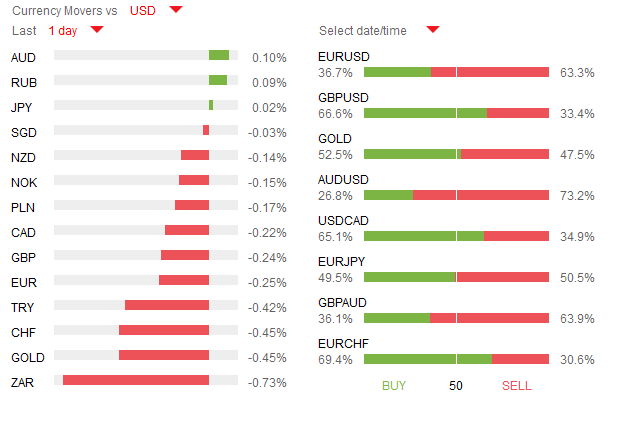

An unappetizing combination of elevated concerns over slowing global growth and incessant declines in oil prices have activated a wave of risk aversion that has engulfed the financial markets this trading week. Global stocks have been left heavily depressed with most major markets subdued as risk appetite sours amid the ongoing instabilities, while safe-haven investments such as the Japanese Yen received a handsome boost. European equities descended into the abyss during trading on Thursday and may be poised to sink lower following the ECB minutes which highlighted a deteriorating outlook for the global economy. Asian markets could be left under immense pressure as fading expectations that the BoJ will intervene to weaken the Yen, coupled with the strengthening Japanese Yen, should consequently leave Asian stocks capped. American markets were punished all week and the bearish domino expected from Europe later today may offer an opportunity for sellers an opportunity to send most

An unappetizing combination of elevated concerns over slowing global growth and incessant declines in oil prices have activated a wave of risk aversion that has engulfed the financial markets this trading week. Global stocks have been left heavily depressed with most major markets subdued as risk appetite sours amid the ongoing instabilities, while safe-haven investments such as the Japanese Yen received a handsome boost. European equities descended into the abyss during trading on Thursday and may be poised to sink lower following the ECB minutes which highlighted a deteriorating outlook for the global economy. Asian markets could be left under immense pressure as fading expectations that the BoJ will intervene to weaken the Yen, coupled with the strengthening Japanese Yen, should consequently leave Asian stocks capped. American markets were punished all week and the bearish domino expected from Europe later today may offer an opportunity for sellers an opportunity to send most

Mohammed Abdulwadud Soubra

Latest News

US stock markets collapsed yesterday, led by the Nasdaq which finished the day nearly 1.5% lower, while the VIX spiked 15% higher as renewed fears over a global slowdown forced investors into treasuries, gold and safe haven currencies. As a result, the Yen surged, as seen in USDJPY, which was down by over 2% at one-point yesterday, though it has pared some of those losses this morning - the pair is up 0.5% in early trading thus far around 108.75. In yesterday’s speech from Janet Yellen, the FED’s Chair stated that the US economy is close to maximum employment and that FOMC members are focused on moving inflation back to 2%. On the other hand, FOMC member Esther George stated that she does not believe the FED should delay interest rate hikes as low rates risk financial stability, particularly in real estate prices.

Today sees the UK report on manufacturing production data, which is forecasted to have contracted by 0.2% month-on-month. Elsewhere, Canada will publish employment figures with the unemployment rate anticipated to remain unchanged at 7.3%. Lastly, the FED’s Dudley, who is in the dove’s camp, is scheduled to speak today at the University of Bridgeport later this afternoon.

US stock markets collapsed yesterday, led by the Nasdaq which finished the day nearly 1.5% lower, while the VIX spiked 15% higher as renewed fears over a global slowdown forced investors into treasuries, gold and safe haven currencies. As a result, the Yen surged, as seen in USDJPY, which was down by over 2% at one-point yesterday, though it has pared some of those losses this morning - the pair is up 0.5% in early trading thus far around 108.75. In yesterday’s speech from Janet Yellen, the FED’s Chair stated that the US economy is close to maximum employment and that FOMC members are focused on moving inflation back to 2%. On the other hand, FOMC member Esther George stated that she does not believe the FED should delay interest rate hikes as low rates risk financial stability, particularly in real estate prices.

Today sees the UK report on manufacturing production data, which is forecasted to have contracted by 0.2% month-on-month. Elsewhere, Canada will publish employment figures with the unemployment rate anticipated to remain unchanged at 7.3%. Lastly, the FED’s Dudley, who is in the dove’s camp, is scheduled to speak today at the University of Bridgeport later this afternoon.

Mohammed Abdulwadud Soubra

Symbol S3 S2 S1 P R1 R2 R3

EUR/USD 1.11551 1.12716 1.13234 1.13881 1.14399 1.15046 1.16211

USD/JPY 104.095 106.333 107.249 108.571 109.487 110.809 113.047

GBP/USD 1.38688 1.39774 1.40161 1.4086 1.41247 1.41946 1.43032

USD/CHF 0.9433 0.94922 0.9523 0.95514 0.95822 0.96106 0.96698

EUR/CHF 1.07446 1.08085 1.08388 1.08724 1.09027 1.09363 1.10002

AUD/USD 0.72516 0.73973 0.74498 0.7543 0.75955 0.76887 0.78344

USD/CAD 1.27886 1.29508 1.30465 1.3113 1.32087 1.32752 1.34374

NZD/USD 0.65987 0.66987 0.67359 0.67987 0.68359 0.68987 0.69987

EUR/GBP 0.79406 0.80124 0.80523 0.80842 0.81241 0.8156 0.82278

EUR/JPY 118.101 120.867 121.973 123.633 124.739 126.399 129.165

GBP/JPY 145.623 149.31 150.677 152.997 154.364 156.684 160.371

CHF/JPY 109.144 111.366 112.257 113.588 114.479 115.81 118.032

GBP/CHF 1.32533 1.33523 1.33902 1.34513 1.34892 1.35503 1.36493

USD/SEK 8.02816 8.08934 8.12744 8.15052 8.18862 8.2117 8.27288

USD/NOK 8.1403 8.2222 8.2704 8.3041 8.3523 8.386 8.4679

EUR/AUD 1.45982 1.485 1.50018 1.51018 1.52536 1.53536 1.56054

EUR/CAD 1.46154 1.47781 1.48646 1.49408 1.50273 1.51035 1.52662

AUD/CAD 0.96649 0.97796 0.982 0.98943 0.99347 1.0009 1.01237

AUD/JPY 75.736 78.793 79.979 81.85 83.036 84.907 87.964

CAD/JPY 77.999 80.333 81.305 82.667 83.639 85.001 87.335

EUR/USD 1.11551 1.12716 1.13234 1.13881 1.14399 1.15046 1.16211

USD/JPY 104.095 106.333 107.249 108.571 109.487 110.809 113.047

GBP/USD 1.38688 1.39774 1.40161 1.4086 1.41247 1.41946 1.43032

USD/CHF 0.9433 0.94922 0.9523 0.95514 0.95822 0.96106 0.96698

EUR/CHF 1.07446 1.08085 1.08388 1.08724 1.09027 1.09363 1.10002

AUD/USD 0.72516 0.73973 0.74498 0.7543 0.75955 0.76887 0.78344

USD/CAD 1.27886 1.29508 1.30465 1.3113 1.32087 1.32752 1.34374

NZD/USD 0.65987 0.66987 0.67359 0.67987 0.68359 0.68987 0.69987

EUR/GBP 0.79406 0.80124 0.80523 0.80842 0.81241 0.8156 0.82278

EUR/JPY 118.101 120.867 121.973 123.633 124.739 126.399 129.165

GBP/JPY 145.623 149.31 150.677 152.997 154.364 156.684 160.371

CHF/JPY 109.144 111.366 112.257 113.588 114.479 115.81 118.032

GBP/CHF 1.32533 1.33523 1.33902 1.34513 1.34892 1.35503 1.36493

USD/SEK 8.02816 8.08934 8.12744 8.15052 8.18862 8.2117 8.27288

USD/NOK 8.1403 8.2222 8.2704 8.3041 8.3523 8.386 8.4679

EUR/AUD 1.45982 1.485 1.50018 1.51018 1.52536 1.53536 1.56054

EUR/CAD 1.46154 1.47781 1.48646 1.49408 1.50273 1.51035 1.52662

AUD/CAD 0.96649 0.97796 0.982 0.98943 0.99347 1.0009 1.01237

AUD/JPY 75.736 78.793 79.979 81.85 83.036 84.907 87.964

CAD/JPY 77.999 80.333 81.305 82.667 83.639 85.001 87.335

Mohammed Abdulwadud Soubra

BOJ

The Japanese Yen has enjoyed one of the best weeks since mid-Feb rallying against all its major peers, to trade at 17 months high against the U.S. dollar, on traders’ belief that BoJ has run out of bullets and global growth is at risk. After flirting with USDJPY 110 level for most of Wednesday and traders found no signs of intervening, the trade developed so fast pulling down the currency pair by more than 200 pips in matter of hours. The stunning move in Yen left some traders wondering why the BoJ who has a long intervention history to weaken the currency hasn’t stepped in. The only official comments came from Chief Cabinet Secretary Yoshihide Suga saying that excessive volatility and disorderly currency moves would have a bad impact on the Japanese economy. He also stated that recent moves were one-sided and would take appropriate steps as needed. This verbal intervention indicates that Japanese policy decision makers are starting to get worried. However,

The Japanese Yen has enjoyed one of the best weeks since mid-Feb rallying against all its major peers, to trade at 17 months high against the U.S. dollar, on traders’ belief that BoJ has run out of bullets and global growth is at risk. After flirting with USDJPY 110 level for most of Wednesday and traders found no signs of intervening, the trade developed so fast pulling down the currency pair by more than 200 pips in matter of hours. The stunning move in Yen left some traders wondering why the BoJ who has a long intervention history to weaken the currency hasn’t stepped in. The only official comments came from Chief Cabinet Secretary Yoshihide Suga saying that excessive volatility and disorderly currency moves would have a bad impact on the Japanese economy. He also stated that recent moves were one-sided and would take appropriate steps as needed. This verbal intervention indicates that Japanese policy decision makers are starting to get worried. However,

Mohammed Abdulwadud Soubra

EUR/USD

The Euro did another attempt to overtake 1.1430resistance level but failed after printing marginal high around 1.1453.

The single currency remains bullish in the daily chart; however, momentum indicators began to show some signs of slowdown in the near-term, which may keep the scenario of a downside correction likely, especially if the pair breaks below 1.1335 hourly support.

Technically, the short-term trend is flat and prices may continue to trade sideways until we see a daily close above 1.1450 peak of below 1.1335/00 support zone.

Support: 1.1335-1.1300-1.1250

Resistance: 1.1450-1.1500-1.1710

The Euro did another attempt to overtake 1.1430resistance level but failed after printing marginal high around 1.1453.

The single currency remains bullish in the daily chart; however, momentum indicators began to show some signs of slowdown in the near-term, which may keep the scenario of a downside correction likely, especially if the pair breaks below 1.1335 hourly support.

Technically, the short-term trend is flat and prices may continue to trade sideways until we see a daily close above 1.1450 peak of below 1.1335/00 support zone.

Support: 1.1335-1.1300-1.1250

Resistance: 1.1450-1.1500-1.1710

Mohammed Abdulwadud Soubra

Pre US Open, Daily Technical Analysis Thursday, April 07, 2016

EUR/USD Intraday: turning down.

Prev Prev arrow

Next Next arrow

Pivot: 1.1455

Most Likely Scenario: short positions below 1.1455 with targets @ 1.1360 & 1.1325 in extension.

Alternative scenario: above 1.1455 look for further upside with 1.1480 & 1.1495 as targets.

Comment: the RSI is badly directed.

GBP/USD Intraday: the downside prevails.

Prev Prev arrow

Next Next arrow

Pivot: 1.4170

Most Likely Scenario: short positions below 1.4170 with targets @ 1.4005 & 1.3945 in extension.

Alternative scenario: above 1.4170 look for further upside with 1.4245 & 1.4325 as targets.

Comment: the RSI is badly directed.

USD/JPY Intraday: key resistance at 109.95.

Prev Prev arrow

Next Next arrow

Pivot: 109.95

Most Likely Scenario: short positions below 109.95 with targets @ 108.15 & 107.70 in extension.

Alternative scenario: above 109.95 look for further upside with 110.50 & 111.05 as targets.

Comment: the RSI is badly directed.

AUD/USD Intraday: turning down.

Prev Prev arrow

Next Next arrow

Pivot: 0.7645

Most Likely Scenario: short positions below 0.7645 with targets @ 0.7530 & 0.7510 in extension.

Alternative scenario: above 0.7645 look for further upside with 0.7685 & 0.7705 as targets.

Comment: the RSI is badly directed.

Gold spot Intraday: further advance.

Prev Prev arrow

Next Next arrow

Pivot: 1225.00

Most Likely Scenario: long positions above 1225.00 with targets @ 1240.50 & 1244.50 in extension.

Alternative scenario: below 1225.00 look for further downside with 1220.00 & 1214.40 as targets.

Comment: the RSI advocates for further upside.

Crude Oil (WTI) (K6) Intraday: bullish bias above 37.42.

Prev Prev arrow

Top Top arrow

Pivot: 37.42

Most Likely Scenario: long positions above 37.42 with targets @ 38.39 & 39.00 in extension.

Alternative scenario: below 37.42 look for further downside with 37.16 & 36.50 as targets.

Comment: a support base at 37.42 has formed and has allowed for a temporary stabilisation.

EUR/USD Intraday: turning down.

Prev Prev arrow

Next Next arrow

Pivot: 1.1455

Most Likely Scenario: short positions below 1.1455 with targets @ 1.1360 & 1.1325 in extension.

Alternative scenario: above 1.1455 look for further upside with 1.1480 & 1.1495 as targets.

Comment: the RSI is badly directed.

GBP/USD Intraday: the downside prevails.

Prev Prev arrow

Next Next arrow

Pivot: 1.4170

Most Likely Scenario: short positions below 1.4170 with targets @ 1.4005 & 1.3945 in extension.

Alternative scenario: above 1.4170 look for further upside with 1.4245 & 1.4325 as targets.

Comment: the RSI is badly directed.

USD/JPY Intraday: key resistance at 109.95.

Prev Prev arrow

Next Next arrow

Pivot: 109.95

Most Likely Scenario: short positions below 109.95 with targets @ 108.15 & 107.70 in extension.

Alternative scenario: above 109.95 look for further upside with 110.50 & 111.05 as targets.

Comment: the RSI is badly directed.

AUD/USD Intraday: turning down.

Prev Prev arrow

Next Next arrow

Pivot: 0.7645

Most Likely Scenario: short positions below 0.7645 with targets @ 0.7530 & 0.7510 in extension.

Alternative scenario: above 0.7645 look for further upside with 0.7685 & 0.7705 as targets.

Comment: the RSI is badly directed.

Gold spot Intraday: further advance.

Prev Prev arrow

Next Next arrow

Pivot: 1225.00

Most Likely Scenario: long positions above 1225.00 with targets @ 1240.50 & 1244.50 in extension.

Alternative scenario: below 1225.00 look for further downside with 1220.00 & 1214.40 as targets.

Comment: the RSI advocates for further upside.

Crude Oil (WTI) (K6) Intraday: bullish bias above 37.42.

Prev Prev arrow

Top Top arrow

Pivot: 37.42

Most Likely Scenario: long positions above 37.42 with targets @ 38.39 & 39.00 in extension.

Alternative scenario: below 37.42 look for further downside with 37.16 & 36.50 as targets.

Comment: a support base at 37.42 has formed and has allowed for a temporary stabilisation.

Mohammed Abdulwadud Soubra

The financial markets were remarkably unmoved during trading on Wednesday evening despite the dovish bias of the FOMC meeting minutes which swiftly discounted any surviving expectations of a US interest rate rise in April. Wednesday’s minutes resonated a similar tone of wariness to Janet Yellen’s rhetoric throughout Q1, while the divide forming between the Fed officials on interest rate timings continued to question the central bank’s credibility. A selection of Fed officials were pushing for an April rate hike despite the instabilities in the global markets, but others remained fearful acknowledging how stubbornly low oil prices and ongoing China woes had exposed the US economy to major downside risks. With global developments and the state of the global economy dictating when or if the Fed raises US interest rates, it seems quite unlikely that the Fed will take any action in Q2.

Dollar bears were offered some encouragement following the dovish minutes

Dollar bears were offered some encouragement following the dovish minutes

Mohammed Abdulwadud Soubra

GBPUSD

The pound has been victim to an incessant selloff from the growing Brexit fears while risk aversion continues to dent investor risk appetite towards the currency. The sentiment is heavily bearish towards the Sterling, and with more selloffs expected amid the heightened uncertainty the GBPUSD may be poised for further declines. From a technical standpoint, there have been consistently lower lows and lower highs, while the MACD trades to the downside. Prices have found comfort below the daily 20 SMA which could provide the additional momentum for a decline towards 1.400. A decisive breakdown below 1.400 may open a path towards 1.385.

The pound has been victim to an incessant selloff from the growing Brexit fears while risk aversion continues to dent investor risk appetite towards the currency. The sentiment is heavily bearish towards the Sterling, and with more selloffs expected amid the heightened uncertainty the GBPUSD may be poised for further declines. From a technical standpoint, there have been consistently lower lows and lower highs, while the MACD trades to the downside. Prices have found comfort below the daily 20 SMA which could provide the additional momentum for a decline towards 1.400. A decisive breakdown below 1.400 may open a path towards 1.385.

Mohammed Abdulwadud Soubra

Crude Oil (WTI) (K6) Intraday: key resistance at 37.25.

Pivot: 37.25

Most Likely Scenario: short positions below 37.25 with targets @ 35.88 & 35.20 in extension.

Alternative scenario: above 37.25 look for further upside with 38.39 & 39.07 as targets.

Comment: the upward potential is likely to be limited by the resistance at 37.25.

Pivot: 37.25

Most Likely Scenario: short positions below 37.25 with targets @ 35.88 & 35.20 in extension.

Alternative scenario: above 37.25 look for further upside with 38.39 & 39.07 as targets.

Comment: the upward potential is likely to be limited by the resistance at 37.25.

Mohammed Abdulwadud Soubra

Gold spot Intraday: bullish bias above 1222.50.

Pivot: 1222.50

Most Likely Scenario: long positions above 1222.50 with targets @ 1232.00 & 1236.80 in extension.

Alternative scenario: below 1222.50 look for further downside with 1214.50 & 1208.50 as targets.

Comment: a support base at 1222.50 has formed and has allowed for a temporary stabilisation.

Pivot: 1222.50

Most Likely Scenario: long positions above 1222.50 with targets @ 1232.00 & 1236.80 in extension.

Alternative scenario: below 1222.50 look for further downside with 1214.50 & 1208.50 as targets.

Comment: a support base at 1222.50 has formed and has allowed for a temporary stabilisation.

Mohammed Abdulwadud Soubra

AUD/USD Intraday: key resistance at 0.7570.

Pivot: 0.7570

Most Likely Scenario: short positions below 0.7570 with targets @ 0.7505 & 0.7475 in extension.

Alternative scenario: above 0.7570 look for further upside with 0.7605 & 0.7645 as targets.

Comment: The pair is shaping a bearish flag.

Pivot: 0.7570

Most Likely Scenario: short positions below 0.7570 with targets @ 0.7505 & 0.7475 in extension.

Alternative scenario: above 0.7570 look for further upside with 0.7605 & 0.7645 as targets.

Comment: The pair is shaping a bearish flag.

Mohammed Abdulwadud Soubra

USD/JPY Intraday: under pressure.

Pivot: 111.05

Most Likely Scenario: short positions below 111.05 with targets @ 109.90 & 109.50 in extension.

Alternative scenario: above 111.05 look for further upside with 111.40 & 111.75 as targets.

Comment: the RSI lacks upward momentum.

Pivot: 111.05

Most Likely Scenario: short positions below 111.05 with targets @ 109.90 & 109.50 in extension.

Alternative scenario: above 111.05 look for further upside with 111.40 & 111.75 as targets.

Comment: the RSI lacks upward momentum.

Mohammed Abdulwadud Soubra

GBP/USD Intraday: under pressure.

Pivot: 1.4195

Most Likely Scenario: short positions below 1.4195 with targets @ 1.4055 & 1.4005 in extension.

Alternative scenario: above 1.4195 look for further upside with 1.4245 & 1.4325 as targets.

Comment: the RSI is badly directed.

Pivot: 1.4195

Most Likely Scenario: short positions below 1.4195 with targets @ 1.4055 & 1.4005 in extension.

Alternative scenario: above 1.4195 look for further upside with 1.4245 & 1.4325 as targets.

Comment: the RSI is badly directed.

Mohammed Abdulwadud Soubra

EUR/USD Intraday: under pressure.

Pivot: 1.1385

Most Likely Scenario: short positions below 1.1385 with targets @ 1.1340 & 1.1310 in extension.

Alternative scenario: above 1.1385 look for further upside with 1.1415 & 1.1435 as targets.

Comment: the RSI is badly directed.

Pivot: 1.1385

Most Likely Scenario: short positions below 1.1385 with targets @ 1.1340 & 1.1310 in extension.

Alternative scenario: above 1.1385 look for further upside with 1.1415 & 1.1435 as targets.

Comment: the RSI is badly directed.

Mohammed Abdulwadud Soubra

Pre US Open, Daily Technical Analysis Wednesday, April 06, 2016 Please note that due to market volatility, some of the below sight prices may have already been reached and scenarios played out. EUR/USD Intraday: under pressure. Pivot: 1.1385 Most Likely Scenario: short positions below 1...

Share on social networks · 1

63

: